Financial News

3 Reasons EBC is Risky and 1 Stock to Buy Instead

Over the past six months, Eastern Bank’s stock price fell to $16.12. Shareholders have lost 5.7% of their capital, which is disappointing considering the S&P 500 has climbed by 6.2%. This was partly driven by its softer quarterly results and may have investors wondering how to approach the situation.

Is there a buying opportunity in Eastern Bank, or does it present a risk to your portfolio? Check out our in-depth research report to see what our analysts have to say, it’s free.

Why Is Eastern Bank Not Exciting?

Despite the more favorable entry price, we're cautious about Eastern Bank. Here are three reasons why EBC doesn't excite us and a stock we'd rather own.

1. Revenue Spiraling Downwards

From lending activities to service fees, most banks build their revenue model around two income sources. Interest rate spreads between loans and deposits create the first stream, with the second coming from charges on everything from basic bank accounts to complex investment banking transactions.

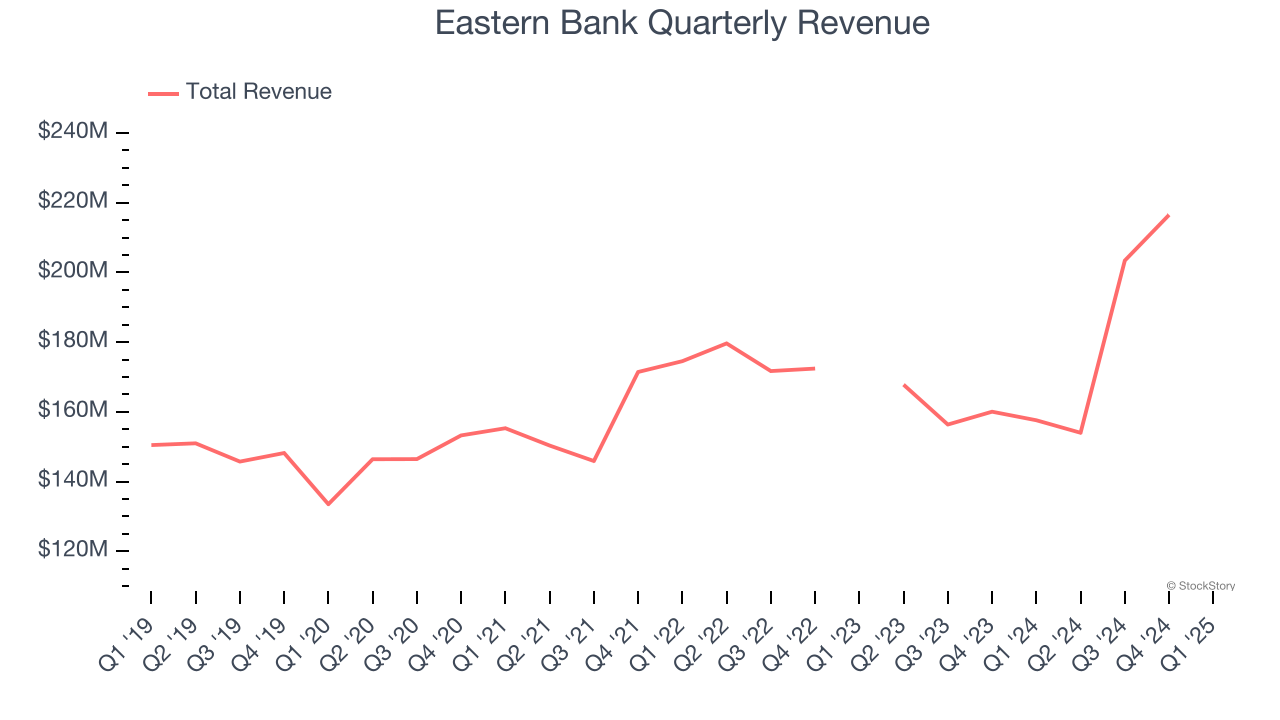

Eastern Bank’s demand was weak over the last five years as its revenue fell at a 1.9% annual rate. This was below our standards and is a sign of lacking business quality.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

