Financial News

OneSoft Solutions Inc. Reports Results for Second Quarter ended June 30, 2024

EDMONTON, AB / ACCESSWIRE / August 28, 2024 / OneSoft Solutions Inc. (the "Company" or "OneSoft") (TSXV:OSS)(OTCQB:OSSIF), a North American developer of cloud-based business solutions, announces its financial results for the three months ("Q2 2024") and six months ("H1 2024") ended June 30, 2024.

Please refer to the Unaudited Condensed Consolidated Financial Statements and Management's Discussion and Analysis ("MD&A") for the three and six months ended June 30, 2024, filed on SEDAR+ at www.sedarplus.ca for more information. Unless otherwise specified, all dollar amounts are denominated in Canadian dollars.

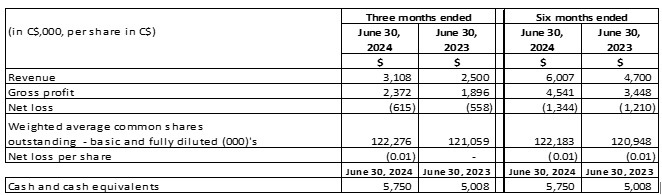

FINANCIAL RESULTS

FINANCIAL HIGHLIGHTS

Q2 2024:

Revenue of $3.1 million increased by 24% or $0.6 million over the three months ended June 30, 2023 ("Q2 2023"), driven by CIM associated revenue.

Gross profit of $2.4 million increased 25% over Q2 2023. Gross margin was 76%, unchanged from the quarter a year ago.

Net loss of $615,000 increased $57,000 over Q2 2023 due to increased costs.

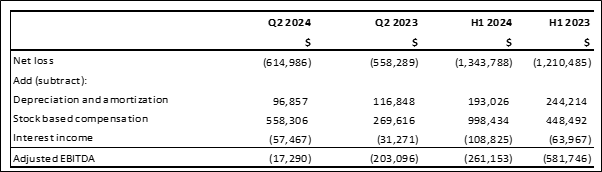

Adjusted EBITDA, a Non-GAAP measure reconciled to the net loss on page 4, improved by $186,000 to a loss of $17,300 in Q2 2024 from a loss of $203,100 in Q2 2023.

Cash and cash equivalents were $5.7 million as at June 30, 2024. The Company has $247,000 of debt

H1 2024

Revenue of $6 million increased 28% or $1.3 million over the six months ended June 30, 2023 ("H1 2023"), driven by CIM associated revenue.

Gross profit of $4.5 million increased by $1.1 million or 32% over H1 2023. Gross margin increased to 76% from 73% in H1 2023.

Net loss increased to $1.3 million from $1.2 million in H1 2023 due to increased cash and non-cash expenses.

Adjusted EBITDA improved by $320,600 to a loss of $261,200 from a loss of $581,800 in H1 2023.

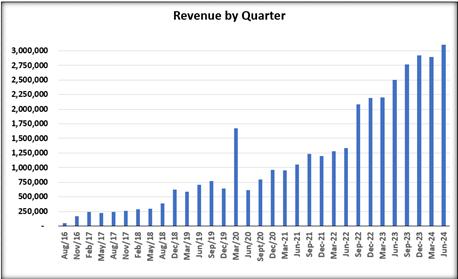

The chart below shows quarterly revenue for the past 8 years. Quarterly revenue generally continues to increase in accordance with Management's expectations, as a result of expanded use of the Company's software and IM Operations services by existing customers.

POST REPORTING DATE EVENTS

On August 12, 2024, the Company announced that it had entered into a binding arrangement agreement dated August 12, 2024 (the "Arrangement Agreement" or the "Arrangement") with Blackstone portfolio companies, irth Solutions LLC and its wholly-owned subsidiary irth Acquisition Corp. (collectively "Irth"), pursuant to which Irth will acquire all of the issued and outstanding shares of OneSoft for $0.88 in cash per Share (the "Consideration"), representing a total cash equity value of approximately CDN$113 million on a fully-diluted basis (the "Transaction").

The Transaction will be implemented by way of a statutory plan of arrangement under the Business Corporations Act (Alberta). Completion of the Transaction is subject to customary conditions, including court, regulatory and TSX-V approval and the approval of (i) at least two-thirds of the votes cast by Shareholders by proxy or at the Shareholder meeting to consider the proposed transaction (the "Meeting"), which is expected to be held in October 2024; and (ii) a simple majority of the votes cast by Shareholders by proxy or at the Meeting (other than the votes of Shareholders excluded for the purposes of any "minority approval" under Multilateral Instrument 61-101 - Protection of Minority Security Holders in Special Transactions ).

