Financial News

3 Reasons PENN is Risky and 1 Stock to Buy Instead

Over the past six months, PENN Entertainment’s stock price fell to $18. Shareholders have lost 5.3% of their capital, which is disappointing considering the S&P 500 has climbed by 6.2%. This was partly due to its softer quarterly results and may have investors wondering how to approach the situation.

Is there a buying opportunity in PENN Entertainment, or does it present a risk to your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free.

Why Do We Think PENN Entertainment Will Underperform?

Even with the cheaper entry price, we're swiping left on PENN Entertainment for now. Here are three reasons why you should be careful with PENN and a stock we'd rather own.

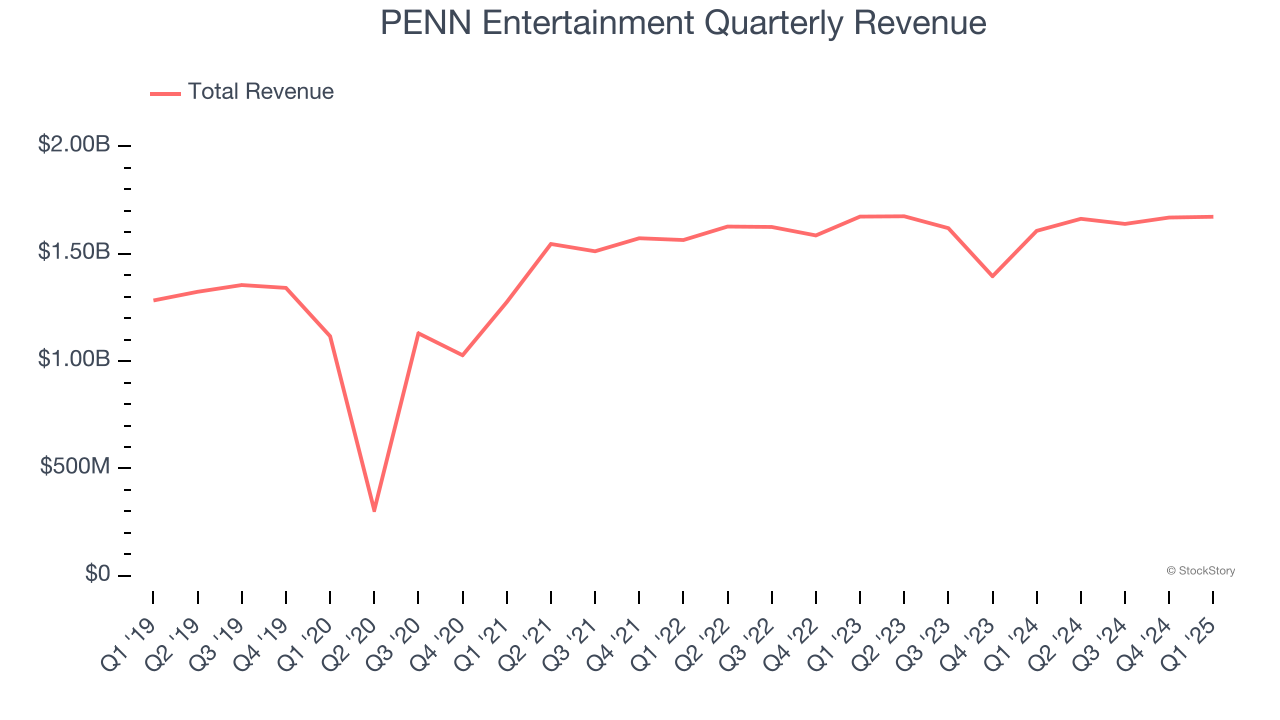

1. Long-Term Revenue Growth Disappoints

Reviewing a company’s long-term sales performance reveals insights into its quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Regrettably, PENN Entertainment’s sales grew at a sluggish 5.3% compounded annual growth rate over the last five years. This was below our standard for the consumer discretionary sector.

