Financial News

Expedia’s (NASDAQ:EXPE) Q2 Sales Beat Estimates, Stock Jumps 13.7%

Online travel agency Expedia (NASDAQ: EXPE) announced better-than-expected revenue in Q2 CY2025, with sales up 6.4% year on year to $3.79 billion. Its non-GAAP profit of $4.24 per share was 2.7% above analysts’ consensus estimates.

Is now the time to buy Expedia? Find out by accessing our full research report, it’s free.

Expedia (EXPE) Q2 CY2025 Highlights:

- Revenue: $3.79 billion vs analyst estimates of $3.71 billion (6.4% year-on-year growth, 2.1% beat)

- Adjusted EPS: $4.24 vs analyst estimates of $4.13 (2.7% beat)

- Adjusted EBITDA: $908 million vs analyst estimates of $852.5 million (24% margin, 6.5% beat)

- Operating Margin: 12.8%, in line with the same quarter last year

- Free Cash Flow Margin: 24.3%, down from 92.2% in the previous quarter

- Room Nights Booked: 105.5 million, up 6.6 million year on year

- Market Capitalization: $23.54 billion

"We delivered a solid second quarter, surpassing our top and bottom line expectations while navigating a dynamic environment,” said Ariane Gorin, CEO of Expedia Group, “Our performance was driven by continued strength across B2B and Advertising and further progress on our key priorities.

Company Overview

Originally founded as a part of Microsoft, Expedia (NASDAQ: EXPE) is one of the world’s leading online travel agencies.

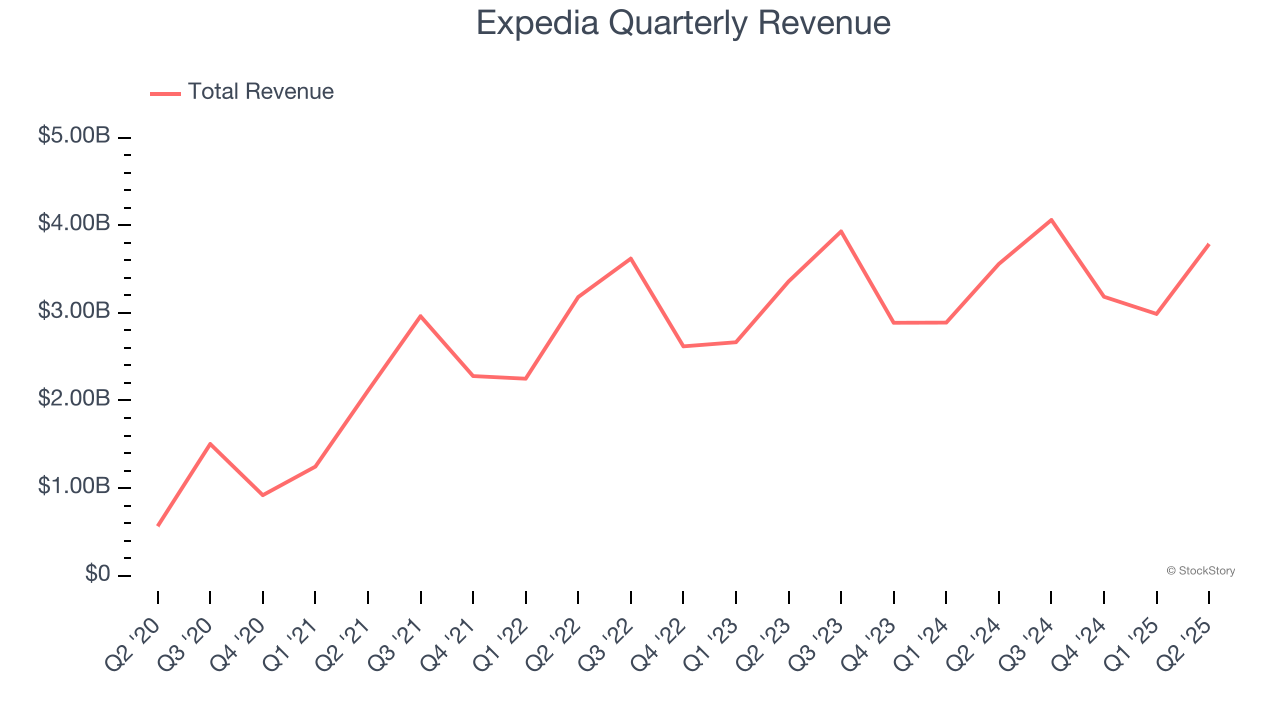

Revenue Growth

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Regrettably, Expedia’s sales grew at a mediocre 9.5% compounded annual growth rate over the last three years. This fell short of our benchmark for the consumer internet sector and is a rough starting point for our analysis.

This quarter, Expedia reported year-on-year revenue growth of 6.4%, and its $3.79 billion of revenue exceeded Wall Street’s estimates by 2.1%.

