Financial News

Canada Goose Presents Its Updated Strategic Growth Plan and Five-Year Financial Outlook

Canada Goose Holdings Inc. (“Canada Goose” or the “Company”) (NYSE: GOOS, TSX: GOOS) will host an Investor Day today, February 7, 2023 at the Company’s headquarters in Toronto. In conjunction with the event, the Company is announcing five-year financial targets and providing an update on its strategic priorities.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20230207005261/en/

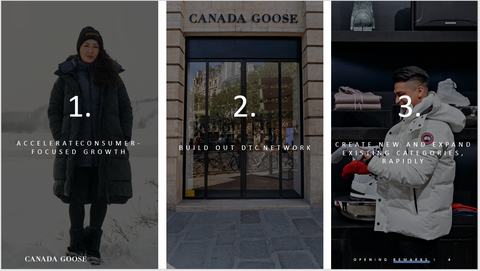

Canada Goose Presents Its Updated Strategic Growth Plan and Five-Year Financial Outlook (Photo: Business Wire)

“Today, Canada Goose is recognized around the world as a performance luxury lifestyle brand, known as a global leader in warmth and protection. Our products are iconic, our style is enduring and our brand has never been stronger. Looking ahead, we see incredible opportunity to continue the revenue growth trajectory we have experienced since the time of our IPO and deliver increasing rates of profitability.” said Dani Reiss, Chairman and CEO.

“As we grow, we will expand our categories, geographies and capabilities with a keen eye towards investing where we see a high return, protecting our brand and delivering high quality, profitable growth,” Mr. Reiss continued, “As I look at the next five years, I am confident in our long-term financial plan, introduced today, to reach $3 billion in revenue, and an adjusted EBIT margin of 30%1 through the execution of our three strategic growth pillars.”

As part of its strategic plan, the Company intends to execute on the following three strategic growth pillars:

- Accelerate Consumer Focused Growth: We have significant opportunity to grow lifetime value of our longstanding and new customers with a focus on women and Gen Z.

- Build our DTC Network: We expect to more than double our retail footprint from the 51 permanent stores at the end of Q3 fiscal 2023 while continuing to grow our digital presence, both through Omnichannel and online. We see opportunity in new markets around the world and expect to increase our DTC penetration within existing markets and will evolve our distribution structure in others.

- Create New and Expand Existing Categories, rapidly: We intend to deliver year-round relevance consistent with Canada Goose’s position as a performance luxury lifestyle brand. We expect continued growth in all categories including in heavyweight and lightweight down and accelerated growth of newer categories such as rainwear, apparel and footwear as well as the addition of further categories including eyewear, luggage and home.

Long-Term Financial Outlook

In fiscal 2028, the Company expects to achieve:

- Revenue of $3 billion representing a CAGR of approximately 20%, in line with the historical performance for revenue CAGR from fiscal 2017, during which the company completed its IPO, through its expected revenue of between $1.175 billion and $1.195 billion in fiscal 2023. This growth is expected to be driven by the acceleration of the consumer-focused growth initiatives, the buildout of the DTC network and the creation of new and more rapid expansion of existing categories as described above. Across geographies, the Company’s strategy is focused on continuing on the luxury trajectory path with growth moving regional revenue as a percentage of total towards an equitable split between North America, EMEA2 and Asia-Pacific.

- 30% adjusted EBIT margin3: The Company’s adjusted EBIT margin target is expected to be delivered through the disciplined execution of its strategy, which actively balances headwinds and tailwinds to maintain gross margin, which is anticipated to continue to benefit from favorable channel mix, pricing and leverage of manufacturing overhead. Selling, General and Administrative expenses (“SG&A”) are expected to leverage from increasing scale and the Company’s proactive approach to invest ahead of growth. The expense structure is also expected to benefit from actions being taken to increase efficiencies and reduce direct costs of goods, improve sourcing costs and leverage technology, among other initiatives. Taken together, the Company expects to achieve $150 million in saved and avoided operating costs by the end of fiscal 2028 while focusing increased spend on the expansion of new categories and business initiatives.

Within the meaning of applicable securities laws, the foregoing financial outlook for the Company’s ongoing 2023 fiscal year and financial guidance for the Company’s 2028 fiscal year and related long-term targets constitute “financial outlook” and “forward-looking information”. The purpose of this financial outlook is to provide a description of management's expectations regarding the Company's annual and long-term financial performance and may not be appropriate for other purposes. Actual results could vary materially as a result of numerous factors, including the risk factors referenced below under “Forward-Looking Information”.

