Financial News

Life Sciences Tools & Services Stocks Q2 Teardown: PacBio (NASDAQ:PACB) Vs The Rest

As the Q2 earnings season comes to a close, it’s time to take stock of this quarter’s best and worst performers in the life sciences tools & services industry, including PacBio (NASDAQ: PACB) and its peers.

The life sciences tools and services sector supports biotech and pharmaceutical R&D and commercialization by providing lab equipment, data analytics, and clinical trial services. These companies benefit from recurring revenue and high margins on specialized products. Looking ahead, the sector is supported by tailwinds like advancements in genomics, personalized medicine, and the use of AI in drug discovery. However, the persistent challenge is dependence on the R&D budgets of large pharmaceutical companies and the volatility of smaller biotech firms. Future headwinds include uncertain research funding and pricing pressures from cost-conscious customers.

The 21 life sciences tools & services stocks we track reported a strong Q2. As a group, revenues beat analysts’ consensus estimates by 4.2% while next quarter’s revenue guidance was 0.5% below.

Thankfully, share prices of the companies have been resilient as they are up 5.6% on average since the latest earnings results.

PacBio (NASDAQ: PACB)

Pioneering what scientists call "HiFi long-read sequencing," recognized as Nature Methods' method of the year for 2022, Pacific Biosciences (NASDAQ: PACB) develops advanced DNA sequencing systems that enable scientists and researchers to analyze genomes with unprecedented accuracy and completeness.

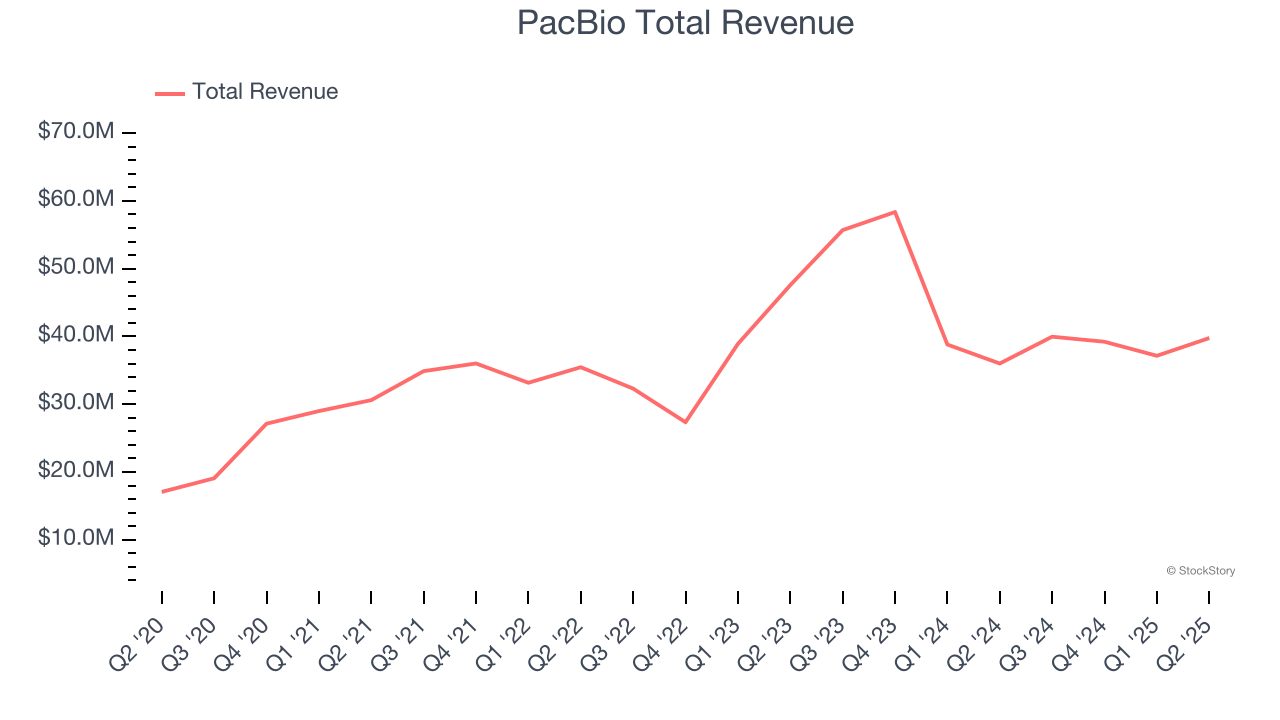

PacBio reported revenues of $39.77 million, up 10.4% year on year. This print exceeded analysts’ expectations by 7.6%. Overall, it was a stunning quarter for the company with a beat of analysts’ EPS estimates.

“PacBio returned to both sequential and year-over-year revenue growth in the second quarter, while also continuing to reduce operating expenses and cash burn,” said Christian Henry, President and Chief Executive Officer.

Unsurprisingly, the stock is down 4.3% since reporting and currently trades at $1.21.

Is now the time to buy PacBio? Access our full analysis of the earnings results here, it’s free.

Best Q2: West Pharmaceutical Services (NYSE: WST)

Founded in 1923 and serving as a critical link in the pharmaceutical supply chain, West Pharmaceutical Services (NYSE: WST) manufactures specialized packaging, containment systems, and delivery devices for injectable drugs and healthcare products.

