Financial News

Toppy Tuesday – What More Can Powell Say or Do at this Point?

Here we are again.

Here we are again.

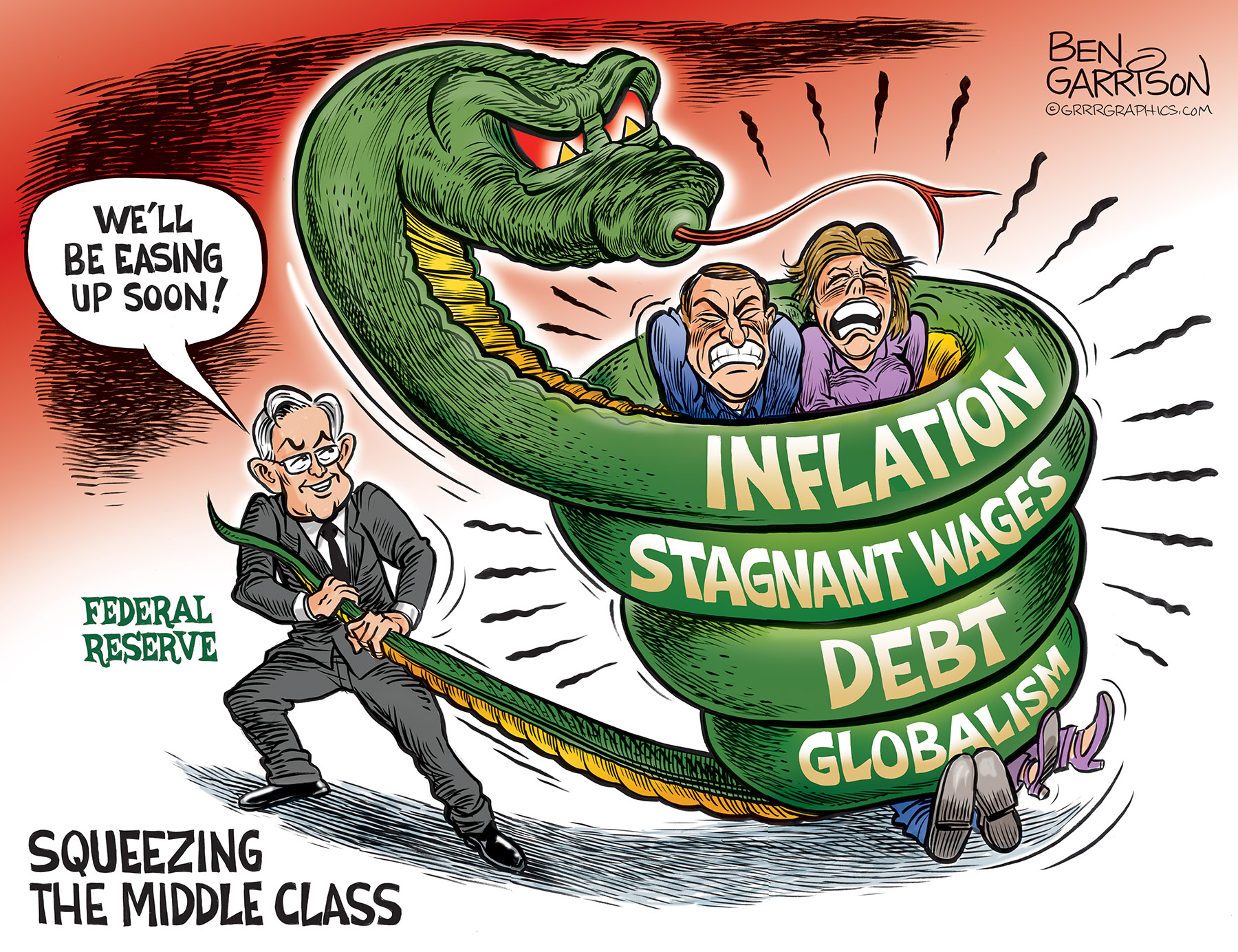

Indexes are still hovering around their all-time highs and Fed Chairman Powell is speaking to Congress. What is he going to say? What can he possibly say to make you believe that the stocks you are massively over-paying for now are going to be even more massively over-paid for by the next sucker down the road? How much money will they have to pour into the system to maintain this farce? Will there ever be consequences or were we just being silly for the past 245 years having a budget?

Money can just be printed when you need it. No matter what you want to spend, you just print more and buy whatever you need, right? That's our current fiscal policy and, as we noted yesterday, the Fed is responsible for most of it and yes, we need the stimulus and we need the liquidity BUT THERE IS A COST – and we haven't even been considering it.

Since the financial crisis, the Fed has kept the cost of borrowing money for banks at near-zero percent interest. That allowed those banks to borrow money to buy their own stock (as did many corporations) to inflate their value but not, of course, the value of their service to Main Street. When money is cheap because interest rates are low or near zero, the beneficiaries are those with the most direct access to it. That means, of course, that the biggest banks, members of the Fed since its inception, get the largest chunks of fabricated money and pay the least amount of interest for it.

Let’s recall that on September 15, 2008, Lehman Brothers crashed. That bank had been around for more than 150 years. Its collapse was a key catalyst in a spiral of disaster that nearly decimated the World financial system. It wasn’t the bankruptcy that did it, however, but the massive amount of money the surviving banks had already lent Lehman to buy the toxic assets they had created. In the wake of Lehman’s bankruptcy, $16 trillion in bailouts and other subsidies from the Federal Reserve and Congress were offered mostly to Wall Street’s biggest banks. That flow of money allowed them to return from the edge of financial disaster.

Stock quotes supplied by Barchart

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the following

Privacy Policy and Terms and Conditions.