Assumptions

The financial outlook for fiscal 2028 and related long-term targets are based on the following key assumptions for the period from the end of fiscal 2023 to the end of fiscal 2028, among others:

- The assumptions discussed above in relation to our long-term targets and strategic growth pillars, including our ability to realize on the initiatives noted therein

- Our ability to increase permanent retail store count to between 130 and 150 with growth across Asia Pacific, EMEA and North America

- Our ability to increase store productivity and e-Commerce sales with year-round product assortments, pricing and an elevated retail and digital experience

- Our ability to optimize wholesale and other distribution, including the introduction of travel retail and the buyback of key distributor markets

- DTC revenue representing approximately 80% of total revenue in fiscal 2028

- Our ability to achieve and maintain DTC gross margin in the mid 70% range and Wholesale gross margin in the mid to high 40% range with heavy weight down, light weight down and other product categories representing approximately 50%, 25% and 25% of revenue, respectively, in fiscal 2028

- SG&A costs decreasing to approximately 40% of revenue with marketing costs increasing slightly faster than revenue as the Company generates more efficiency from its overhead costs and improves store productivity

- Taxation rates consistent with historical levels

- No material fluctuations in foreign exchange rates relative to current levels

The Company’s outlook is based on its best assessment of the current macroeconomic environment, including ongoing global supply chain and inflationary pressures, foreign currency volatility, the war in Ukraine, COVID-19 variants and other COVID-related disruptions. Over the course of its long-term outlook, the Company expects the recovery of retail environment strength to pre-pandemic levels, decrease in inflationary pressures to normalized levels and stability of other economic factors in the regions in which the Company operates.

The financial outlook for fiscal 2028 and related long-term targets also incorporate the Company’s previously announced fiscal 2023 financial outlook. Please refer to the press release issued on February 2, 2023 under “Full Year Fiscal 2023 Outlook” for a description of the material factors and assumptions used to develop financial outlook for the Company’s ongoing 2023 fiscal year.

The financial outlook for the Company’s ongoing 2023 fiscal year and financial outlook for the Company’s 2028 fiscal year and related long-term targets excludes certain anticipated restructuring related and other net charges as described under (or as incorporated by reference under) “Non-IFRS Financial Measures and Other Specified Financial Measures”.

Investor Day Webcast

The investor meeting will be streamed live and can be accessed on the Company’s Investor Relations website at http://investor.canadagoose.com beginning at 10 A.M. Eastern Standard Time on Tuesday, February 7, 2023. A replay of the event and presentation materials will be available on the website for approximately one year after the event. The Company will present its strategic growth plan, and several members of management will speak including:

Dani Reiss, Chairman and CEO; Penny Brook, Chief Marketing and Experience Officer; Carrie Baker, President; Paul Cadman, President Asia Pacific; Ana Mihaljevic, President North America and Executive Vice President Sales Operations and Planning; Woody Blackford, Chief Product Officer; John Moran, Chief Operating Officer; and Jonathan Sinclair, Executive Vice President and Chief Financial Officer.

About Canada Goose

Founded in 1957 in a small warehouse in Toronto, Canada, Canada Goose (NYSE: GOOS, TSX:GOOS) is a lifestyle brand and a leading manufacturer of performance luxury apparel. Every collection is informed by the rugged demands of the Arctic, ensuring a legacy of functionality is embedded in every product from parkas and rainwear to apparel and accessories. Canada Goose is inspired by relentless innovation and uncompromised craftsmanship, recognized as a leader for its Made in Canada commitment. In 2020, Canada Goose announced HUMANATURE, its purpose platform that unites its sustainability and values-based initiatives, reinforcing its commitment to keep the planet cold and the people on it warm. Canada Goose also owns Baffin, a Canadian designer and manufacturer of performance outdoor and industrial footwear. Visit www.canadagoose.com for more information.

Forward-Looking Information

This press release contains forward-looking statements, including statements that refer to expectations, intentions, projections or other characterization of future events or circumstances contained in this press release. These statements are neither historical facts nor assurances of future performance. Instead, they are based on our current beliefs, expectations and assumptions regarding the future of our business, future plans and strategies, and other future conditions. Forward-looking statements can be identified by words such as “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “forecast,” “intend,” “may,” “plan,” “predict,” “project,” “potential,” “should,” “will,” “would,” and other similar expressions, although not all forward-looking statements contain these identifying words. These forward-looking statements include all matters that are not historical facts. They appear in many places throughout this press release and include statements regarding our intentions, beliefs, or current expectations concerning, among other things, our results of operations, financial condition, business prospects, expectations regarding industry trends and the size and growth rates of addressable markets, our business plan, and our growth strategies, including plans for expansion to new markets and new products and expectations for seasonal trends. The financial outlook for the Company’s ongoing 2023 fiscal year and financial outlook for the Company’s 2028 fiscal year and related long-term targets also constitute forward-looking information as described above under “Long-Term Financial Outlook”.

