Financial News

3 Oversold Dividend Kings Trading at Rare Discounts Right Now

With over 50 years of straight dividend increases, Dividend Kings are some of the most sought-after stocks for income investors. I’m even willing to bet that any balanced portfolio will likely include one or a handful of these top-shelf stocks due to their steady income generation and reliable dividend payouts.

However, that kind of fame comes with a price. In this case, Dividend Kings are usually fairly or even slightly overvalued due to their mature company status, reliable revenue streams, and shareholder-friendly policies. So, it may be tough to find Dividend Kings that are “cheap” today.

But we may be just in luck. I ran the numbers, and apparently, we have a handful of Dividend Kings right now trading at cheap valuations based on not just one but three metrics. Let’s take a look.

How I Came Up With The Following Stocks

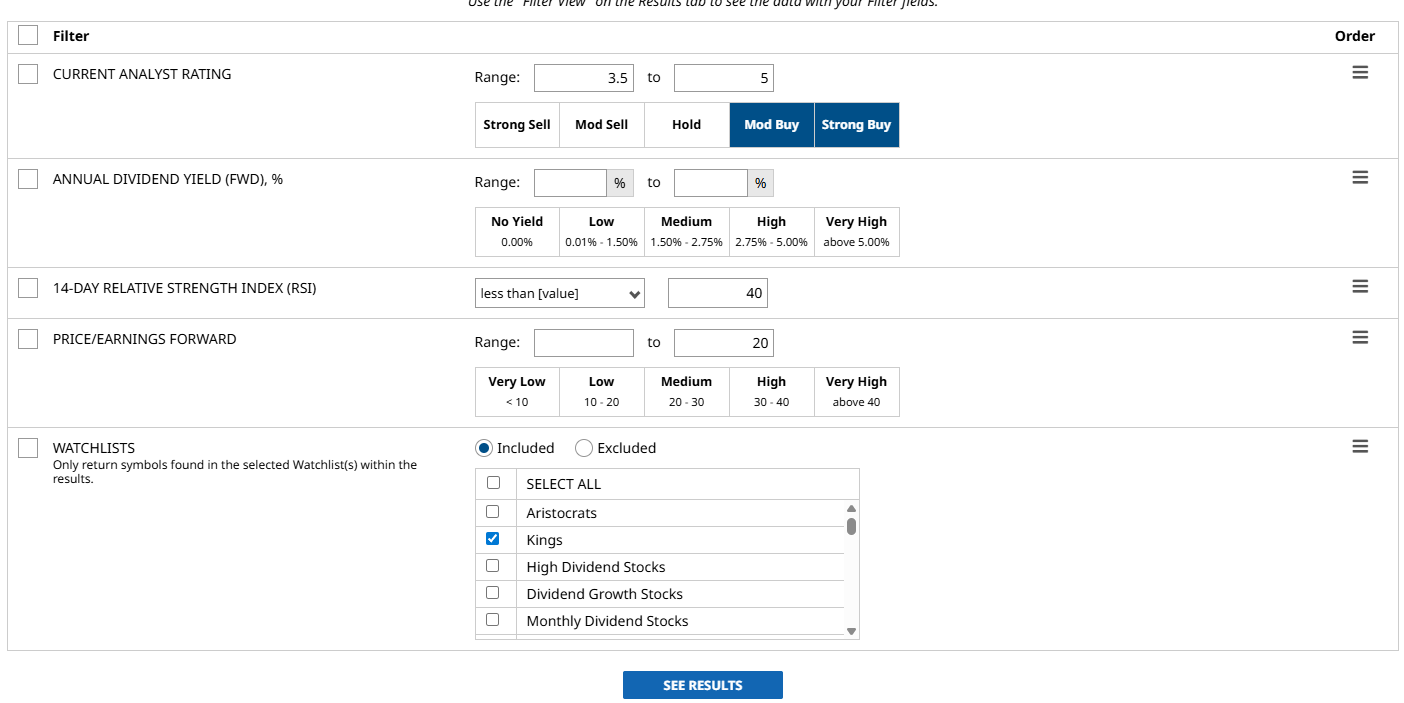

To get my shortlist, I used the following filters on Barchart’s Stock Screener:

- Current Analysts Rating: 3.5 (Moderate Buy) to 5 (Strong Buy). This filter shows the average stock score based on Wall Street consensus. A moderate to strong buy rating indicates that analysts still see potential for the stock to go higher.

