Financial News

John Marshall Bancorp, Inc. Surpasses $2 Billion in Assets; 9th Consecutive Quarter of Record Earnings

John Marshall Bancorp, Inc. (OTCQB: JMSB) (the “Company”), parent company of John Marshall Bank (the “Bank”), reported its financial results for the three months ended March 31, 2021.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20210421005196/en/

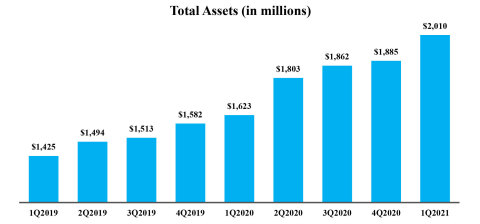

Total Assets (in millions) (Graphic: Business Wire)

Selected Highlights

- Ninth Consecutive Quarter of Record Earnings - The Company reported net income of $5.1 million for the three months ended March 31, 2021, a 12.7% increase over the $4.5 million reported for the three months ended March 31, 2020. Earnings per diluted share for the three months ended March 31, 2021 were $0.37, a 12.1% increase over the $0.33 reported for the three months ended March 31, 2020. Return on average assets was 1.05% and return on average equity was 10.89% for the three months ended March 31, 2021. Return on average assets was 1.14% and return on average equity was 10.87% for the three months ended March 31, 2020.

- Record Pre-Tax, Pre-Provision Income - The Company achieved record pre-tax, pre-provision (“PTPP”) income of $8.9 million for the three months ended March 31, 2021, a 49.3% increase from the same period a year ago. Management believes PTPP income enables financial statement users to assess the Company’s ability to generate capital to cover potential credit losses which could arise before the COVID pandemic’s eradication. PTPP annualized return on average assets was 1.84% for the three months ended March 31, 2021 versus 1.50% for the three months ended March 31, 2020.

- Strong Growth as Assets Surpass $2.0 Billion - Total assets increased 23.8% or $386.9 million to $2.01 billion at March 31, 2021. Gross loans net of unearned income increased $269.0 million or 20.1% from March 31, 2020 to March 31, 2021. Gross loans net of unearned income and Paycheck Protection Program (“PPP”) loans grew $151.2 million or 11.3% from March 31, 2020 to March 31, 2021. Total deposits grew $381.9 million or 27.7% from March 31, 2020 to March 31, 2021. Non-interest bearing demand deposits grew 52.7% or $144.9 million from March 31, 2020 to March 31, 2021.

- Asset Quality Remains Pristine - For the sixth consecutive quarter, the Company had no non-performing loans, no loans 30 days or more past due and no real estate owned at quarter-end March 31, 2021. The Company had $1 thousand in charge-offs during the first quarter of 2021 and no charge-offs during the first quarter of 2020. Troubled debt restructurings were $589 thousand at March 31, 2021, a decrease of $58 thousand, from $647 thousand at March 31, 2020. The Company had no COVID modifications as of March 31, 2021. The Company believes its allowance for loan losses is appropriate for the inherent risks and uncertainties associated with the pandemic.

- Net Interest Margin Unchanged from 4Q 2020 - The net interest margin was 3.43% for the three months ended March 31, 2021, unchanged from the three months ended December 31, 2020 and an increase of 10 basis points from the three months ended March 31, 2020. Excluding the impact of PPP loans, the net interest margin was 3.25% for the three months ended March 31, 2021, a decrease of eight basis points from 3.33% a year ago.

- Efficiency Ratio Under 50% - The efficiency ratio improved from 54.6% for the three months ended March 31, 2020 to 47.1% for the three months ended March 31, 2021. Noninterest expense to average assets declined from 1.81% for the three months ended March 31, 2020 to 1.64% for the three months ended March 31, 2021.

Chris Bergstrom, President and Chief Executive Officer, commented, “One year ago, our Company revamped the way we conducted business. While the delivery of our products and services necessarily changed due to the pandemic, our mission of building value by delivering tailored banking services and exceptional client experiences has not. Through the resolve, adaptability and commitment of the economic first responders at John Marshall Bank, we are reporting our best quarter ever while exceeding the milestone of $2 billion in assets. Our strong balance sheet provides the support for the future growth of our Company. We believe we are well-positioned for continued success.”

Balance Sheet Review

Assets

Total assets were $2.01 billion at March 31, 2021, $1.89 billion at December 31, 2020 and $1.62 billion at March 31, 2020. During the first quarter of 2021, assets increased $124.5 million or 26.8% annualized. Year-over-year asset growth from March 31, 2020 to March 31, 2021 was $386.9 million or 23.8%.

Loans

Gross loans were $1.61 billion at March 31, 2021, $1.56 billion at December 31, 2020 and $1.34 billion at March 31, 2020. Gross loans net of unearned income increased $269.0 million or 20.1% from March 31, 2020 to March 31, 2021. Excluding PPP loans, gross loans net of unearned income increased $151.2 million or 11.3% from March 31, 2020 to March 31, 2021. Gross loans net of unearned income grew $43.3 million or 11.2% annualized during the first quarter of 2021. Excluding the impact of PPP loans, gross loans net of unearned income grew 11.0% annualized during the first quarter of 2021.

Investment Securities

The Company’s portfolio of investments in fixed income securities was $212.6 million at March 31, 2021, $151.9 million at December 31, 2020 and $139.4 million at March 31, 2020. Year-over-year bond growth from March 31, 2020 to March 31, 2021 was $73.1 million or 52.5%. The year-over year increase in fixed income securities was funded by PPP loan payoffs and deposit growth.

Interest Bearing Deposits in Banks

Interest-bearing deposits in banks were $154.5 million at March 31, 2021, $130.2 million at December 31, 2020 and $101.7 million at March 31, 2020. The Company expects to continue to reinvest these funds in higher yielding assets as opportunities and liquidity management allow.

Deposits

Total deposits were $1.76 billion at March 31, 2021, $1.64 billion at December 31, 2020 and $1.38 billion at March 31, 2020. Year-over-year deposit growth from March 31, 2020 to March 31, 2021 was $381.9 million or 27.7%. Deposits grew $121.3 million or 30.0% annualized during the first quarter of 2021.

