Financial News

Qualcomm Wants to Beat Nvidia in AI Chips, but QCOM Stock Needs to Win Over Wall Street First

Qualcomm (QCOM) was touted as a great 5G technology stock, but it never lived up to the hype. With AI dominating Wall Street these days, QCOM has another challenge at hand: convincing Wall Street that the chipmaker has great AI prospects. In the past, Qualcomm’s legal feud with Apple (AAPL) was largely responsible for the negative sentiment. Despite resolving those issues, the company continues to operate under the shadows of AI giants like Nvidia (NVDA), Broadcom (AVGO), and AMD (AMD).

The chipmaker has no shortage of quality products and a product pipeline. It is working on bringing AI to devices, also called “edge” computing. It recently announced the Snapdragon 8 Elite Gen 5 SoC(System on a Chip), which combines components like the CPU, GPU, and memory onto one chip. This system is designed specifically for mobile devices, but QCOM also has a solution that will power edge computing on future cars, helping develop Advanced Driver Assistance Systems(ADAS). The company’s Snapdragon Digital Chassis platform will go a long way in defining its role in fully software-defined vehicles of the future, helping it tap into multiple segments of the automotive industry.

The company is also looking at expansion through acquisitions, with the recent acquisition of Alphawave IP Group being an example. The deal is expected to be completed in the first quarter of 2026 and will give Qualcomm access to Alphawave’s chiplet interconnect technologies that are used in AI workloads and high-performance computing (HPC).

About Qualcomm Stock

Qualcomm is a global developer of wireless technology products, serving many industries,, including mobile devices, automotive, and Internet of Things (IoT) among others. It also licenses its intellectual properties to generate further revenue. The company is headquartered in San Diego, California.

The company’s stock is now flat for the last one year, despite gaining over 40% from its April lows. This is, of course, a significant underperformance compared to the broader market, but earnings disappointments and geopolitical issues have more to do with it than the company’s underlying technologies.

The underperformance has meant that the company now trades at a forward price/earnings (P/E) of 17.92x compared to Nvidia’s 42.91x and AMD’s 94.96x. The price/sales (P/E) ratio of 3.06x shows significant undervaluation when compared to Nvidia’s 21.83x and AMD’s 12.05x. There is no doubt that Wall Street is not giving the company the same respect it does other chipmakers. Some of this is justified as both Nvidia and AMD enjoy superior technologies that lead the industry. However, it seems Wall Street is underestimating the potential of the company and its role in the AI revolution.

A dividend yield of just over 2% helps investors solidify their gains in an otherwise cyclical business. The payout is one aspect where Qualcomm has done an outstanding job compared to its peers in the semiconductor industry.

Qualcomm Beats Q4 Earnings Estimates and Gives Strong Guidance

Qualcomm announced its Q4 earnings report on Nov. 5, and the market did not react positively, despite the fact that it beat consensus EPS estimates by 9.4%. A revenue of $11.3 billion and an EPS of $2.56 clocked in above expectations. Automotive revenues exceeded the $1 billion mark for the first time, registering a 17% YoY growth. All this was not enough for Wall Street, not surprising considering the growth of other AI companies.

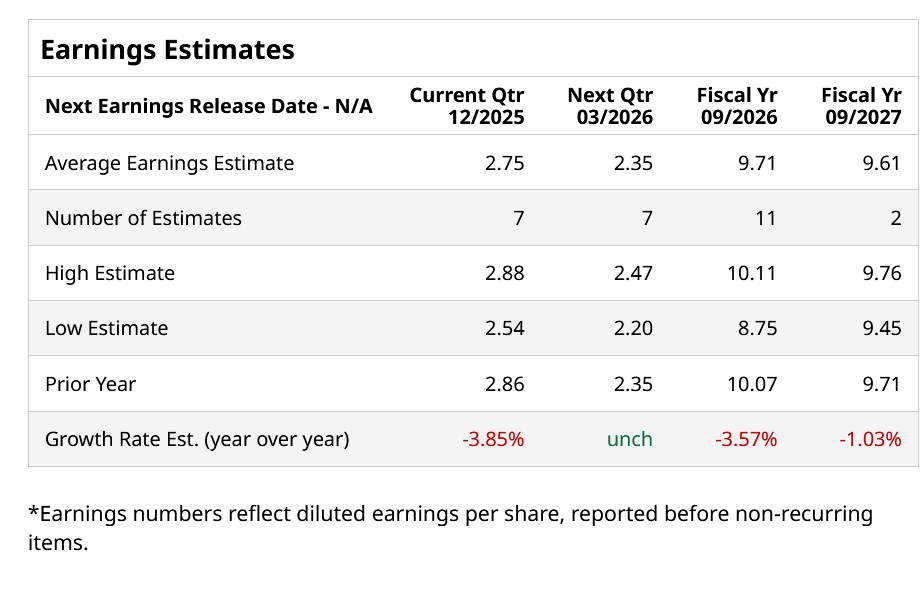

Record results are expected to continue in fiscal Q1, 2026. Revenue is expected to come in between $11.8 billion and $12.6 billion, with an EPS of $3.4 at the midpoint. Automotive revenues are likely to stay flat quarter-over-quarter (QoQ). The company says it is on track to deliver $22 billion in revenue from its IoT and automotive business by FY2029. Wall Street, however, isn’t very optimistic as reflected by our Earnings Estimates data:

Management highlighted that it was still negotiating deals with Huawei while expecting volatility due to changes in its handset market share. Meanwhile, investments in data center infrastructure will likely help improve margins in the future. The company discussed the launch of Snapdragon Ride Pilot on the earnings call as well as its AI200 and AI250 AI chips, both of which are expected to generate investor excitement in the future.

