Financial News

Golden Minerals Drills 1.5m Grading 4.02 g/t Au and 1,473.2 g/t Ag at Yoquivo

Golden Minerals Company (“Golden Minerals”, “Golden” or the “Company”) (NYSE-A: AUMN and TSX: AUMN) is pleased to report assay results from the first five holes of a 21-hole, second phase drill program recently completed at its Yoquivo gold-silver project in northwest Chihuahua state, Mexico. Highlights from the drilling include:

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20220127005345/en/

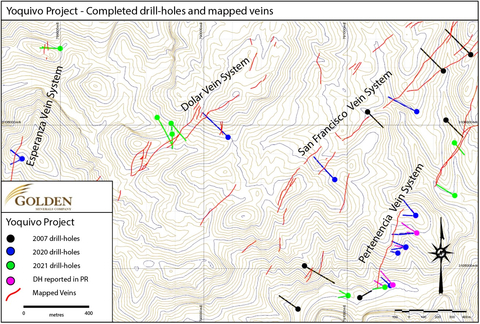

Figure 1: Phase 2 drilling, Yoquivo Project, Chihuahua (Graphic: Golden Minerals Company)

- 2.4 meters (“m”) @ 0.51 grams per tonne (“g/t”) Au and 706.0 g/t Ag

- 1.5m @ 4.02 g/t Au and 1,473.2 g/t Ag

- 2.4m @ 1.03 g/t Au and 266.6 g/t Ag

The drill program included 3,949m comprised of 21 holes exploring the Pertenencia, Esperanza and Dolar vein systems. Drill holes were designed to follow up on the high-grade zones intersected by the Company’s 2020 drill program and to explore additional veins to identify new high-grade zones. The Company is currently awaiting additional assay results that it expects to report in the coming months.

Significant results are summarized in the table below, with complete results available on the Company website. [link]

| Hole ID | From (m) |

To (m) |

Interval (m) |

Au g/t |

Ag g/t |

Target |

| YQ_021_001 | 239.5 |

241.2 |

1.7 |

0.09 |

66.8 |

Pertenencia Vein |

| including | 239.5 |

239.9 |

0.4 |

0.19 |

138.0 |

Pertenencia Vein |

| YQ_021_001 | 243.1 |

243.6 |

0.5 |

0.27 |

329.0 |

Pertenencia Vein |

| YQ_021_002 | 165.0 |

167.4 |

2.4 |

0.51 |

706.0 |

Pertenencia Vein |

| YQ_021_002 | 204.7 |

213.1 |

8.5 |

0.16 |

90.9 |

Pertenencia Vein |

| including | 204.7 |

207.0 |

2.4 |

0.18 |

115.7 |

Pertenencia Vein |

| including | 209.5 |

209.9 |

0.4 |

0.67 |

309.0 |

Pertenencia Vein |

| YQ_021_003 | 57.5 |

58.7 |

1.2 |

0.05 |

25.9 |

Pertenencia Vein |

| YQ_021_004 | 100.2 |

101.7 |

1.5 |

4.02 |

1473.2 |

Pertenencia Vein |

| YQ_021_004 | 124.4 |

126.0 |

1.6 |

0.33 |

109.8 |

Pertenencia Vein |

| including | 125.8 |

126.0 |

0.3 |

0.92 |

313.0 |

Pertenencia Vein |

| YQ_021_004 | 131.5 |

135.0 |

3.5 |

0.49 |

158.0 |

Pertenencia Vein |

| including | 131.5 |

131.8 |

0.3 |

1.67 |

578.0 |

Pertenencia Vein |

| YQ_021_004 | 139.1 |

141.4 |

2.4 |

1.03 |

266.6 |

Pertenencia Vein |

| including | 139.7 |

140.1 |

0.4 |

5.15 |

1320.0 |

Pertenencia Vein |

| YQ_021_004 | 194.5 |

198.0 |

3.5 |

0.04 |

179.2 |

Pertenencia Vein |

| including | 196.9 |

197.4 |

0.5 |

0.11 |

904.0 |

Pertenencia Vein |

| YQ_021_005 | 159.0 |

159.6 |

0.6 |

0.40 |

221.0 |

Pertenencia Vein |

Note: Intervals in the table represent drilled length; true widths are estimated to be 50-90% of drilled widths depending on the dip of the vein and the inclination of the drill-hole. Intervals and grades have been rounded to either one or two decimal places.

Initial results from the Phase 2 drill program appear to show two distinct styles of mineralization:

- Banded quartz-sulphide low-sulphidation epithermal, veins and breccias

- Sulphide-rich fault zones and andesite breccias

As a result of identifying the new mineralization style in fault zones and breccias, the Company is relogging and resampling the drill core from drilling conducted at the project by West Timmins Mining in 2007 to ascertain whether any additional areas of mineralization can be identified that may not have been sampled.

Warren Rehn, Golden Minerals’ President and Chief Executive Officer, commented, “We are pleased with this first set of results from the second phase of drilling at Yoquivo. Hole two demonstrates the potential for the Pertenencia vein to host significant high-grade mineralization, and we’re also excited about hole four which hit multiple high-grade veins suggesting there may be additional blind veins to be found on the property. To date, we’ve explored only a very small portion of this property. We plan to build on these results and continue to advance this high-quality project.”