Non-interest bearing demand deposits were $419.8 million at March 31, 2021, $362.6 million at December 31, 2020 and $274.9 million at March 31, 2020. Year-over-year non-interest bearing demand deposit growth from March 31, 2020 to March 31, 2021 was $144.9 million, or 52.7%. During the first quarter of 2021, non-interest bearing deposits grew $57.2 million or 64.0% annualized. Non-interest bearing demand deposits represented 23.8% of total deposits at March 31, 2021, 22.1% of total deposits at December 31, 2020 and 19.9% at March 31, 2020.

Core customer funding (includes IntraFi Demand®, IntraFi Money Market® and IntraFi CD®, which are all reciprocal deposits maintained by customers) was $1.51 billion at March 31, 2021, $1.40 billion at December 31, 2020 and $1.21 billion at March 31, 2020. Year-over-year core customer funding sources increased by $294.5 million or 24.3% from March 31, 2020 to March 31, 2021. Non-maturing deposits were 61.4% of total deposits as of March 31, 2021, 60.3% as of December 31, 2020 and 56.3% as of March 31, 2020.

IntraFi® certificates of deposits (formerly known as Certificate of Deposit Account Registry Service (CDARS)) deposits were $38.3 million at March 31, 2021, $39.7 million at December 31, 2020 and $57.4 million at March 31, 2020. Year-over-year, IntraFi® certificates of deposits decreased $19.1 million from March 31, 2020 to March 31, 2021.

Certificates of deposits were $385.6 million at March 31, 2021, $374.4 million at December 31, 2020 and $378.0 million at March 31, 2020. Year-over-year certificates of deposit increased $7.6 million from March 31, 2020 to March 31, 2021. QwickRate® certificates of deposit were $38.6 million at March 31, 2021, $29.8 million at December 31, 2020 and $20.0 million at March 31, 2020. Year-over-year QwickRate® certificates of deposit increased $18.6 million from March 31, 2020 to March 31, 2021. Brokered deposits were $217.0 million at March 31, 2021, $207.6 million at December 31, 2020 and $148.1 million at March 31, 2020. Brokered deposits increased $68.9 million from March 31, 2020 to March 31, 2021. Management continues to utilize wholesale funding in order to selectively realize lower funding costs and achieve certain asset/liability objectives.

Borrowings

Borrowings, consisting of Federal Home Loan Bank of Atlanta (“FHLB”) advances were $22.0 million at March 31, 2021, $22.0 million at December 31, 2020 and $37.0 million at March 31, 2020. FHLB advances decreased $15.0 million or 40.5% from March 31, 2020 to March 31, 2021. Management continues to retire FHLB advances as they mature to increase contingent funding sources. As of March 31, 2021, the Bank had approximately $288 million remaining in secured borrowing capacity with the FHLB, an increase of $72 million over the $216 million of FHLB secured borrowing capacity as of March 31, 2020.

The Company had subordinated notes with a balance of $24.7 million at March 31, 2021 and December 31, 2020 and $24.6 million at March 31, 2020.

Shareholders’ Equity and Capital Levels

Total shareholders’ equity was $188.9 million at March 31, 2021, $186.1 million at December 31, 2020 and $170.8 million at March 31, 2020. Year-over-year shareholders’ equity increased by $18.1 million, or 10.6%. Accumulated other comprehensive income declined from $3.6 million at March 31, 2020 to $1.2 million at March 31, 2021. An increase in market yields for investments with maturities three years or longer has reduced the Company’s unrealized gains in its bond portfolio, as bond prices and yields vary inversely.

Total common shares outstanding increased from 13,445,479, including 55,908 shares relating to unvested stock awards, at March 31, 2020, to 13,634,754, including 68,375 shares relating to unvested stock awards, at March 31, 2021. The year-over-year increase in shares outstanding was the result of exercises of share options and additional grants of unvested stock awards.

The Bank’s capital ratios remain well above regulatory minimums for well-capitalized banks. As of March 31, 2021, the Bank’s total risk-based capital ratio was 14.6%, compared to 13.9% at March 31, 2020.

Asset Quality

For the sixth consecutive quarter, the Company had no non-accrual loans, no loans 30 days or more past due and no other real estate owned at quarter-end March 31, 2021.

Troubled debt restructurings were $589 thousand at March 31, 2021, a decrease of $58 thousand, from $647 thousand at March 31, 2020. All troubled debt restructurings were performing in accordance with their modified terms as of March 31, 2021 and March 31, 2020.

The Company did not have any loans with COVID loan modifications as of March 31, 2021.

Income Statement Review

Net Interest Income

Net interest income was $16.3 million for the three months ended March 31, 2021, an increase of $3.5 million or 26.9% from $12.8 million for the three months ended March 31, 2020. The net interest margin was 3.43% for the three months ended March 31, 2021 as compared to 3.33% for the three months ended March 31, 2020.

Average loans net of unearned income increased $255.4 million or 19.3% compared to the three months ended March 31, 2020, with a 47 basis point decline in yield. Average securities increased $43.3 million, or 31.6% compared to the three months ended March 31, 2020, with a 68 basis point decline in yield. Average interest-bearing deposits in other banks increased $73.3 million or 78.5% compared to the three months ended March 31, 2020, with a 118 basis point decline in yield. The average yield on interest-bearing assets decreased 67 basis points from 4.62% for the three months ended March 31, 2020 to 3.95% for the three months ended March 31, 2021, primarily due to the decline in rates since the end of the first quarter of 2020.

The average cost of interest-bearing liabilities declined 103 basis points or 58.2% from 1.77% for the three months ended March 31, 2020 to 0.74% for the three months ended March 31, 2021. The average cost of interest-bearing deposits decreased 104 basis points when comparing the quarter ended March 31, 2020 to the quarter ended March 31, 2021. The average cost of other borrowed funds decreased 75 basis points when comparing the quarter ended March 31, 2020 to the quarter ended March 31, 2021. The declines in funding costs were similarly due to the decline in rates since the end of the first quarter of 2020.

