Financial News

Competition Is Heating Up, But Bank of America Still Thinks AMD Stock Is a Buy Here

Advanced Micro Devices (AMD) has always been one of the world’s top chipmakers, but lately it’s been stepping out of Nvidia’s (NVDA) shadow in a big way. Thanks to accelerating growth and rising demand for its chips, AMD has become a top choice for leading artificial intelligence (AI) companies, including OpenAI, the creator of ChatGPT and a key customer.

That excitement has sent AMD shares soaring this year, as investors increasingly see the company as a serious contender in the AI hardware race. But the hotter the AI chip market gets, the more crowded the field becomes. And now a new threat is emerging from none other than Google parent Alphabet (GOOG) (GOOGL). On Nov. 25, AMD stock tanked nearly 4.2% after reports surfaced that Meta (META) is considering a multi-billion-dollar investment in Google’s custom Tensor Processing Units (TPUs).

Google has begun pitching its TPUs to major customers, including Meta and top financial institutions, in hopes of shaking up the current GPU-dominated market. And Meta, a major Nvidia GPU buyer, is reportedly exploring deploying Google’s TPUs in its data centers by 2027, and may even start renting the chips from Google Cloud as early as next year.

Bank of America (BAC) analyst Vivek Arya highlighted the potential challenge, noting that neither Meta nor Google has officially confirmed such a deal, but “if true, it can intensify the competitive landscape for Meta’s current GPU suppliers NVDA and AMD.” And yet, Bank of America is holding firm with a “Buy” rating on AMD, a clear vote of confidence that the company is poised to thrive as AI demand skyrockets. Given this backdrop, here’s a closer look at this chip giant.

About AMD Stock

California-based AMD is a global semiconductor leader that designs GPUs, microprocessors, and high-performance computing solutions for fast-growing industries such as gaming, data centers, and AI. The company’s technology plays a role in the lives of billions of people every day, powering everything from Fortune 500 companies to advanced scientific research that changes how the world lives, works, and plays.

On the high-performance side, more companies are now turning to AMD’s Instinct MI300-series accelerators for data center and AI-training workloads, offering a strong, competitive alternative to Nvidia’s GPUs. At the same time, AMD is gaining momentum in the new era of AI PCs and workstations with its Ryzen AI Max and Strix Halo processors, which combine fast Zen CPU cores, integrated RDNA graphics, and dedicated NPUs to run AI directly on the device.

