Financial News

Atomic Energy Advancement Act in support of developing new nuclear power assets could drive uranium stocks higher (UEC,STUD.V)

Uranium Energy Corp (NYSEMKT: UEC) has been a standout performer, showcasing the immense potential for savvy investors to achieve significant returns. In 2020, the stock was trading at a modest $0.40 per share, but it soared to over $8 per share last month. While timing the market with precision is a feat beyond the reach of most and dwelling on past successes doesn't pave the way for future gains, the pertinent question for traders and investors now is: Can Uranium Energy replicate this extraordinary growth trajectory? More intriguingly, is it possible to attain such lucrative outcomes with a lesser capital outlay? As the energy sector continues to evolve and the demand for clean, sustainable energy solutions like nuclear power gains momentum, UEC's strategic position within the uranium industry could potentially set the stage for another remarkable period of growth. Investors and traders looking for the next big opportunity may potentially find Uranium Energy's prospects particularly enticing, especially if they're aiming to maximize returns on a more modest initial investment. Further, The House of Representatives recently passed the Atomic Energy Advancement Act, 365-36, in support of developing new nuclear power assets. Should the legislation make it to the Oval Office for the president's signature, shares of uranium related stocks will potentially soar.

One uranium mining stock that we would like to draw your attention to is Stallion Uranium Corp. (STUD.V). Stallion Uranium is working to Fuel the Future with Uranium through the exploration of over 3,000 sq/km in the Athabasca Basin, home to the largest high-grade uranium deposits in the world. The company, with JV partner Atha Energy (CSE:SASK), holds the largest contiguous project in the Western Athabasca Basin adjacent to multiple high-grade discovery zones.

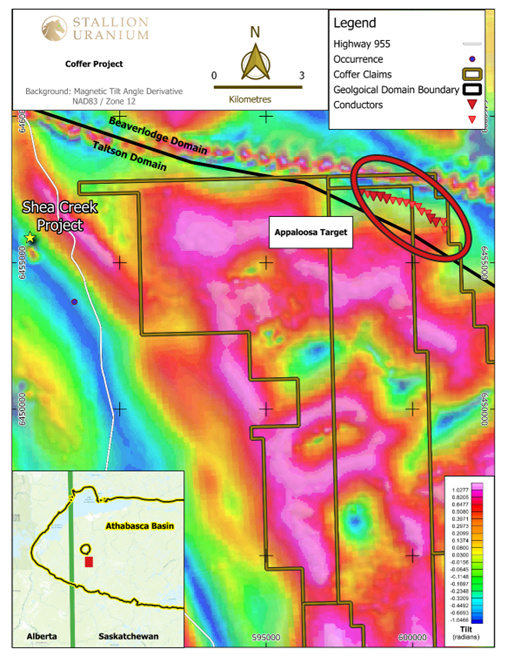

Stallion Uranium Corp (STUD.V)., based in Vancouver, British Columbia, has initiated drilling at its high-priority Appaloosa Target within the Coffer Project, situated in the prolific Southwestern Athabasca Basin, Saskatchewan, Canada. This marks the company's first drill program on the 100% owned project, aiming to uncover uranium mineralization through the exploration of conductive electromagnetic anomalies and other geophysical indicators. Approximately 3,300 meters will be drilled across three holes to target these anomalies.

CEO Drew Zimmerman expressed optimism about the potential for a significant uranium discovery, highlighting the systematic approach and advanced targeting that has led to this milestone. The drill program, conducted by CYR Drilling, will explore a 6 km long electromagnetic conductor deemed conducive for uranium deposits due to its geological setting.

Stallion plans to release preliminary scintillometer readings as an early indication of radioactive material presence, with final assay results expected in summer 2024. This exploration effort underscores Stallion's commitment to fueling the future with uranium, as they hold the largest contiguous project in the Western Athabasca Basin, known for high-grade uranium deposits, alongside gold project ventures in Idaho and Nevada.

Watch the video below to know more about Stallion Uranium Corp. (STUD.V)

Video Link: https://www.youtube.com/embed/40tlVuB7FHY

Stallion Uranium's ambitious drill program at the Appaloosa Target represents a significant step forward in the company's quest to uncover new uranium deposits in the world-renowned Athabasca Basin. By leveraging advanced technology and a strategic approach to exploration, Stallion not only underscores its commitment to fueling a clean energy future but also highlights its potential to deliver substantial value to investors and stakeholders. As the industry watches closely, the outcomes of this drilling campaign could set a new precedent for uranium exploration and further cement Stallion Uranium's position as a leader in the sector.