Excluding PPP loans, the net interest margin was 3.25% for the three months ended March 31, 2021. The yield on earning assets would have been 3.81% and the yield on loans would have been 4.47% for the three months ended March 31, 2021, if PPP loans were excluded.

On a linked quarterly basis, net interest margin was unchanged at 3.43% for the three months ended March 31, 2021 and the three months ended December 31, 2020. The average yield on interest-bearing assets decreased 12 basis points from 4.07% for the three months ended December 31, 2020 to 3.95% for the three months ended March 31, 2021. The average cost of interest-bearing liabilities declined 18 basis points from 0.92% for the three months ended December 31, 2020, compared to 0.74% for the three months ended March 31, 2021.

Provision for Loan Losses

The Company had a $2.4 million provision for loan losses for the three months ended March 31, 2021, compared to $419 thousand for the same period in 2020. The Company had $1 thousand in charge-offs during the first quarter of 2021 and no charge-offs during the first quarter of 2020.

The allowance for loan losses as a percentage of total loans increased from 0.84% at March 31, 2020 to 1.21% at March 31, 2021. The allowance for loan losses increased $8.2 million or 73.4% from March 31, 2020 to March 31, 2021. The allowance for loan losses as a percentage of total loans (excluding PPP loans) increased from 0.84% at March 31, 2020 to 1.30% at March 31, 2021. There were no PPP loans at March 31, 2020. The Company does not have a reserve on PPP loan balances, as they are 100% guaranteed by the Small Business Administration. The Company continues to monitor and evaluate the adequacy of the allowance for loan losses as additional data becomes available.

The ongoing increase in the Company’s provision for loan losses takes into consideration, among other things, the continued weakness in sectors such as hospitality and retail, how companies may perform when stimulus funds are no longer available, government restrictions that remain in place, the delayed rollout of the vaccines and the uncertainty surrounding the COVID variants and whether another surge may arise. While the Company’s loan portfolio, generally speaking, continues to perform very well, certain borrowers’ ability to service their debt could depend upon resolution of the above uncertainties.

Noninterest Income

The Company’s recurring sources of noninterest income consist primarily of bank owned life insurance income, service charges on deposit accounts and insurance commissions. Generally speaking, loan fees are included in interest income on the loan portfolio and not reported as noninterest income.

For the three months ended March 31, 2021, the Company reported total noninterest income of $464 thousand, compared to $244 thousand during the three months ended March 31, 2020. The Company experienced a $127 thousand year-over-year increase in insurance commissions for the three months ended March 31, 2021 when compared to the same period in 2020. The increase was a result of higher production and related incentives. As a result of stock market appreciation, the market adjustment on equity securities increased $129 thousand in the three months ended March 31, 2021 as compared to the three months ended March 31, 2020. Service charges on deposit accounts declined $13 thousand, bank owned life insurance declined $12 thousand and other service charges and fees decreased $6 thousand for the three months ended March 31, 2021 when compared to the same period in 2020. The year-over-year decline in service charges and other fees was mostly related to lower account activity for the three months ended March 31, 2021 when compared to the same period in 2020.

Noninterest Expense

For the three months ended March 31, 2021, noninterest expense increased 10.5%, to $7.9 million, compared to $7.1 million for the same period in 2020. Salaries and employee benefits expense was $5.0 million during the three months ended March 31, 2021, up $503 thousand or 11.2% when compared to $4.5 million during the three months ended March 31, 2020. The increase was primarily the result of incentive compensation tied to performance and six net new hires over the last twelve months. Occupancy expense increased 4.1% or $20 thousand and furniture and equipment expense decreased 12.7% or $47 thousand when comparing the three months ended March 31, 2021 to the same period in 2020. The increase in occupancy expense was mostly related to additional cleaning expenses related to COVID and general increase in rent expenses. Furniture and equipment expense declined due to renegotiation of software and equipment contracts during the past year. Other operating expense increased by 15.4%, or $277 thousand when comparing the three months ended March 31, 2021 to the same period in 2020. The higher other operating expense for the three months ended March 31, 2021 when compared to the same period in 2020, was mostly related to higher Federal Deposit Insurance Corporation deposit insurance, state bank franchise tax and higher marketing expenses.

About John Marshall Bancorp, Inc.

John Marshall Bancorp, Inc. is the bank holding company for John Marshall Bank. John Marshall Bank is headquartered in Reston, Virginia with eight full-service branches located in Alexandria, Arlington, Loudoun, Prince William, Reston, Rockville, Tysons, and Washington, D.C. and one loan production office in Arlington, Virginia. The Company is dedicated to providing an exceptional customer experience and value to local businesses, business owners and consumers in the Washington D.C. Metro area. The Bank offers a comprehensive line of sophisticated banking products, services and a digital platform that rival those of the largest banks. Dedicated relationship managers serving as direct point-of-contact along with an experienced staff help achieve customer’s financial goals. Learn more at www.johnmarshallbank.com.

In addition to historical information, this press release contains certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 which are based on certain assumptions and describe future plans, strategies and expectations of the Company. These forward-looking statements are generally identified by use of the words “believe,” “expect,” “intend,” “anticipate,” “estimate,” “project,” “will,” “should,” “may,” “view,” “opportunity,” “potential,” or similar expressions or expressions of confidence. The Company’s ability to predict results or the actual effect of future plans or strategies is inherently uncertain. Factors which could have a material adverse effect on the operations of the Company and its subsidiary include, but are not limited to the following: changes in interest rates, general economic conditions, public health crises (such as the governmental, social and economic effects of COVID), levels of unemployment in the Bank’s lending area, real estate market values in the Bank’s lending area, future natural disasters, the level of prepayments on loans and mortgage-backed securities, legislative/regulatory changes, monetary and fiscal policies of the U.S. Government including policies of the U.S. Treasury and the Board of Governors of the Federal Reserve System, the quality or composition of the loan or investment portfolios, demand for loan products, deposit flows, competition, demand for financial services in the Company’s market area, accounting principles and guidelines, and other conditions which by their nature are not susceptible to accurate forecast, and are subject to significant uncertainty. These risks and uncertainties should be considered in evaluating forward-looking statements and undue reliance should not be placed on such statements. The Company does not undertake, and specifically disclaims any obligation, to publicly release the result of any revisions which may be made to any forward-looking statements to reflect events or circumstances after the date of such statements or to reflect the occurrence of anticipated or unanticipated events. Annualized, pro forma, projected and estimated numbers are used for illustrative purpose only, are not forecasts and may not reflect actual results.

