Financial News

HireQuest Reports Financial Results for the Fourth Quarter and Year End 2021

Q4 2021 EPS of $0.16 per Diluted Share, Net Income of $2.2 million, and Adjusted EBITDA of $3.5 million

Full Year 2021 EPS of $0.87 per Diluted Share, Net Income of $11.8 million, and Adjusted EBITDA of $14.7 million

GOOSE CREEK, SC / ACCESSWIRE / March 15, 2022 / HireQuest, Inc. (Nasdaq:HQI), a national franchisor of on-demand, executive search, and commercial staffing services, today reported financial results for the fourth quarter and year ended December 31, 2021.

Fourth Quarter 2021 Summary

- Franchise royalties increased 88% to $6.1 million compared to $3.2 million in the prior year period. Organic royalties, excluding the effect of the Snelling and Link acquisitions, increased 47% compared to the year-prior period.

- Staffing revenue from owned locations was $231,000 and was related to the Dental Power acquisition.

- Service revenue increased 168% to $471,000 compared to $176,000 in the prior year period.

- Total revenue increased 99% to $6.8 million compared to $3.4 million in the prior year period.

- Net Income was $2.2 million, or $0.16 per diluted share, compared to net income of $1.4 million, or $0.10 per diluted share in the prior year period.

- Adjusted EBITDA improved to $3.5 million compared to $1.9 million in the prior year period.

Full Year 2021 Summary

- Franchise royalties increased 67% to $21.3 million compared to $12.8 million in the prior year. Organic royalties, excluding the effect of the Snelling and Link acquisitions, increased 30% compared to the full year 2020.

- Staffing revenue from owned locations increased 100% to $231,000 and was related to the Dental Power acquisition.

- Service revenue increased 19% to $1.2 million compared to $1.0 million in the prior year.

- Total revenue increased 67% to $22.8 million compared to $13.8 million in the prior year.

- Net Income was $11.8 million, or $0.87 per diluted share, compared to net income of $5.4 million, or $0.39 per diluted share for full year 2020.

Subsequent to Quarter End

- HireQuest acquired dmDickason's staffing division, expanding the Company's national footprint in West Texas and New Mexico.

- HireQuest acquired The Dubin Group, Inc., and Dubin Workforce Solutions, Inc., related businesses based in Philadelphia, that provide executive placement services and commercial staffing, respectively. The acquisitions expand the Company's presence in the Northeast and add higher margin executive placement services in the region.

- HireQuest acquired the staffing and executive search operations of Northbound Executive Search, LTD., a New York City based provider of executive placement and short-term consultant services to blue chip clients in the financial services industry. The acquisition further expands the Company's footprint in the higher margin executive placement vertical and expands its national reach into the Northeast.

- The Company's Board of Directors declared a quarterly cash dividend of $0.06 per share of common stock to be paid on March 15, 2022, to shareholders of record as of March 1, 2022.

System-wide sales for the fourth quarter of 2021 were $106.8 million compared to $54.8 million for the same period in 2020. The growth was due to a 45% increase in sales from existing franchisees as well as new sales from the acquired Snelling, Link and Dental Power networks. System-wide sales for full year 2021 were $354.5 million compared to $212.8 million in 2020.

"The fourth quarter caps a strong year for the Company," commented Rick Hermanns, HireQuest's President and Chief Executive Officer. "Our solid performance demonstrates the strength of our differentiated model in the staffing space which better serves customers, employees, franchisees, and shareholders. In the fourth quarter, we continued the momentum we built in the third quarter. Most critically, we exceeded our pre-pandemic system wide sales, excluding Snelling and Link. This should set us up for a very strong 2022.

"We made four acquisitions in 2021 adding attractive new market verticals and enhancing our technology platform. The Link and Snelling acquisitions early in the year established us in the commercial staffing vertical and the Dental Power Staffing acquisition in Q4 provided entry to the dental staffing market. We also added Recruit Media, an HR tech start-up with a next-gen SaaS recruitment platform that streamlines workforce communications, allowing our franchisees to more efficiently serve customers while establishing HireQuest as a leading technology innovator within our space. Our asset light franchise model has enabled us to quickly integrate these acquisitions with relatively low operational effort. And most importantly, we have been retaining existing customers and adding clients to the acquired businesses."

Fourth Quarter 2021 Financial Results

The company's gross profit is calculated by aggregating its revenue derived from franchise royalties, gross profit from owned locations, and service revenue. Franchise royalties are the royalties earned from franchisees primarily on the basis of their sales to their customers. Gross profit from owned locations is sales at owned locations less cost of staffing revenue. Service revenue consists of interest charged to franchisees on overdue accounts and other fees for optional services we provide our franchisees.

Franchise royalties in the fourth quarter of 2021 were $6.1 million compared to $3.2 million in the year-ago quarter. Organically, excluding the contribution from Snelling and Link, franchise royalties increased 47%.Service revenue was $471,000 compared to $176,000 in the prior-year quarter, an increase of 168%. Staffing revenue from owned locations was $231,000 and was related to the Dental Power acquisition. Total revenue in the fourth quarter of 2021 was $6.8 million compared to $3.4 million in the year-ago quarter, an increase of 99%.