The Arrangement Agreement contains customary representations, warranties and covenants, including customary non-solicitation covenants from OneSoft, as well as "right to match" provisions in favour of Irth.

Subject to the satisfaction of all conditions to closing pursuant to the Arrangement Agreement, the Transaction is anticipated to be completed in the fourth quarter of 2024. Upon closing of the Transaction, the shares will be delisted from the TSX-V as well as the OTCQB market and OneSoft will cease to be a reporting issuer under applicable Canadian securities laws.

Copies of the Arrangement Agreement have been publicly filed by OneSoft on its profile on SEDAR+ at www.sedarplus.ca. Additional details regarding the terms and conditions of the Transaction, the background to the Transaction and the rationale for the recommendation made by a special committee (the "Special Committee") consisting of the independent members of OneSoft's board of directors (the "Board") and the Board will be set out in a management information circular to be mailed to shareholders in connection with the Meeting and filed by OneSoft on its profile on SEDAR+ at www.sedarplus.ca.

BOARD RECOMMENDATION TO SHAREHOLDERS REGARDING THE SALE OF ONESOFT TO IRTH ACQUISITION CORP.

Following careful consideration by the OneSoft Board of Directors, it was unanimously agreed that acceptance of the Arrangement Agreement is in the best interests of the Company and is fair to the OneSoft shareholders. Accordingly, the Board unanimously approved the Arrangement and recommends that Shareholders vote FOR the Arrangement Agreement.

The recommendation of the Board is based on the following factors and considerations as are stated in the Q2 2024 MD&A and will be detailed in a Management Information Circular that will be sent to all shareholders approximately 30 days before the Meeting and will be filed on the Company's profile at SEDAR+:

Significant Premium The all-cash consideration represents a premium of 42% to the closing price of the Common Shares on the TSX-V on August 9, 2024, the last trading day prior to the announcement of the Arrangement.

Certainty of Value and Liquidity. The consideration offered to Shareholders under the Arrangement is all cash, which allows Shareholders to immediately realize value for their entire investment in OneSoft without liquidity concerns.

Treatment of Employees. The compensation and benefits of employees will be at a level substantially comparable and no less favourable to those provided today to employees of the Company and the Purchaser's internal culture and strategic direction is believed to be well suited to all employees post-transaction.

Customer Considerations. The transaction is believed to be in the best interests of the Company's customers

Highest Proposal. The Consideration is the highest price that could be obtained from Irth and represents an increase from the firm price consideration proposed by another potential acquiror.

Compelling Value Relative to Alternatives. A comprehensive market check process was conducted by management and the Board to research the Company's alternatives to increase value for shareholders, following which a determination was made that the Irth offer is the best go-forward alternative for the Company, its shareholders and its other stakeholders.

Fairness Opinion. Grant Thornton LLP was engaged to provide a fairness opinion, who concluded the consideration is fair to shareholders, from a financial point of view.

Role of the Special Committee. The market check process and evaluation of the sale to Irth was supervised by the independent directors of the Company, who determined that the Arrangement is in the best interests of the Company and its stakeholders and is fair to Shareholders from a financial point of view.

Support for the Arrangement. The Board and management, who hold approximately 25.5% of the common shares outstanding, have entered into voting and support agreements to vote their Shares in favour of the Arrangement.

Transaction Certainty. The obligation of the Purchaser to complete the Arrangement is subject to a limited number of customary conditions and is not subject to a financing condition.

Ability to Respond to Superior Proposal. The Board is able to consider and respond to a superior proposal, should one arise, subject to certain terms and conditions. No superior proposal has been received to date.

Appropriateness of Deal Protections. The deal protection measures included in the Arrangement Agreement are reasonable and appropriate in the circumstances.

-

Procedural Safeguards for Shareholders. The Arrangement is subject to Shareholder and Court approvals:

the Arrangement Resolution must be approved by at least two-thirds (66-2/3%) of the votes cast by Shareholders, and

a majority of the votes cast by the Shareholders after excluding the votes attached to the Common Shares held by the Shareholders whose votes are required to be excluded, and

the Arrangement must also be approved by the Court of King's Bench of Alberta, which provides further protection to the interests of shareholders.

Profile of Irth Acquisition Corp. Irth Acquisition Corp.'s private equity sponsors, its Parent, Irth Solutions LLC, and its guarantors, have the ability and financial capacity to conclude this transaction.

Accelerated Vesting of Securities. Holders of all stock options and restricted share units will receive appropriate value for their securities and participate in the cash consideration of this Arrangement. The dilutive effects for shareholders regarding these options and RSUs is removed..

