Financial News

Modern Fast Food Stocks Q2 Highlights: Chipotle (NYSE:CMG)

Let’s dig into the relative performance of Chipotle (NYSE: CMG) and its peers as we unravel the now-completed Q2 modern fast food earnings season.

Modern fast food is a relatively newer category representing a middle ground between traditional fast food and sit-down restaurants. These establishments feature an expanded menu selection priced above traditional fast food options, often incorporating fresher and cleaner ingredients to serve customers prioritizing quality. These eateries are capitalizing on the perception that your drive-through burger and fries joint is detrimental to your health because of inferior ingredients.

The 8 modern fast food stocks we track reported a slower Q2. As a group, revenues missed analysts’ consensus estimates by 1.5%.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 20.2% since the latest earnings results.

Chipotle (NYSE: CMG)

Born from a desire to offer quick meals with fresh, flavorful ingredients, Chipotle (NYSE: CMG) is a fast-food chain known for its healthy, Mexican-inspired cuisine and customizable dishes.

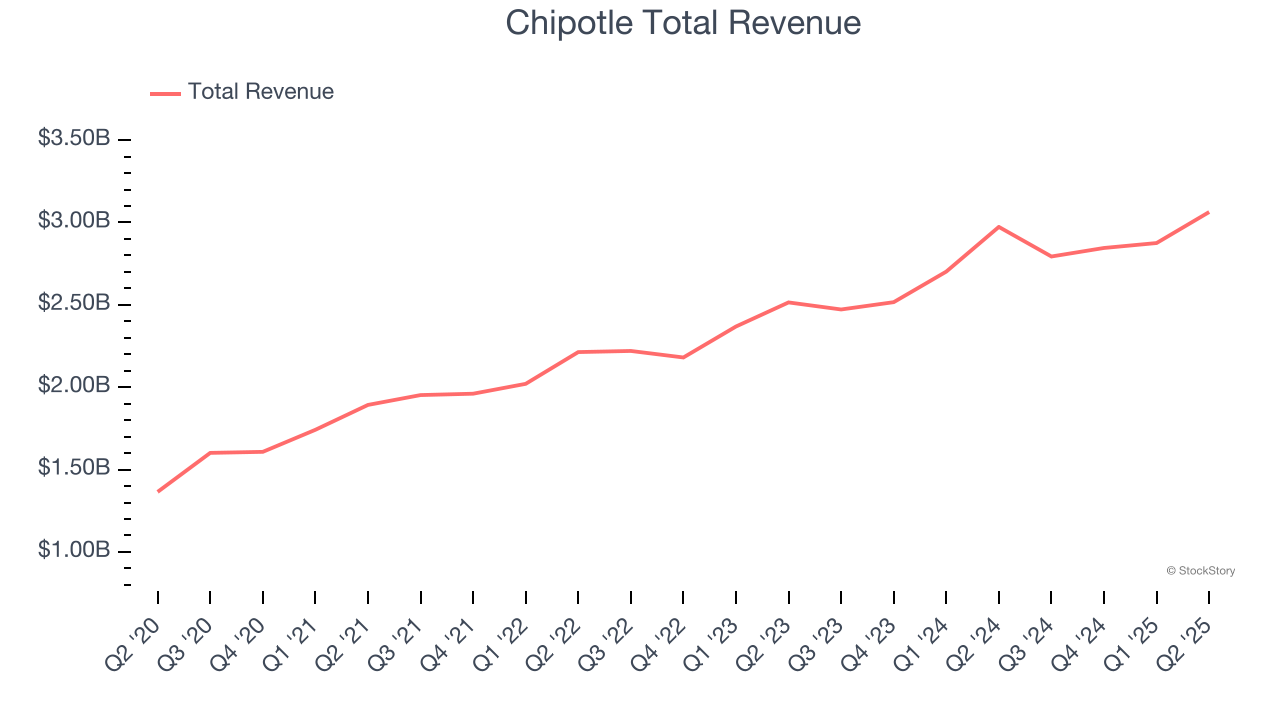

Chipotle reported revenues of $3.06 billion, up 3% year on year. This print fell short of analysts’ expectations by 1.5%. Overall, it was a slower quarter for the company with a slight miss of analysts’ same-store sales estimates.

"We are seeing momentum build as we rolled out our summer marketing initiatives and as our comparisons ease," said Scott Boatwright, Chief Executive Officer, Chipotle.

Unsurprisingly, the stock is down 24.2% since reporting and currently trades at $40.04.

Is now the time to buy Chipotle? Access our full analysis of the earnings results here, it’s free.

Best Q2: Shake Shack (NYSE: SHAK)

