Financial News

HSBC Just Doubled Its Price Target on Intel Stock. Should You Buy INTC Ahead of Earnings?

Intel (INTC) has been fighting its way back into investors’ favor after a year of questions around foundry execution and uneven visibility in its core businesses, yet in 2026, the stock keeps hitting a 4-year peak as optimism around data center demand builds with the help of government support.

That bullish turn got louder this week when HSBC bumped Intel from “Reduce” to “Hold” and lifted its price target to $50 from $26. Seaport Research upgraded to “Buy” with a $65 target, and Susquehanna nudged its target to $45, all ahead of Intel’s Jan. 22 quarter. Analysts cite a sharper-than-expected rebound in server CPU demand driven by “agentic” AI. HSBC sees FY26 server shipments up 15% to 20% vs. the Street’s 4% to 6% and improving foundry engagement.

With consensus at $0.08 a share on $13.38 billion revenue, the big question for investors is simple: buy INTC before earnings or wait for the print?

About Intel Stock

Based in Santa Clara, Intel Corporation is one of the world’s largest semiconductor companies. It designs and manufactures advanced chips for PCs, data centers, and other devices, a unique integrated device manufacturer (IDM) that controls its own foundry network.

Strategically, Intel secured major investments and partnerships in the past couple of months. Nvidia (NVDA) put in $5 billion, SoftBank (SFTBY) put in $2 billion, and the U.S. government remains a key shareholder. These moves strengthened the balance sheet and funded Lip-Bu Tan’s turnaround plan.

Product-wise, Intel has begun shipping its new “Panther Lake” PC processors on the 18A node and says 18A yields are now above 60%. Foundry momentum is also rising: KeyBanc notes external server CPU capacity is nearly “sold out” and even speaks of a potential 10 to 15% price hike, while reports suggest Apple will use Intel to make low-end chips by 2027.

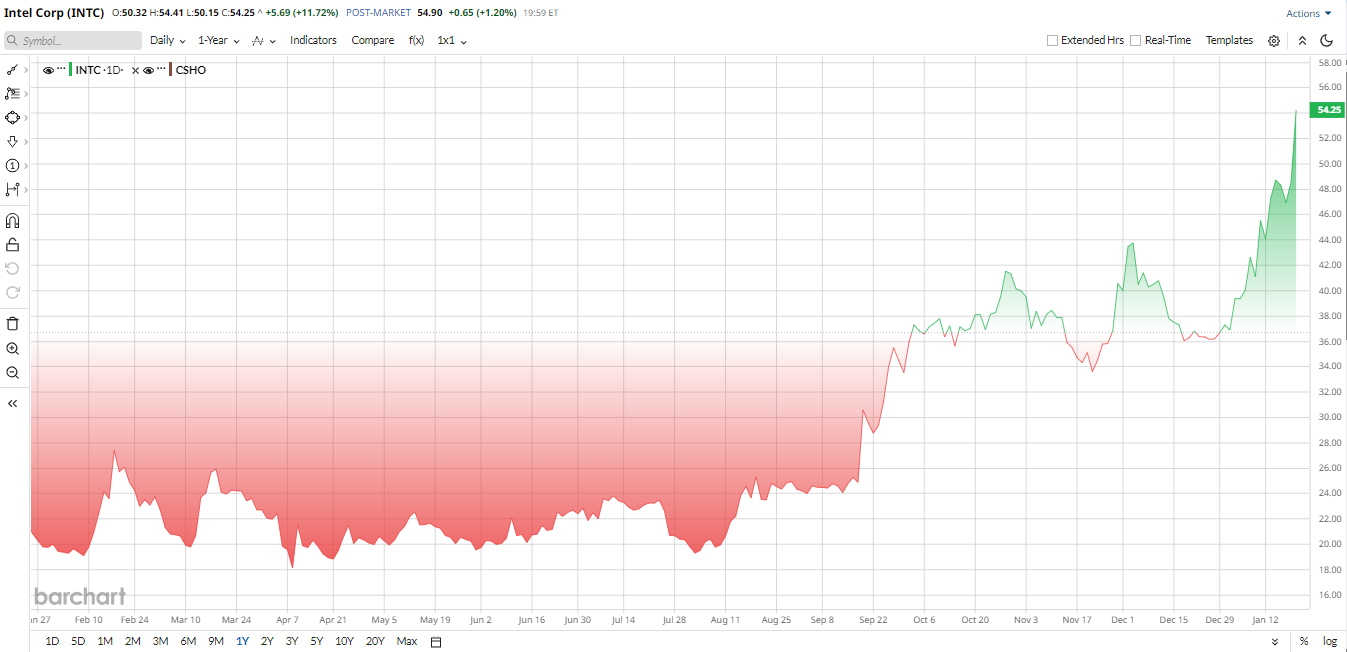

Intel stock has soared and keeps hitting new peaks. INTC rallied about 145% over the past year versus a 13% gain in the S&P 500 Index ($SPX), as investors began to price in a turnaround. The rally carried into 2026; by mid-January, INTC was up about 19% year-to-date (YTD).