Looking ahead, sell-side analysts expect revenue to grow 3.9% over the next 12 months, a deceleration versus the last three years. This projection is underwhelming and implies its products and services will see some demand headwinds.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

Room Nights Booked

Booking Growth

As an online travel company, Expedia generates revenue growth by increasing both the number of stays (or experiences) booked and the commission charged on those bookings.

Over the last two years, Expedia’s room nights booked, a key performance metric for the company, increased by 8.7% annually to 105.5 million in the latest quarter. This growth rate is decent for a consumer internet business and indicates people enjoy using its offerings.

In Q2, Expedia added 6.6 million room nights booked, leading to 6.7% year-on-year growth. The quarterly print was lower than its two-year result, suggesting its new initiatives aren’t accelerating booking growth just yet.

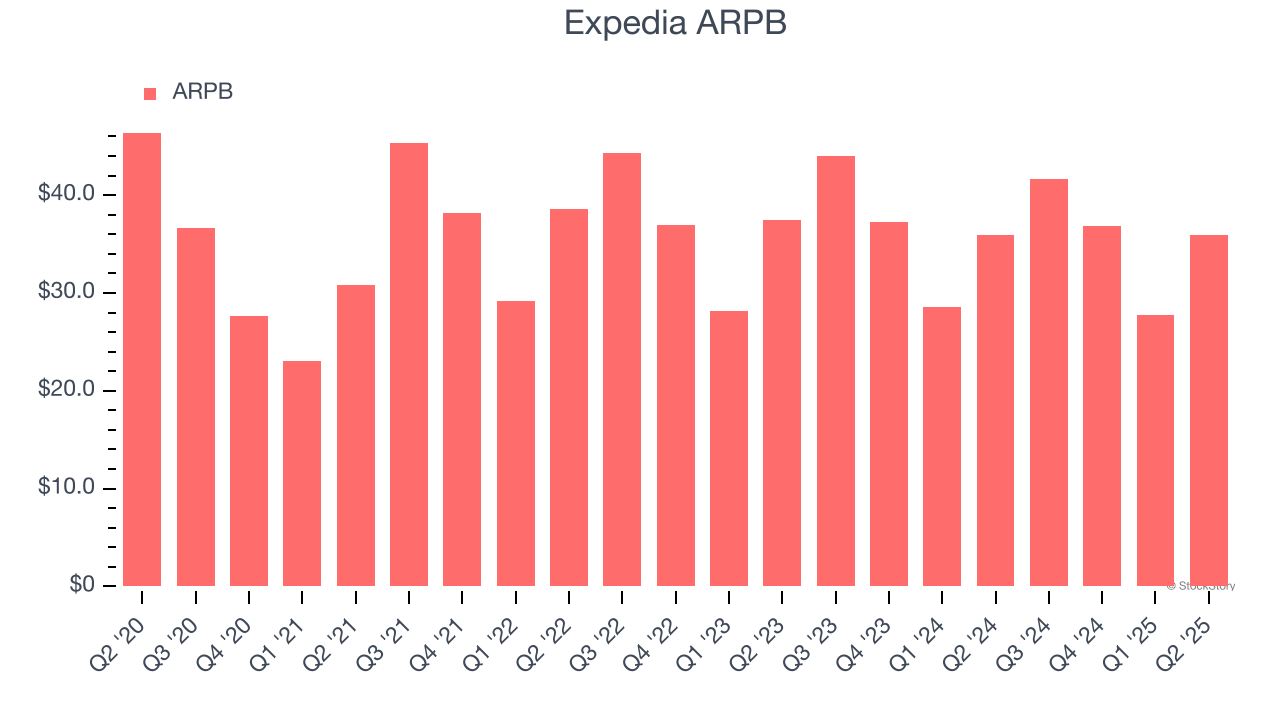

Revenue Per Booking

Average revenue per booking (ARPB) is a critical metric to track because it not only measures how much users book on its platform but also the commission that Expedia can charge.

Expedia’s ARPB fell over the last two years, averaging 1.5% annual declines. This isn’t great, but the increase in room nights booked is more relevant for assessing long-term business potential. We’ll monitor the situation closely; if Expedia tries boosting ARPB by taking a more aggressive approach to monetization, it’s unclear whether bookings can continue growing at the current pace.

This quarter, Expedia’s ARPB clocked in at $35.89. It was flat year on year, worse than the change in its room nights booked.

Key Takeaways from Expedia’s Q2 Results

We enjoyed seeing Expedia beat analysts’ EBITDA expectations this quarter. We were also happy its number of room nights booked outperformed Wall Street’s estimates. Overall, we think this was a decent quarter with some key metrics above expectations. The stock traded up 13.7% to $214 immediately following the results.

Sure, Expedia had a solid quarter, but if we look at the bigger picture, is this stock a buy? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.

More News

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the following

Privacy Policy and Terms Of Service.