Financial News

Zeta (ZETA): Buy, Sell, or Hold Post Q1 Earnings?

Over the last six months, Zeta’s shares have sunk to $15.45, producing a disappointing 18.6% loss - a stark contrast to the S&P 500’s 5% gain. This might have investors contemplating their next move.

Is now the time to buy Zeta, or should you be careful about including it in your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free.

Why Is Zeta Not Exciting?

Despite the more favorable entry price, we're swiping left on Zeta for now. Here are three reasons why there are better opportunities than ZETA and a stock we'd rather own.

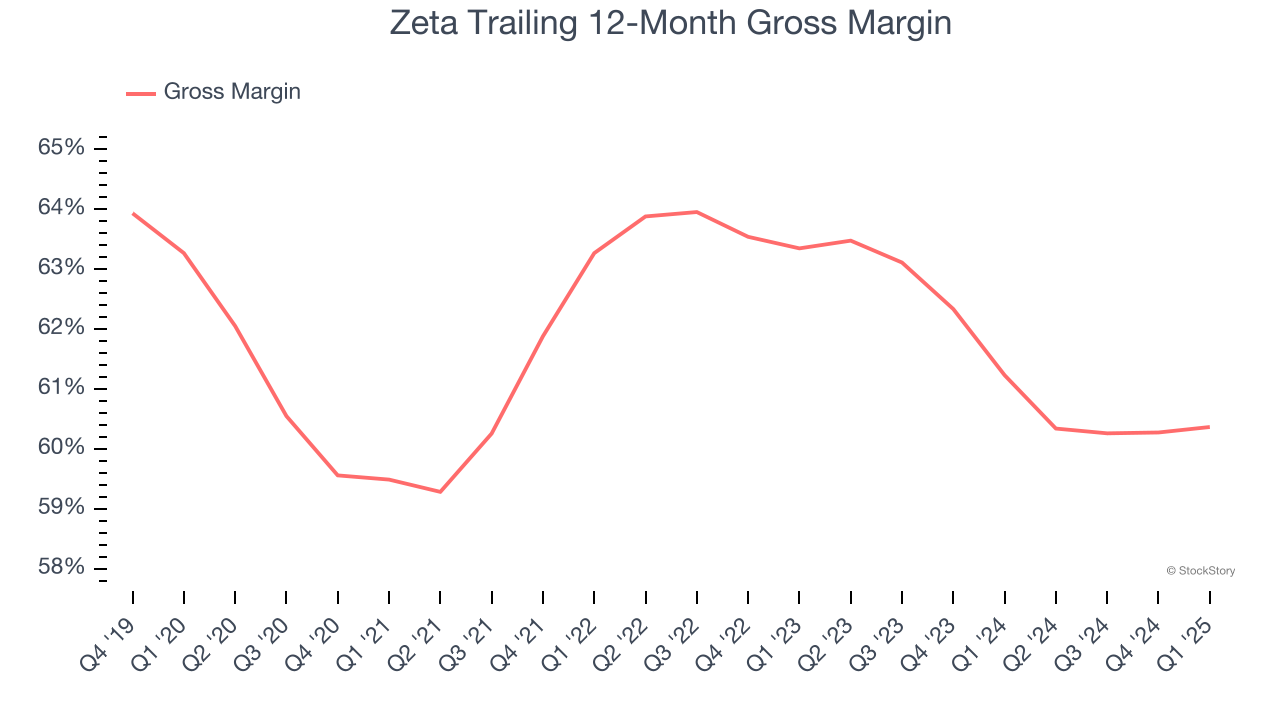

1. Low Gross Margin Reveals Weak Structural Profitability

For software companies like Zeta, gross profit tells us how much money remains after paying for the base cost of products and services (typically servers, licenses, and certain personnel). These costs are usually low as a percentage of revenue, explaining why software is more lucrative than other sectors.

