Financial News

Consumers See Health and Well-being as “Essential” Spend Category, Accenture Survey Finds

Research highlights consumer-facing companies need to respond to redefined consumer priorities

Despite financial uncertainty, consumers are not willing to reduce the amount they spend on health and well-being, according to the latest in a series of consumer surveys that Accenture (NYSE: ACN) has been conducting to test the pulse of consumer outlook and sentiment since the start of the pandemic.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20220906006116/en/

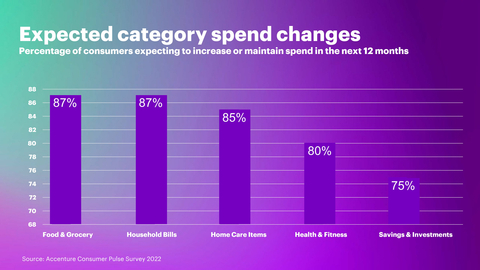

Expected Category Spend Changes (Graphic: Business Wire)

The survey — of more than 11,000 consumers in 16 countries — found that even in the face of widespread uncertainty and personal financial strains, consumers are considering health and fitness to be an “essential,” alongside groceries and household cleaning products. Even though two-thirds (66%) of survey respondents said they feel squeezed financially, 80% also said they intend to maintain or increase their spend on areas related to health and fitness — such as exercise classes or vitamins and supplements — in the next year.

“Despite hard times, it is clear that people have redefined health and well-being to be an essential good and plan to maintain or increase their spend in this area this year, regardless of income levels,” said Oliver Wright, a senior managing director at Accenture who leads its Consumer Goods & Services industry practice globally. “With the health and wellness market expected to increase to more than $1 trillion in spend globally by 2025, consumer-facing companies must tap into cross-industry expertise and scientific and technological breakthroughs while also considering consumers’ changing priorities when designing new offerings.”

Rich Birhanzel, a senior managing director at Accenture and head of its Health industry practice globally, said, “People's desire to take more control of their health and well-being is only increasing. It's vital for the healthcare industry to continue to explore and partner with consumer-facing companies to improve access, experience and outcomes for people and their healthcare journeys.”

The survey also found that respondents seem to be taking a more holistic view of wellness, reframing it as much more of a consumer staple. In addition to more than four in 10 respondents (42%) saying they are increasing the amount of physical activity, one-third (33%) of respondents said that they’re more focused on self-care — such as indulging in a bath or beauty treatment — than they were a year ago.

Even with rising travel costs, the survey found that half (51%) of consumers also plan to maintain or increase their spend on leisure travel in the next year — perhaps not surprising considering the widely recognized well-being benefits associated with a vacation. Furthermore, of the high-income consumers who have booked a trip over the next 12 months, two in five (39%) have booked a luxury trip or wellness retreat. Among millennials, one in five (21%) booked to go away to a wellness retreat this year. In addition, one-third (33%) of all survey respondents said they are willing to sacrifice spending on non-essential household products or electronics so that they can afford to travel.

Emily Weiss, a senior managing director at Accenture who leads its Travel industry practice globally, said, “While the focus on personal well-being is not necessarily new, it is now less an indulgence and more of a non-negotiable essential for today’s consumers, even at a time when many are feeling financial pressures. There is a huge opportunity here for travel and consumer-facing companies to tap into ecosystem partnerships and the local communities to offer differentiated experiences since wellness tourism today is about much more than the destination or activities — it is an extension of the values and lifestyle of the traveler.”

While the survey identified where and how consumers are prioritizing spend, it is important that businesses understand the context in which those purchasing decisions are made. According to a recent Accenture report, “The Human Paradox: From Customer Centricity to Life Centricity,” it is becoming increasingly difficult for consumers to balance purpose and practicality in their purchases, with nearly two-thirds (64%) wishing that companies would respond faster with new offerings to meet their changing needs. Only by understanding the context will businesses have the right strategy to offer the most relevant brands, products or services.

“Retailers and brands can manage the impact of the evolving consumer trade-offs by staying close to consumer trends and pivoting quickly to respond to them,” said Jill Standish, a senior managing director at Accenture who leads its Retail industry practice globally. “While there’s an undeniable headwind, retailers have always been good at innovating to solve problems, and innovation will become increasingly important to create new levels of value, drive down costs, and do the right thing for society and the planet. It calls for extraordinary levels of collaboration, commitment and consumer engagement — not to mention technology and business innovation that is grounded in insight from reliable data sources.”

You can explore our new thought leadership app, which provides a personalized feed of all our latest reports, case studies, blogs, interactive data charts, podcasts and more. Visit http://www.accenture.com/foresight

About the Research

Accenture’s Consumer Pulse Survey 2022 offers insights into consumer outlook, sentiment and behaviors. This year’s survey is relevant to all consumer industries but is focused on consumer goods, retail, travel and health. Accenture surveyed a representative sample of 11,311 consumers from 16 countries: Brazil, Canada, Chile, China, France, Germany, India, Indonesia, Italy, Singapore, Spain, Sweden, United Arab Emirates, the U.K., the U.S. and Vietnam. The survey was conducted online and targeted consumers who have made purchases for their household in the past six months. Respondents were split evenly across gender and age group. The survey was conducted between Feb. 7 and 15. This was supplemented with an additional consumer survey, conducted between April 7 and 25, which included 10,085 respondents from eight countries in the original survey: Canada, China, France, Germany, India, Italy, the U.K. and the U.S.

Findings of the survey are presented in an Accenture report for the retail industry.

About Accenture

Accenture is a global professional services company with leading capabilities in digital, cloud and security. Combining unmatched experience and specialized skills across more than 40 industries, we offer Strategy and Consulting, Technology and Operations services and Accenture Song — all powered by the world’s largest network of Advanced Technology and Intelligent Operations centers. Our 710,000 people deliver on the promise of technology and human ingenuity every day, serving clients in more than 120 countries. We embrace the power of change to create value and shared success for our clients, people, shareholders, partners and communities. Visit us at accenture.com.

Copyright ©2022 Accenture. All rights reserved. Accenture and its logo are registered trademarks of Accenture.

View source version on businesswire.com: https://www.businesswire.com/news/home/20220906006116/en/

Contacts

Aleks Vujanic

Accenture

+44 7500 974 814

aleks.vujanic@accenture.com

Tara Burns

Accenture

+44 7850 435 158

tara.burns@accenture.com

More News

View More

Recent Quotes

View MoreQuotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.