Financial News

TONOGOLD to Acquire Large Diversified US Focused Uranium Company

Highlights

- Acquisition includes 3 Projects located in West-Central USA known for historic production of uranium/vanadium.

- Proximity to licensed, operating processing plants using both conventional an in-situ recovery.

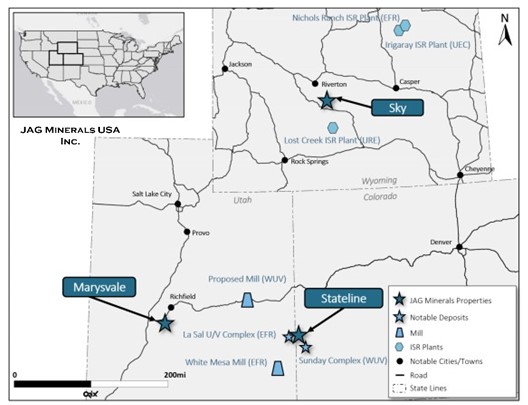

WOODLAND HILLS, CA / ACCESSWIRE / April 11, 2024 / TONOGOLD Resources Inc (OTC PINK:TNGL) ("TONOGOLD" or the "Company" advises it has entered a term sheet to acquire 100% of the issued shares of JAG Minerals Pty Ltd which has a 100% interest in JAG Minerals USA Inc. ("JAG US"). This acquisition will allow TONOGOLD to accelerate development and exploration of the Marysvale (hardrock uranium/vanadium mine), SKY Project (uranium roll front) and thirteen (13) historic high-grade vanadium/uranium mines in Montrose County, Colorado and San Juan County, Utah.

Marysvale Project

The property lies adjacent to the Central Mining Area, where an estimated 1.39mlb of U308 at 0.22% was produced from more than 10 mines between 1949 and 1966.

JAG USA has leased 20 unpatented mining claims and one (1) state lease.

Highlights:

- Marysvale Project was drilled by Phillips Uranium between 1977 - 1981 and this project has a historical working and pre-2007 NI 43-101 resource.

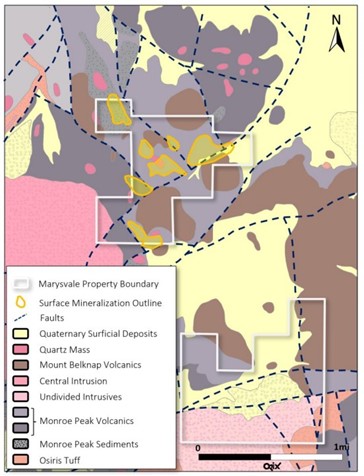

- Favorable geology with mineralization occurring from surface to a depth of at least 500 ft in strong clay-altered Rhyolitis Volcanics. (Refer Figure 2)

- Drilling intersected anomalous uranium and vanadiumin multiple zones.

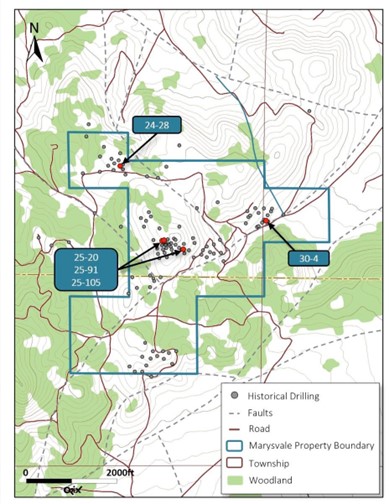

- 127 historical drill holes were completed by Minex, PhillipsUranium and TrigonExploration Ltd between 1997 - 2007 (refer Figure 3: Marysvale Historic Drilling locations.).

- Follow up drilling is required to confirm the pre-2007 resource estimates and test identified new zones.

127 historical drillholes on current Marysvale Property, completed by Minex, Phillips and Trigon between 1977 and 2007, see Figure 3.

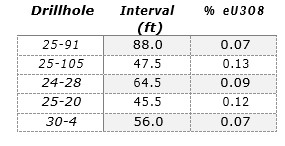

Several drillholes intersected anomalous uranium mineralization in multiple zones. The five best intercepts are listed in Table 1.

Table 1: Historic drilling intercepts.

