Financial News

Sleep Number (NASDAQ:SNBR) Misses Q2 Sales Targets, Stock Drops 25.5%

Bedding manufacturer and retailer Sleep Number (NASDAQ: SNBR) fell short of the market’s revenue expectations in Q2 CY2025, with sales falling 19.7% year on year to $327.9 million. The company’s full-year revenue guidance of $1.45 billion at the midpoint came in 4.3% below analysts’ estimates. Its GAAP loss of $1.09 per share was significantly below analysts’ consensus estimates.

Is now the time to buy Sleep Number? Find out by accessing our full research report, it’s free.

Sleep Number (SNBR) Q2 CY2025 Highlights:

- Revenue: $327.9 million vs analyst estimates of $357.4 million (19.7% year-on-year decline, 8.3% miss)

- EPS (GAAP): -$1.09 vs analyst estimates of -$0.14 (significant miss)

- Adjusted EBITDA: $23.56 million vs analyst estimates of $24.65 million (7.2% margin, 4.4% miss)

- Operating Margin: 0%, down from 1.5% in the same quarter last year

- Free Cash Flow was -$6.86 million compared to -$14.99 million in the same quarter last year

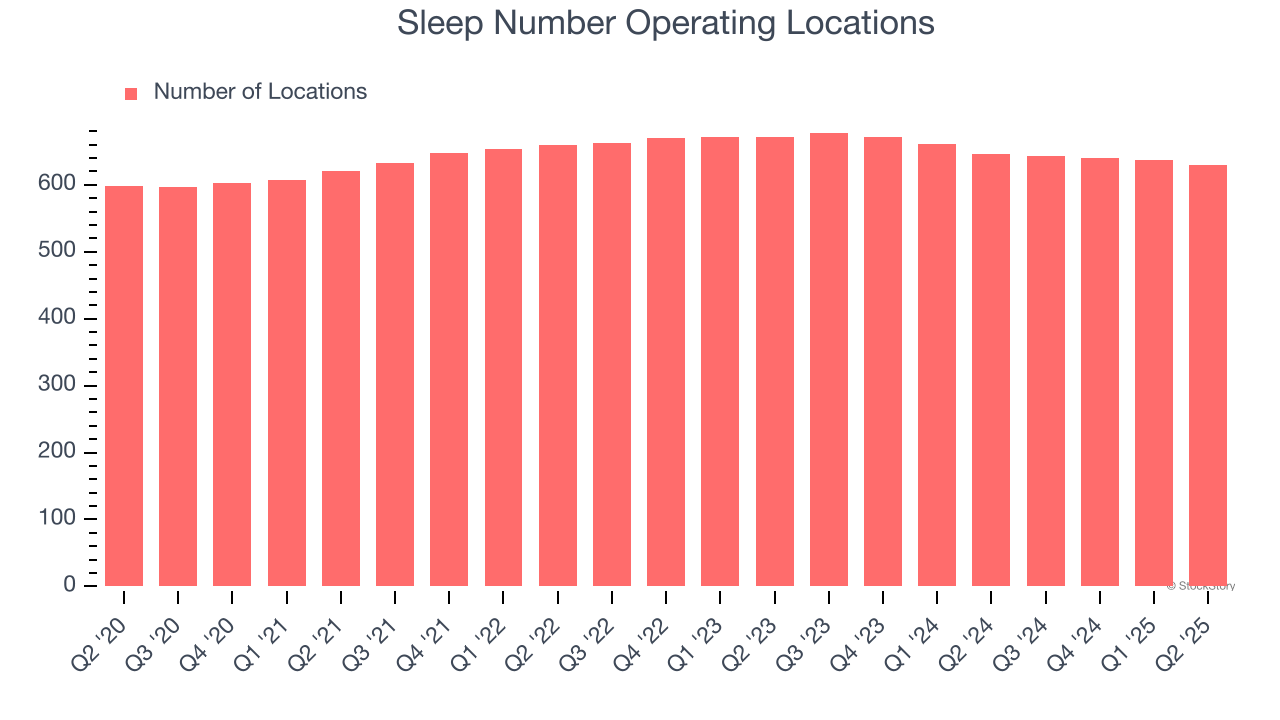

- Locations: 630 at quarter end, down from 646 in the same quarter last year

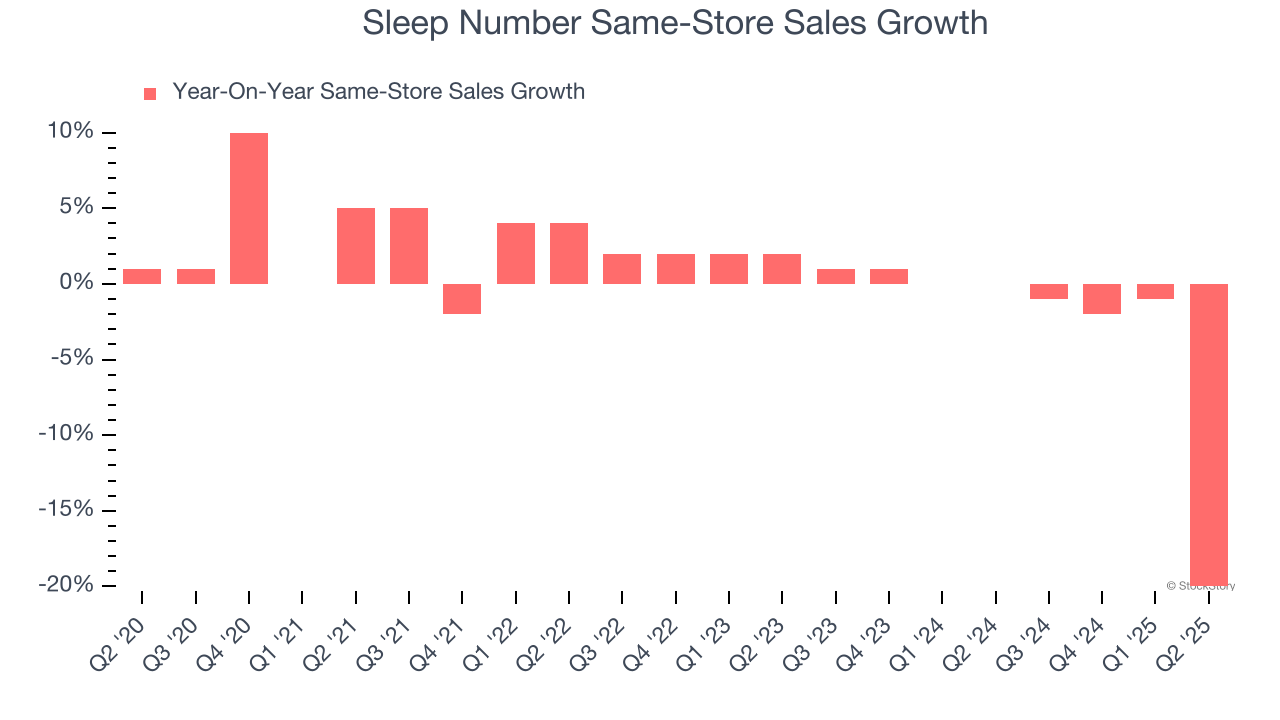

- Same-Store Sales fell 20% year on year (0% in the same quarter last year)

- Market Capitalization: $184.9 million

Company Overview

Known for mattresses that can be adjusted with regards to firmness, Sleep Number (NASDAQ: SNBR) manufactures and sells its own brand of bedding products such as mattresses, bed frames, and pillows.

Revenue Growth

A company’s long-term performance is an indicator of its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years.

With $1.52 billion in revenue over the past 12 months, Sleep Number is a small retailer, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and negotiating leverage with suppliers.

As you can see below, Sleep Number struggled to increase demand as its $1.52 billion of sales for the trailing 12 months was close to its revenue six years ago (we compare to 2019 to normalize for COVID-19 impacts). This was mainly because it closed stores and observed lower sales at existing, established locations.

This quarter, Sleep Number missed Wall Street’s estimates and reported a rather uninspiring 19.7% year-on-year revenue decline, generating $327.9 million of revenue.

