Financial News

Pitney Bowes Parcel Shipping Index: Consumer Demand for “Real-Time Retail” Shakes Carrier Market Share

U.S. Market Parcel Revenue Sees First Decline in Seven Years Despite Increased Parcel Volume

Pitney Bowes Inc. (NYSE: PBI), a global shipping and mailing company that provides technology, logistics, and financial services, today released its annual U.S. Parcel Shipping Index, which revealed significant shifts in the carrier competitive landscape and consumer behaviors in 2023.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20240417690112/en/

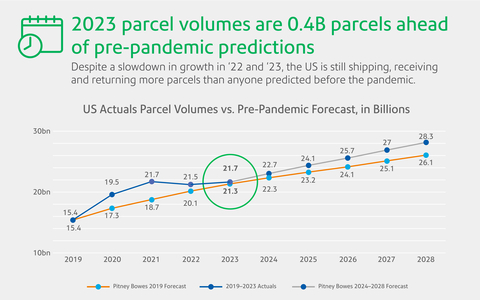

2023 U.S. parcel volume ahead of pre-pandemic predictions (Photo: Business Wire)

Of the four largest carriers (USPS, Amazon Logistics, UPS, and FedEx), only Amazon Logistics grew volumes year-over-year, and by a staggering 15.7%. One year after passing FedEx in parcel volumes, Amazon Logistics has passed UPS and is gaining momentum on market leader USPS.

Both Amazon Logistics and USPS experienced revenue growth, while UPS and FedEx declined in both parcel volume and revenue. Meanwhile, the “others” category comprised of smaller carriers witnessed substantial growth in revenue and volume. Although Amazon Logistics nearly tripled its shipping volumes from 2019 to 2023 (from 2B to 5.9B), it remains fourth in market share by revenue ($28.6B), generating less than half of UPS ($68.9B) and FedEx ($63.2B), foreshadowing a secular shift in the economics of last mile delivery towards smaller parcels and cost-effective shipping services.

“Despite the continued aftershocks of the COVID-19 pandemic, persistent inflation, and pessimistic economic perceptions, consumer spending remains resilient, primarily via a growing demand for affordable goods from global marketplaces. The result is an influx of smaller, less-expensive, lightweight packages which drive up volumes at a lower rate of revenue-per-piece,” said Shemin Nurmohamed, EVP and President, Sending Technology Solutions at Pitney Bowes.

The four largest carriers shared more of the market with smaller competitors in 2023, as "other” carriers saw their combined volumes grow 28.5%. This was underscored by a 0.5% increase (to 21.7B) in parcel volume alongside the first parcel revenue decline in seven years (0.3% decline to $197.9B).

“The legacy players are still adapting as the delivery landscape shifts to favor natively direct-to-consumer parcel networks that are designed from the start to serve residential deliveries, such as the USPS, Amazon Logistics and specialized/localized carriers,” said Vijay Ramachandran, VP of Go-to-Market Enablement and Experience at Pitney Bowes. “While parcel volume growth has shifted from double to single digits, consumers’ appetites for 'real-time retail,’ or affordable goods that are brought to market based on fast-moving trends, will continue to elevate parcel volumes well beyond the effects of the pandemic.”

Nurmohamed added: “As shippers gain access to an array of carrier options, multi-carrier platforms with recommendation engines help them identify and select the best carriers for their network and individual shipments, meeting customer demands efficiently and cost-effectively. It’s what Pitney Bowes is delivering for clients today.”

Carrier Volume

While U.S. parcel volume didn’t change significantly from 2022, total volume was up 0.5% from 21.5 billion in 2022 to 21.7 billion in 2023. Additionally, 2023 was the first time in the Index’s history that Amazon Logistics—the only carrier that did not see a decline—surpassed UPS in parcel volume.

- The USPS generated the highest parcel volume, at 6.6 billion parcels and down almost 1% from last year.

- This was followed by Amazon Logistics generating 5.9 billion parcels, up 15.7% from the previous year.

- UPS declined 10.3% from the previous year to 4.6 billion parcels.

- FedEx declined 6.1% from 4.1 billion in 2022 to 3.9 billion in 2023.

- The “others” category grew 28.5% in 2023, from 0.5 billion to 0.6 billion parcels.

Market Share by Volume

- USPS continues to have the largest market share (31%).

- For the first time in the Index’s history, Amazon Logistics became the second provider with the largest market share (27%), surpassing UPS.

- UPS fell to third place with a 21% market share.

- The “others” category increased its share from 2% to almost 3% of the market.

Carrier Revenue

In 2023, U.S. parcel revenue declined slightly for the first time in 7 years by 0.3% from $198.4 billion in 2022 to $197.9 billion, reflecting high capacity built after the pandemic and intense competition.

- UPS generated the highest parcel revenue of the major carriers at $68.9 billion, down 6.4% year-over-year.

- This was followed by FedEx at $63.2 billion, down 3.1% from last year.

- USPS increased 0.8% to $31.7 billion from $31.4 billion in 2022.

- Amazon Logistics grew 19% to $28.6 billion from $24 billion in the previous year. It also saw the highest CAGR 2016 – 2023 at 60%.

- The “others” category had the most significant revenue growth of 32.5% in one year, to $5.6 billion in 2023 from $4.3 billion in 2022.

Market Share by Revenue

- UPS had the largest parcel revenue market share, with 35% of the market, a 2% decrease from 2022, followed by FedEx, with a 32% share in 2023.

- USPS maintained its revenue market share of 16%.

- Amazon Logistics increased by two percentage points to 14%.

- The “others” category increased from 2.1% to 2.8%.

Forecast

- Pitney Bowes forecasts that U.S. parcel volume will reach between 23 billion and 35 billion by 2029.

- The most likely scenario is that it will reach 29 billion with a 5% CAGR between 2024 and 2029.

About the Pitney Bowes Parcel Shipping Index

The Pitney Bowes Parcel Shipping Index measures parcel volume and spend for business-to-business, business-to-consumer, consumer-to-business, and consumer-consigned shipments that weigh up to 70 pounds (31.5 kg). Parcels are defined as shipments that do not require special handling. The Index provides last-mile view of parcels. Carrier revenue includes the cost to ship an item from its point of origin to point of destination, and margins charged by the carrier. This does not include the price value of the item being shipped.

About Pitney Bowes

Pitney Bowes (NYSE: PBI) is a global shipping and mailing company that provides technology, logistics, and financial services to more than 90 percent of the Fortune 500. Small business, retail, enterprise, and government clients around the world rely on Pitney Bowes to reduce the complexity of sending mail and parcels. For the latest news, corporate announcements, and financial results, visit www.pitneybowes.com/us/newsroom. For additional information, visit Pitney Bowes at www.pitneybowes.com.

View source version on businesswire.com: https://www.businesswire.com/news/home/20240417690112/en/

Contacts

Marifer Rodriguez

Director of Communications

marifer.rodriguez@pb.com

More News

View More

Recent Quotes

View MoreQuotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.