Financial News

No Surprises In Nvidia’s (NASDAQ:NVDA) Q2 Sales Numbers But Inventory Levels Increase

Leading designer of graphics chips Nvidia (NASDAQ: NVDA) met Wall Street’s revenue expectations in Q2 CY2025, with sales up 55.6% year on year to $46.74 billion. The company expects next quarter’s revenue to be around $54 billion, close to analysts’ estimates. Its non-GAAP profit of $1.05 per share was 4% above analysts’ consensus estimates.

Is now the time to buy Nvidia? Find out by accessing our full research report, it’s free.

Nvidia (NVDA) Q2 CY2025 Highlights:

- Revenue: $46.74 billion vs analyst estimates of $46.52 billion (55.6% year-on-year growth, in line)

- Adjusted EPS: $1.05 vs analyst estimates of $1.01 (4% beat)

- Adjusted Operating Income: $30.17 billion vs analyst estimates of $29.11 billion (64.5% margin, 3.6% beat)

- Revenue Guidance for Q3 CY2025 is $54 billion at the midpoint, roughly in line with what analysts were expecting

- Operating Margin: 60.8%, down from 62.1% in the same quarter last year

- Free Cash Flow Margin: 28.8%, down from 45% in the same quarter last year

- Inventory Days Outstanding: 106, up from 59 in the previous quarter

- Market Capitalization: $4.44 trillion

“Blackwell is the AI platform the world has been waiting for, delivering an exceptional generational leap — production of Blackwell Ultra is ramping at full speed, and demand is extraordinary,” said Jensen Huang, founder and CEO of NVIDIA.

Company Overview

Founded in 1993 by Jensen Huang and two former Sun Microsystems engineers, Nvidia (NASDAQ: NVDA) is a leading fabless designer of chips used in gaming, PCs, data centers, automotive, and a variety of end markets.

