Financial News

9 Best Investment Newsletters

According to legendary investor Warren Buffett, the #1 rule of investing is simple: Don’t lose money.

Most successful investors echo this simple rule.

But simple doesn’t mean easy. Avoiding losses in the market is easier said than done.

While every investor will experience loss at some point, learning as much as you can and always doing your due diligence can help you avoid unnecessary losses.

One of the easiest ways to increase your market prowess and knowledge? Financial newsletters.

Top investment newsletters can give you a leg up on the market in various ways — you might find fresh investing ideas, learn about new investing strategies, or discover techniques to diversify and manage your portfolio.

The problem? There are thousands of financial newsletters to choose from. You don’t want to waste your time. You want to focus on the best investment newsletters.

We’ve done the legwork for you. Below, you’ll find 8 of the best investment newsletters right now, including the best stock newsletters, the best investment subscriptions, and more.

The 9 Best Investment Newsletters in 2024

The best investment newsletter for you might be different from the investor down the block. Check out the descriptions below to find the best fit for your investing style.

1. StockNewsYes, StockNews is at the top of the list — we firmly believe in our offerings. With plenty of different options for investors, StockNews is a great one-stop shop for several of the best investment newsletters.

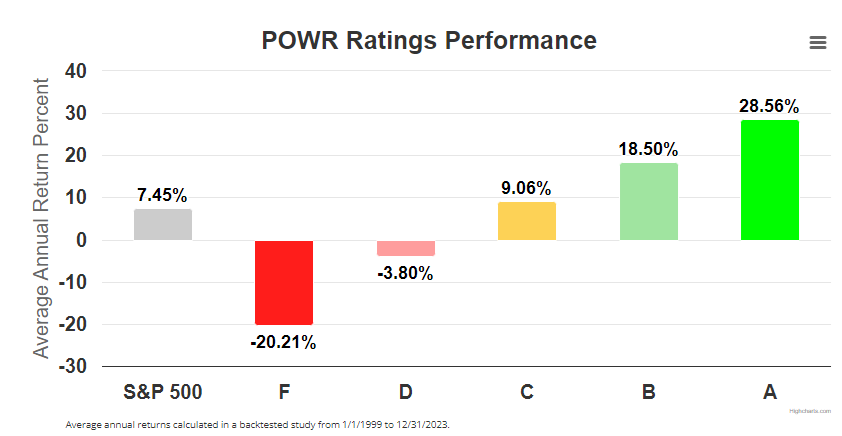

There are a variety of different services available. Many are based on the POWR rating system, a proprietary ratings model “to put the odds of investing success in your favor.” Stocks are classified by a grading system, and on their website, they report that their “A” rated stocks would have generated an annual compounded return of +28.56%.

Source: StockNews

Subscription-wise, you can choose from POWR-based newsletters like POWR Stocks Under $10, POWR Breakouts, or POWR Options, or you can follow select trades of 40-year investing veteran Steve Reitmeister with the Reitmeister Total Return newsletter.

For the most bang for your buck, newcomers to StockNews might want to start with POWR Platinum — a bundle of several of their market-beating newsletter services that you can try via a 30-day trial for just $1.

StockNews isn’t just one of the best investment newsletter providers — it’s also a great spot to research stocks. With so many options available and an impressive track record, it’s well worth checking out.

Get Started With StockNews

2. WallStreetZen IdeasLet’s start with a free investment newsletter that nonetheless provides a lot of value — WallStreetZen Ideas. This relative newcomer to the financial newsletter scene is currently published three times per week.

Source: WallStreetZen

Per the newsletter’s website, its goal is to “provide data-driven market updates to help you bridge the gap between catalysts and potential action.” Here’s how it delivers on that promise and why it’s one of the best stock newsletters out there.

First off, each newsletter starts with a section called “Hot or Not: Stock Market Edition.” It’s a fun but informative feature that breaks down some of the biggest winners and losers in the market. This feature can give you ideas for short-term trades as well as alert you to larger catalysts that might inspire long-term investments.