Looking ahead, sell-side analysts expect revenue to grow 1.7% over the next 12 months. While this projection implies its newer products will spur better top-line performance, it is still below the sector average.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

Store Performance

Number of Stores

A retailer’s store count often determines how much revenue it can generate.

Sleep Number operated 630 locations in the latest quarter. Over the last two years, the company has generally closed its stores, averaging 2.3% annual declines.

When a retailer shutters stores, it usually means that brick-and-mortar demand is less than supply, and it is responding by closing underperforming locations to improve profitability.

Same-Store Sales

The change in a company's store base only tells one side of the story. The other is the performance of its existing locations and e-commerce sales, which informs management teams whether they should expand or downsize their physical footprints. Same-store sales gives us insight into this topic because it measures organic growth for a retailer's e-commerce platform and brick-and-mortar shops that have existed for at least a year.

Sleep Number’s demand has been shrinking over the last two years as its same-store sales have averaged 2.8% annual declines. This performance isn’t ideal, and Sleep Number is attempting to boost same-store sales by closing stores (fewer locations sometimes lead to higher same-store sales).

In the latest quarter, Sleep Number’s same-store sales fell by 20% year on year. This decrease represents a further deceleration from its historical levels. We hope the business can get back on track.

Key Takeaways from Sleep Number’s Q2 Results

We struggled to find many positives in these results as it missed Wall Street’s estimates across the board. Overall, this quarter could have been better. The stock traded down 25.5% to $6.08 immediately after reporting.

Sleep Number didn’t show it’s best hand this quarter, but does that create an opportunity to buy the stock right now? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.

More News

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the following

Privacy Policy and Terms Of Service.