- Annual Dividend Yield (Forward): Left blank, so I can sort the results using this criterion.

- 14-Day Relative Strength Index (RSI): 40 and below. The Relative Strength Index is a popular technical indicator that tracks the stock’s recent price movement and plots it on a 0-100 range to measure its momentum. Anything above 80 is considered “overbought,” while anything below 30 is “oversold.” I’ve set the maximum to 40 to capture what I call the “practical oversold zone,” which tells me the stock is either on its way down to the traditional “oversold” level or on its way back up.

- Price-to-Earnings (P/E) Forward: 20 and below. The forward P/E ratio compares the stock’s current trading price to its projected earnings, showing how much investors are paying for every dollar of the company’s earnings. Lower P/E ratios mean “cheaper” valuations. Though the range is highly variable, a P/E of around 20 is generally accepted as the “fairly valued” level.

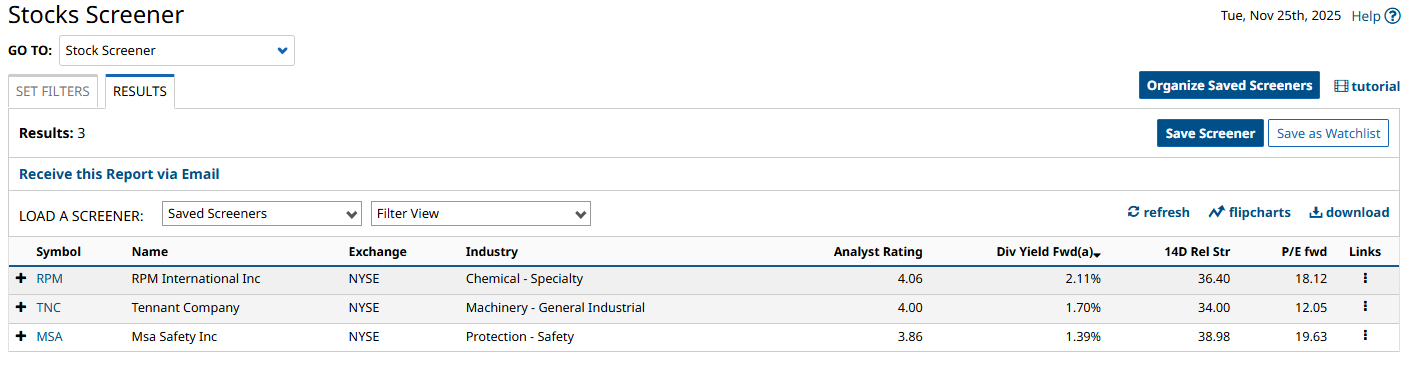

With these filters set, I ran the screen and got exactly three companies, arranged from highest to lowest dividend yields:

Now, I’ll cover all three, starting with:

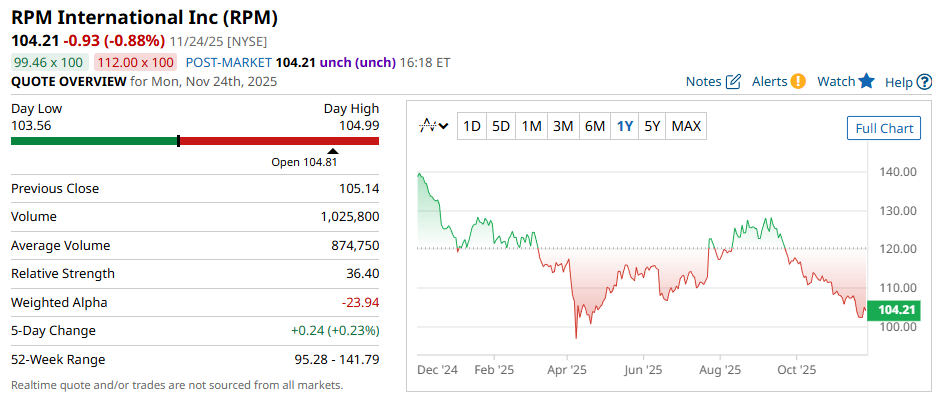

RPM International Inc (RPM).