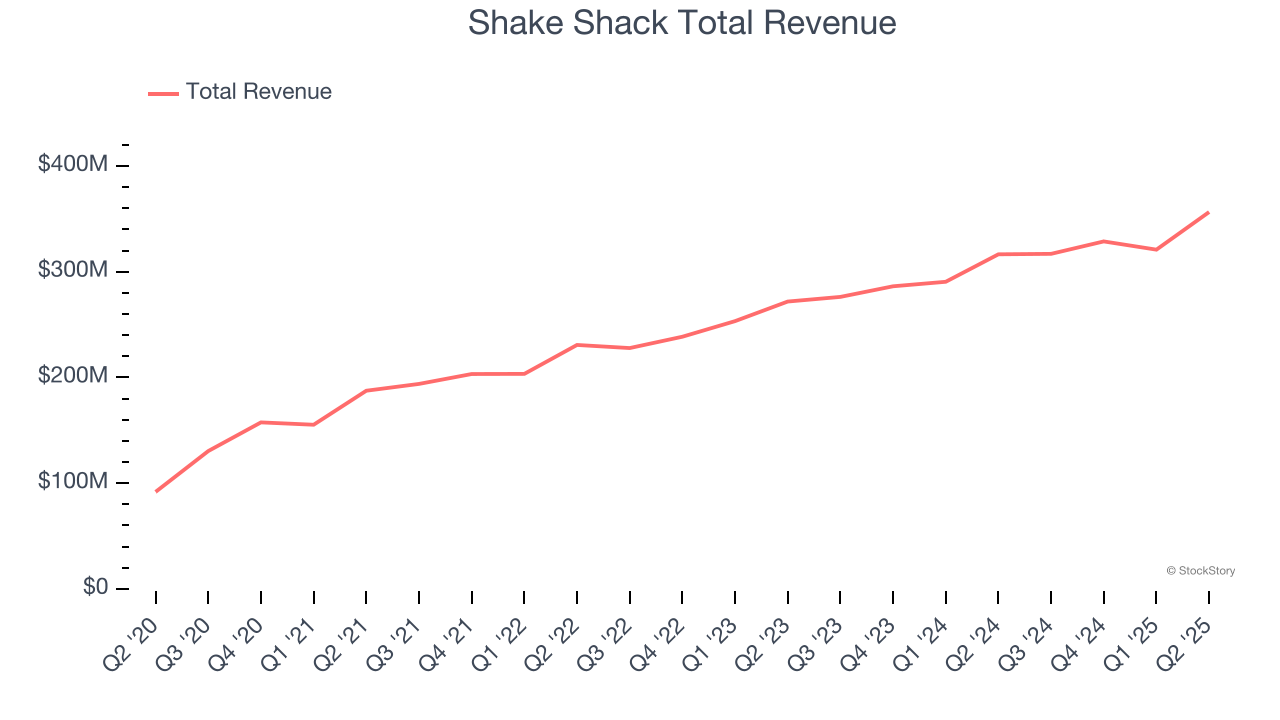

Started as a hot dog cart in New York City's Madison Square Park, Shake Shack (NYSE: SHAK) is a fast-food restaurant known for its burgers and milkshakes.

Shake Shack reported revenues of $356.5 million, up 12.6% year on year, outperforming analysts’ expectations by 0.9%. The business had a strong quarter with an impressive beat of analysts’ EBITDA and EPS estimates.

Shake Shack achieved the biggest analyst estimates beat among its peers. Although it had a fine quarter compared its peers, the market seems unhappy with the results as the stock is down 34.7% since reporting. It currently trades at $92.08.

Is now the time to buy Shake Shack? Access our full analysis of the earnings results here, it’s free.

Weakest Q2: Noodles (NASDAQ: NDLS)

Offering pasta, mac and cheese, pad thai, and more, Noodles & Company (NASDAQ: NDLS) is a casual restaurant chain that serves all manner of noodles from around the world.

Noodles reported revenues of $126.4 million, flat year on year, falling short of analysts’ expectations by 3.9%. It was a disappointing quarter as it posted full-year revenue guidance missing analysts’ expectations and a significant miss of analysts’ EBITDA estimates.

Noodles delivered the highest full-year guidance raise but had the weakest performance against analyst estimates and slowest revenue growth in the group. As expected, the stock is down 39.8% since the results and currently trades at $0.61.

Read our full analysis of Noodles’s results here.

Sweetgreen (NYSE: SG)

Founded in 2007 by three Georgetown University alum, Sweetgreen (NYSE: SG) is a casual quick service chain known for its healthy salads and bowls.

Sweetgreen reported revenues of $185.6 million, flat year on year. This number missed analysts’ expectations by 3.3%. Overall, it was a disappointing quarter as it also logged full-year revenue guidance missing analysts’ expectations.

Sweetgreen had the weakest full-year guidance update among its peers. The stock is down 35.5% since reporting and currently trades at $8.15.

Read our full, actionable report on Sweetgreen here, it’s free.

CAVA (NYSE: CAVA)

Starting from a single Washington, D.C. location, CAVA (NYSE: CAVA) operates a fast-casual restaurant chain offering customizable Mediterranean-inspired dishes.

CAVA reported revenues of $280.6 million, up 20.2% year on year. This print lagged analysts' expectations by 1.8%. It was a slower quarter as it also produced a significant miss of analysts’ same-store sales estimates and full-year EBITDA guidance missing analysts’ expectations.

CAVA delivered the fastest revenue growth among its peers. The stock is down 26.7% since reporting and currently trades at $62.01.

Read our full, actionable report on CAVA here, it’s free.

Market Update

Thanks to the Fed’s series of rate hikes in 2022 and 2023, inflation has cooled significantly from its post-pandemic highs, drawing closer to the 2% goal. This disinflation has occurred without severely impacting economic growth, suggesting the success of a soft landing. The stock market thrived in 2024, spurred by recent rate cuts (0.5% in September and 0.25% in November), and a notable surge followed Donald Trump’s presidential election win in November, propelling indices to historic highs. Nonetheless, the outlook for 2025 remains clouded by potential trade policy changes and corporate tax discussions, which could impact business confidence and growth. The path forward holds both optimism and caution as new policies take shape.

Want to invest in winners with rock-solid fundamentals? Check out our Hidden Gem Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.

More News

View More

Recent Quotes

View MoreQuotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.