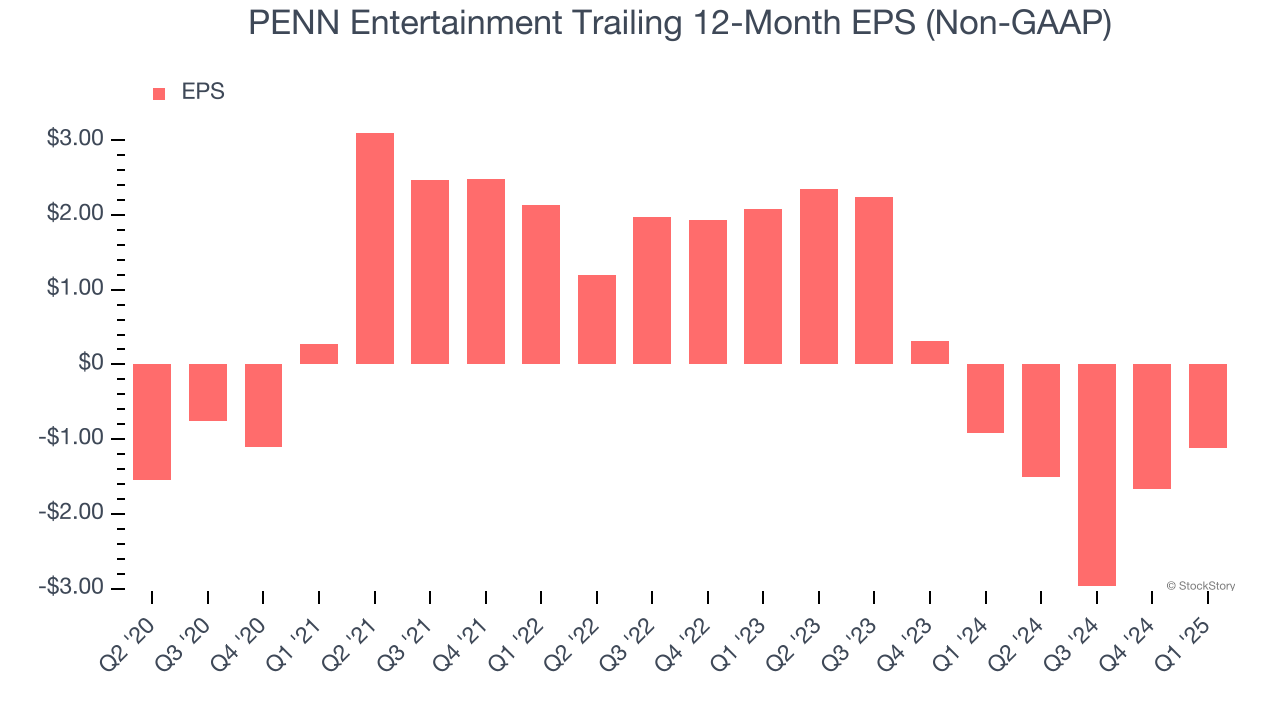

2. EPS Trending Down

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Sadly for PENN Entertainment, its EPS declined by 46.8% annually over the last five years while its revenue grew by 5.3%. This tells us the company became less profitable on a per-share basis as it expanded.

3. New Investments Fail to Bear Fruit as ROIC Declines

ROIC, or return on invested capital, is a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, PENN Entertainment’s ROIC has unfortunately decreased significantly. Paired with its already low returns, these declines suggest its profitable growth opportunities are few and far between.

Final Judgment

PENN Entertainment doesn’t pass our quality test. Following the recent decline, the stock trades at 1.8× forward EV-to-EBITDA (or $18 per share). While this valuation is fair, the upside isn’t great compared to the potential downside. There are more exciting stocks to buy at the moment. We’d suggest looking at a dominant Aerospace business that has perfected its M&A strategy.

Stocks We Like More Than PENN Entertainment

The market surged in 2024 and reached record highs after Donald Trump’s presidential victory in November, but questions about new economic policies are adding much uncertainty for 2025.

While the crowd speculates what might happen next, we’re homing in on the companies that can succeed regardless of the political or macroeconomic environment. Put yourself in the driver’s seat and build a durable portfolio by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.

More News

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the following

Privacy Policy and Terms Of Service.