Zeta’s gross margin is substantially worse than most software businesses, signaling it has relatively high infrastructure costs compared to asset-lite businesses like ServiceNow. As you can see below, it averaged a 60.4% gross margin over the last year. That means Zeta paid its providers a lot of money ($39.64 for every $100 in revenue) to run its business.

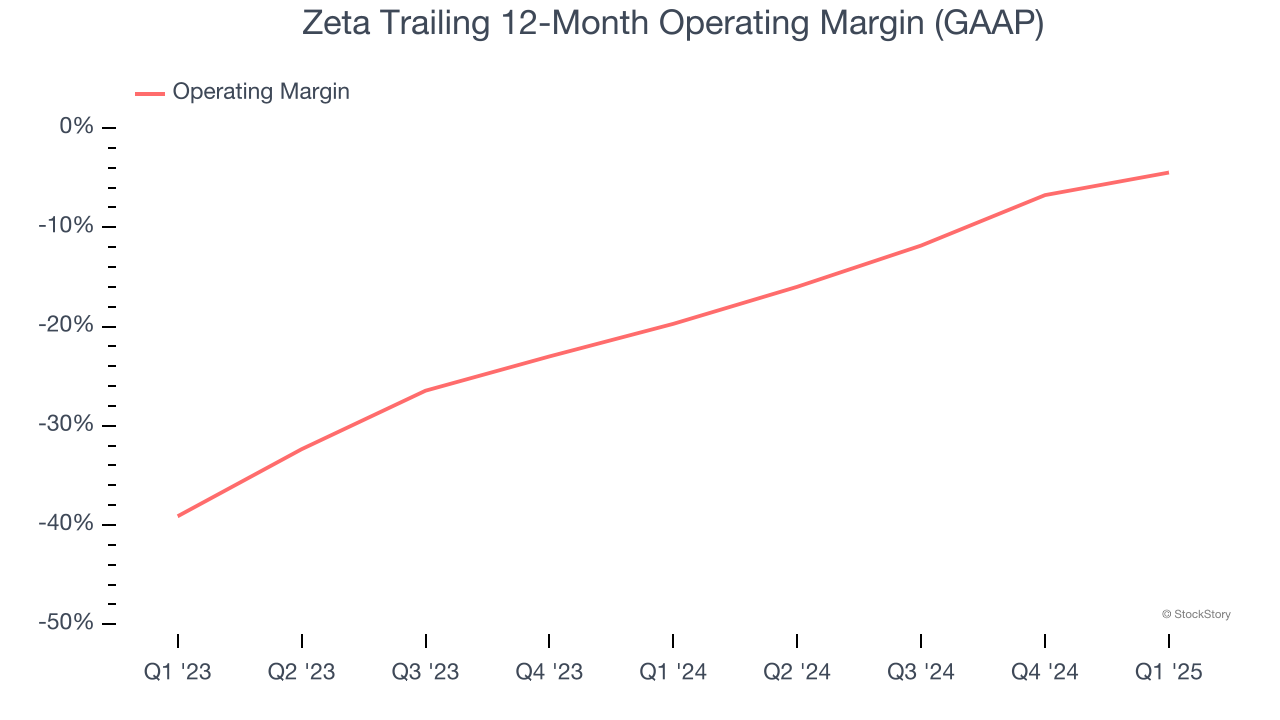

2. Operating Losses Sound the Alarms

While many software businesses point investors to their adjusted profits, which exclude stock-based compensation (SBC), we prefer GAAP operating margin because SBC is a legitimate expense used to attract and retain talent. This is one of the best measures of profitability because it shows how much money a company takes home after developing, marketing, and selling its products.

Zeta’s expensive cost structure has contributed to an average operating margin of negative 4.5% over the last year. Unprofitable, high-growth software companies require extra attention because they spend heaps of money to capture market share. As seen in its fast historical revenue growth, this strategy seems to have worked so far, but it’s unclear what would happen if Zeta reeled back its investments. Wall Street seems to be optimistic about its growth, but we have some doubts.

