Financial News

2 Reasons to Watch AMZN and 1 to Stay Cautious

Amazon trades at $228.79 and has moved in lockstep with the market. Its shares have returned 11.6% over the last six months while the S&P 500 has gained 10.5%.

Is now a good time to buy AMZN? Find out in our full research report, it’s free.

Why Does Amazon Spark Debate?

Founded by Jeff Bezos after quitting his stock-picking job at D.E. Shaw, Amazon (NASDAQ: AMZN) is the world’s largest online retailer and provider of cloud computing services.

Two Positive Attributes:

1. Skyrocketing Revenue Shows Strong Momentum

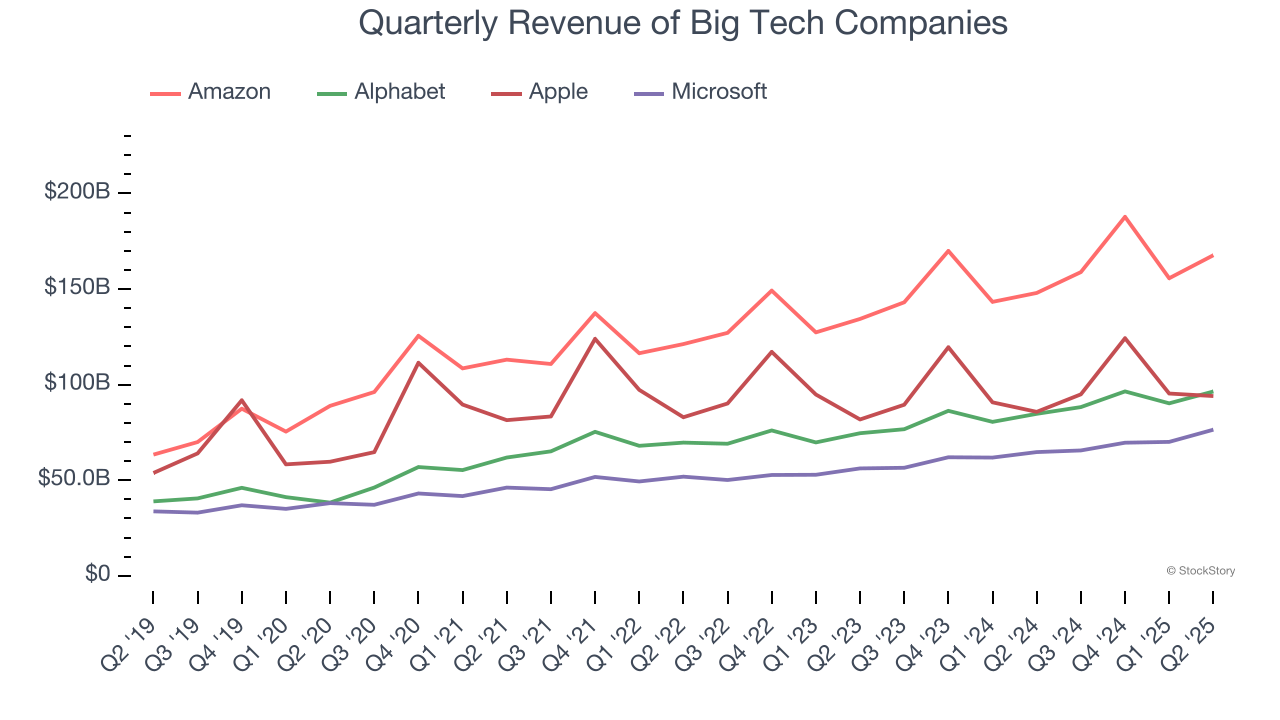

Amazon shows that fast growth and massive scale can coexist despite conventional wisdom. The company’s revenue base of $321.8 billion five years ago has doubled to $670 billion in the last year, translating into an incredible 15.8% annualized growth rate.

Over the same period, Amazon’s big tech peers Alphabet, Microsoft, and Apple put up annualized growth rates of 17.5%, 14.5%, and 8.3%, respectively.

