Financial News

Land & Buildings Issues Letter to Ventas Shareholders Detailing Continued Underperformance and Why Meaningful Board Change is Needed Now

Ventas’ Total Shareholder Return, Earnings Growth and Senior Housing Operating NOI Growth Underperformance Have Persisted and Substantially Worsened Relative to Closest Peer Welltower

Company’s Discounted Valuation to Welltower Has Widened Materially Year-to-Date Amid a Crisis of Confidence Among Shareholders

Believes Meaningful Board Change is Necessary to Restore Accountability and Maximize Value for All Stakeholders

Today Land & Buildings Investment Management, LLC (together with its affiliates, “Land & Buildings”), a significant shareholder of Ventas, Inc. (NYSE: VTR) (“Ventas”, “VTR”, or the “Company”), issued a letter to shareholders detailing the Company’s long-term underperformance and undervaluation. Land & Buildings believes further action is necessary to address the lackluster returns shareholders have suffered – and continue to suffer – under the current Board of Directors (the “Board”) and management.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20230911869063/en/

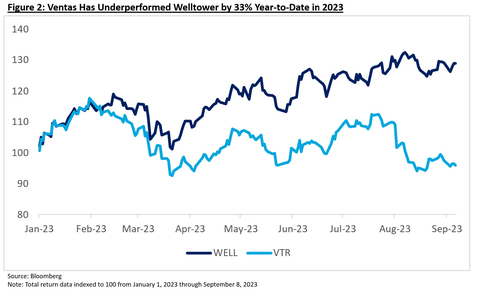

Figure 2: Ventas Has Underperformed Welltower by 33% Year-to-Date in 2023 (Graphic: Business Wire)

The full text of the letter is below:

Dear Fellow Ventas Shareholders,

As significant shareholders of Ventas, our interests are directly aligned with yours.

Leading up to the 2022 Annual Meeting, we outlined the factors we believed had contributed to the Company’s sustained underperformance, and why meaningful change was needed on the Ventas Board in order to finally reverse this trend. In particular, we spotlighted the Company’s inability to close the valuation and performance gap with its closest peer, Welltower Inc. (“Welltower”). The Board’s defense highlighted the Company’s “positive momentum,” “decisive” response to the COVID-19 pandemic and “exceptional” total shareholder return performance over time.1 These claims rang hollow then and they ring hollow now.

Ultimately, some shareholders opted to give the Board the benefit of the doubt and allow more time to right the ship. Proxy advisory firm Institutional Shareholder Services Inc. (“ISS”) echoed similar sentiments but made clear during our campaign that it agreed with many shareholder concerns, concluding, “Should the efforts of the company's leadership to close the multiple gap [with Welltower] fall short, shareholders have the potential solution of supporting more substantive changes at next year's annual meeting…”.2

It is now over a year later, and shareholders have been patient. Unfortunately, this patience has not been rewarded.

Underperformance has continued while the valuation gap to Welltower has materially widened

The fundamentals of senior housing are strengthening across multiple key pillars with accelerating demographic-driven needs-based demand, declining new competitive supply growth and waning expense headwinds. Yet Ventas has generated a negative total return year-to-date, underperforming Welltower by 33%. And despite the continued senior housing strength and recovery, Ventas has failed to outperform the Healthcare REIT Index (which also comprises more troubled sectors such as skilled nursing and hospitals). (See Figure 1: VTR Has Consistently Underperformed WELL, Accelerating to Downside YTD and Figure 2: Ventas Has Underperformed Welltower by 33% Year-to-Date in 2023).