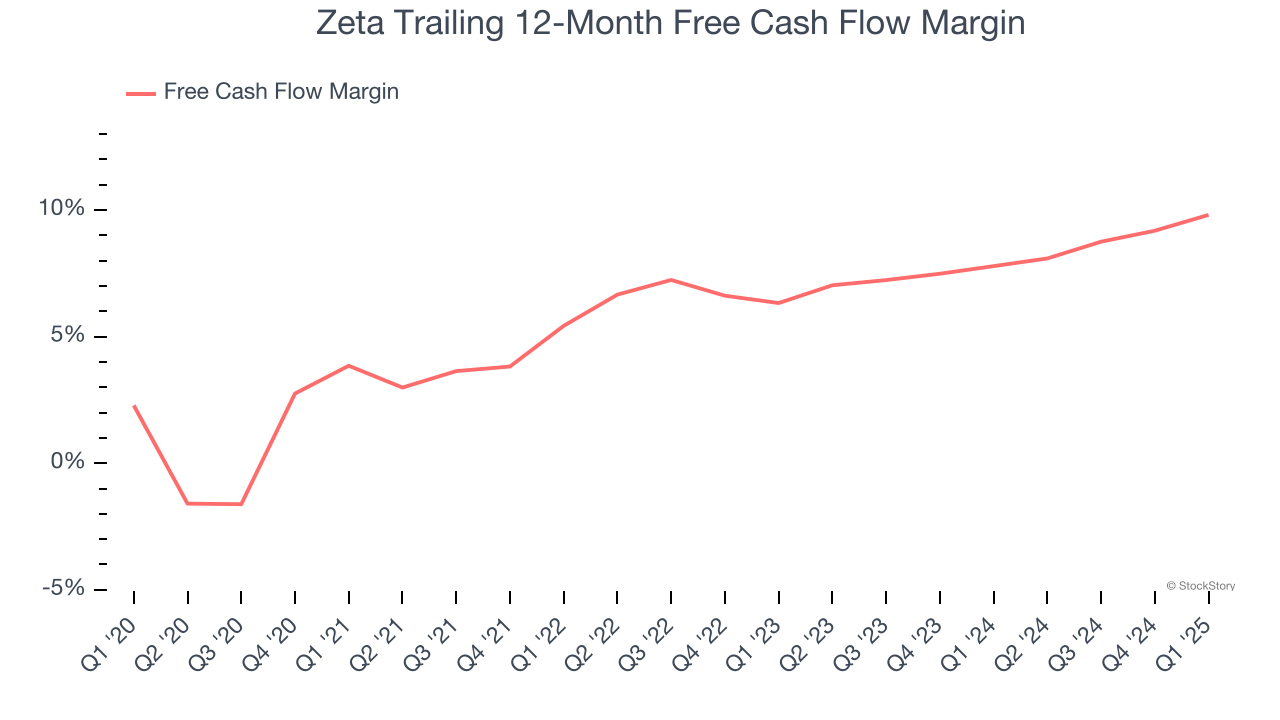

3. Mediocre Free Cash Flow Margin Limits Reinvestment Potential

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Zeta has shown mediocre cash profitability over the last year, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 9.8%, subpar for a software business.

Final Judgment

Zeta isn’t a terrible business, but it isn’t one of our picks. Following the recent decline, the stock trades at 2.6× forward price-to-sales (or $15.45 per share). While this valuation is reasonable, we don’t really see a big opportunity at the moment. We're pretty confident there are superior stocks to buy right now. We’d suggest looking at one of our all-time favorite software stocks.

Stocks We Would Buy Instead of Zeta

Market indices reached historic highs following Donald Trump’s presidential victory in November 2024, but the outlook for 2025 is clouded by new trade policies that could impact business confidence and growth.

While this has caused many investors to adopt a "fearful" wait-and-see approach, we’re leaning into our best ideas that can grow regardless of the political or macroeconomic climate. Take advantage of Mr. Market by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.

More News

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the following

Privacy Policy and Terms Of Service.