About Yoquivo

Golden holds an option to purchase seven concessions that comprise the Yoquivo property, totaling 1,974.8 hectares located in western Chihuahua State in northern Mexico, for payments totaling $0.75 million over four years and subject to a 2% net smelter return royalty on production capped at $2 million. The claims cover an underexplored epithermal precious metals district that shows similar mineralization to the adjacent Ocampo mining district, and the Company, through systematic exploration, hopes to identify significant high-grade mineralization.

Review by Qualified Person and Quality Control

The technical contents of this press release have been reviewed by Matthew Booth, a Qualified Person for the purposes of NI 43-101. Mr. Booth has over 17 years of mineral exploration experience and is a Qualified Person member of the American Institute of Professional Geologists (CPG 12044).

To ensure reliable sample results, Golden Minerals uses a quality assurance/quality control program that monitors the chain of custody of samples and includes the insertion of blanks, duplicates, and reference standards in each batch of samples.

Quality Assurance / Quality Control

Diamond drilling was conducted by Eco Drilling México S. de R.L. de C.V with a Coretech CSD 1300G rig. Drill holes were drilled to depths ranging from 102m to 351m and were drilled at azimuths of 140° or 310° and a dip ranging from -45° to -75°. No water was encountered during drilling. Holes were positioned with a hand-held GPS (accuracy +/- 5 meters) and later surveyed with a Differential GPS once the drilling campaign was completed.

Samples of the core were obtained using a diamond saw to cut the core in half, retaining one half for a permanent core record, and the other sent for analysis.

Drill-core samples were shipped to ALS Chemex sample preparation facility in Chihuahua, Chihuahua, Mexico for sample preparation and for analysis at the ALS laboratory in North Vancouver. The ALS Chihuahua and North Vancouver facilities are ISO 9001 and ISO/IEC 17025 certified. ALS Global in North Vancouver, British Columbia, Canada, is a facility certified as ISO 9001:2008 and accredited to ISO/IEC 17025:2005 from the Standards Council of Canada.

Samples were crushed to 70% passing 2mm (PREP-31) with a split of up to 250 grams pulverized to 85% passing 75 micrometers (-200 mesh). The sample pulps and crushed splits were transferred internally to ALS Global’s North Vancouver, Canada analytical facility for gold and multi-element analysis. Pulps (30 gram split) are submitted for Au analysis by fire assay with atomic absorption finish (Au-AA23) and silver samples were analyzed by atomic absorption (Ag-AA45).

Over-limit Au (>10.0 g/t Au) and Ag (>1500 g/t Ag) samples are analyzed by fire assay with gravimetric finish (Au-GRA22 and Ag-GRA21). Over-limit base metal samples (>10,000 ppm or 1%) are re-analyzed inductively coupled plasma atomic emission spectrometry using protocols for higher grade results (ICP-AES) for Cu, Pb and Zn (Cu-OG62, Pb-OG62, Zn-OG62).

In-house quality control samples (blanks, standards, duplicates, preparation duplicates) were inserted into the sample set by Golden Minerals. ALS Global conducts its own internal QA/QC program of blanks, standards and duplicates, and the results were provided with the Company sample certificates. The results of the ALS control samples were reviewed by Golden Minerals and the Company’s QP and evaluated for acceptable tolerances.

All sample and pulp rejects are stored at the Company’s secure warehouse in Velardeña, Durango pending full review of the analytical data, and future selection of pulps for independent third-party check analyses, if required.

About Golden Minerals

Golden Minerals is a growing gold and silver producer based in Golden, Colorado. The Company is primarily focused on producing gold and silver from its Rodeo Mine and advancing its Velardeña Properties in Mexico and, through partner funded exploration, its El Quevar silver property in Argentina, as well as acquiring and advancing selected mining properties in Mexico, Nevada and Argentina.

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended and Section 21E of the Securities Exchange Act of 1934, as amended, and applicable Canadian securities legislation, including statements regarding the anticipated additional assay results from the Yoquivo drill program and the Company’s plans for reporting the results, the potential for the Pertenencia vein to host significant high-grade mineralization, the possibility that additional blind veins will be discovered at the Yoquivo property, and the Company’s plans to continue exploration and to advance the Yoquivo project. . These statements are subject to risks and uncertainties, including changes in interpretations of geological, geostatistical, metallurgical, mining or processing information, and interpretations of the information resulting from exploration, analysis or mining and processing experience. Golden Minerals assumes no obligation to update this information. Additional risks relating to Golden Minerals may be found in the periodic and current reports filed with the SEC by Golden Minerals, including the Company’s Annual Report on Form 10-K for the year ended December 31, 2020.

For additional information please visit http://www.goldenminerals.com/ or contact:

View source version on businesswire.com: https://www.businesswire.com/news/home/20220127005345/en/

Contacts

Golden Minerals Company

Karen Winkler, Director of Investor Relations

(303) 839-5060

More News

View More

Recent Quotes

View MoreQuotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.