Financial News

3 Reasons LOW is Risky and 1 Stock to Buy Instead

Over the past six months, Lowe’s shares (currently trading at $236.21) have posted a disappointing 8.1% loss, well below the S&P 500’s 3.6% gain. This may have investors wondering how to approach the situation.

Is there a buying opportunity in Lowe's, or does it present a risk to your portfolio? Get the full breakdown from our expert analysts, it’s free.

Why Is Lowe's Not Exciting?

Even though the stock has become cheaper, we don't have much confidence in Lowe's. Here are three reasons why there are better opportunities than LOW and a stock we'd rather own.

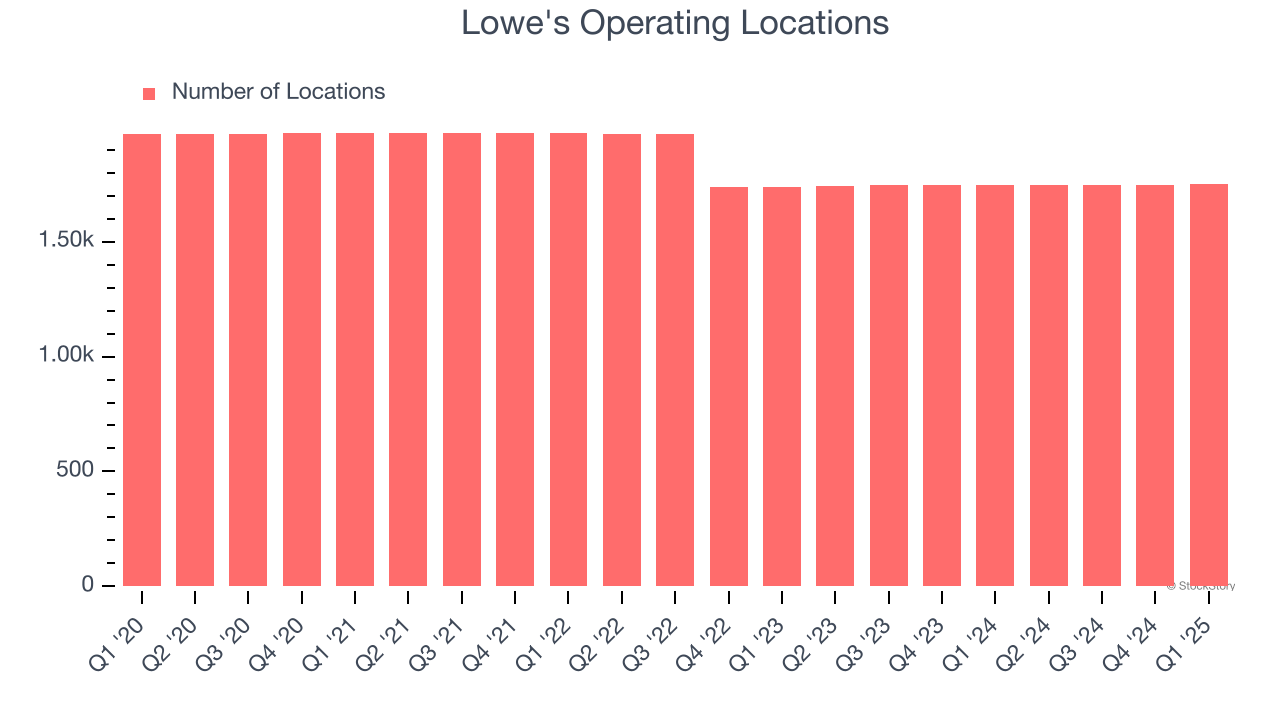

1. Stores Are Closing, a Headwind for Revenue

The number of stores a retailer operates is a critical driver of how quickly company-level sales can grow.

Lowe's listed 1,750 locations in the latest quarter and has generally closed its stores over the last two years, averaging 2.7% annual declines.

When a retailer shutters stores, it usually means that brick-and-mortar demand is less than supply, and it is responding by closing underperforming locations to improve profitability.