Revenue Growth

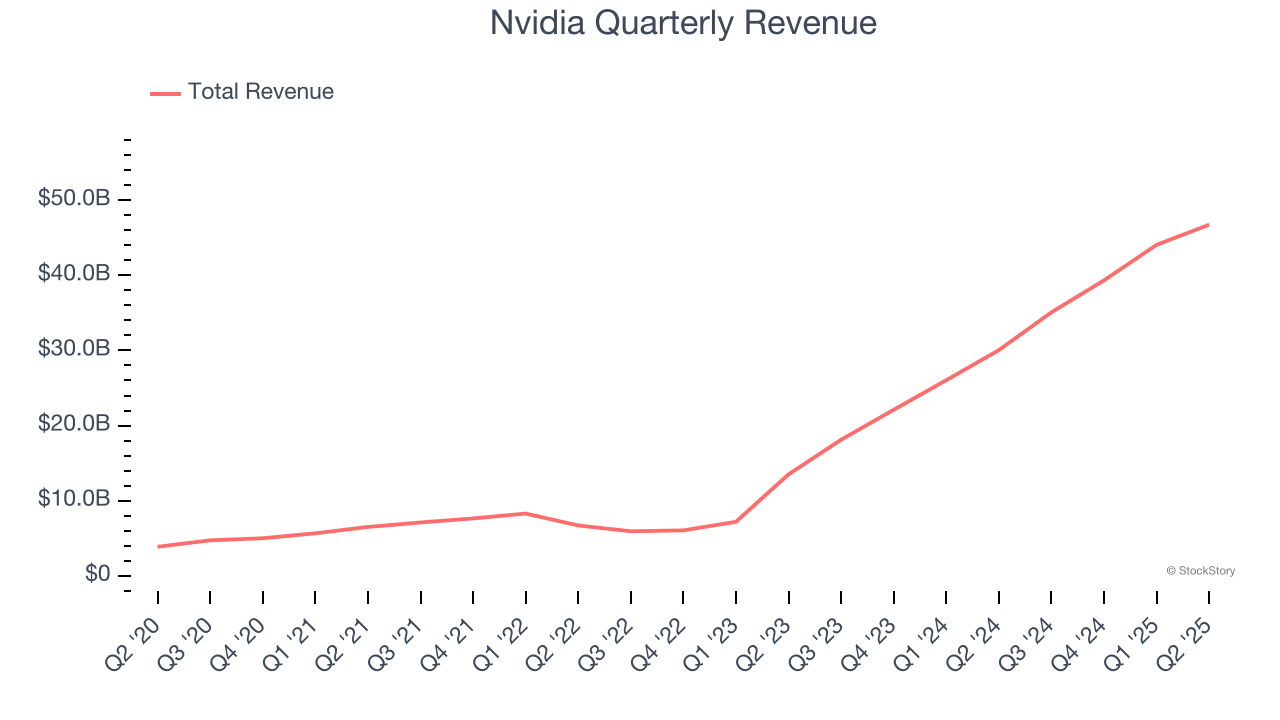

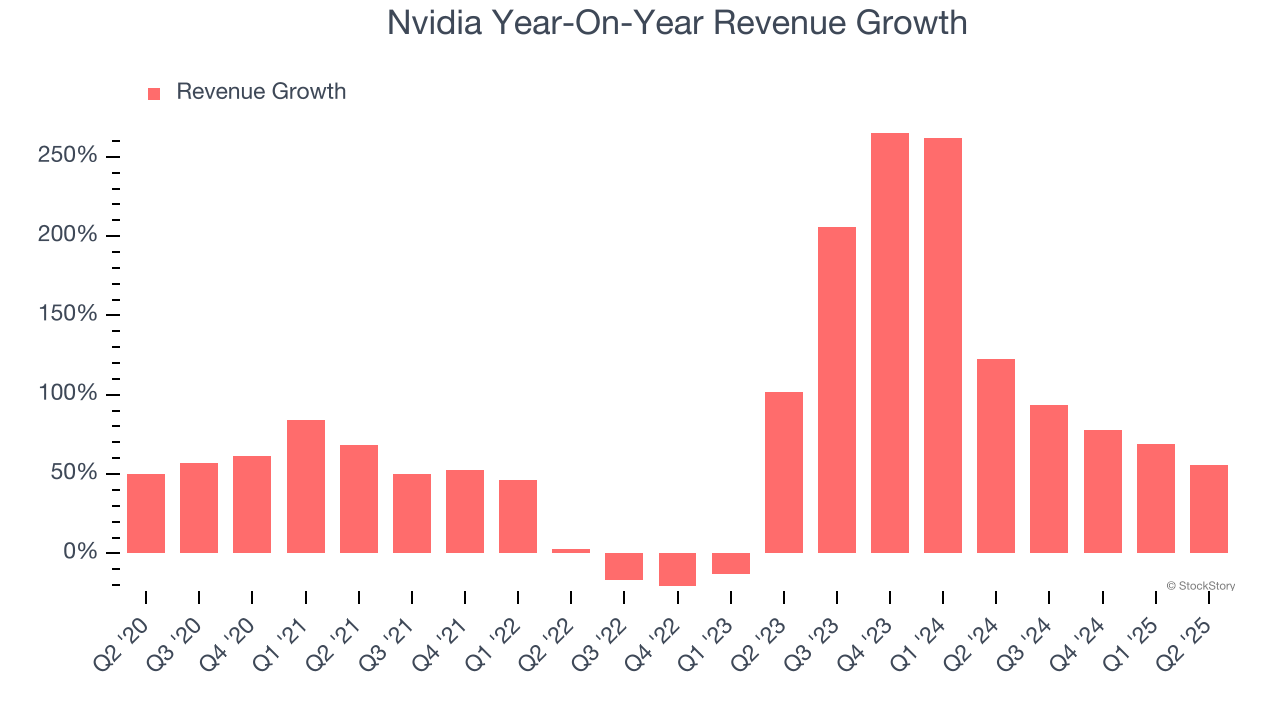

A company’s long-term sales performance is one signal of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Thankfully, Nvidia’s 66.1% annualized revenue growth over the last five years was incredible. Its growth surpassed the average semiconductor company and shows its offerings resonate with customers, a great starting point for our analysis. Semiconductors are a cyclical industry, and long-term investors should be prepared for periods of high growth followed by periods of revenue contractions (which can sometimes offer opportune times to buy).

Long-term growth is the most important, but short-term results matter for semiconductors because the rapid pace of technological innovation (Moore's Law) could make yesterday's hit product obsolete today. Nvidia’s annualized revenue growth of 125% over the last two years is above its five-year trend, suggesting its demand was strong and recently accelerated.