| John Marshall Bancorp, Inc. | ||||||||

| Financial Highlights (Unaudited) | ||||||||

| (Dollar amounts in thousands, except per share data) | ||||||||

At or For the Three Months Ended |

||||||||

March 31, |

||||||||

2021 |

2020 |

|||||||

| Selected Balance Sheet Data | ||||||||

| Cash and cash equivalents | $ |

161,397 |

|

$ |

110,490 |

|

||

| Total investment securities |

|

219,106 |

|

|

146,371 |

|

||

| Loans net of unearned income |

|

1,605,783 |

|

|

1,336,821 |

|

||

| Allowance for loan losses |

|

19,381 |

|

|

11,176 |

|

||

| Total assets |

|

2,009,988 |

|

|

1,623,045 |

|

||

| Non-interest bearing demand deposits |

|

419,796 |

|

|

274,878 |

|

||

| Interest bearing deposits |

|

1,341,594 |

|

|

1,104,564 |

|

||

| Total deposits |

|

1,761,390 |

|

|

1,379,442 |

|

||

| Shareholders' equity |

|

188,904 |

|

|

170,771 |

|

||

| Summary Results of Operations | ||||||||

| Interest income | $ |

18,747 |

$ |

17,818 |

|

|||

| Interest expense |

|

2,465 |

|

4,991 |

|

|||

| Net interest income |

|

16,282 |

|

|

12,827 |

|

||

| Provision for loan losses |

|

2,365 |

|

419 |

|

|||

| Net interest income after provision for loan losses |

|

13,917 |

|

|

12,408 |

|

||

| Noninterest income |

|

464 |

|

|

244 |

|

||

| Noninterest expense |

|

7,893 |

|

7,140 |

|

|||

| Income before income taxes |

|

6,488 |

|

|

5,512 |

|

||

| Net income |

|

5,074 |

|

4,501 |

|

|||

| Per Share Data and Shares Outstanding | ||||||||

| Earnings per share - basic | $ |

0.37 |

|

$ |

0.34 |

|

||

| Earnings per share - diluted | $ |

0.37 |

|

$ |

0.33 |

|

||

| Tangible book value per share | $ |

13.85 |

|

$ |

12.70 |

|

||

| Weighted average common shares (basic) |

|

13,557,779 |

|

|

13,282,179 |

|

||

| Weighted average common shares (diluted) |

|

13,809,751 |

|

|

13,688,921 |

|

||

| Common shares outstanding at end of period |

|

13,634,754 |

|

|

13,445,479 |

|

||

| Performance Ratios | ||||||||

| Return on average assets (annualized) |

|

1.05 |

% |

|

1.14 |

% |

||

| Return on average equity (annualized) |

|

10.89 |

% |

|

10.87 |

% |

||

| Net interest margin |

|

3.43 |

% |

|

3.33 |

% |

||

| Noninterest income as a percentage of average assets (annualized) |

|

0.10 |

% |

|

0.06 |

% |

||

| Noninterest expense as a percentage of average assets (annualized) |

|

1.64 |

% |

|

1.81 |

% |

||

| Efficiency ratio |

|

47.1 |

% |

|

54.6 |

% |

||

| Asset Quality | ||||||||

| Non-performing assets to total assets |

|

0.00 |

% |

|

0.00 |

% |

||

| Non-performing loans to total loans |

|

0.00 |

% |

|

0.00 |

% |

||

| Allowance for loan losses to non-performing loans |

|

N/M |

|

|

N/M |

|

||

| Allowance for loan losses to total loans (1) |

|

1.21 |

% |

|

0.84 |

% |

||

| Net charge-offs (recoveries) to average loans (annualized) |

|

0.00 |

% |

|

0.00 |

% |

||

| Loans 30-89 days past due and accruing interest | $ |

- - |

|

$ |

- - |

|

||

| Non-accrual loans | $ |

- - |

|

$ |

- - |

|

||

| Other real estate owned | $ |

- - |

|

$ |

- - |

|

||

| Non-performing assets (2) | $ |

- - |

|

$ |

- - |

|

||

| Troubled debt restructurings (total) | $ |

589 |

|

$ |

647 |

|

||

| Performing in accordance with modified terms | $ |

589 |

|

$ |

647 |

|

||

| Not performing in accordance with modified terms | $ |

- - |

|

$ |

- - |

|

||

| Bank Capital Ratios | ||||||||

| Tangible equity / tangible assets |

|

9.4 |

% |

|

10.5 |

% |

||

| Total risk-based capital ratio |

|

14.6 |

% |

|

13.9 |

% |

||

| Tier 1 risk-based capital ratio |

|

13.4 |

% |

|

13.1 |

% |

||

| Leverage ratio |

|

10.8 |

% |

|

11.9 |

% |

||

| Common equity tier 1 ratio |

|

13.4 |

% |

|

13.1 |

% |

||

| Other Information | ||||||||

| Number of full time equivalent employees |

|

143 |

|

|

137 |

|

||

| # Full service branch offices |

|

8 |

|

|

8 |

|

||

| # Loan production or limited service branch offices |

|

1 |

|

|

1 |

|

||

(1) The allowance for loan losses to total loans, excluding PPP loans of $117.8 million was 1.30% at March 31, 2021. PPP loans received no allocations in the allowance estimate due to the underlying guarantees. |