Forward-looking statements are based on management’s beliefs and assumptions and on information currently available to management. Certain assumptions made in preparing the forward-looking statements contained in this press release include: our ability to continue operating our business amid the societal, political, and economic disruption caused by the ongoing COVID-19 pandemic and recent and ongoing geopolitical events; limited disruption to our DTC channel, including store closures, however caused, including due to recent and ongoing geopolitical events, the COVID-19 pandemic and economic disruptions or other events; our ability to implement our growth strategies; our ability to maintain strong business relationships with our customers, suppliers, wholesalers, and distributors; our ability to keep pace with changing consumer preferences; our ability to protect our intellectual property; and the continued absence of material global supply chain disruptions to our business and ability to fulfill demand and maintain sufficient inventory levels, which we continue to monitor; and the absence of material adverse changes in our industry or the global economy. By their nature, forward-looking statements involve risks and uncertainties because they relate to events and depend on circumstances that may or may not occur in the future. We believe that these risks and uncertainties include, but are not limited to, those described in the “Risk Factors” section of our Annual Report on Form 20-F for the year ended April 3, 2022 and those referred to under the headings “Cautionary Note Regarding Forward-Looking Statements” and “Factors Affecting our Performance” in our Management’s discussion and analysis of financial condition and results of operations for the third and three quarters ended January 1, 2023 (“Q3 2023 MD&A”). These risks are not exhaustive and other unknown and unpredictable factors could also have a material adverse effect on the performance or results of the Company.

Although we base the forward-looking statements contained in this press release on assumptions that we believe are reasonable, we caution readers that actual results and developments (including our results of operations, financial condition and liquidity, and the development of the industry in which we operate) may differ materially from those made in or suggested by the forward-looking statements contained in this press release. Additional impacts may arise that we are not aware of currently. The potential of such additional impacts intensifies the business and operating risks which we face, and these should be considered when reading the forward-looking statements contained in this press release. In addition, even if results and developments are consistent with the forward-looking statements contained in this press release, those results and developments may not be indicative of results or developments in subsequent periods. As a result, any or all of our forward-looking statements in this press release may prove to be inaccurate. No forward-looking statement is a guarantee of future results. Moreover, we operate in a highly competitive and rapidly changing environment in which new risks often emerge. It is not possible for our management to predict all risks, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements we may make. Consequently, all of the forward-looking information contained herein is qualified by the foregoing cautionary statements. You should read this press release and the documents that we reference herein completely and with the understanding that our actual future results may be materially different from what we expect. The forward-looking statements contained herein are made as of the date of this press release (or as of the date specifically indicated), and we do not assume any obligation to update any forward-looking statements except as required by applicable laws. For greater certainty, references herein to “forward-looking statements” include “forward-looking information” within the meaning of Canadian securities laws.

Non-IFRS Financial Measures and Other Specified Financial Measures

This press release includes certain financial measures that are “non-IFRS financial measures” and certain financial measures that are “non-IFRS ratios”, including adjusted EBIT margin. These financial measures are employed by the Company to measure its operating and economic performance and to assist in business decision-making, as well as providing key performance information to senior management. The Company believes that, in addition to conventional measures prepared in accordance with IFRS, certain investors and analysts use this information to evaluate the Company’s operating and financial performance. These financial measures are not defined under IFRS nor do they replace or supersede any standardized measure under IFRS. Other companies in our industry may calculate these measures differently than we do, limiting their usefulness as comparative measures.

Additional information including definitions of non-IFRS financial measures and other specified financial measures and reconciliations of non-IFRS financial measures to the nearest IFRS measure can be found under the heading “Non-IFRS Financial Measures and Other Specified Financial Measures” in our Q3 2023 MD&A, as filed on SEDAR at www.sedar.com and with the SEC at www.sec.gov, which section is incorporated by reference in this press release.

The Company is not able to provide, without unreasonable effort, a reconciliation of the guidance for non-IFRS adjusted EBIT to net income, the most directly comparable IFRS measure, because the Company does not currently have sufficient data to accurately estimate the variables and individual adjustments included in the most directly comparable IFRS measure that would be necessary for such reconciliations, including (a) income tax related accruals in respect of certain one-time items (b) the impact of foreign currency exchange and (c) non-recurring expenses that cannot reasonably be estimated in advance. These adjustments are inherently variable and uncertain and depend on various factors that are beyond the Company's control and as a result it is also unable to predict their probable significance. Therefore, because management cannot estimate on a forward-looking basis without unreasonable effort the impact these variables and individual adjustments will have on its reported results in accordance with IFRS, it is unable to provide a reconciliation of the non-IFRS measures included in the forward-looking guidance included herein.

1 See “Non-IFRS Financial Measures and Other Specified Financial Measures”. Operating income as a percentage of revenue was 14.3% for the fiscal year ended April 3, 2022

2 EMEA comprises Europe, the Middle East, Africa and Latin America

3 See “Non-IFRS Financial Measures and Other Specified Financial Measures”. Operating income as a percentage of revenue was 14.3% for the fiscal year ended April 3, 2022.

View source version on businesswire.com: https://www.businesswire.com/news/home/20230207005261/en/

Contacts

Investors:

ir@canadagoose.com

Media:

media@canadagoose.com

More News

View More

Recent Quotes

View MoreQuotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.