Financial News

Dear Parents – You Have More Influence on Your Kids’ Finances Than You Think

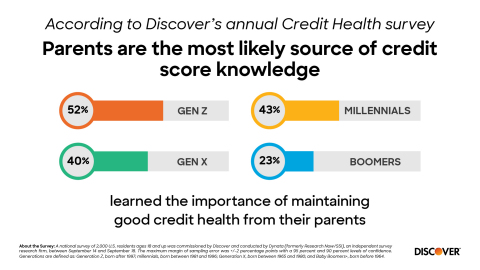

Parents are the most likely source of credit score knowledge, according to Discover’s annual Credit Health survey

While most people may look to social media influencers for advice on the latest fashion, DIY projects or dance moves, when it comes to learning the importance of building good credit habits, it’s actually their parents who carry the most influence. Discover’s annual Credit Health survey revealed people are most likely to learn about the importance of building good credit habits from their parents, 38%, showing the influence parents can have over their children’s financial habits.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20211027005306/en/

According to Discover's annual Credit Health survey, Parents are the most likely source of credit score knowledge (Photo: Business Wire)

Parental influence is more prevalent for Gen Z, who cited both their parents (52%) and high school education, 44%, as stepping-up to teach them about the importance of good credit health early on. In fact, Gen Zers are getting an education about credit scores younger than generations that came before them. Nearly seven in 10, 69%, say they learned about their scores between ages 15 – 19, double that of other generations. Meanwhile, other generations report that they learned about credit scores in their 20s.

Learned about the importance of maintaining good credit health… |

Gen Z |

Millennials |

Gen X |

Boomers |

Between 15-19 |

69% |

30% |

17% |

9% |

In their 20s |

30% |

49% |

44% |

35% |

From their parents |

52% |

43% |

40% |

23% |

In high school |

44% |

28% |

17% |

9% |

“Credit health may not be something people think about until they’re ready to hit life’s next major milestone – but the reality is that building a credit score is a long-term practice, rather than a single change,” said Stefanie O’Connell Rodriguez, a nationally-recognized personal finance author and speaker. “Receiving monthly credit checks through Discover’s Credit Scorecard* is an easy way to put that practice into motion and see exactly what factors are most impacting your credit score – so you can tweak your strategy over time to be sure you’re in a good credit position for life’s next big moment.”

Credit Scores and the Impact on Daily Lives

Discover’s survey also asked consumers what they wish they knew about their credit score when they were first starting out on their financial journeys. Thinking back, 21% said they wish they’d known the impact credit scores have on the interest rates they’re able to get on loans.

Slightly more than half of millennials, 55%, and Gen Xers, 52%, said their credit score has held them back from making a major purchase or life decision. Millennials report they have been kept from purchasing a home, 23%, while Gen Xers have been denied personal loans, 26%. Four in 10 of Gen Z report their credit score has already held them back, as well, with 25% saying they haven’t been able to the house/condo they wanted.

The Pandemic’s Impact on Credit Health

According to Discover’s survey, people’s satisfaction with their credit scores slipped amid the pandemic, reaffirming the need to think about credit health early and often. This year, just over half, 55%, of people say they’re satisfied with their current credit score, a decrease from 63% in 2020.

Discover’s Credit Health survey shows that 66% of people are actively trying to improve their credit score, a 12-percentage point jump from 2020. To help achieve this goal, 34% say they are checking their credit score more often than last year, almost double those who said the same in 2020, 18%.

Factors contributing to why people are checking their scores… |

Gen Z |

Millennials |

Gen X |

Boomers |

Wanting to maintain/stay on top of credit scores |

32% |

37% |

36% |

36% |

Concern over identity theft |

29% |

34% |

45% |

43% |

Wanting to improve their score |

48% |

46% |

42% |

17% |

Intent to make a large purchase soon |

29% |

29% |

17% |

6% |

Wanting to apply for a new credit card |

24% |

20% |

14% |

4% |

“Americans are continuing to rebound from difficulties presented by the past year, and it’s encouraging to see people working toward better scores despite setbacks. At Discover, we understand everyone may not yet have perfect credit, and that’s why we’ve designed products and tools to help them on their journeys to brighter financial futures,” said Shannon Kors, Vice President of Marketing and Product Strategy at Discover. “Products like the Discover it® Secured credit card can help build credit with responsible use.”** The Credit Scorecard can help customers better understand the factors that impact their credit score.”

For more information about Discover’s offerings, go to discover.com.

About the Survey

A national survey of 2,000 U.S. residents ages 18 and up was commissioned by Discover and conducted by Dynata (formerly Research Now/SSI), an independent survey research firm, between September 14 and September 18. The maximum margin of sampling error was +/-2 percentage points with a 95 percent and 90 percent levels of confidence. Generations are defined as: Generation Z, born after 1997; millennials, born between 1981 and 1996; Generation X, born between 1965 and 1980; and Baby Boomers+, born before 1964.

About Discover

Discover Financial Services (NYSE: DFS) is a digital banking and payment services company with one of the most recognized brands in U.S. financial services. Since its inception in 1986, the company has become one of the largest card issuers in the United States. The company issues the Discover card, America's cash rewards pioneer, and offers private student loans, personal loans, home loans, checking and savings accounts and certificates of deposit through its banking business. It operates the Discover Global Network comprised of Discover Network, with millions of merchant and cash access locations; PULSE, one of the nation's leading ATM/debit networks; and Diners Club International, a global payments network with acceptance around the world. For more information, visit www.discover.com/company.

*FICO® Credit Score Terms: Your FICO® Credit Score, key factors and other credit information are based on data from TransUnion® and may be different from other credit scores and other credit information provided by different bureaus. This information is intended for and only provided to Primary account holders who have an available score. See Discover.com/FICO about the availability of your score. Your score, key factors and other credit information are available on Discover.com. Customers will see up to a year of recent scores online. Discover and other lenders may use different inputs, such as FICO® Credit Scores, other credit scores and more information in credit decisions. This benefit may change or end in the future. FICO is a registered trademark of Fair Isaac Corporation in the United States and other countries.

**Discover reports your credit history to the three major credit bureaus so it can help build your credit if used responsible. Late payments, delinquencies or other derogatory activity with your credit card accounts and loans may adversely impact your ability to build credit.

View source version on businesswire.com: https://www.businesswire.com/news/home/20211027005306/en/

Dear Parents – You Have More Influence on Your Kids’ Finances Than You Think

Contacts

Derek Cuculich

224-405-0665

derekcuculich@discover.com

@Discover_News

More News

View More

Recent Quotes

View MoreQuotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.