Financial News

3 Reasons to Avoid SSTK and 1 Stock to Buy Instead

What a brutal six months it’s been for Shutterstock. The stock has dropped 33.5% and now trades at $19.97, rattling many shareholders. This might have investors contemplating their next move.

Is there a buying opportunity in Shutterstock, or does it present a risk to your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free.

Why Is Shutterstock Not Exciting?

Even though the stock has become cheaper, we're sitting this one out for now. Here are three reasons why SSTK doesn't excite us and a stock we'd rather own.

1. Growth in Customer Spending Lags Peers

Average revenue per request (ARPR) is a critical metric to track because it measures how much the company earns in transaction fees from each request. ARPR also gives us unique insights into a user’s average order size and Shutterstock’s take rate, or "cut", on each order.

Shutterstock’s ARPR growth has been mediocre over the last two years, averaging 3.4%. This isn’t great, but the increase in paid downloads is more relevant for assessing long-term business potential. We’ll monitor the situation closely; if Shutterstock tries boosting ARPR by taking a more aggressive approach to monetization, it’s unclear whether requests can continue growing at the current pace.

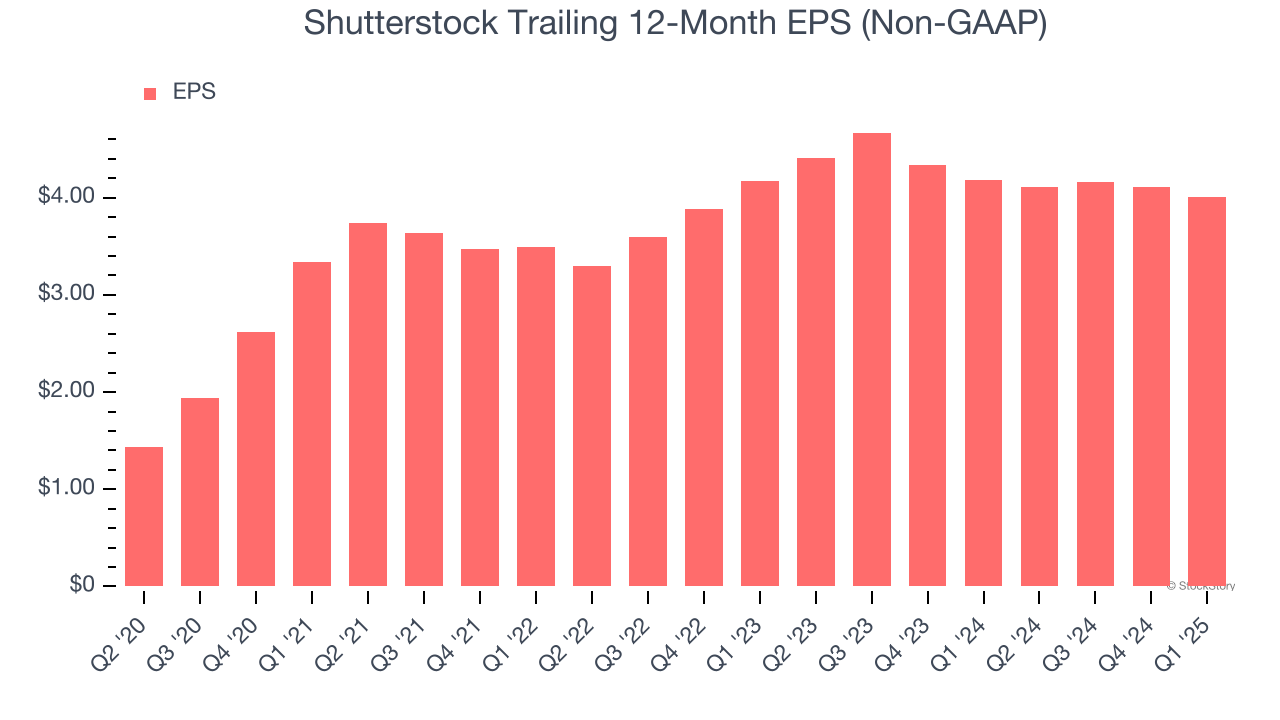

2. EPS Barely Growing

Analyzing the change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

Shutterstock’s EPS grew at a weak 4.7% compounded annual growth rate over the last three years, lower than its 6.9% annualized revenue growth. This tells us the company became less profitable on a per-share basis as it expanded.