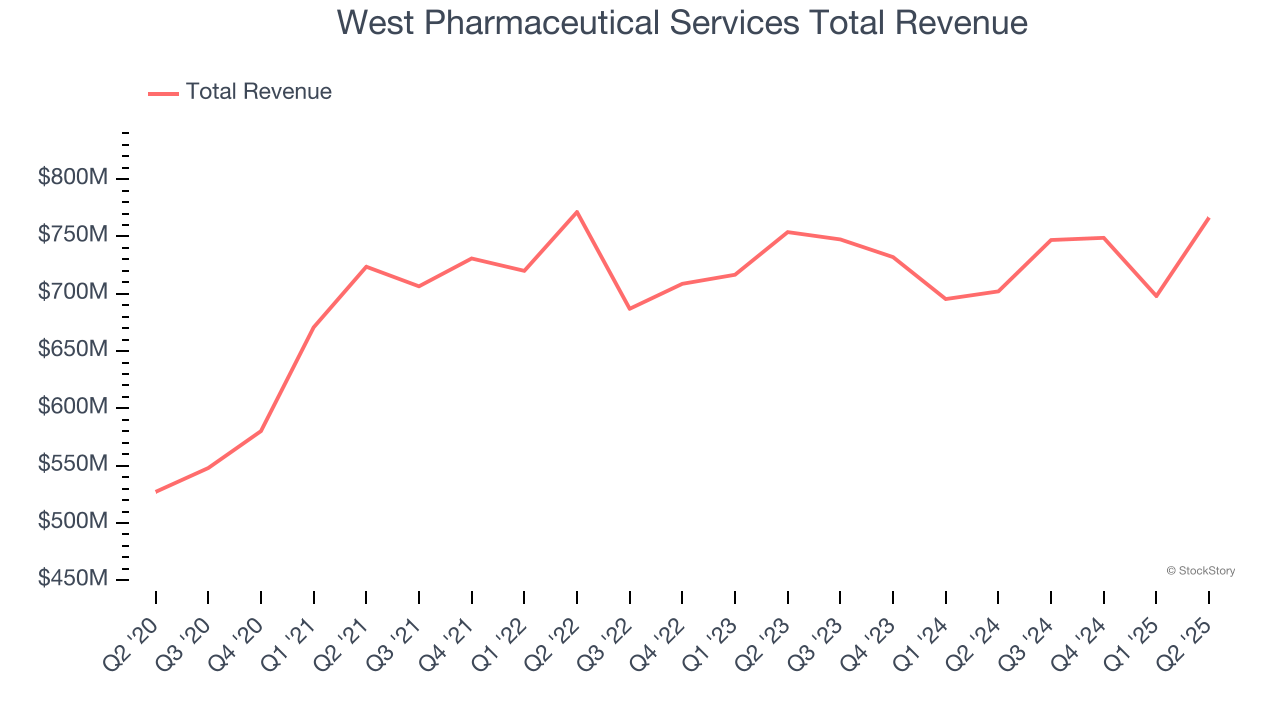

West Pharmaceutical Services reported revenues of $766.5 million, up 9.2% year on year, outperforming analysts’ expectations by 5.6%. The business had a stunning quarter with full-year revenue and EPS guidance exceeding analysts’ expectations.

The market seems happy with the results as the stock is up 11.5% since reporting. It currently trades at $253.50.

Is now the time to buy West Pharmaceutical Services? Access our full analysis of the earnings results here, it’s free.

Weakest Q2: Bruker (NASDAQ: BRKR)

With roots dating back to the pioneering days of nuclear magnetic resonance technology, Bruker (NASDAQ: BRKR) develops and manufactures high-performance scientific instruments that enable researchers and industrial analysts to explore materials at microscopic, molecular, and cellular levels.

Bruker reported revenues of $797.4 million, flat year on year, falling short of analysts’ expectations by 1.5%. It was a disappointing quarter as it posted a significant miss of analysts’ full-year EPS guidance estimates.

Bruker delivered the weakest full-year guidance update in the group. As expected, the stock is down 16.5% since the results and currently trades at $31.70.

Read our full analysis of Bruker’s results here.

Thermo Fisher (NYSE: TMO)

With over 14,000 sales personnel and a portfolio spanning more than 2,500 technology manufacturers, Thermo Fisher Scientific (NYSE: TMO) provides scientific equipment, reagents, consumables, software, and laboratory services to pharmaceutical, biotech, academic, and healthcare customers worldwide.

Thermo Fisher reported revenues of $10.86 billion, up 3% year on year. This number topped analysts’ expectations by 1.6%. It was a strong quarter as it also put up a narrow beat of analysts’ organic revenue and operating income estimates.

The stock is up 12.5% since reporting and currently trades at $480.

Read our full, actionable report on Thermo Fisher here, it’s free.

Azenta (NASDAQ: AZTA)

Serving as the guardian of some of medicine's most valuable materials, Azenta (NASDAQ: AZTA) provides biological sample management, storage, and genomic services that help pharmaceutical and biotechnology companies preserve and analyze critical research materials.

Azenta reported revenues of $143.9 million, flat year on year. This print missed analysts’ expectations by 3.8%. All in all, it was a softer quarter for the company.

Azenta had the weakest performance against analyst estimates among its peers. The stock is down 8.5% since reporting and currently trades at $29.66.

Read our full, actionable report on Azenta here, it’s free.

Market Update

As a result of the Fed’s rate hikes in 2022 and 2023, inflation has come down from frothy levels post-pandemic. The general rise in the price of goods and services is trending towards the Fed’s 2% goal as of late, which is good news. The higher rates that fought inflation also didn't slow economic activity enough to catalyze a recession. So far, soft landing. This, combined with recent rate cuts (half a percent in September 2024 and a quarter percent in November 2024) have led to strong stock market performance in 2024. The icing on the cake for 2024 returns was Donald Trump’s victory in the U.S. Presidential Election in early November, sending major indices to all-time highs in the week following the election. Still, debates around the health of the economy and the impact of potential tariffs and corporate tax cuts remain, leaving much uncertainty around 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Growth Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.

More News

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the following

Privacy Policy and Terms Of Service.