Financial News

BlackRock 2025 Private Markets Outlook: A New Era of Growth

- New frontiers in private credit, emerging AI-driven opportunities, more M&A and IPO activity, and tailwinds for real estate are set to define private markets in 2025

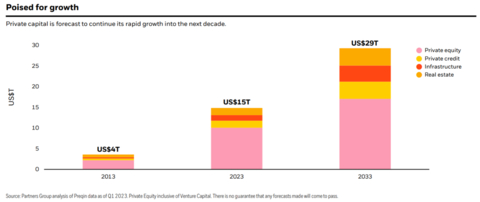

- Industry estimates project private markets will grow from $13 trillion today to more than $20 trillion by 20301

BlackRock Inc. (NYSE: BLK) today released its annual Private Markets Outlook mapping out how the sector, spanning geographies and asset classes, will evolve in the year ahead. Covering trends in private debt, infrastructure, private equity and real estate, the report helps clients navigate this rapidly growing space.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20241216468500/en/

(Graphic: Business Wire)

Fundamentals across private markets remain resilient, setting the stage for a new phase of growth in 2025, marked by elevated investment activity, a rise in exits, lower financing costs and more demand for long-term capital. Industry estimates project private markets will grow from $13 trillion today to more than $20 trillion by 2030.2 All client segments, especially retail wealth, are expected to increase their allocations to private markets as they seek long-dated, profitable assets to match long-dated liabilities. This new wave of investment into the real economy should help transform markets and economies. One major growth area is AI, which presents a range of opportunities across all private asset classes.

“Investors everywhere are keen on private markets,” said Mark Wiedman, Head of BlackRock’s Global Client Business. “Today, the sector accounts for $13 trillion but we expect it to grow to more than $20 trillion by the end of the decade, driven by rising allocations across pensions, insurance, wealth, and sovereign investors. Credit and infrastructure will lead the way with the fastest growth. And everywhere investors will demand transparent, holistic information about their private exposures in the context of their whole portfolio.”

Private Debt: Double Down on Growth

Private debt continues to cement its status as a sizable and scalable asset class for a wide range of long-term investors. But there is plenty of room for growth. At $1.6 trillion in global AUM, the asset class accounts for 10% of the $16.4 trillion alternative investment universe.3

Private debt is taking on more deals as banks become increasingly selective, and the public debt markets focus on deals that are often too large for middle-market businesses. More companies have come to value the certainty of execution and flexibility that private debt provides. At the same time, investors increasingly look to private credit as a portfolio diversifier.

There is plenty of room to grow as the asset class continues to expand its role. One of the newest frontiers is asset-backed finance, where private lenders only hold a roughly 5% market share, of a $5.5 trillion addressable market in the U.S. alone, according to Oliver Wyman.4

Private debt is also becoming more global. While North America represents more than 60% of total private debt AUM,5 Europe and Asia-Pacific have been growing. Today, these regions are more reliant upon bank financing, suggesting a significant opportunity for private debt to expand, similar to the funding diversification that has taken place in the U.S.

One of the main themes we see persisting into 2025 is dispersion, but not widespread market disruption. While the private debt market has proven itself resilient, dispersion will likely remain the case across private debt, highlighting the importance of granular credit selection and structural protections.

Infrastructure and AI: Unlocking Opportunities

Artificial Intelligence (AI) is driving a transformative shift in global economies and industries are increasingly reliant on private capital to unlock AI’s full potential. Private assets offer opportunities to invest across the entire AI value chain – including data centers and data infrastructure.

While capex for AI data centers is expected to exceed $1.5 trillion by 20306, power is also a key component of the AI buildout, driving fresh investment in power generation and transmission infrastructure. In response, more data-center operators are forming partnerships with power producers and exploring "behind-the-meter" solutions, generating their own off-grid power through solar, wind, natural gas, and even nuclear energy.

Given the massive investment required to meet growing AI data center demand and the complexity of integrating power and data center development capabilities, we believe this represents a significant opportunity for experienced infrastructure investors.