2. Substandard TBVPS Growth Indicates Limited Asset Expansion

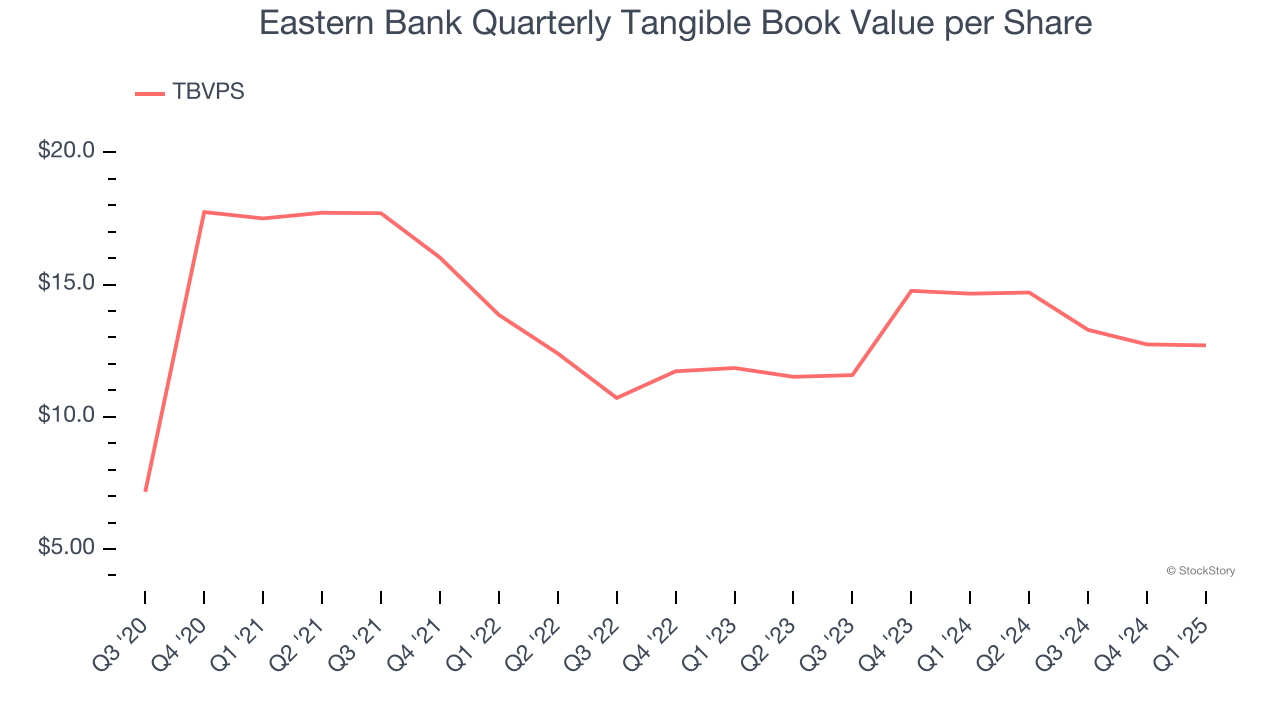

For banks, tangible book value per share (TBVPS) is a crucial metric that measures the actual value of shareholders’ equity, stripping out goodwill and other intangible assets that may not be recoverable in a worst-case scenario.

Disappointingly for investors, Eastern Bank’s TBVPS grew at a sluggish 3.5% annual clip over the last two years.