SKY Project

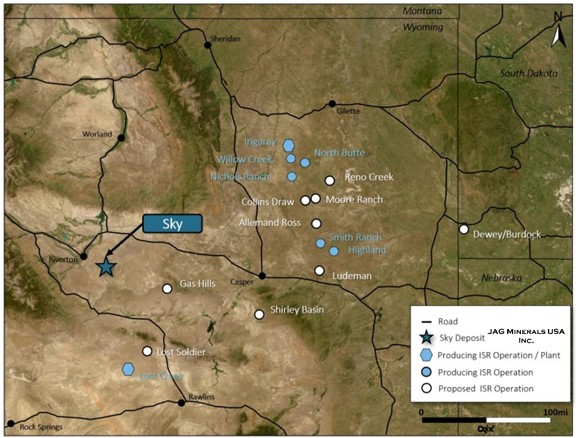

The property is in Fremont Country, Wyoming 34 miles South-East to the West of the historic Gas Hills Uranium District (Figure4).

JAG USA Inc. has leased 57 unpatented mining claims and two Wyoming State leases.

Highlights:

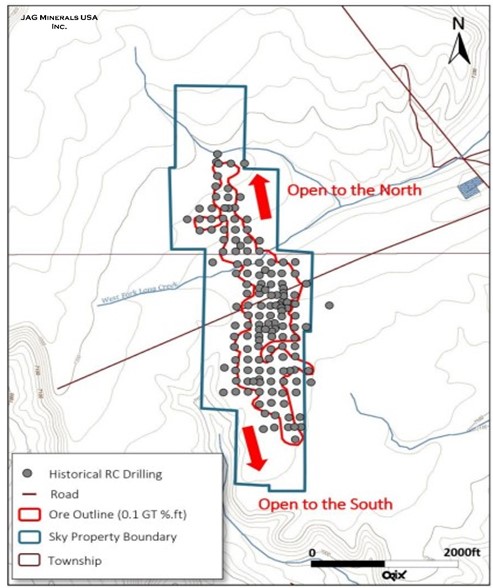

- 161 historical reverse circulation (RC) drillholes which defined the exploration trend at an average drill hole spacing of 200 ft (Figure 5).

- Strathmore 2007 NI 43-101 Compliant Mineral Resources

- Mineralization is open to the North and South.

- Core technical studies conducted by Pathfinder (1979) to characterize physical and chemical conditions proved consistency along strike of mineralization. Study concluded the mineralization is conducive to In-situ extraction.

Stateline

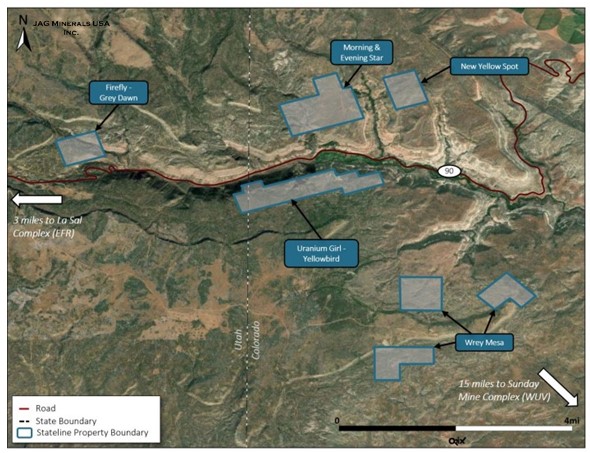

The property is in the La Sal Creek mining district (Figure6).

JAG USA Inc. leased86 unpatented mining claims in Utah and Colorado, totaling 719.6 Ha.

Highlights:

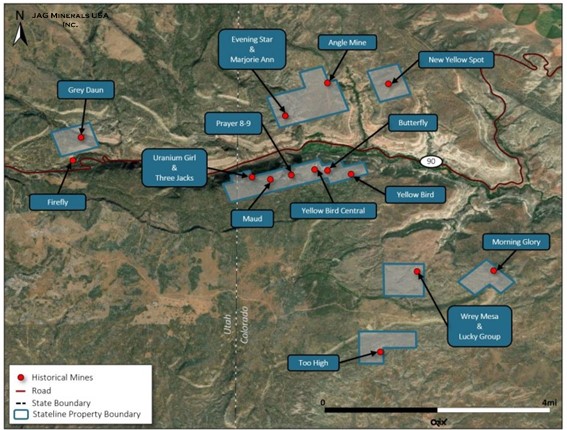

- Past production from this region as some of the highest vanadium (V205) percents known in North America:

- Nearby mines have demonstrated historical grades can be replicated with modern mining techniques.