2. Outstanding Long-Term EPS Growth

We track the long-term change in earnings per share (EPS) because it shows whether a company’s growth is profitable. It also explains how taxes and interest expenses affect the bottom line.

Amazon’s EPS grew at an astounding 38.2% compounded annual growth rate over the last five years, higher than its 15.8% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

One Reason to be Careful:

Mediocre Free Cash Flow Margin Limits Reinvestment Potential

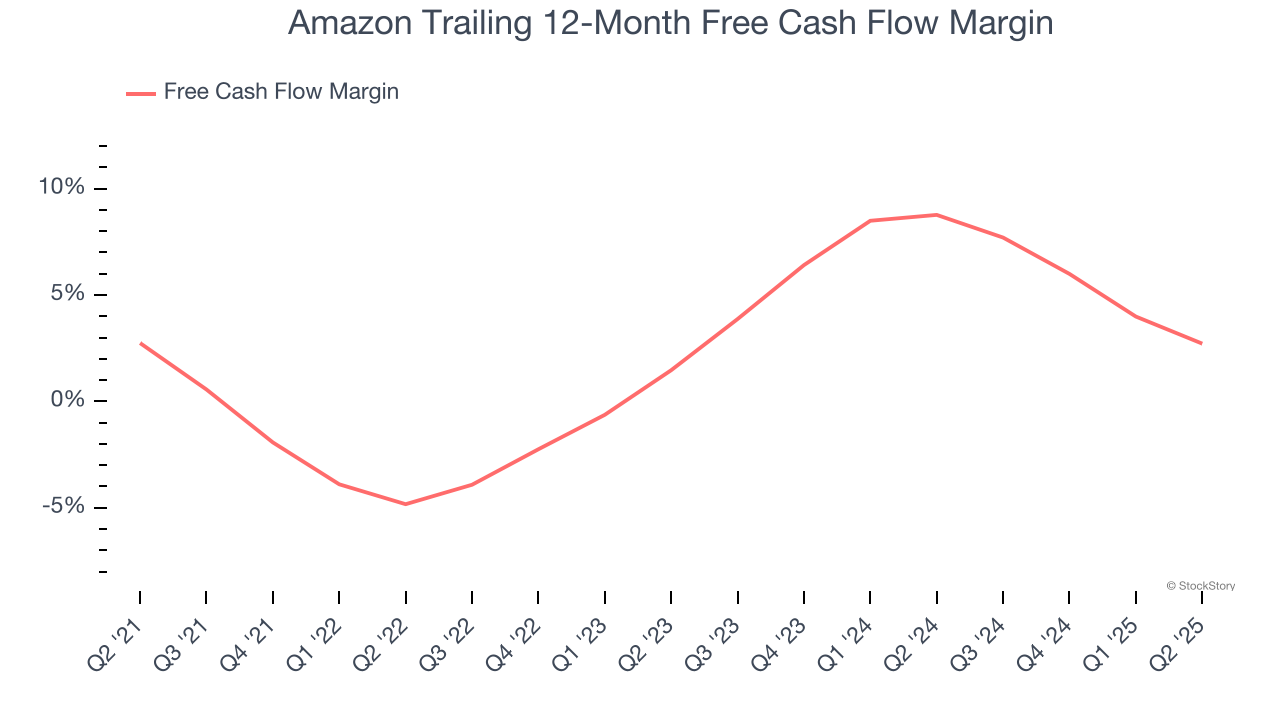

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills or invest for the future.

Amazon has shown poor cash profitability over the last five years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 2.5%, lousy for a consumer internet business.

Final Judgment

Amazon’s positive characteristics outweigh the negatives, but at $228.79 per share (or 34.3× forward price-to-earnings), is now the right time to buy the stock? See for yourself in our comprehensive research report, it’s free.

High-Quality Stocks for All Market Conditions

Trump’s April 2025 tariff bombshell triggered a massive market selloff, but stocks have since staged an impressive recovery, leaving those who panic sold on the sidelines.

Take advantage of the rebound by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.

More News

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the following

Privacy Policy and Terms Of Service.