On valuation metrics, Intel looks roughly in line with semiconductor peers. Its price/sales ratio is about 4x, around 15% below the industry median of 4.7x. Its enterprise value/EBITDA is about 18.4x, essentially matching the sector median of 19x. So all this means Intel appears fairly valued, modestly cheaper on sales, and roughly in line on cash flow, relative to the broader chip industry.

What to Expect from the Upcoming Quarter

Intel will report Q4 2025 results on Jan. 22 after the market close. Street estimates call for roughly $13.39 billion in revenue and $0.08 EPS, down slightly year-over-year (YoY) versus $14.26 billion and $0.13 EPS in Q4 2024. Analysts expect a boom in the Data Center & AI (DCAI) segment; one estimate sees DC revenue up 30% to $4.43 billion in Q4, thanks to AI-driven server demand. PC group sales are seen as largely flat or up modestly, $8.21 billion at north of 2.5%.

Notably, Intel has a history of surprising on the upside. In the last four quarters, it beat sales targets by 4.7% on average and earnings by 77%, recently reporting $0.23 vs. $0.01 expected.

Investors will watch whether that streak continues. Key things to watch in the call include management’s 2026 guidance, server CPU pricing (analysts even expect possible 10 to 15% ASP increases), memory-cost impacts on PCs, and progress on the 18A and external foundry roadmap.

Any sign of improved profit margins, Intel’s adjusted gross margin is predicted to be in the mid-30s, having been 36.5% in Q4, will be cheered, while any notable headwinds from memory shortages or continued PC share loss to rivals will draw scrutiny.

Analyst Upgrades and Impacts

The opinion of Wall Street toward Intel is becoming warmer. In addition to HSBC and Seaport, other companies have just increased their expectations by referring to the improvement of the fundamentals in both data centers and production. For instance, KeyBanc has also upgraded Intel to “Overweight,” having a price target of $60, attributing progress on its 18A process and the accelerating server demand.

Citigroup also upgraded the stock from “Sell” to “Hold” with a price of $50, claiming that Intel might enjoy the constraint in the supply of advanced packaging, and UBS increased its price target to $49 and stood at a “Neutral” position. Jefferies restated a Hold rating and a goal of $45, stating that the short-term performance of the management might also be weak.

Despite these positives, skeptics remain. After CES, Bank of America reiterated an “Underperform” rating and a $40 target and estimated a fourth-quarter revenue of approximately $13.4 billion and a 36.5% gross margin, which is generally consistent with the forecast.

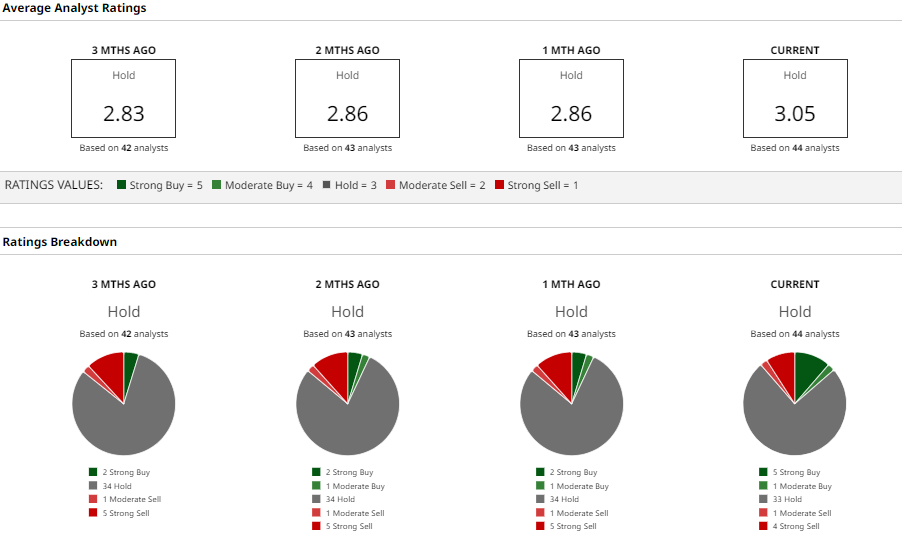

On the whole, although the latest upgrades attest to the increasing belief in the AI-based server opportunity and better performance of Intel, the Wall Street sentiment is "Hold" with an average price target of approximately $41, indicating that there will be minimal downside in the case unless the performance of both the earnings and guidance is obviously above expectations.

On the date of publication, Nauman Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Calling Back to Jimmy Carter, Citigroup’s CEO Says Credit Card Rate Caps Would ‘Not Be Good’ for the U.S. Economy

- ‘Yes or No AI’: 93% of DuckDuckGo Users Overwhelmingly Reject AI, So What Does This Mean for the Future of Nvidia, Alphabet, and Other AI Stocks?

- KHC Is Low-Hanging Fruit for Greg Abel: Which Warren Buffett Stock Will He Sell Next?

- The ‘Trump Effect’ Makes Intel’s Earnings Report Tonight Very Special. Why You Should Brace for a Double-Digit Move in INTC Stock.

More News

View More

Recent Quotes

View MoreQuotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.