(2) Non-performing assets consist of non-accrual loans, loans 90 day or more past due and still accruing interest, and other real estate owned. Does not include troubled debt restructurings which were accruing interest at the date indicated. |

| John Marshall Bancorp, Inc. | ||||||||||||||||||

| Consolidated Balance Sheets | ||||||||||||||||||

| (Dollar amounts in thousands, except per share data) | ||||||||||||||||||

|

|

|

|

|

|

% Change |

||||||||||||

March 31, |

|

December 31, |

|

March 31, |

|

Last Three |

|

Year Over |

||||||||||

2021 |

|

2020 |

|

2020 |

|

Months |

|

Year |

||||||||||

Assets |

(Unaudited) |

|

(Unaudited) |

|

(Unaudited) |

|

|

|

|

|||||||||

| Cash and due from banks | $ |

6,868 |

|

$ |

8,228 |

|

$ |

8,762 |

|

-16.5 |

% |

-21.6 |

% |

|||||

| Interest-bearing deposits in banks |

|

154,529 |

|

|

130,229 |

|

|

101,728 |

|

18.7 |

% |

51.9 |

% |

|||||

| Securities available-for-sale, at fair value |

|

212,562 |

|

|

151,900 |

|

|

139,413 |

|

39.9 |

% |

52.5 |

% |

|||||

| Restricted securities, at cost |

|

5,089 |

|

|

5,676 |

|

|

6,343 |

|

-10.3 |

% |

-19.8 |

% |

|||||

| Equity securities, at fair value |

|

1,455 |

|

|

967 |

|

|

615 |

|

50.5 |

% |

136.6 |

% |

|||||

| Loans net of unearned income |

|

1,605,783 |

|

|

1,562,524 |

|

|

1,336,821 |

|

2.8 |

% |

20.1 |

% |

|||||

| Allowance for loan losses |

|

(19,381 |

) |

|

(17,017 |

) |

|

(11,176 |

) |

13.9 |

% |

73.4 |

% |

|||||

| Net loans |

|

1,586,402 |

|

|

1,545,507 |

|

|

1,325,645 |

|

2.6 |

% |

19.7 |

% |

|||||

| Bank premises and equipment, net |

|

1,990 |

|

|

2,422 |

|

|

2,260 |

|

-17.8 |

% |

-11.9 |

% |

|||||

| Accrued interest receivable |

|

4,818 |

|

|

5,308 |

|

|

3,982 |

|

-9.2 |

% |

21.0 |

% |

|||||

| Bank owned life insurance |

|

20,694 |

|

|

20,587 |

|

|

20,237 |

|

0.5 |

% |

2.3 |

% |

|||||

| Right of use assets |

|

5,611 |

|

|

5,944 |

|

|

6,929 |

|

-5.6 |

% |

-19.0 |

% |

|||||

| Other assets |

|

9,970 |

|

|

8,728 |

|

|

7,131 |

|

14.2 |

% |

39.8 |

% |

|||||

| Total assets | $ |

2,009,988 |

|

$ |

1,885,496 |

|

$ |

1,623,045 |

|

6.6 |

% |

23.8 |

% |

|||||

| Liabilities and Shareholders' Equity | ||||||||||||||||||

Liabilities |

||||||||||||||||||

| Deposits: | ||||||||||||||||||

| Non-interest bearing demand deposits | $ |

419,796 |

|

$ |

362,582 |

|

$ |

274,878 |

|

15.8 |

% |

52.7 |

% |

|||||

| Interest bearing demand deposits |

|

590,083 |

|

|

563,956 |

|

|

468,330 |

|

4.6 |

% |

26.0 |

% |

|||||

| Savings deposits |

|

72,102 |

|

|

62,138 |

|

|

32,745 |

|

16.0 |

% |

120.2 |

% |

|||||

| Time deposits |

|

679,409 |

|

|

651,444 |

|

|

603,489 |

|

4.3 |

% |

12.6 |

% |

|||||

| Total deposits |

|

1,761,390 |

|

|

1,640,120 |

|

|

1,379,442 |

|

7.4 |

% |

27.7 |

% |

|||||

| Federal Home Loan Bank advances |

|

22,000 |

|

|

22,000 |

|

|

37,000 |

|

0.0 |

% |

-40.5 |

% |

|||||

| Subordinated debt |

|

24,692 |

|

|

24,679 |

|

|

24,642 |

|

0.1 |

% |

0.2 |

% |

|||||

| Accrued interest payable |

|

692 |

|

|

877 |

|

|

899 |

|

-21.1 |

% |

-23.0 |

% |

|||||

| Lease liabilities |

|

5,873 |

|

|

6,208 |

|

|

7,172 |

|

-5.4 |

% |

-18.1 |

% |

|||||

| Other liabilities |

|

6,437 |

|

|

5,531 |

|

|

3,119 |

|

16.4 |

% |

106.4 |

% |

|||||

| Total liabilities |

|

1,821,084 |

|

|

1,699,415 |

|

|

1,452,274 |

|

7.2 |

% |

25.4 |

% |

|||||

| Shareholders' Equity | ||||||||||||||||||

| Preferred stock, par value $0.01 per share; authorized 1,000,000 shares; none issued |

|

- - |

|

|

- - |

|

|

- - |

|

- - |

|

- - |

|

|||||

| Common stock, nonvoting, par value $0.01 per share; authorized 1,000,000 shares; none issued |

|

- - |

|

|

- - |

|

|

- - |

|

- - |

|

- - |

|

|||||

| Common stock, voting, par value $0.01 per share; authorized 20,000,000 shares; issued and outstanding, 13,634,754 at 3/31/2021 including 68,375 unvested shares, 13,606,558 shares at 12/31/2020 including 74,000 unvested shares and 13,445,479 at 3/31/2020, including 55,908 unvested shares |

