Financial News

Digital Dollar Project to Launch Pilot Programs to Explore Designs and Uses of a U.S. Central Bank Digital Currency

Project co-founder Accenture to provide initial funding for pilots, which marks next step in bringing the digital dollar closer to reality

The Digital Dollar Project (DDP) will launch at least five pilot programs over the next 12 months with interested stakeholders and DDP participants to measure the value of and inform the future design of a U.S. central bank digital currency (CBDC), or “digital dollar.”

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20210503005330/en/

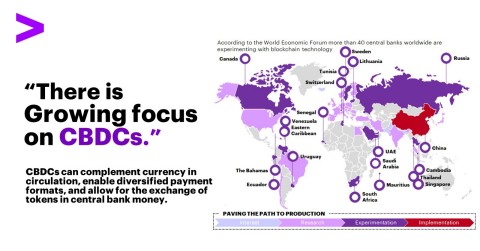

There is growing focus on CBDCs (Photo: Business Wire)

A non-profit partnership between Accenture (NYSE: ACN) and the Digital Dollar Foundation, the DDP was created last year to encourage research and public discussion on the potential advantages of a U.S. CBDC — a new form of money designed specifically for the digital world that complements the existing forms of physical and electronic monies.

The pilots, for which Accenture is providing the first phase of funding, will explore, analyze and identify technical and functional requirements; assess benefits and outstanding challenges; test applications and approaches; and consider potential use cases for both retail and wholesale commercial utilization. The DDP will release to the public the results of and insights from the pilots for use in academic study, as well as policy consideration by Congress.

“Central bank digital currencies will play an important role in how we modernize our financial systems — increasing access to and inclusion within them while also providing a valuable innovation frontier for new products and services in conjunction with other key innovations such as digital identity,” said David Treat, a senior managing director at Accenture, who leads its Blockchain and Multi-Party Systems practice globally. “Accenture is excited to collaborate with the entire stakeholder community to learn from pilot programs across a range of use cases and share the outcomes and insights in an open and transparent manner.”

J. Christopher Giancarlo, former chairman of the U.S. Commodity Futures Trading Commission and co-founder of the Digital Dollar Foundation, said, “The U.S. doesn’t need to be first to the central bank digital currency, but it does need to be a leader in setting standards for the digital future of money, which is why our pilot testing collaboration with Accenture and other partners is so critical. We need to better understand how to balance the complex issues of a CBDC and how to incorporate key societal values, like privacy rights, financial inclusion and rule of law. Together, this project team will conduct research, experiment and develop thought leadership in an open manner in the interest of informing public policy.”

Adrienne Harris, who has advised financial institutions, fintech companies and venture capital firms, will also join the Digital Dollar Project’s Executive Board. Adrienne is a Senior Advisor at Brunswick Group and a Professor of the Practice at University of Michigan, where she’s a Gates Foundation Senior Research Fellow with the Center for Finance, Law and Policy. She was a special assistant for economic policy on President Obama’s National Economic Council, and a senior advisor to the deputy secretary of the U.S. Treasury Department.

The Project’s efforts are intended to complement other important CBDC work being conducted, including by the Federal Reserve Bank of Boston and the Massachusetts Institute of Technology, and to help inform three of the key preconditions for a CBDC identified by researchers at the Federal Reserve. Among the areas that the Project’s pilot phase will focus on are:

- gathering empirical evidence to inform the public policy and technology decisions that the official sector will need to consider;

- informing all involved stakeholders on the proposed benefits of a U.S. CBDC, including the challenges and opportunities, as well as the design, implementation and specific use of such currency; and

- evaluating and cataloguing emerging standards and policies – including with respect to global interoperability and the preservation of key norms and consumer protections – for a U.S. CBDC.

Accenture has made an initial investment in the DDP to support its operational requirements and intends to match the funds necessary to launch the first five pilot programs. The process to begin evaluating and prioritizing the five pilots is already underway, with the first three to be announced within the next two months. The DDP intends to make its CBDC test ground transparent and accessible to all stakeholders, public and private, and serve as a neutral platform to explore the future of U.S. currency.

The U.S. Federal Reserve is one of many central banks around the world considering the introduction of a digital currency. According to a recent survey, 80% of the world’s central banks are engaged in research or experimentation toward developing a CBDC. These include the People’s Bank of China, the European Central Bank and the Bank of England, which are each forging ahead with their own plans for digital currencies.

The DDP is open to participants from all relevant sectors, including commercial institutions, the innovation community, non-profit organizations and universities that want to lead or participate in pilots. To express interest, please email Join@Digitaldollarproject.org.

About The Digital Dollar Project

The Digital Dollar Project is a partnership between Accenture and the Digital Dollar Foundation to advance the exploration of a United States Central Bank Digital Currency (CBDC). The purpose of the Project is to encourage research and public discussion on the potential advantages of a digital dollar, convene private sector thought leaders and actors, and propose possible models to support the public sector. The Project will develop a framework for potential, practical steps that can be taken to establish a dollar CBDC.

About Accenture

Accenture is a global professional services company with leading capabilities in digital, cloud, and security. Combining unmatched experience and specialized skills across more than 40 industries, we offer Strategy and Consulting, Interactive, Technology, and Operations services — all powered by the world’s largest network of Advanced Technology and Intelligent Operations centers. Our 537,000 people deliver on the promise of technology and human ingenuity every day, serving clients in more than 120 countries. We embrace the power of change to create value and shared success for our clients, people, shareholders, partners, and communities. Visit us at www.accenture.com.

About The Digital Dollar Foundation

The Digital Dollar Foundation is a not-for-profit organization created to support the Digital Dollar Project’s efforts to advance the exploration of a United States Central Bank Digital Currency to advance the needs of global financial systems and consumers. The Foundation is led by the Honorable J. Christopher Giancarlo, Charles H. Giancarlo and Daniel Gorfine.

View source version on businesswire.com: https://www.businesswire.com/news/home/20210503005330/en/

Contacts

Alison Geib

Accenture

+1 703 947 4404

alison.geib@accenture.com

Denise Berard

Accenture

+1 617 488 3611

denise.berard@accenture.com

More News

View More

Recent Quotes

View MoreQuotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.