Second, you’ll get three “Strong Buy” recommendations from top-rated analysts, where you gain access to what is otherwise a Premium feature on the WallStreetZen website. You’ll see a breakdown of the recent rating, the analyst’s track record, and the “why” behind the rating.

Finally, you’ll find a few timely stories about current market events. These might include breakdowns of recent earnings reports, overall market trends, or a spotlight on specific stocks.

WallStreetZen keeps things light but gives you plenty of actionable investing ideas — and it’s free. It’s well worth your time.

Get Started With WallStreetZen Ideas (FREE)

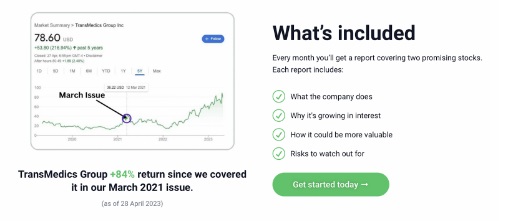

3. Motley Fool Stock AdvisorIf you’re looking for specific stock picks with a full-blown thesis, Motley Fool’s Stock Advisor is one of the best investment subscriptions out there.

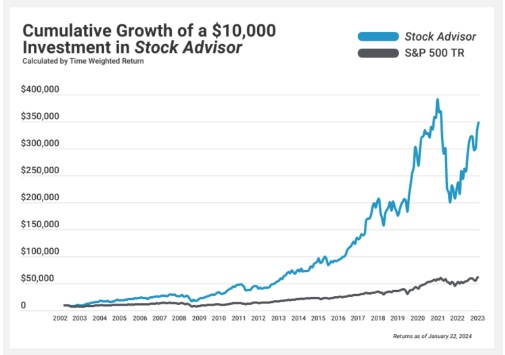

Who’s behind Stock Advisor? David and Tom Gardner, brothers and former hedge fund managers who have a ton of experience and a great eye for high-potential stocks. Just take a look at the service’s track record:

Source: Motley Fool Stock Advisor

This service is ideal if you’re looking for high-conviction stock picks with analysis to back them up, delivered by a team with a long track record of success.

With Stock Advisor, you’ll get 2 new stock picks every month, with a detailed thesis on each pick. But you’ll also receive a lot more, including:

- A “Best Buys Now” list, which features 10 stocks to watch.

- Motley Fool’s “Starter Stocks List,” which includes their foundational stock picks, geared toward new investors.

- Access to the company’s robust educational library.

- Access to their community of investors so you can connect with like-minded investors.

Stock Advisor is not free, but considering the track record and all of the resources you get, it’s worth it. There’s an introductory price of $79 for the first year for new members, which renews at the regular price of $199 per year afterward.

Get Started With Motley Fool Stock Advisor

4. Seeking Alpha – Alpha PicksLaunched in 2022, Alpha Picks is one of the best investment subscriptions to debut in recent memory. It’s a product of the top-rated stock research service Seeking Alpha.

If you’re familiar with Seeking Alpha, then you already know how much information is available on the site — trending data, analyst ratings, quant scores, and much, much more.

Alpha Picks is a bit more targeted. It takes that huge amount of data and distills it into two monthly stock picks.

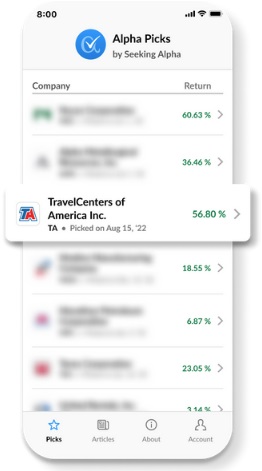

Source: Alpha Picks

The two stocks are chosen using a proprietary Seeking Alpha system which reviews valuation, profitability, growth, trends, and other key metrics to select the highest-conviction picks.