Gross profit in the fourth quarter of 2021 was $6.6 million compared to $3.4 million in the year-ago quarter, an increase of 94%.

Selling, general and administrative ("SG&A") expenses in the fourth quarter of 2021 were $4.4 million or 67% of gross profit compared to $2.2 million, or 63% of gross profit for the fourth quarter last year. The increase is primarily due to a change in the timing of accounting for annual incentive compensation which historically was included in Q1 results.

Net Income in the fourth quarter of 2021 was $2.2 million, or $0.16 per diluted share, compared to net income of $1.4 million, or $0.10 per diluted share, in the fourth quarter last year.

Adjusted EBITDA for the fourth quarter of 2021 was $3.5 million compared to $1.9 million in the fourth quarter last year.

Full Year 2021 Financial Results

Franchise royalties for the full year 2021 were $21.3 million compared to $12.8 million in the prior year, an increase of 67%. Organic franchise royalties, excluding the effect of the Snelling and Link acquisitions, increased 30% compared to full year 2020. Staffing revenue from owned locations was $231,000 and was related to the Dental Power acquisition. Service revenue was $1.2 million compared to $1.0 million in the prior year, an increase of 19%. Total revenue for the full year 2021 was $22.8 million compared to $13.8 million in the prior year, an increase of 65%.

Gross profit for the full year 2021 was $22.6 million compared to $13.8 million in the prior year, an increase of 64%.

Selling, general and administrative ("SG&A") expenses for the full year 2021 were $13.4 million compared to $8.7 million for the prior year. SG&A as a percentage of gross profit decreased to 59% in full year 2021 compared to 63% in fiscal year 2020. Total SG&A in 2021 primarily increased due to increased incentive compensation resulting from improved business performance in 2021. Due to changes in timing of accounting for annual incentive compensation, full year 2021 results include incentive compensation expense in Q1 2021 that would have been included in Q4 2020 if the current methodology was used.

Net Income for the full year 2021 was $11.8 million, or $0.87 per diluted share, compared to net income of $5.4 million, or $0.39 per diluted share, in the prior year.

Adjusted EBITDA for the full year 2021 was $14.7 million compared to $9.6 million in the prior year.

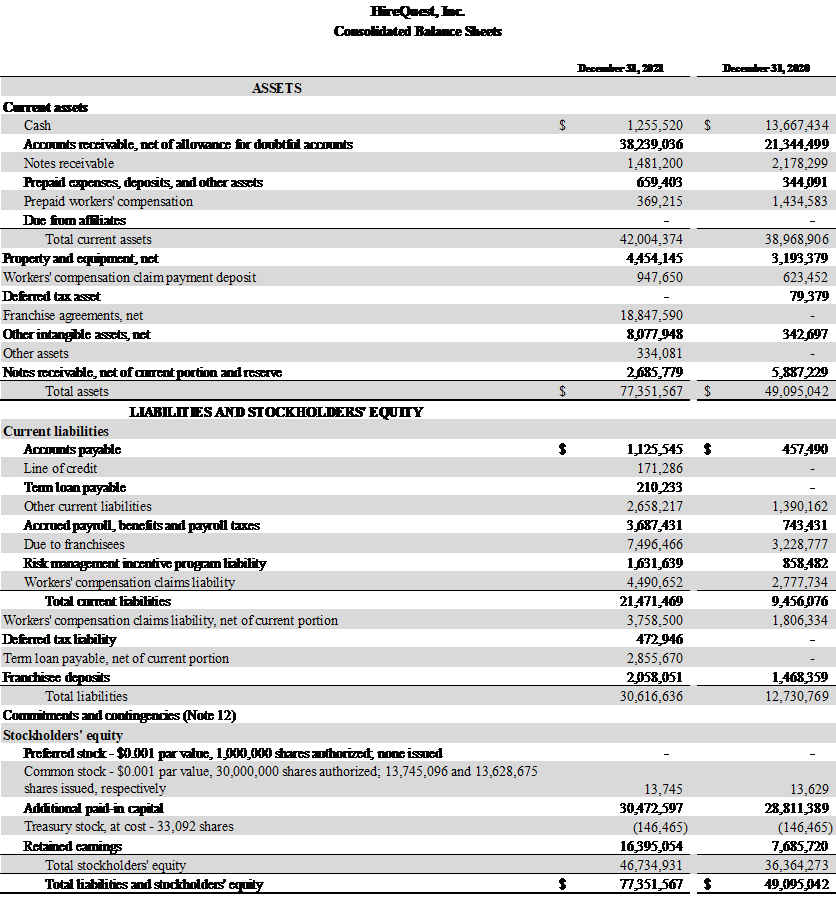

Balance Sheet and Capital Structure

Cash was $1.3 million as of December 31, 2021, compared to $13.7 million as of December 31, 2020. The decrease reflects the purchase price for recent acquisitions and significantly higher accounts receivable.