Figure 1: VTR Has Consistently Underperformed WELL, Accelerating to Downside YTD

| Total Shareholder Returns | Trailing 5 Years |

Trailing 3 Years |

Trailing 1 Year |

2023 YTD |

| Ventas Inc (NYSE: VTR) | -10% |

8% |

-9% |

-4% |

| Welltower Inc. (NYSE: WELL) | 50% |

51% |

12% |

29% |

| VTR Performance vs. WELL | -59% |

-43% |

-21% |

-33% |

Source: Bloomberg |

||||

Note: Data through September 8, 2023 |

||||

Further, Ventas’ relative valuation spread to Welltower has widened. Ventas is now trading at a 35% multiple discount to Welltower and 190bps higher cap rate. When we first highlighted – in April 2022 – the significant undervaluation and underperformance of Ventas and our suggestions for how to improve the Company (see: CureVentas.com/curing-a-decade-of-underperformance), Ventas was trading at a 16% lower cash flow (AFFO) multiple and a 80bps higher implied cap rate to Welltower. (See Figure 3: VTR Price/AFFO Multiple Has Collapsed Relative to WELL, Now 9 Turns Cheaper).

We also see no signs of Ventas’ consistent earnings growth (FFO per share) underperformance compared to Welltower reversing. Ventas is guiding to a decline in earnings in 2023 year-over-year while Welltower expects continued growth and has raised guidance multiple times this year. This long-term pattern of earnings estimate revisions cascading lower over time has continued since our proxy contest last year, with consensus estimates for 2023 and 2024 down 10% or more since then, driven in part by overleverage and poor balance sheet management.

A prolonged failure of oversight

The second quarter earnings release this month felt like history repeating itself. The most recent blunder, a poor performing U.S. independent living portfolio that requires a new operator and major reinvestment, is just another misstep in a long line of Ventas’ mistakes that we believe has led us to where we are today.

Top-rated independent REIT research firm Green Street wrote on August 3, 2023 in a note titled An Airball, “Ventas (VTR) released 2Q results that included a disappointing SHOP NOI growth print due to a weak occupancy trajectory…Despite the industry’s favorable demand and supply imbalance, Ventas’s poor results…serve as reminders that senior housing is an operationally intensive business with a wide range of outcomes that are highly dependent on the quality of the operator.”

Quarter after quarter, Ventas provides us with fresh, clear examples of the serious issues plaguing the Company: 1) ineffective Board oversight of management’s capital allocation and operations, 2) corporate governance practices that do not ensure management accountability, and 3) chronically poor investor communication. Last quarter it was the Company’s forced conversion of its $486 million Santerre mezzanine loan into equity while underwhelming guidance marred the quarter before that.

We have previously called for significant enhancements across each of these areas. While lip service has been paid, real change has not been enacted and shareholders continue to suffer. Underperformance has persisted without repercussions for management, governance changes have been cosmetic, and investors continue to be routinely surprised by new problems at Ventas.

Ventas is facing a crisis of investor confidence – action is needed now

Land & Buildings has heard from many frustrated shareholders in recent months. This outpouring of concern has only accelerated in the past several weeks. We believe patience has finally run out and that substantial change is clearly and urgently required to right the ship at Ventas.

Despite Land & Buildings’ continued disappointment with management and the Board, we remain open to continuing our dialogue with the Company regarding opportunities to restore accountability and proper governance, improve performance and drive shareholder value for the benefit of all Ventas stakeholders. However, the status quo cannot continue. While Land & Buildings hopes to reach a constructive resolution with Ventas, it will not hesitate to do whatever is necessary to maximize value at the Company for its long-suffering shareholders.

Stay tuned.

Sincerely,

Jonathan Litt

Land & Buildings Investment Management, LLC

1 https://ir.ventasreit.com/press-releases/news-details/2022/Ventas-Mails-Letter-to-Shareholders-Highlighting-Highly-Qualified-Board-Overseeing-Superior-Long-Term-Shareholder-Returns/default.aspx |

2 Permission to quote ISS was neither sought nor obtained. |

View source version on businesswire.com: https://www.businesswire.com/news/home/20230911869063/en/

Contacts

Media

Longacre Square Partners

Dan Zacchei

dzacchei@longacresquare.com

More News

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the following

Privacy Policy and Terms Of Service.