Financial News

3 Big Reasons to Love Progressive (PGR)

Progressive trades at $261.66 per share and has stayed right on track with the overall market, gaining 8% over the last six months. At the same time, the S&P 500 has returned 6.2%.

Is PGR a buy right now? Find out in our full research report, it’s free.

Why Are We Positive On Progressive?

Starting as a small auto insurance company in 1937 with a pioneering focus on high-risk drivers, Progressive (NYSE: PGR) is a major auto, property, and commercial insurance provider that offers policies through independent agents, online platforms, and over the phone.

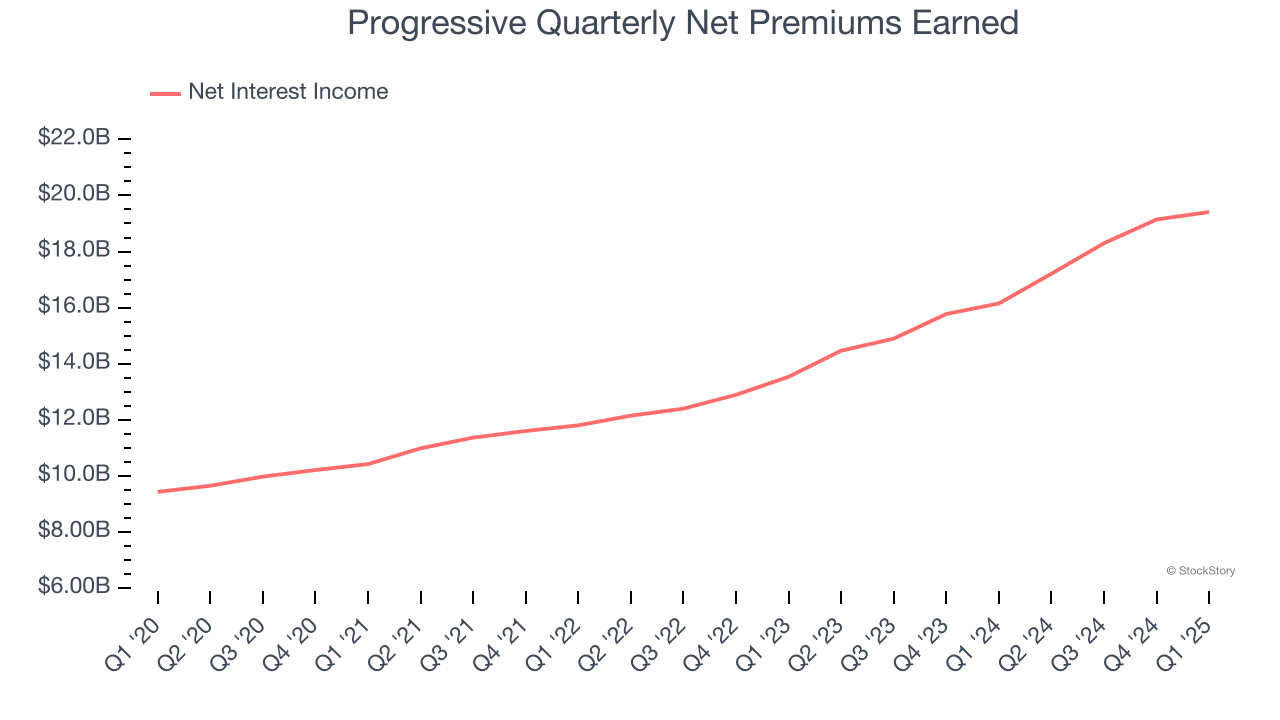

1. Net Premiums Earned Skyrockets, Fueling Growth Opportunities

Net premiums earned commands greater market attention due to its reliability and consistency, whereas investment and fee income are often seen as more volatile revenue streams that fluctuate with market conditions.

Progressive’s net premiums earned has grown at a 20.5% annualized rate over the last two years, much better than the broader insurance industry.