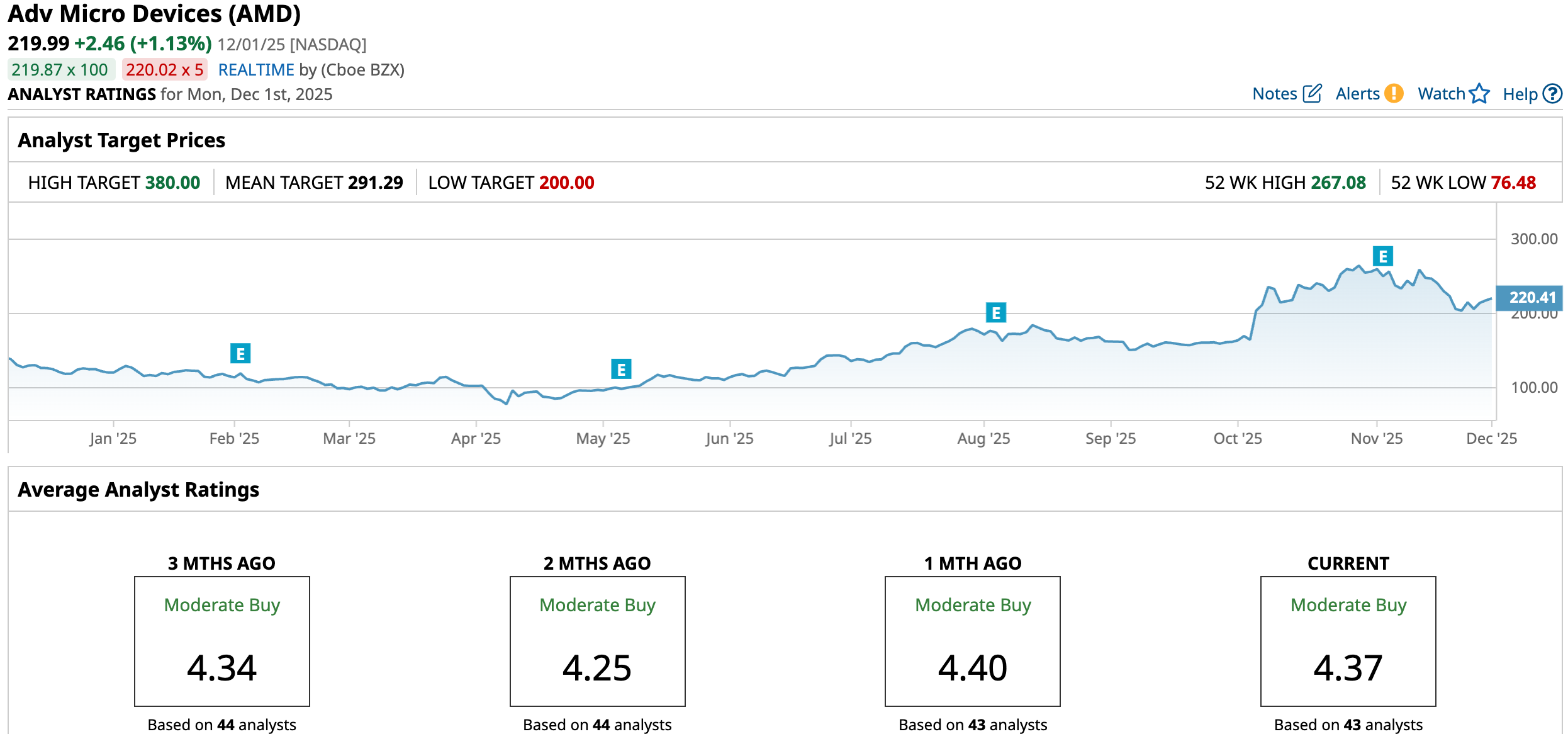

At a massive $354.2 billion market capitalization, AMD is a major force in the semiconductor world, but the ride hasn’t been perfectly smooth for the chipmaker. After touching a record high of $267.08 in October, the stock has pulled back about 21.34% as investors wrestle with concerns around cost pressures, high interest rates, and a fiercely evolving AI chip landscape.

Still, when we zoom out, the long-term performance looks promising. AMD’s shares have already surged more than 82% so far in 2025, as the company’s chips increasingly prove they can go toe-to-toe with AI darling Nvidia. In fact, that robust rally is far outpacing the broader S&P 500 Index ($SPX), which is up around a modest 16.3% this year.

For years, OpenAI and other AI developers have relied almost entirely on Nvidia’s graphics chips to power their massive models. But AMD grabbed the spotlight in October after securing a major agreement with OpenAI, a deal that could allow the AI pioneer to take a 10% stake in the chipmaker.

Under the partnership, OpenAI will deploy 6 gigawatts of AMD’s Instinct GPUs over multiple years and across future chip generations, starting with an initial 1-gigawatt rollout in the second half of next year. The announcement sent AMD shares soaring by almost 24% on Oct. 6, signaling a major breakthrough in its push to become a top supplier for the world’s most advanced AI systems.

Inside AMD’s Q3 Earnings Report

On Nov. 4, AMD rolled out its fiscal 2025 third-quarter results, and the numbers easily outpaced expectations. Powered by booming demand for its high-performance processors and AI accelerators, the company delivered record revenue of $9.2 billion, up 36% year-over-year (YOY) and well above Wall Street’s $8.8 billion estimate. It was a clear signal that AMD’s AI strategy is gaining serious traction.

Much of that growth came from AMD’s data center business, which combines standard CPUs and GPUs built for AI workloads. That segment delivered $4.34 billion in revenue, up 22%, powered by strong demand for 5th Gen EPYC processors and Instinct MI350-series GPUs. Meanwhile, the Client and Gaming division surged to $4 billion, up an impressive 73% YOY.

Within that, Client revenue hit a record $2.8 billion, thanks to robust Ryzen processor sales and a richer product mix, while Gaming brought in $1.3 billion, up a stunning 181% annually on strong demand for Radeon gaming GPUs and higher semi-custom sales. Profitability also showed healthy improvement.

On an adjusted basis, AMD reported earnings per share (EPS) of $1.20, a 30% rise YOY, beating analyst estimates of $1.17. As CFO Jean Hu noted, the company’s continued investments in AI and high-performance computing are driving significant growth and setting AMD up for long-term value creation.

Looking ahead, AMD expects a strong finish to the year. For fiscal Q4 2025, management is forecasting revenue around $9.6 billion, plus or minus $300 million, which, at the midpoint, would mean roughly 25% YOY growth and about 4% sequential growth. Also, non-GAAP gross margin for the quarter is anticipated to land near 54.5%.

How Are Analysts Viewing AMD Stock?

While the latest headlines about Meta’s potential investment in Google’s custom chips have hurt AMD's shares, Wall Street remains optimistic about the company. In fact, Bank of America analyst Vivek Arya, for instance, believes that even if Meta starts adopting Google’s TPUs, companies like AMD don’t need to panic. The total addressable AI data-center chip market is expanding rapidly, with Arya expecting it to grow nearly fivefold to around $1.2 trillion by the end of the decade, leaving plenty of room for multiple winners.

The analyst also explained that while custom chips like Google’s TPUs can be cheaper for large, internal workloads at companies such as Google or maybe Meta, they don’t offer the flexibility needed for public clouds like Microsoft Azure (MSFT), Amazon Web Services (AWS) (AMZN), and many smaller cloud operators. That’s why even Google still depends on GPUs in its public cloud, a sign that companies like Nvidia and AMD remain essential players in the AI chip race.

Overall, Wall Street still has a positive view on AMD, with the stock earning a “Moderate Buy” consensus rating. Among the 43 analysts covering the company, 28 rate it a “Strong Buy,” three consider it a “Moderate Buy,” and the remaining 12 recommend “Hold.” Price targets also signal potential upside ahead. The average estimate of $291.29 points to roughly 32% gains, while the most optimistic call of $380 suggests the stock could climb as much as 73% from current levels.

On the date of publication, Anushka Mukherji did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- JPMorgan Just Upgraded CleanSpark Stock. Should You Buy Shares Here?

- Dear Walmart Stock Fans, Mark Your Calendars for December 9

- Nvidia Just Bet $2 Billion on Synopsys. Should You Buy SNPS Stock Too?

- Salesforce CEO Marc Benioff Just Said Gemini 3 Changed the World. Does That Make GOOGL Stock a Buy?

More News

View More

Recent Quotes

View MoreQuotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.