BUSINESS UPDATE

The Company continued its status quo business operations during Q2 2024 to continue developing functionality modules that integrate with the CIM platform, including External Corrosion Management ("ECM"), Crack Management ("CM"), Probabilistic Risk Management ("RM") and Geohazard Strain Management ("GS").

Several customers continued to expand their use of CIM by ingesting additional miles and adopting the new functionality offered to them, including some modules that generated new subscription revenue and associated service revenue in the quarter. A sale to the Company's first South American customer was concluded in Q2 2024 with incremental revenue will be realized commencing in Q3 2024 and other potential sales continue to be pursued. The Company encountered several delays in signing other new CIM contracts that are still expected in 2024.

The Company hosted a company-wide, in person employee meeting in Q2 2024, wherein all employees met to contribute and consider several matters, for the purpose of debating and deciding upon the most productive go-forward operational strategies The general consensus of the Company employees from this exercise is that customer and prospective customers will continue to demand more and enhanced solutions and that delivery to meet customer expectations can only be accomplished with a commitment from Management to provide additional resources. The consensus of customer facing employees is a firm belief that additional development, marketing and sales efforts will be required to maintain the Company's competitive moat and increase its market presence, particularly considering new competitive AI projects that may arise in the future.

Some of the Company's operational management team encountered distractions from normal operational duties in Q2 2024, as they were involved in many aspects of the market check process the Company conducted in 2024, including due diligence efforts to investigate and research future market conditions, matters associated with the proposed transaction with another potential acquiror of the Company that was ultimately rejected and matters associated with the Irth acquisition.

CORPORATE UPDATE

Senior Management has been focused on conducting a market check process, which began in earnest in August 2023. The senior Management team compiled various go-forward business and financial plans and operational scenarios that reflect several potential go-forward alternatives for the Company. Additionally, the Company compiled data rooms of extensive disclosures requested by Irth and the other proposed offer that was ultimately rejected by the Special Committee and the Company. The Company estimates that approximately $409,000 was spent during the past 2 quarters for M&A and market check initiatives.

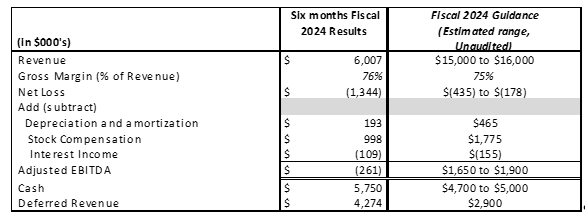

FISCAL 2024 GUIDANCE

The following table reflects the actual results for Q2 Fiscal 2024 compared to the Fiscal 2024 financial guidance published on February 20, 2024.

Notes regarding 2024 Guidance:

Fiscal 2024 revenue is estimated to be in the range of $15 million to $16 million, representing a 44% to 54% increase, respectively, over Fiscal 2023 revenue. Year to date revenue in 2024 was below expectation due to delayed signing of new customers and the delayed CIM implementation by our new South American customer which only started July 2024. Management believes the revenue gap may be overcome by the end of the fiscal year, and it is not changing its Fiscal 2024 revenue guidance at this time.

The net loss and Adjusted EBITDA results year to date 2024 include $409,000 of expenses incurred year-to-date for M&A and market check investigation, as discussed earlier in this document. Although a portion of these expenses were not contemplated when the Fiscal 2024 guidance was published, Management is not changing its Fiscal 2024 Guidance at this point but will review this after the conclusion of Q3 2024 to determine if any revisions to its Guidance estimates are warranted.

As expected, many customers renewed their CIM contracts during 2024 and paid the subscription price at the start of the contract period. This caused cash and deferred revenue to exceed their respective year-end values forecast in the Fiscal 2024 guidance. Management anticipates that payment of expenses prior to 2024 year-end and realization of deferred revenue should cause these values to reduce by year-end to those stated in the Guidance. Deferred revenue may vary materially from Guidance due to timing of cash receipts and CIM utilization by customers and is also dependent upon achieving planned revenue and closing of sales to new customers during 2024.

OUTLOOK

Irrespective that the Company entered into the Arrangement Agreement, the business will continue to operate in the normal course until such time as the Transaction closes, subject to certain restrictions as stated and agreed in the Acquisition Agreement. The Company will continue to strive to achieve its 2024 objectives, including completing the new functionality modules currently under development, integrating them into the CIM platform and advancing its technology and solutions in the marketplace. New customer acquisitions will continue to be pursued and prospective customer interest confirms that the Company can potentially grow its customer base.

The Company's sales pipeline continues to strengthen, irrespective that closing of sales for certain prospective customers has encountered delays. Management is optimistic that these expected customer additions are only delayed and not lost and that OneSoft is well positioned to capitalize on the shareholder value that has been created to date, regardless of whether or not the Irth Arrangement concludes as anticipated.