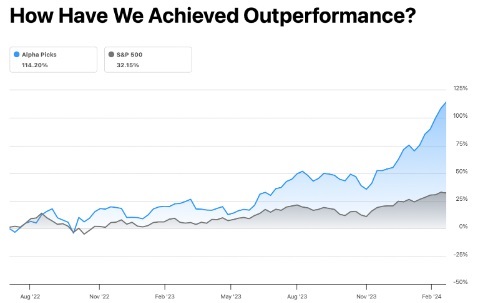

While Alpha Picks is still new, its track record so far is pretty impressive:

Source: Alpha Picks

Alpha Picks isn’t just one of the best investment newsletters — it’s a whole lot more.

In addition to the robust reports that accompany each stock pick, you also receive frequent updates on past picks and sell alerts if the thesis changes on any of them.

If you love stock research and want to know the “why” behind investments, but don’t necessarily have the time to do all the due diligence yourself, Alpha Picks is a great way to get a head start on the process and save time.

At $499 per year, Alpha Picks is not cheap. But when you consider all of the resources you get, plus the service’s impressive track record, it may be worth it if it’s aligned with your investing strategy.

Get Started With Seeking Alpha — Alpha Picks

5. Ticker NerdThis is one of the best investment newsletters that is still somewhat under the radar. Ticker Nerd’s goal is to find stocks with high growth potential, and they deliver their findings through two reports each month.

But don’t confuse these reports with stock recommendations. Ticker Nerd positions itself as a research service. Unlike some of the other best investment newsletters on this list, Ticker Nerd doesn’t hold positions in the stocks they recommend. They’re simply reporting on stocks that have high potential.

Their reports look at all sorts of data, such as analyst ratings, social media sentiment, quantitative analysis, fundamental analysis, and more. Once they locate a stock with potential, their team does a deep dive to create a detailed report.

As a member, you also gain access to all of the past reports. Since the stocks they feature generally have a long-term investment thesis, you can still find great investment ideas within these past reports.

Source: Ticker Nerd

Once again: Not free. However, consider this: the tools necessary to do the research Ticker Nerd does would cost a few hundred dollars per year (at least). With a price tag of $149 per year, Ticker Nerd is worth it if you want a head start on research and exposure to investment ideas that you might not have considered.

Real talk: Navigating the Zacks website can be overwhelming. You’ll find a variety of both free and paid options, and it can be hard to know where to start. The good news? It’s quality stuff.

While many different Zacks offerings would fit on this best investment newsletter list, Zacks Premium is what we’ll focus on because it offers a superior value. You can get a 30-day free trial, which is not common in the financial newsletter space. From there, it will cost you $249 per year.

Zacks Premium offers you access to both stock recommendations and research tools. One of the biggest selling points of Zacks Premium is the stock recommendation newsletters — the Zacks #1 Stock List and the market-beating Focus List.

Plus, the way they organize stocks is unique. Unlike a service like Motley Fool Stock Advisor, Zacks takes it upon itself to analyze thousands of stocks and classify them by a Zacks Rank which ranges from 1 (a Strong Buy) to 5 (Strong Sell).

In addition to the daily newsletter and free articles, you’ll gain access to exclusive commentary, tools, and recommendation portfolios for long-term investing.

As for their track record? See below:

Source: Zacks

Considering their track record, this makes it a very compelling offer.

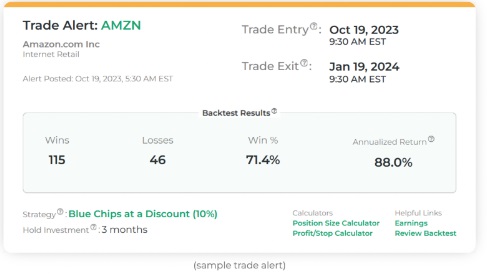

7. Stock Market GuidesStock Market Guides is one of the best investment newsletters in that you can choose from different options that suit your unique needs. It provides trade alerts powered by a proprietary scanner software.

There are four different subscriptions to choose from:

- Premarket alerts for stocks before the market opens.

- Market hours alerts during market hours for stocks.

- Pre-market alerts for options, providing a strategic advantage.

- Market hours alerts during market hours for options, keeping you ahead of the curve.