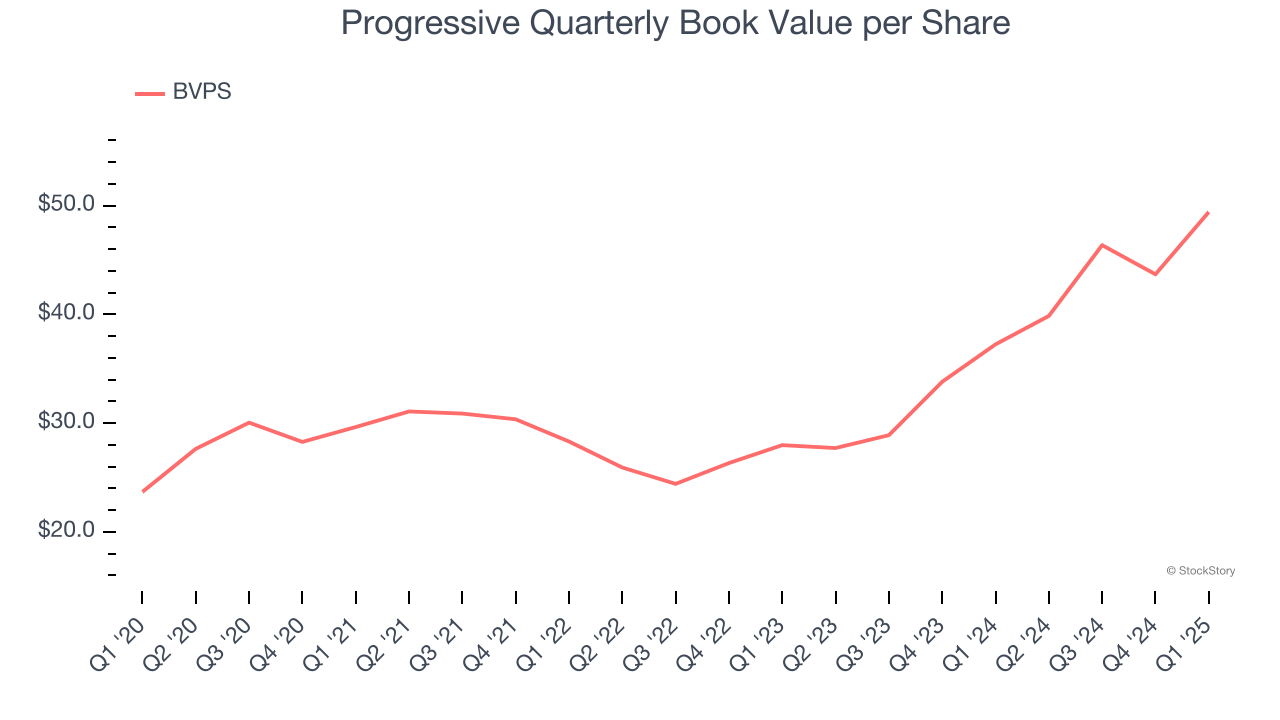

2. Growing BVPS Reflects Strong Asset Base

Book value per share (BVPS) serves as a key indicator of an insurer’s financial stability, reflecting a company’s ability to maintain adequate capital levels and meet its long-term obligations to policyholders.

Progressive’s BVPS increased by 15.9% annually over the last five years, and growth has recently accelerated as BVPS grew at an incredible 32.9% annual clip over the past two years (from $27.97 to $49.41 per share).

3. Projected BVPS Growth Is Remarkable

The key to book value per share (BVPS) growth is an insurer’s ability to earn underwriting profits while generating strong returns on its float - Warren Buffet’s secret sauce.

Over the next 12 months, Consensus estimates call for Progressive’s BVPS to grow by 26.6% to $48.69, elite growth rate.

Final Judgment

These are just a few reasons why we think Progressive is an elite insurance company, but at $261.66 per share (or 4.5× forward P/B), is now the time to initiate a position? See for yourself in our comprehensive research report, it’s free.

Stocks We Like Even More Than Progressive

Market indices reached historic highs following Donald Trump’s presidential victory in November 2024, but the outlook for 2025 is clouded by new trade policies that could impact business confidence and growth.

While this has caused many investors to adopt a "fearful" wait-and-see approach, we’re leaning into our best ideas that can grow regardless of the political or macroeconomic climate. Take advantage of Mr. Market by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.

More News

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the following

Privacy Policy and Terms Of Service.