RECONCILIATION OF NET LOSS TO ADJUSTED EBITDA

Q2 2024 EARNINGS WEBCAST / CONFERENCE CALL

OneSoft's CEO Dwayne Kushniruk, CFO Paul Johnston, and President & COO Brandon Taylor will host a live webinar on Wednesday, August 28, 2024 at 11:00am ET to review the results, provide Company updates, and answer investor questions following the presentation. Conference call details are as follow:

CONFERENCE CALL DETAILS:

DATE: Wednesday, August 28, 2024

TIME: 11:00am ET (8:00am PT)

WEBCAST: Webcast Link

Optional Participant Telephone Numbers:

Canada/ USA: 1-844-763-8274 (Toll-free)

International Toll-Free 1-647-484-8814 (TOLL)

Callers should dial in 5 - 10 minutes prior to the scheduled start time and ask to join the OneSoft Solutions call.

REPLAY: Available at: https://www.onesoft.ca/

About OneSoft and OneBridge

OneSoft has developed software technology and products that have capability to transition legacy, on-premises licensed software applications to operate on the Microsoft Azure Cloud Platform. Our business strategy is to seek opportunities to incorporate Data Science and Machine Learning, business intelligence and predictive analytics to create cost-efficient, subscription-based software-as-a-service solutions. Visit www.onesoft.ca for more information.

OneSoft's wholly owned subsidiaries, OneBridge Solutions develops and markets revolutionary new SaaS solutions that use advanced Data Sciences and Machine Learning to analyze big data using predictive analytics to assist Oil & Gas pipeline operators to predict pipeline failures and thereby save lives, protect the environment, reduce operational costs, and address regulatory compliance requirements. Visit www.onebridgesolutions.com for more information.

For more information, please contact.

OneSoft Solutions Inc. |

Sean Peasgood, Investor Relations |

Forward-looking Statements

This news release contains forward-looking statements relating to the future operations and profitability of OneSoft Solutions Inc. (the "Company") and other statements that are not historical facts. Forward-looking statements are often identified by terms such as "may", "should", "anticipate", "expects", "believe", "will", "intends", "plans" and similar expressions. Any statements that are contained in this news release that are not statements of historical fact may be deemed to be forward-looking statements. Such forward-looking information is provided to deliver information about management's current expectations and plans relating to the future. Investors are cautioned that reliance on such information may not be appropriate for other purposes, such as making investment decisions.

In respect of the forward-looking information and statements, the Company has placed reliance on certain assumptions that it believes are reasonable at this time, including expectations and assumptions concerning, among other things: the impact of Covid-19 on the business operations of the Company and its current and prospective customers; the availability and cost of labor and services; the efficacy of its software; our interpretation based on various industry information sources regarding the total miles of pipeline in the USA and globally and which segments are piggable; our understanding of metrics, activities and costs regarding evaluation, inspection and maintenance is in alignment with various industry information sources and is reasonably accurate; that counterparties to material agreements will continue to perform in a timely manner; that there are no unforeseen events preventing the performance of contracts; that there are no unforeseen material development or other costs related to current growth projects or current operations; the success of growth projects; future operating costs; interest and foreign exchange rates; planned synergies, capital efficiencies and cost-savings; the sufficiency of budgeted capital expenditures in carrying out planned activities; and no changes in applicable tax laws. Accordingly, readers should not place undue reliance on the forward-looking information contained in this press release. Since forward-looking information addresses future events and conditions, such information by its very nature involves inherent risks and uncertainties. Actual results could differ materially from those currently anticipated due to many factors and risks. These include but are not limited to the risks associated with the industries in which the Company operates in general such as: costs and expenses; interest rate and exchange rate fluctuations; competition; ability to access sufficient capital from internal and external sources; and changes in legislation, including but not limited to tax laws.

Readers are cautioned that the foregoing list of factors is not exhaustive. Forward-looking statements contained in this news release are expressly qualified by this cautionary statement. The forward-looking statements contained in this news release are made as of the date of this news release, and the Company undertakes no obligation to update publicly or to revise any of the included forward-looking statements, whether because of new information, future events or otherwise, except as expressly required by Canadian securities law.

This news release does not constitute an offer to sell or the solicitation of an offer to buy any securities within the United States. The securities to be offered have not been and will not be registered under the U.S. Securities Act of 1933, as amended, or any state securities laws, and may not be offered or sold in the United States absent registration or an applicable exemption from the registration requirements of such Act or other laws.

The TSX Venture Exchange has not reviewed and does not accept responsibility for the adequacy or accuracy of this release.

SOURCE: OneSoft Solutions Inc.

View the original press release on accesswire.com

More News

View More

Recent Quotes

View MoreQuotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.