What Are Analysts Saying About QCOM Stock?

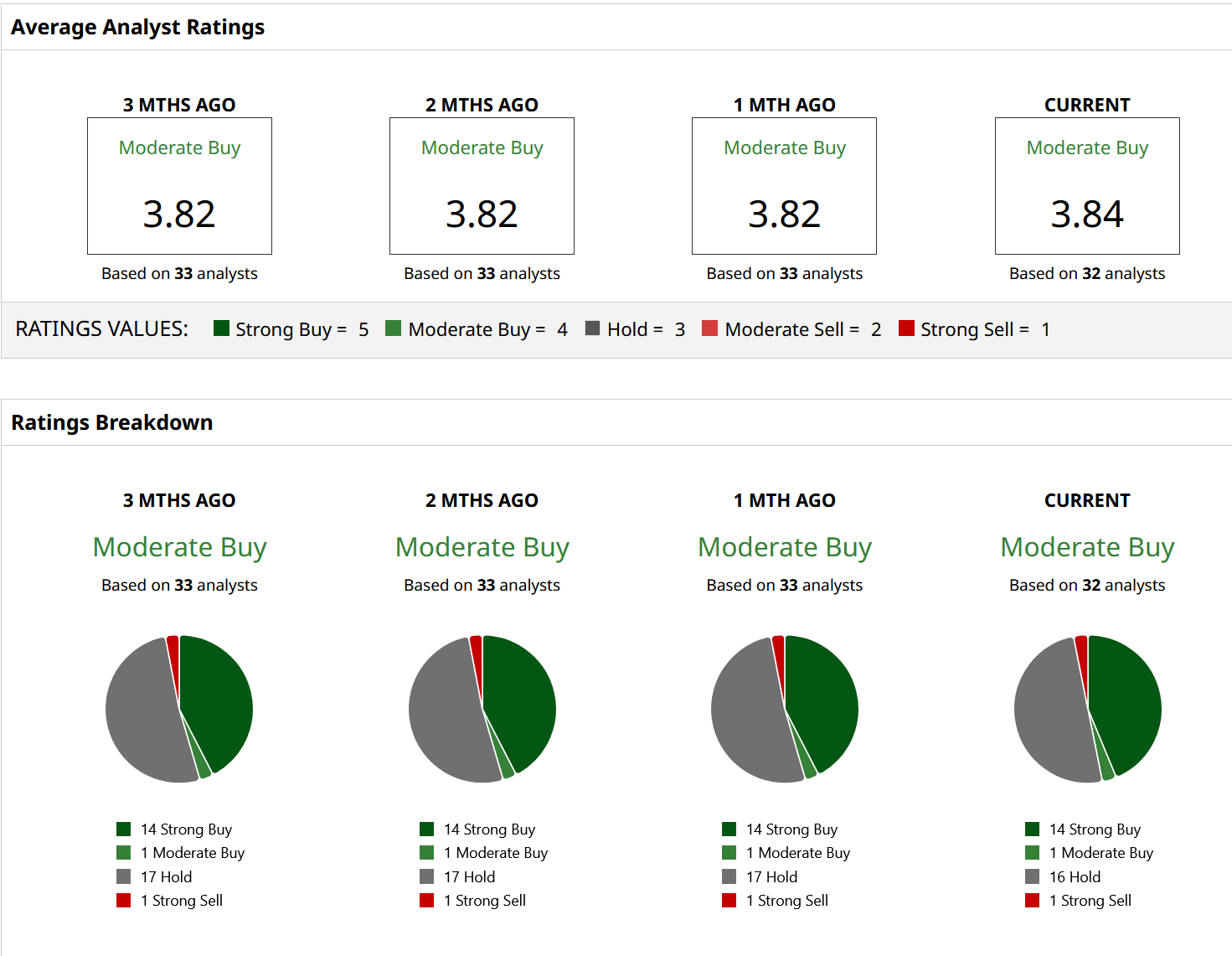

A total of 32 analysts cover QCOM stock on Wall Street. Half of them have a “Hold” rating on the stock, with just one “Strong Sell” rating. It is almost as if there are two camps on Wall Street when it comes to the stock: one that is wary of showing any optimism and another that truly believes in the company, with 14 “Strong Buy” ratings and one “Moderate Buy.”

The question for investors now is which side they believe in. The lowest target price is $157, while the highest target price of $225 offers 32% upside from here on. The stock is trading a little below its mean target price of $188.17.

On the date of publication, Jabran Kundi did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Google Has a ‘Secret Weapon’ That Could Make GOOGL Stock One of the Best AI Buys for 2026

- Plug Power Just Got a $275 Million Boost. Should You Buy PLUG Stock Here?

- Shareholders Just Approved a $1 Trillion Pay Package for Elon Musk. What Does That Mean for Tesla Stock in 2026?

- Options Traders Bet Beyond Meat Stock Could Move 30% When It Posts Delayed Q3 Earnings This Week

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.