3. TBVPS Projections Show Stormy Skies Ahead

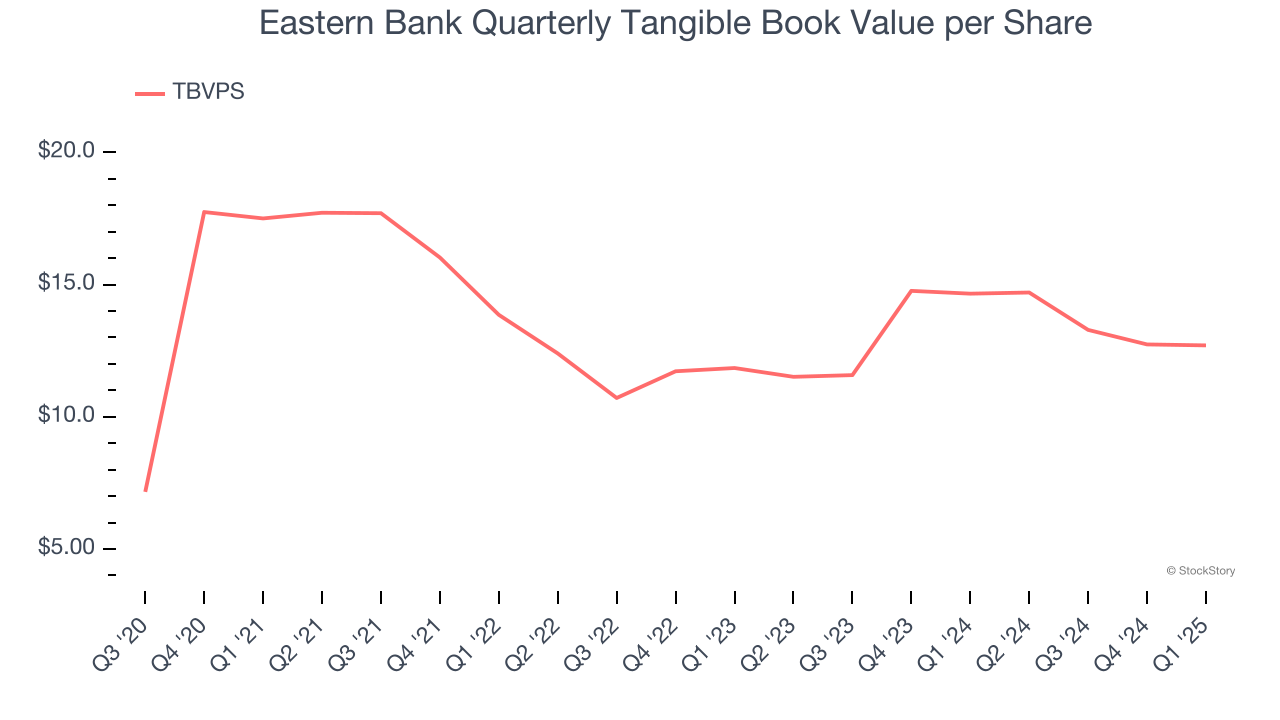

Tangible book value per share (TBVPS) growth is driven by a bank’s ability to earn more than its cost of capital through lending activities while maintaining a strong balance sheet.

Over the next 12 months, Consensus estimates call for Eastern Bank’s TBVPS to shrink by 3.5% to $12.26, a sour projection.

Final Judgment

Eastern Bank isn’t a terrible business, but it doesn’t pass our quality test. Following the recent decline, the stock trades at 1× forward P/B (or $16.12 per share). Investors with a higher risk tolerance might like the company, but we don’t really see a big opportunity at the moment. We're fairly confident there are better stocks to buy right now. Let us point you toward our favorite semiconductor picks and shovels play.

Stocks We Like More Than Eastern Bank

The market surged in 2024 and reached record highs after Donald Trump’s presidential victory in November, but questions about new economic policies are adding much uncertainty for 2025.

While the crowd speculates what might happen next, we’re homing in on the companies that can succeed regardless of the political or macroeconomic environment. Put yourself in the driver’s seat and build a durable portfolio by checking out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.

More News

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the following

Privacy Policy and Terms Of Service.