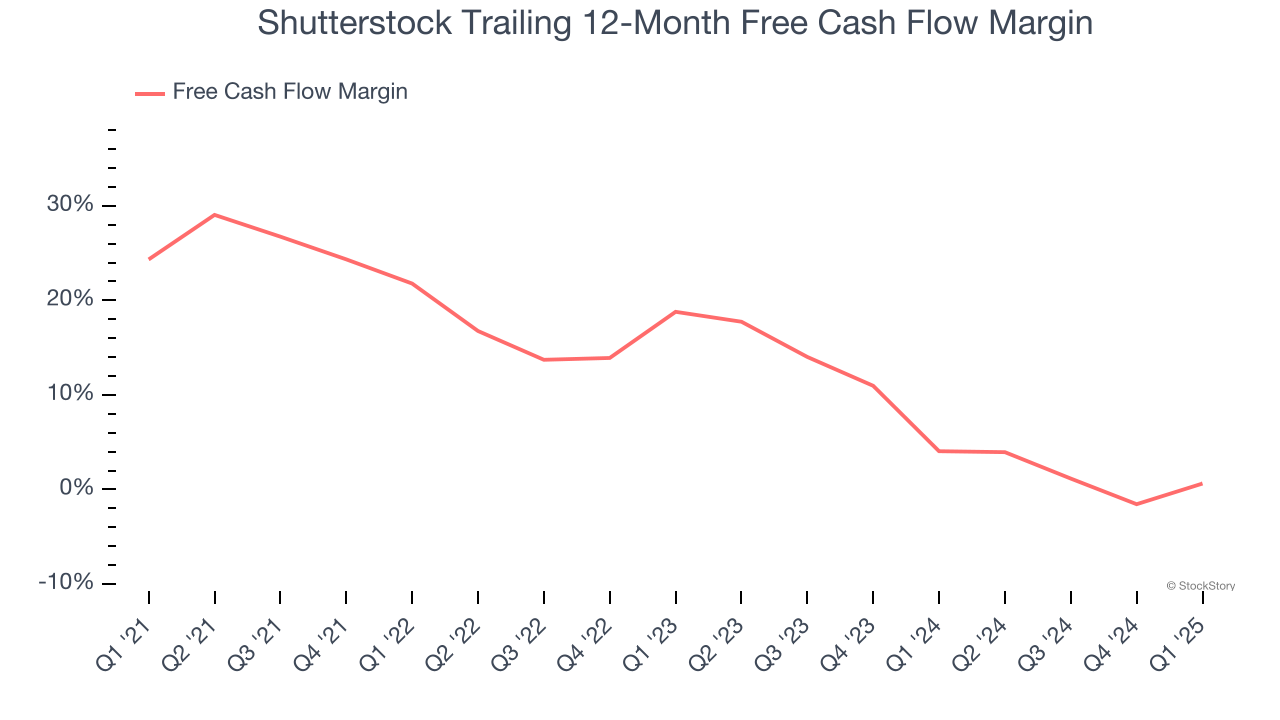

3. Free Cash Flow Margin Dropping

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

As you can see below, Shutterstock’s margin dropped by 21.2 percentage points over the last few years. Almost any movement in the wrong direction is undesirable because of its already low cash conversion. If the trend continues, it could signal it’s becoming a more capital-intensive business. Shutterstock’s free cash flow margin for the trailing 12 months was breakeven.

Final Judgment

Shutterstock isn’t a terrible business, but it doesn’t pass our bar. After the recent drawdown, the stock trades at 3.4× forward EV/EBITDA (or $19.97 per share). This valuation is reasonable, but the company’s shakier fundamentals present too much downside risk. We're pretty confident there are superior stocks to buy right now. We’d suggest looking at one of our all-time favorite software stocks.

Stocks We Would Buy Instead of Shutterstock

Donald Trump’s victory in the 2024 U.S. Presidential Election sent major indices to all-time highs, but stocks have retraced as investors debate the health of the economy and the potential impact of tariffs.

While this leaves much uncertainty around 2025, a few companies are poised for long-term gains regardless of the political or macroeconomic climate, like our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.

More News

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the following

Privacy Policy and Terms Of Service.