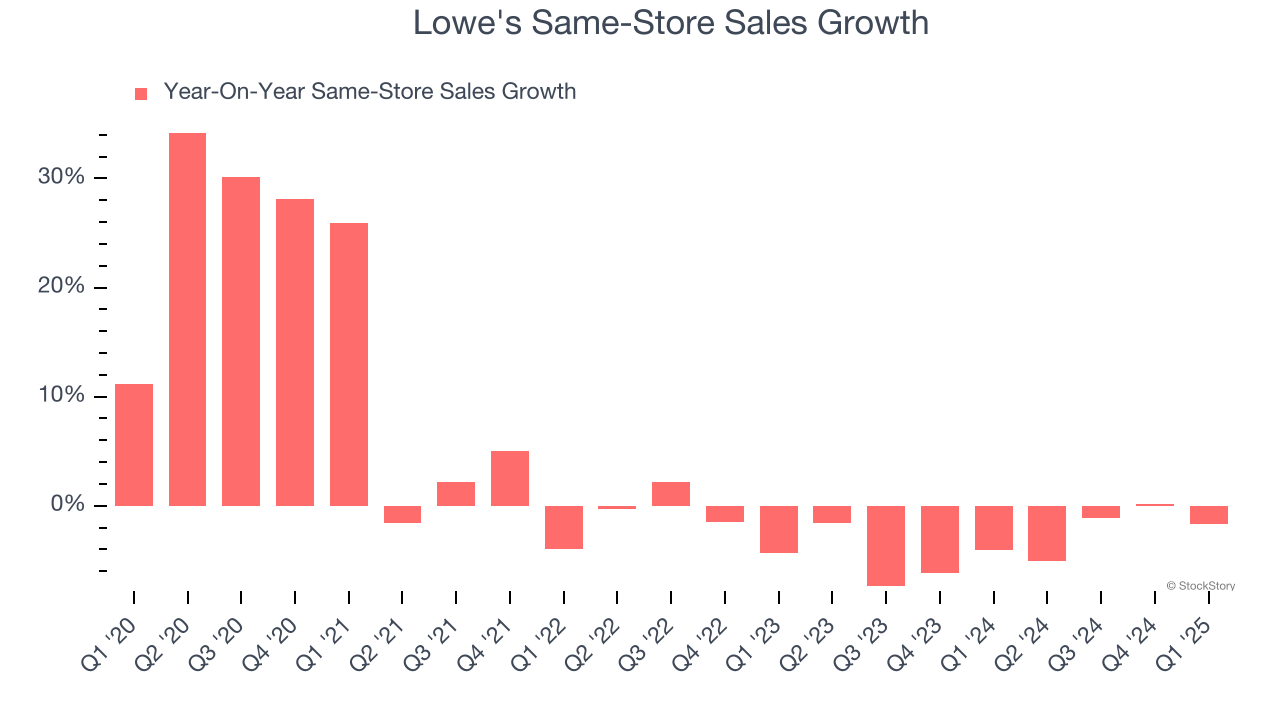

2. Shrinking Same-Store Sales Indicate Waning Demand

Same-store sales is a key performance indicator used to measure organic growth at brick-and-mortar shops for at least a year.

Lowe’s demand has been shrinking over the last two years as its same-store sales have averaged 3.4% annual declines.

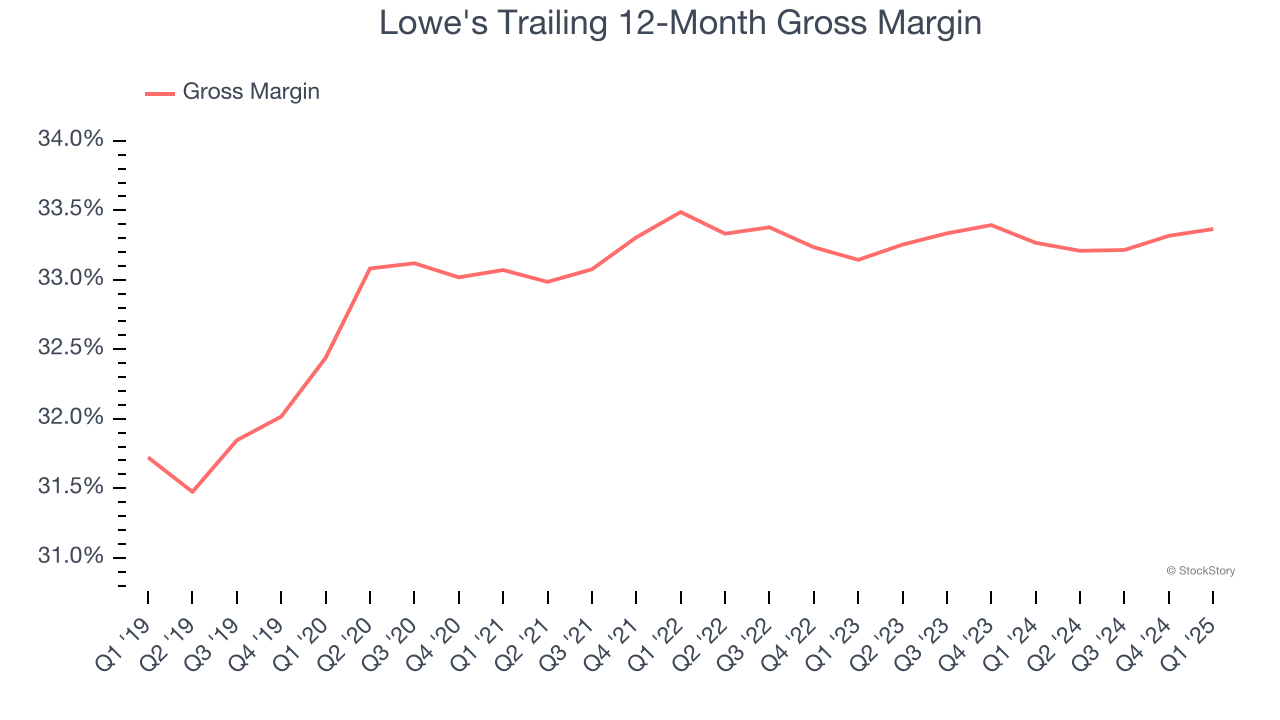

3. Low Gross Margin Hinders Flexibility

Gross profit margins are an important measure of a retailer’s pricing power, product differentiation, and negotiating leverage.

Lowe’s gross margin is slightly below the average retailer, giving it less room to invest in areas such as marketing and talent to grow its brand. As you can see below, it averaged a 33.3% gross margin over the last two years. That means Lowe's paid its suppliers a lot of money ($66.68 for every $100 in revenue) to run its business.

Final Judgment

Lowe's isn’t a terrible business, but it doesn’t pass our bar. After the recent drawdown, the stock trades at 18.9× forward P/E (or $236.21 per share). Beauty is in the eye of the beholder, but we don’t really see a big opportunity at the moment. We're fairly confident there are better investments elsewhere. We’d suggest looking at the most dominant software business in the world.

Stocks We Like More Than Lowe's

Donald Trump’s April 2024 "Liberation Day" tariffs sent markets into a tailspin, but stocks have since rebounded strongly, proving that knee-jerk reactions often create the best buying opportunities.

The smart money is already positioning for the next leg up. Don’t miss out on the recovery - check out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.

More News

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the following

Privacy Policy and Terms Of Service.