This quarter, Nvidia’s year-on-year revenue growth of 55.6% was magnificent, and its $46.74 billion of revenue was in line with Wall Street’s estimates. Although the company met estimates, this was its third consecutive quarter of decelerating growth, indicating that the current upcycle is potentially losing some steam. Company management is currently guiding for a 53.9% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 45.6% over the next 12 months, a deceleration versus the last two years. Still, this projection is eye-popping given its scale and indicates the market sees success for its products and services.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

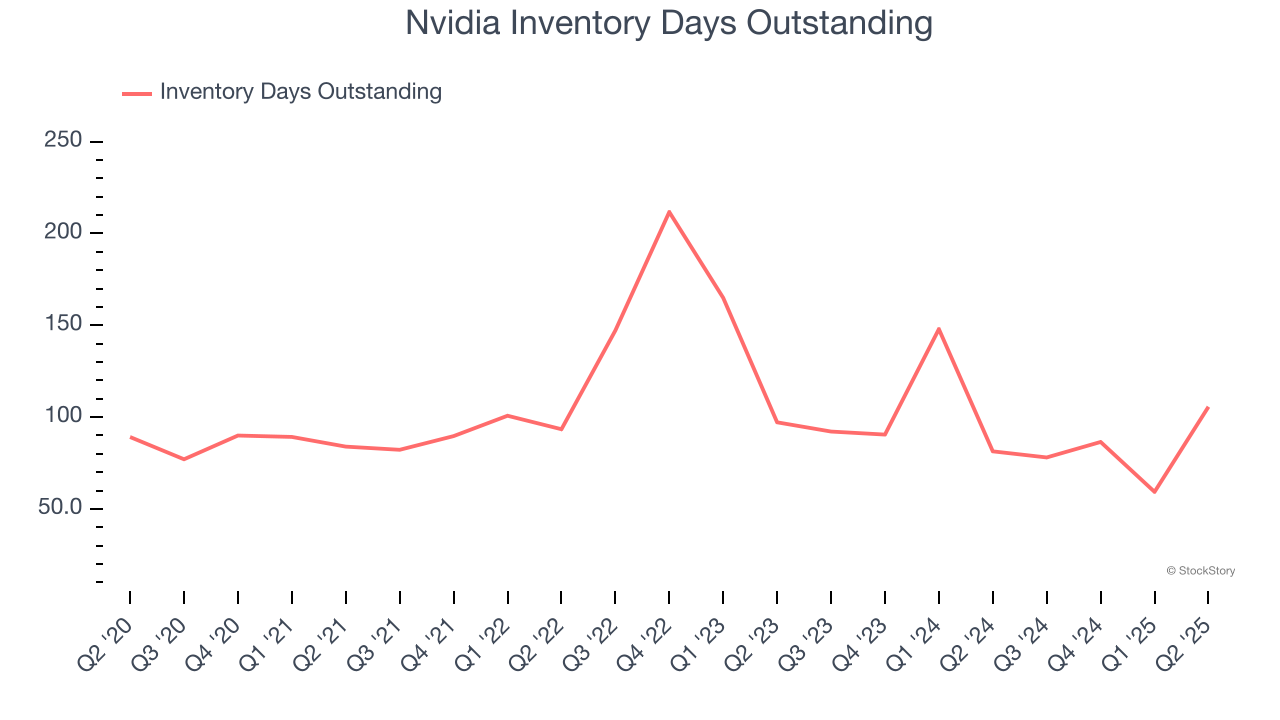

Product Demand & Outstanding Inventory

Days Inventory Outstanding (DIO) is an important metric for chipmakers, as it reflects a business’ capital intensity and the cyclical nature of semiconductor supply and demand. In a tight supply environment, inventories tend to be stable, allowing chipmakers to exert pricing power. Steadily increasing DIO can be a warning sign that demand is weak, and if inventories continue to rise, the company may have to downsize production.

This quarter, Nvidia’s DIO came in at 106, which is 2 more days than its five-year average, suggesting that the company’s inventory levels have grown slightly above the long-term average.

Key Takeaways from Nvidia’s Q2 Results

It was good to see Nvidia beat analysts’ EPS expectations this quarter. We were also happy its adjusted operating income outperformed Wall Street’s estimates. On the other hand, its revenue was just in line with expectations, as was revenue guidance. Additionally, inventory levels increased. Overall, this print was not all blue skies and blowout beats, and shares traded down 1.5% to $178.87 immediately following the results.

Big picture, is Nvidia a buy here and now? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.

More News

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the following

Privacy Policy and Terms Of Service.