|

136 |

|

|

135 |

|

|

134 |

|

0.7 |

% |

1.5 |

% |

|||||

| Additional paid-in capital |

|

90,295 |

|

|

89,995 |

|

|

88,890 |

|

0.3 |

% |

1.6 |

% |

|||||

| Retained earnings |

|

97,239 |

|

|

92,165 |

|

|

78,141 |

|

5.5 |

% |

24.4 |

% |

|||||

| Accumulated other comprehensive income |

|

1,234 |

|

|

3,786 |

|

|

3,606 |

|

-67.4 |

% |

-65.8 |

% |

|||||

| Total shareholders' equity |

|

188,904 |

|

|

186,081 |

|

|

170,771 |

|

1.5 |

% |

10.6 |

% |

|||||

| Total liabilities and shareholders' equity | $ |

2,009,988 |

|

$ |

1,885,496 |

|

$ |

1,623,045 |

|

6.6 |

% |

23.8 |

% |

|||||

| John Marshall Bancorp, Inc. | ||||||||||

| Consolidated Statements of Income | ||||||||||

| (Dollar amounts in thousands, except per share data) | ||||||||||

Three Months Ended |

||||||||||

March 31, |

||||||||||

2021 |

2020 |

% Change |

||||||||

| (Unaudited) | (Unaudited) | |||||||||

| Interest and Dividend Income | ||||||||||

| Interest and fees on loans | $ |

17,839 |

$ |

16,625 |

|

7.3 |

% |

|||

| Interest on investment securities, taxable |

|

769 |

|

772 |

|

-0.4 |

% |

|||

| Interest on investment securities, tax-exempt |

|

30 |

|

26 |

|

15.4 |

% |

|||

| Dividends |

|

65 |

|

95 |

|

-31.6 |

% |

|||

| Interest on deposits in banks |

|

44 |

|

300 |

|

-85.3 |

% |

|||

| Total interest and dividend income |

|

18,747 |

|

17,818 |

|

5.2 |

% |

|||

| Interest Expense | ||||||||||

| Deposits |

|

2,060 |

|

4,458 |

|

-53.8 |

% |

|||

| Federal Home Loan Bank advances |

|

33 |

|

160 |

|

-79.4 |

% |

|||

| Subordinated debt |

|

372 |

|

372 |

|

0.0 |

% |

|||

| Other short-term borrowings |

|

- - |

|

1 |

|

-100.0 |

% |

|||

| Total interest expense |

|

2,465 |

|

4,991 |

|

-50.6 |

% |

|||

| Net interest income |

|

16,282 |

|

12,827 |

|

26.9 |

% |

|||

| Provision for loan losses |

|

2,365 |

|

419 |

|

464.4 |

% |

|||

| Net interest income after provision for loan losses |

|

13,917 |

|

12,408 |

|

12.2 |

% |

|||

| Noninterest Income | ||||||||||

| Service charges on deposit accounts |

|

121 |

|

134 |

|

-9.7 |

% |

|||

| Bank owned life insurance |

|

107 |

|

119 |

|

-10.1 |

% |

|||

| Other service charges and fees |

|

41 |

|

47 |

|

-12.8 |

% |

|||

| Insurance commissions |

|

155 |

|

28 |

|

453.6 |

% |

|||

| Gain on sale of securities |

|

10 |

|

12 |

|

-16.7 |

% |

|||

| Other operating income (loss) |

|

30 |

|

(96 |

) |

131.3 |

% |

|||

| Total noninterest income |

|

464 |

|

244 |

|

90.2 |

% |

|||

| Noninterest Expenses | ||||||||||

| Salaries and employee benefits |

|

4,989 |

|

4,486 |

|

11.2 |

% |

|||

| Occupancy expense of premises |

|

507 |

|

487 |

|

4.1 |

% |

|||

| Furniture and equipment expenses |

|

322 |

|

369 |

|

-12.7 |

% |

|||

| Other operating expenses |

|

2,075 |

|

1,798 |

|

15.4 |

% |

|||

| Total noninterest expenses |

|

7,893 |

|

7,140 |

|

10.5 |

% |

|||

| Income before income taxes |

|

6,488 |

|

5,512 |

|

17.7 |

% |

|||

| Income tax expense |

|

1,414 |

|

1,011 |

|

39.9 |

% |

|||

| Net income | $ |

5,074 |

$ |

4,501 |

|

12.7 |

% |

|||

| Earnings Per Share | ||||||||||

| Basic | $ |

0.37 |

$ |

0.34 |

|

8.8 |

% |

|||

| Diluted | $ |

0.37 |

$ |

0.33 |

|

12.1 |

% |

|||

| John Marshall Bancorp, Inc. | ||||||||||||||||||||||||||||||

| Loan, Deposit and Borrowing Detail (Unaudited) | ||||||||||||||||||||||||||||||

| (Dollar amounts in thousands) | ||||||||||||||||||||||||||||||

2021 |

2020 |

|||||||||||||||||||||||||||||

Loans |

1Q | Q4 | Q3 | Q2 | Q1 | |||||||||||||||||||||||||

| $ Amount | % of Total | $ Amount | % of Total | $ Amount | % of Total | $ Amount | % of Total | $ Amount | % of Total | |||||||||||||||||||||