Total assets were $77.4 million as of December 31, 2021. Total liabilities were $30.6 million.

Working capital as of December 31, 2021 was $20.5 million compared to $29.5 million at December 31, 2020.

At December 31, 2021 the Company had $19.1 million in availability on its revolving credit facility.

On March 15, 2022, the company paid a quarterly cash dividend of $0.06 per share of common stock to shareholders of record as of March 1, 2022, its seventh consecutive quarterly dividend. The company intends to pay a $0.06 cash dividend on a quarterly basis, based on its business results and financial position.

Conference Call

HireQuest will hold a conference call to discuss its financial results.

Date: Tuesday, March 15, 2022

Time: 4:30 p.m. Eastern time

Toll-free dial-in number: 888-506-0062

International dial-in number: 973-528-0011

Entry Code: 424210

Please call the conference telephone number 5-10 minutes prior to the start time. An operator will register your name and organization.

The conference call will be broadcast live and available for replay at https://www.webcaster4.com/Webcast/Page/2359/43398 and via the investor relations section of HireQuest's website at www.hirequest.com.

A replay of the conference call will be available through March 29, 2022.

Toll Free: 877-481-4010

International: 919-882-2331

Replay Passcode: 44753

About HireQuest

HireQuest, Inc. is a nationwide franchisor of on-demand, executive search, and commercial staffing solutions for HireQuest Direct, HireQuest, Snelling, Link, and Northbound Executive Search franchised offices across the United States. Through its national network of over 220 franchisee-owned offices in more than 36 states and the District of Columbia, HireQuest provides employment for approximately 73,000 individuals annually that work for thousands of customers in numerous industries including construction, light industrial, manufacturing, hospitality, clerical, medical, travel, financial services, and event services. For more information, visit www.hirequest.com.

Important Cautions Regarding Forward-Looking Statements

This news release includes, and the company's officers and other representatives may sometimes make or provide certain estimates and other forward-looking statements within the meaning of the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act, and Section 21E of the Exchange Act, including, among others, statements with respect to future economic conditions, future revenue or sales and the growth thereof; operating results; anticipated benefits of the acquisition of Snelling and/or Link, or the status of integration of those entities. Forward-looking statements can be identified by words such as: "anticipate," "intend," "plan," "goal," "seek," "believe," "project," "estimate," "expect," "strategy," "future," "likely," "may," "should," "will," and similar references to future periods.

While the company believes these statements are accurate, forward-looking statements are not historical facts and are inherently uncertain. They are based only on the company's current beliefs, expectations, and assumptions regarding the future of its business, future plans and strategies, projections, anticipated events and trends, the economy, and other future conditions. The company cannot assure you that these expectations will occur, and its actual results may be significantly different. Therefore, you should not place undue reliance on these forward-looking statements. Important factors that may cause actual results to differ materially from those contemplated in any forward-looking statements made by the company include the following: the level of demand and financial performance of the temporary staffing industry; the financial performance of the company's franchisees; changes in customer demand; the effects of any global pandemic including the impact of COVID-19; the relative success or failure of acquisitions and new franchised offerings; the extent to which the company is successful in gaining new long-term relationships with customers or retaining existing ones, and the level of service failures that could lead customers to use competitors' services; significant investigative or legal proceedings including, without limitation, those brought about by the existing regulatory environment or changes in the regulations governing the temporary staffing industry and those arising from the action or inaction of the company's franchisees and temporary employees; strategic actions, including acquisitions and dispositions and the company's success in integrating acquired businesses including, without limitation, successful integration following the acquisitions of Snelling, Link, and Dental Power; disruptions to the company's technology network including computer systems and software; natural events such as severe weather, fires, floods, and earthquakes, or man-made or other disruptions of the company's operating systems; and the factors discussed in the "Risk Factors" section and elsewhere in the company's most recent Annual Report on Form 10-K.

Any forward-looking statement made by the company or its management in this news release is based only on information currently available to the company and speaks only as of the date on which it is made. The company and its management disclaim any obligation to update or revise any forward-looking statement, whether written or oral, that may be made from time to time, based on the occurrence of future events, the receipt of new information, or otherwise, except as required by law.

Company Contact:

HireQuest, Inc.

David Hartley, Director of Corporate Development

(800) 835-6755

Email: cdhartley@hirequest.com

Investor Relations Contact:

IMS Investor Relations

John Nesbett/Jennifer Belodeau

(203) 972-9200

Email: hirequest@imsinvestorrelations.com

-- Tables Follow -

SOURCE: HireQuest, Inc.

View source version on accesswire.com:

https://www.accesswire.com/693208/HireQuest-Reports-Financial-Results-for-the-Fourth-Quarter-and-Year-End-2021

More News

View More

Recent Quotes

View MoreQuotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.