- Land package includes thirteen (13) historic producing uranium and vanadium mines (mining took place between1945 - 1971 (Figure 7).

Key Terms in agreement:

- TONOGOLD (Buyer) and JAG Minerals Pty Ltd and JAG Minerals USA Inc (Seller).

- The Buyer will purchase, and the Seller will sell, the full legal and beneficial interest in 100% of the issued and outstanding shares of the capital of the company.

- Purchase price is subject to TONOGOLD having a 90-day due diligence period with the agreedprice being US $6,500,000.

- The purchase price will be made up of US $4,500,000 in in TONOGOLD shares at a deemed issue price equal to the volume weighted average price (VWAP) for the 15 trading days prior to signing of a Stock Purchase Agreement. A further US $2,000,000 will be paid to JAG shareholders at the date of settlement.

- TONOGOLD has an exclusive period of 60 days from the signing of this term sheet. The Buyer has executed the term sheet and has paid the Seller a non-refundable payment of US $60,000.

TONOGOLD CEO William Hunter stated: "We are pleased to get a Term Sheet completed on the JAG uranium and vanadium properties, as it now positions the company in the North American Uranium and Rare Earth Elements sector.These properties have been subject to extensive exploration and mining so we know the uranium and vanadium are there and this will allow for a rapid restatement of the historic resources on the Sky and Marysvale properties. The next steps forward will be the review of the JAG Data Set, followed by Board approvals and a corporate restructuring. While this process is running, the JAG technical team will continue to complete their 2023 exploration program and produce a 2024 exploration plan that will focus on developing higher grade targets and bringing these resource calculations into an internationally accepted resource statement"

Restructure update:

Over the last year, the Company has been working on restructuring the capital structure and has made significant progress in doing so. The Company has worked with its Convertible Loan Note ("CLN") holders to convert their Notes into shares at a price of $0.10/share. At this time, the Company has a significant number of acceptances from the CLN holders and the Company is confident of achieving 100% acceptances in the near-term. This will significantly clean up the capital structure in order to create a situation where the Company can achieve its goals going forward.

The Company has recently launched a $500,000 convertible loan note ("New Note") and has received funds totaling $160,000 to date. Key terms of the New Note include:

- Term: 1 year

- Principal and accrued interest will become payable at the end of the Term. The Company has the election to repay the Notes in cash or if such election isn't made, they will automatically convert into Common Shares of Tonogold at the lower of $0.02 (two cents) per share or 25% discount to the price which the Company issues shares in an equity financing prior to the expiry of the Term.

- Interest rate of 12% pa compounded quarterly and added to the principal balance

For the sake of clarity there are no warrants to be issued under this New Convertible Note.

Qualified Person Statement

The information contained in this report that relates to Exploration Results, Mineral Resource Estimates, and Mineral Reserves is based on data compiled by Mr. Andrew Hawker, a Member of the Australasian Institute of Mining and Metallurgy. Mr. Hawker is a Geological Consultant for Hawker Geological Services Pty Ltd. He has reviewed and approved the technical information regarding exploration results and Mineral Resource estimates in this news release. Mr. Hawker possesses sufficient relevant experience with the style of mineralisation and type of deposit under consideration, as well as the activity being undertaken, to qualify as an independent Qualified Person as defined by NI43-101. The information in this report regarding Mineral Reserves is also based on data compiled by Mr. Hawker. He consents to the inclusion of this information in the report in the form and context in which it appears.

Enquiries

For further information, please contact: William Hunter

Interim CEO Tonogold Resources Inc M: +1 203 856 7285

E: bhunter@tonogold.com

SOURCE: Tonogold Resources, Inc.

View the original press release on accesswire.com

More News

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the following

Privacy Policy and Terms Of Service.