| Commercial business loans | $ |

60,637 |

|

3.8 |

% |

$ |

67,549 |

|

4.4 |

% |

$ |

77,709 |

|

5.1 |

% |

$ |

77,987 |

|

5.1 |

% |

$ |

81,553 |

|

6.1 |

% |

|||||

| Commercial PPP loans |

|

117,796 |

|

7.3 |

% |

|

114,411 |

|

7.3 |

% |

|

148,156 |

|

9.6 |

% |

|

148,156 |

|

9.7 |

% |

|

- - |

|

0.0 |

% |

|||||

| Commercial owner-occupied real estate loans |

|

307,918 |

|

19.2 |

% |

|

290,802 |

|

18.6 |

% |

|

260,575 |

|

17.0 |

% |

|

267,032 |

|

17.6 |

% |

|

255,010 |

|

19.1 |

% |

|||||

| Total business loans |

|

486,351 |

|

30.3 |

% |

|

472,762 |

|

30.3 |

% |

|

486,440 |

|

31.7 |

% |

|

493,175 |

|

32.4 |

% |

|

336,563 |

|

25.2 |

% |

|||||

| Investor real estate loans |

|

502,940 |

|

31.3 |

% |

|

497,087 |

|

31.8 |

% |

|

498,352 |

|

32.5 |

% |

|

480,220 |

|

31.6 |

% |

|

470,163 |

|

35.2 |

% |

|||||

| Construction & development loans |

|

250,208 |

|

15.6 |

% |

|

243,741 |

|

15.6 |

% |

|

237,195 |

|

15.4 |

% |

|

236,927 |

|

15.6 |

% |

|

243,023 |

|

18.2 |

% |

|||||

| Multi-family loans |

|

84,689 |

|

5.3 |

% |

|

69,367 |

|

4.4 |

% |

|

49,277 |

|

3.2 |

% |

|

55,797 |

|

3.7 |

% |

|

58,362 |

|

4.3 |

% |

|||||

| Total commercial real estate loans |

|

837,837 |

|

52.2 |

% |

|

810,195 |

|

51.8 |

% |

|

784,824 |

|

51.1 |

% |

|

772,944 |

|

50.9 |

% |

|

771,548 |

|

57.7 |

% |

|||||

| Residential mortgage loans |

|

281,964 |

|

17.5 |

% |

|

278,763 |

|

17.8 |

% |

|

262,049 |

|

17.1 |

% |

|

252,494 |

|

16.6 |

% |

|

227,172 |

|

17.0 |

% |

|||||

| Consumer loans |

|

793 |

|

0.0 |

% |

|

1,000 |

|

0.1 |

% |

|

1,208 |

|

0.1 |

% |

|

1,448 |

|

0.1 |

% |

|

1,099 |

|

0.1 |

% |

|||||

| Total loans | $ |

1,606,945 |

|

100.0 |

% |

$ |

1,562,720 |

|

100.0 |

% |

$ |

1,534,521 |

|

100.0 |

% |

$ |

1,520,061 |

|

100.0 |

% |

$ |

1,336,382 |

|

100.0 |

% |

|||||

| Less: Allowance for loan losses |

|

(19,381 |

) |

|

(17,017 |

) |

|

(14,441 |

) |

|

(12,725 |

) |

|

(11,176 |

) |

|||||||||||||||

| Net deferred loan costs (fees) |

|

(1,162 |

) |

|

(196 |

) |

|

(1,808 |

) |

|

(2,430 |

) |

|

439 |

|

|||||||||||||||

| Net loans | $ |

1,586,402 |

|

$ |

1,545,507 |

|

$ |

1,518,272 |

|

$ |

1,504,906 |

|

$ |

1,325,645 |

|

|||||||||||||||

2021 |

2020 |

|||||||||||||||||||||||||||||

1Q |

Q4 |

Q3 |

Q2 |

Q1 |

||||||||||||||||||||||||||

Deposits |

$ Amount | % of Total | $ Amount | % of Total | $ Amount | % of Total | $ Amount | % of Total | $ Amount | % of Total | ||||||||||||||||||||