First on the list is RPM International, a U.S.-based industrial company that specializes in specialty coatings, sealants, and building materials. The company’s leading brands include Tremco, Carboline, Stonhard, and Seal-Krete from its Industrial/Performance Brands, and Rust-Oleum, Zinsser, and Sunnyside from its Consumer Business.

RPM stock is trading with a 14-day RSI of 36.40 and an 18.21 forward P/E, which is slightly below the sector average of around 19.

Today, RPM pays $2.16 per share per year in dividends, which translates to around a 2.11% forward yield. It also has a 52-year streak of dividend increases. A consensus among 17 analysts rates RPM stock a moderate buy with an average score of 4.06, the highest on this list.

Tennant Company (TNC)

Next up is Tennant Company, an industrial firm that designs, manufactures, and sells industrial and commercial floor‑cleaning machines, sustainable detergent‑free technologies, specialty coatings, and more. The company offers the full range of services, including machine sales, parts offering, and insurance-like service plans through Tennant True that cover all maintenance and equipment optimization.

Tennant stock trades around 34 on the 14-day RSI, reflecting its recent price decline. It also has a forward P/E of 12.05, lower than the sector average of 18.

The company pays $1.18 annually, which reflects an approximate 1.7% yield, with its most recent dividend payment marking its 54th consecutive increase. A consensus among four analysts rates the stock a moderate buy with an average score of 4.0.

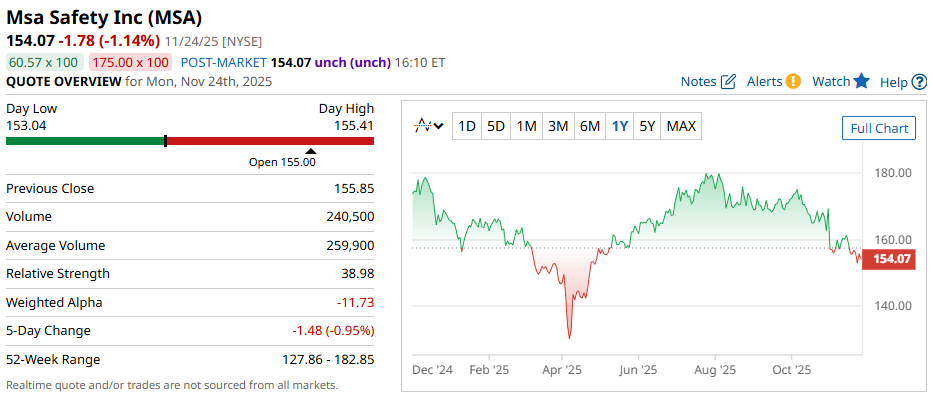

MSA Safety Inc (MSA)

Finally, we have MSA Safety, another industrial products company that develops and manufactures safety products. The company has a global presence and offers a range of products, from safety headgear to gas and flame detectors for mining, firefighting, HVAC, and the utility industry.

Today, MSA stock trades at a 14-day RSI of 39, right at the threshold. It also has a forward P/E of around 19.7, again right at the maximum level and slightly above the industry average.

Still, the company pays $2.12 per share per year, which translates to around a 1.4% yield. Last June, MSA Safety increased its dividends for the 55th consecutive year.

Meanwhile, a consensus among seven analysts rates MSA stock a moderate buy with an average score of 3.86.

Final Thoughts

These three Dividend Kings are trading at a discount, which may offer an attractive entry opportunity.

However, remember that while RSI and forward P/E are popular ways to identify oversold, and perhaps cheap stocks, they are not 100% accurate indicators of where the stock is going from here. So, always do your due diligence by reviewing a company’s fundamentals, growth prospects, and any material news before making an investment decision.

On the date of publication, Rick Orford did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Occidental Petroleum Could Hike Its Dividend - Price Target is At Least 21% Higher

- This ‘Strong Buy’ Retail Stock Has Great Earnings Growth and Has Doubled This Year

- Our Top Chart Strategist Analyzes the 'Generational Buying Opportunity' in Meta Stock

- Corporate Insiders Have Sold $25 Billion in Stock in Just 60 Days. Before You Panic and Sell Your Shares, Read This.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.