This allows you to choose a subscription that’s in line with not only your style but your availability. For instance, if you work during the day, you might want to focus on pre-market alerts.

By the way, alerts are easy to read. Here’s a sample from their website:

Source: Stock Market Guides

But it’s not just one of the best investment newsletters because of the different subscription varieties. It’s all about the research that backs up each alert. Every alert comes with a comprehensive analysis of past setups, empowering you to make informed decisions. Transparency is key — every alert includes the average annualized returns.

Plus, you can filter the alerts you receive based on your preferred hold time, share price, or any other criteria you deem important.

Expect more than just alerts — the service will keep you informed with regular market updates, ensuring you're always in tune with the latest trends and developments.

Considering the relatively low price tag ($49/month), Stock Market Guides is worth considering.

Get Started With Stock Market Guides

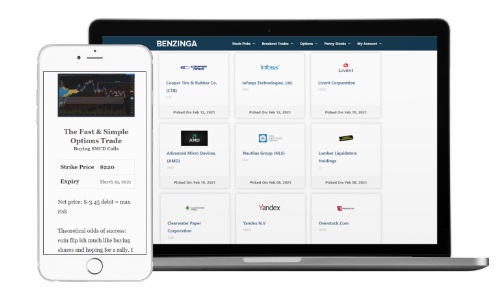

8. Benzinga OptionsHere’s one of the best investment newsletters to consider if options trading is your wheelhouse: Benzinga Options.

This newsletter/subscription service comes from winning options trader Nic Chahine, a highly profitable options trader who boasts an impressive 90%+ success rate. As a subscriber to what many consider the best investing newsletters for options traders, you get access to his trades — and his inner workings, because he does a great job at explaining his reasoning to subscribers.

Source: Benzinga Options

Once you sign up, you’ll receive high-probability ideas for trades twice per month. On average, the holding periods range between a week and three months.

Also worth noting: Benzinga Options is appropriate for options newbies. Chahine isn’t just a pro trader — he’s a pro at explaining his callouts, which are simple to follow and implement. As a bonus, his options trades can be customized to suit your portfolio and desired position size.

At $297 per year, it’s not exactly cheap. But when you factor in the ability to learn from a guru, you’re receiving a lot for your investment.

Get Started With Benzinga Options

9. The Average JoeLet’s close out the list with another free investment newsletter: The Average Joe.

Delivered 4x per week, this is one of the best investment newsletters for investors who like information with a side of humor. They liken themselves to IKEA instructions for investors, and once you start reading, you’ll see why. The language is simple and clear, and you can read and absorb it quickly.

Source: The Average Joe

But don’t let the ease of use fool you. You’ll always pick up something new in The Average Joe, and their insights are always fresh and spot on. Like with WallStreetZen Ideas, this isn’t a premium stock-picking service. It’s more of a way to get a pulse on the market, learn about market and stock trends, and improve your investing prowess.

Best of all, the price is right — why not give this free newsletter a try and see why so many subscribers consider it one of the best investing newsletters?

Get Started With The Average Joe

The Bottom Line: What’s the Best Investment Newsletter?

What are the best investment newsletters? There isn’t a one-size-fits-all answer. It depends on your investing style and objectives.

All of the services we’ve listed here have something to offer. For instance, if you’re just looking for ideas and a general market pulse, check out WallStreetZen Ideas — after all, it’s free. If you’re looking for more tailored stock alerts that you can take action on, consider one of the best investment subscriptions like StockNews, Ticker Nerd, or Motley Fool Stock Advisor.

SPY shares were trading at $508.39 per share on Friday afternoon, up $0.89 (+0.18%). Year-to-date, SPY has gained 6.96%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Ryan Taylor

Ryan is a Property Financial Analyst and active real estate agent in Michigan. He has worked in the retirement industry for Voya Financial and Alerus Financial as a Retirement Analyst. Ryan holds a bachelor's degree in business from Ferris State University.

The post 9 Best Investment Newsletters appeared first on StockNews.comStock quotes supplied by Barchart

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the following

Privacy Policy and Terms and Conditions.