Private Equity: A Turning Tide

The tide is turning for private equity. In 2024, deal activity jumped 21% and exceeded pre-pandemic averages by 45%.7 In addition, a more active exit market, coupled with an increased focus from GPs on returning capital, is offering relief to investors seeking distributions. Last year saw a turning point with distributions overtaking capital calls for the first time in eight years.

Valuations in private equity continue to track below public markets, offering attractive entry points. Among sectors, we continue to see opportunities across healthcare, specifically take-private deals and corporate carveouts, and we believe AI will fuel LBO activity among incumbent businesses with data that can be tapped with large language models.

We see significant opportunity in private equity overall, particularly within the middle market, as both M&A activity and IPOs increase, driving more exits and distributions, and leading, in turn, to new investments.

Real Estate: A New Cycle

After a challenging two-year downturn, we believe the real estate sector is now poised to benefit from a number of economic tailwinds, with both cyclical and structural trends at play in the sector. We’ve seen sentiment improve, with an uptick in bidding interest. The new cycle will likely look very different compared to the period following the global financial crisis, with a relatively higher cost of capital and further dispersion between winners and losers.

In a world of higher volatility, we see real estate opportunities aligned with long-term structural trends around aging demographics in developed countries, properties that can facilitate e-commerce and new trade partners, as well as a heightened demand among tenants for energy-efficient buildings.

The Asia-Pacific region, in particular, offers a compelling cyclical and structural opportunity, where investors can tap into strong regional growth, differentiated markets with uncorrelated performance, and growth sectors still in the early stages of their evolution.

To download BlackRock’s 2025 Private Markets Outlook, please click here.

Forward Looking Statements

Certain information contained in this presentation constitutes “forward-looking statements,” which can be identified by the use of forward looking terminology such as “may,” “will,” “should,” “expect,” “anticipate,” “project,” “estimate,” “intend,” “continue,” “target,” “believe,” the negatives thereof, other variations thereon or comparable terminology. Due to various risks and uncertainties inherent in the capital markets or otherwise facing the asset management industry, actual events or results or the actual performance of the Fund may differ materially from those reflected or contemplated in such forward-looking statements.

About BlackRock

BlackRock’s purpose is to help more and more people experience financial well-being. As a fiduciary to investors and a leading provider of financial technology, we help millions of people build savings that serve them throughout their lives by making investing easier and more affordable. For additional information on BlackRock, please visit www.blackrock.com/corporate.

______________________________

1 2025 Private Markets Outlook, p. 3; Source: Preqin, September 18, 2024. Note: There is no guarantee that any forecasts will come to pass.

2 Ibid.

3 2025 Private Markets Outlook, p. 14; Source: Preqin, September 2024. Note: There is no guarantee that any forecasts will come to pass.

4 Ibid.; Source: “Private Credit's Next Act,” April 2024, Oliver Wyman. Note: The Oliver Wyman analysis and estimates were aggregated from a range of sources including, but not limited to: Federal Reserve Board (Z1 tables, G19, G20 and H8); Federal Reserve Bank of New York; Federal Reserve Bank of Dallas; Bureau of Transportation Statistics (BTS); Dealogic; Conning, Inc., Conning Esoteric ABS Strategy Fact Sheet — used with permission; Finsight.com; Structured Finance Association; Boeing (Commercial Aircraft Finance Market Outlook); Secured Finance Network; Equipment Leasing and Finance Association; Morgan Stanley Research; CACIB Research; company reports and disclosures.

5 Ibid.; Preqin, November 2024.

6 2025 Private Markets Outlook, p. 11. Source: McKinsey Data Center Demand Models, RBC BlackRock Investment Institute, BNEF, Grid Strategies, Goldman Sachs Research. Note: There can be no assurances that any forecasts or estimates will materialize.

7 2025 Private Markets Outlook, p. 18; Pitchbook Q3 2024 Global PE First Look. Note: Changes quoted are based on YTD 9/30/24 figures annualised.

View source version on businesswire.com: https://www.businesswire.com/news/home/20241216468500/en/

Contacts

Media

Christa Zipf

christa.zipf@blackrock.com

+1-646-231-0013

+1-347-814-3447

More News

View More

Recent Quotes

View MoreQuotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.