Coming back to UEC, Uranium Energy UEC reported second-quarter fiscal 2024 adjusted earnings per share of 1 cent, which was in line with the Zacks Consensus Estimate. The bottom line marked a 67% plunge from the earnings per share of 3 cents in the year-ago quarter.

Uranium Energy’s revenues were $0.12 million in the quarter under review, down 100% from $47.9 million in the year-ago quarter. Revenues from the quarter only reflected revenues from toll processing services, as the company did not sell any of its purchased uranium inventory. Sales of uranium inventory generated revenues of $47.8 million in the year-ago quarter, and revenues from toll processing services were $0.09 million.

Other uranium and nuclear stocks worth monitoring include NexGen Energy (NYSE: NXE), Denison Mines (NYSE: DNN), Energy Fuels Inc (NYSE: UUUU)., and the Sprott Uranium Miners ETF, each contributing uniquely to the sector's dynamics and offering potential investment opportunities

Source:

https://finance.yahoo.com/news/uranium-energy-stock-millionaire-maker-144900223.html

https://finance.yahoo.com/news/stallion-uranium-commences-drilling-appaloosa-113000704.html

https://finance.yahoo.com/quote/STUD.V?.tsrc=fin-srch

https://finance.yahoo.com/news/uranium-energy-uec-q2-earnings-143700648.html

*Disclaimer: This blog post is for informational purposes only and is not intended as investment advice. Please conduct your own due diligence or consult a financial advisor before making any investment decisions. This enhanced blog post positions Stallion Uranium within the broader context of uranium's growing importance as a future energy source, highlighting the company's strategic initiatives and potential in this vital sector. This blog post is for informational purposes only and is not intended as investment advice. Please conduct your own research or consult a financial advisor before making any investment decisions. FOR EDUCATIONAL AND INFORMATION PURPOSES ONLY; NOT INVESTMENT ADVICE. Please ensure to fully read and comprehend our disclaimer found at https://Stud.Report/disclaimer/. Starting on December 1, 2023, STUD.report has been compensated $25,000 per month for coverage of STUD by Volans Capital Corp. Stud.Report is neither an investment advisor nor a registered broker. No current owner, employee, or independent contractor of Stud.Report is registered as a securities broker-dealer, broker, investment advisor, or IA representative with the U.S. Securities and Exchange Commission, any state securities regulatory authority, or any self-regulatory organization. This article may contain forward-looking statements as defined under Section 27A of the Securities Act of 1933 and 21E of the Exchange Act of 1934. These statements, often incorporating terms like "believes," "anticipates," "estimates," "expects," "projects," "intends," or similar expressions about future performance or conduct, are based on present expectations, estimates, and projections, and are not historical facts. They carry various risks and uncertainties that may result in significant deviation from the anticipated results or events. Past performance does not guarantee future results.Stud.Report does not commit to updating forward-looking statements based on new information or future events. Readers are encouraged to review all public SEC filings made by the profiled companies at https://www.sec.gov/edgar/searchedgar/companysearch. It is always important to conduct thorough due diligence and exercise caution in trading.Stud.Report is not managed by a licensed broker, a dealer, or a registered investment adviser. The content here is purely informational and should not be taken as investment advice. The Private Securities Litigation Reform Act of 1995 provides investors a safe harbor regarding forward-looking statements. Any statement that projects, foresees, expects, anticipates, estimates, believes, or understands certain actions to possibly occur are not historical facts and may be forward-looking statements. These statements are based on expectations, estimates, and projections that could cause actual results to differ greatly from those anticipated. Investing in micro-cap and growth securities is speculative and entails a high degree of risk, potentially leading to a total or substantial loss of investment. Please note that no content published here constitutes a recommendation to buy or sell a security. It is solely informational, and you should not construe it as legal, tax, investment, financial, or other advice. No content in this article constitutes an offer or solicitation by Stud.Report or any third-party service provider to buy or sell securities or other financial instruments. The content in this article does not address the circumstances of any specific individual or entity and does not constitute professional and/or financial advice. Stud.Report is not a fiduciary by virtue of any person's use of or access to this content.

Media Contact

Company Name: Stud.Report

Contact Person: Jason Roy

Email: info@stud.report

Country: United States

Website: https://stud.report/

More News

View More

Recent Quotes

View MoreQuotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.