| Noninterest-bearing demand deposits | $ |

419,796 |

|

23.8 |

% |

$ |

362,582 |

|

22.1 |

% |

$ |

385,885 |

|

23.8 |

% |

$ |

398,670 |

|

25.5 |

% |

$ |

274,878 |

|

19.9 |

% |

|||||

| Interest-bearing demand deposits: | ||||||||||||||||||||||||||||||

| NOW accounts(1) |

|

245,274 |

|

13.9 |

% |

|

233,993 |

|

14.3 |

% |

|

227,816 |

|

14.1 |

% |

|

207,558 |

|

13.3 |

% |

|

179,197 |

|

13.0 |

% |

|||||

| Money market accounts(1) |

|

344,807 |

|

19.6 |

% |

|

329,960 |

|

20.1 |

% |

|

321,760 |

|

19.8 |

% |

|

303,378 |

|

19.4 |

% |

|

289,131 |

|

21.0 |

% |

|||||

| Savings accounts |

|

72,102 |

|

4.1 |

% |

|

62,138 |

|

3.8 |

% |

|

60,418 |

|

3.7 |

% |

|

49,896 |

|

3.2 |

% |

|

32,745 |

|

2.4 |

% |

|||||

| Certificates of deposit | ||||||||||||||||||||||||||||||

| $250,000 or more |

|

265,772 |

|

15.1 |

% |

|

258,744 |

|

15.8 |

% |

|

281,302 |

|

17.4 |

% |

|

250,779 |

|

16.1 |

% |

|

249,802 |

|

18.1 |

% |

|||||

| Less than $250,000 |

|

119,828 |

|

6.8 |

% |

|

115,634 |

|

7.0 |

% |

|

117,171 |

|

7.2 |

% |

|

121,600 |

|

7.8 |

% |

|

128,176 |

|

9.3 |

% |

|||||

| QwickRate® certificates of deposit |

|

38,565 |

|

2.2 |

% |

|

29,765 |

|

1.8 |

% |

|

29,781 |

|

1.8 |

% |

|

31,764 |

|

2.0 |

% |

|

20,011 |

|

1.4 |

% |

|||||

| IntraFi® certificates of deposit |

|

38,284 |

|

2.2 |

% |

|

39,725 |

|

2.4 |

% |

|

36,909 |

|

2.3 |

% |

|

37,320 |

|

2.4 |

% |

|

57,398 |

|

4.2 |

% |

|||||

| Brokered deposits |

|

216,962 |

|

12.3 |

% |

|

207,579 |

|

12.7 |

% |

|

161,104 |

|

9.9 |

% |

|

160,626 |

|

10.3 |

% |

|

148,104 |

|

10.7 |

% |

|||||

| Total deposits | $ |

1,761,390 |

|

100.0 |

% |

$ |

1,640,120 |

|

100.0 |

% |

$ |

1,622,146 |

|

100.0 |

% |

$ |

1,561,591 |

|

100.0 |

% |

$ |

1,379,442 |

|

100.0 |

% |

|||||

Borrowings |

||||||||||||||||||||||||||||||

| Federal Home Loan Bank advances | $ |

22,000 |

|

47.1 |

% |

$ |

22,000 |

|

47.1 |

% |

$ |

22,000 |

|

47.1 |

% |

$ |

26,000 |

|

51.3 |

% |

$ |

37,000 |

|

60.0 |

% |

|||||

| Subordinated debt |

|

24,692 |

|

52.9 |

% |

|

24,679 |

|

52.9 |

% |

|

24,667 |

|

52.9 |

% |

|

24,655 |

|

48.7 |

% |

|

24,642 |

|

40.0 |

% |

|||||

| Total borrowings | $ |

46,692 |

|

100.0 |

% |

$ |

46,679 |

|

100.0 |

% |

$ |

46,667 |

|

100.0 |

% |

$ |

50,655 |

|

100.0 |

% |

$ |

61,642 |

|

100.0 |

% |

|||||

| Total deposits and borrowings | $ |

1,808,082 |

|

$ |

1,686,799 |

|

$ |

1,668,813 |

|

$ |

1,612,246 |

|

$ |

1,441,084 |

|

|||||||||||||||

| Core customer funding sources (2) | $ |

1,505,863 |

|

84.4 |

% |

$ |

1,402,776 |

|

84.4 |

% |

$ |

1,431,261 |

|

87.1 |

% |

$ |

1,369,201 |

|

86.2 |

% |

$ |

1,211,327 |

|

85.5 |

% |

|||||

| Wholesale funding sources (3) |

|

277,527 |

|

15.6 |

% |

|

259,344 |

|

15.6 |

% |

|

212,885 |

|

12.9 |

% |

|

218,390 |

|

13.8 |

% |

|

205,115 |

|

14.5 |

% |

|||||

| Total funding sources | $ |

1,783,390 |

|

100.0 |

% |

$ |

1,662,120 |

|

100.0 |

% |

$ |

1,644,146 |

|

100.0 |

% |

$ |

1,587,591 |

|

100.0 |

% |

$ |

1,416,442 |

|

100.0 |

% |

|||||

| (1) Includes IntraFi® accounts. | ||||||||||||||

| (2) Includes IntraFi Demand®, IntraFi Money Market® and IntraFi CD®, which are all reciprocal deposits maintained by customers. | ||||||||||||||

| (3) Consists of QwickRate® certificates of deposit, brokered deposits, federal funds purchased and Federal Home Loan Bank advances. |

| John Marshall Bancorp, Inc. | ||||||||||||||||||

| Average Balance Sheets, Interest and Rates (unaudited) | ||||||||||||||||||

| (Dollar amounts in thousands) | ||||||||||||||||||

Three Months Ended March 31, 2021 |

Three Months Ended March 31, 2020 |

|||||||||||||||||

Interest |

Average |

Interest |

Average |

|||||||||||||||

Average |

Income- |

Yields |

Average |

Income- |

Yields |

|||||||||||||

Balance |

Expense |

/Rates |

Balance |

Expense |

/Rates |

|||||||||||||

| Assets | ||||||||||||||||||

| Securities | $ |

180,180 |

$ |

864 |

1.94 |

% |

$ |

136,918 |

$ |

893 |

2.62 |

% |

||||||

| Loans, net of unearned income |

|

1,575,847 |

|

17,839 |

4.59 |

% |

|

1,320,447 |

|

16,625 |

5.06 |

% |

||||||

| Interest-bearing deposits in other banks |

|

166,808 |

|

44 |

0.11 |

% |

|

93,474 |

|

300 |

1.29 |

% |

||||||

| Total interest-earning assets | $ |

1,922,835 |

$ |

18,747 |

3.95 |

% |

$ |

1,550,839 |

$ |

17,818 |

4.62 |

% |

||||||

| Other assets |

|

31,253 |

|

38,732 |

||||||||||||||

| Total assets | $ |

1,954,088 |

$ |

1,589,571 |

||||||||||||||

| Liabilities & Shareholders' equity | ||||||||||||||||||

| Interest-bearing deposits | ||||||||||||||||||

| NOW accounts | $ |

238,993 |

$ |

198 |

0.34 |

% |

$ |

149,077 |

$ |

345 |

0.93 |

% |

||||||

| Money market accounts |

|

335,291 |

|

317 |

0.38 |

% |

|

292,886 |

|

902 |

1.24 |

% |

||||||

| Savings accounts |

|

67,248 |

|

65 |

0.39 |

% |

|

30,797 |

|

101 |

1.32 |

% |

||||||

| Time deposits |

|

665,003 |

|

1,480 |

0.90 |

% |

|

592,889 |

|

3,110 |

2.11 |

% |

||||||

| Total interest-bearing deposits | $ |

1,306,535 |

$ |

2,060 |

0.64 |

% |

$ |

1,065,649 |

$ |

4,458 |

1.68 |

% |

||||||

| Federal funds purchased | $ |

1 |

$ |

- - |

0.00 |

% |

$ |

132 |

$ |

1 |

3.05 |

% |

||||||

| Subordinated debt |

|

24,684 |

|

372 |

6.11 |

% |

|

24,635 |

|

372 |

6.07 |

% |

||||||

| Other borrowed funds |

|

19,522 |

|

33 |

0.69 |

% |

|

44,703 |

|

160 |

1.44 |

% |

||||||

| Total interest-bearing liabilities | $ |

1,350,742 |

$ |

2,465 |

0.74 |

% |

$ |

1,135,119 |

$ |

4,991 |

1.77 |

% |

||||||

| Demand deposits |

|

403,143 |

|

276,209 |

||||||||||||||

| Other liabilities |

|

11,208 |

|

11,641 |

||||||||||||||

| Total liabilities | $ |

1,765,093 |

$ |

1,422,969 |

||||||||||||||

| Shareholders' equity |

|

188,995 |

|

166,602 |

||||||||||||||

| Total liabilities and shareholders' equity | $ |

1,954,088 |

$ |

1,589,571 |

||||||||||||||

| Interest rate spread | 3.21 |

% |

2.85 |

% |

||||||||||||||

| Net interest income and margin | $ |

16,282 |

3.43 |

% |

$ |

12,827 |

3.33 |

% |

||||||||||

View source version on businesswire.com: https://www.businesswire.com/news/home/20210421005196/en/

Contacts

Chris Bergstrom

(703) 584-0840

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the following

Privacy Policy and Terms and Conditions.