Financial News

Q1 Earnings Highlights: WEBTOON (NASDAQ:WBTN) Vs The Rest Of The Digital Media & Content Platforms Stocks

Wrapping up Q1 earnings, we look at the numbers and key takeaways for the digital media & content platforms stocks, including WEBTOON (NASDAQ: WBTN) and its peers.

AI-driven content creation, personalized media experiences, and digital advertising are evolving, which could benefit companies investing in these themes. For example, companies with a portfolio of licensed visual content or platforms facilitating direct monetization models could see increased demand for years. On the other hand, headwinds include growing regulatory scrutiny on AI-generated content, with many publishers balking at anything that gets no human oversight. Additional areas to navigate include the phasing out of third-party cookies, which could make traditional ways of tracking the online behavior of consumers (a secret sauce in digital marketing) much less effective.

The 7 digital media & content platforms stocks we track reported a slower Q1. As a group, revenues missed analysts’ consensus estimates by 3.5% while next quarter’s revenue guidance was 1.2% below.

While some digital media & content platforms stocks have fared somewhat better than others, they have collectively declined. On average, share prices are down 2.5% since the latest earnings results.

WEBTOON (NASDAQ: WBTN)

Pioneering a vertical-scrolling format optimized for mobile devices, WEBTOON Entertainment (NASDAQ: WBTN) operates a global platform where creators publish serialized web-comics and web-novels that users can read in bite-sized episodes.

WEBTOON reported revenues of $325.7 million, flat year on year. This print fell short of analysts’ expectations by 1%. Overall, it was a softer quarter for the company with a significant miss of analysts’ EPS estimates and revenue guidance for next quarter slightly missing analysts’ expectations.

Junkoo Kim, Founder and CEO, said, “We are pleased to report both revenue and Adjusted EBITDA above the midpoint of our guidance. Total revenue was up 5.3% on a constant currency basis, with all three revenue streams – Paid Content, Advertising, and IP Adaptations – contributing to growth.”

Unsurprisingly, the stock is down 7.2% since reporting and currently trades at $9.16.

Read our full report on WEBTOON here, it’s free.

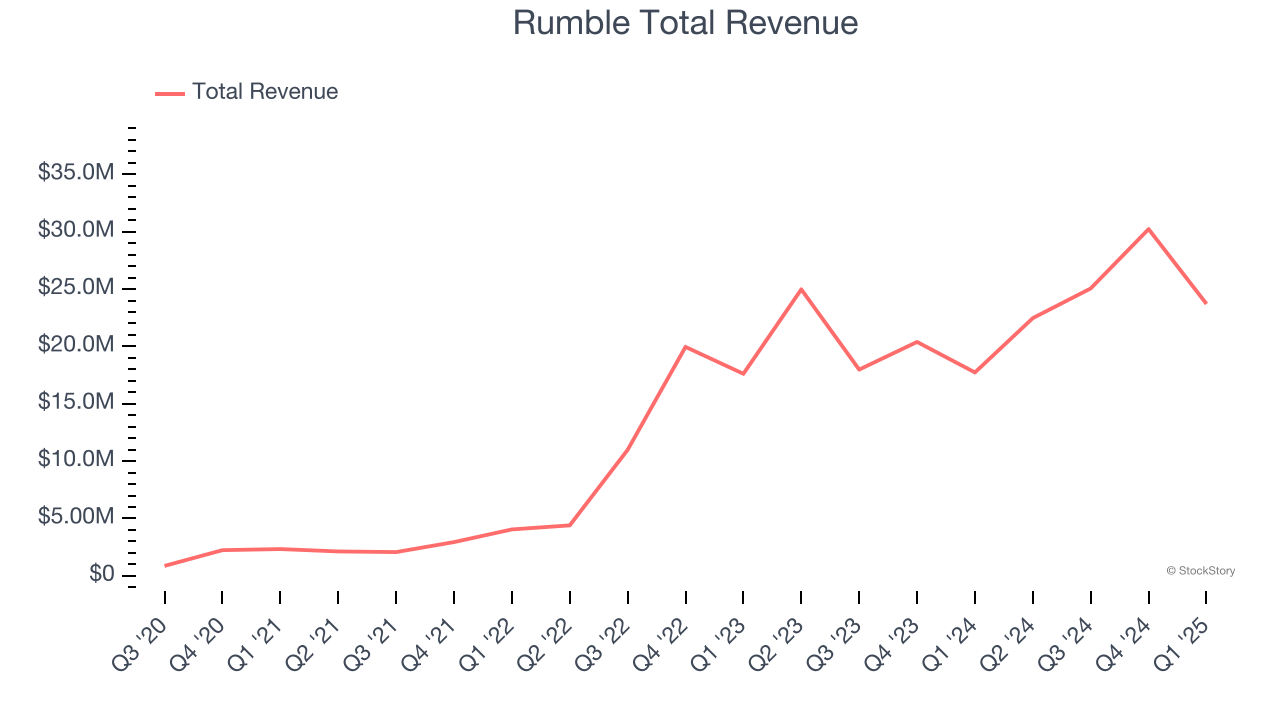

Best Q1: Rumble (NASDAQ: RUM)

Founded in 2013 as a champion for content creator rights and free expression, Rumble (NASDAQ: RUM) is a video sharing platform that positions itself as a free speech alternative to mainstream platforms, offering creators more favorable revenue-sharing opportunities.

Rumble reported revenues of $23.71 million, up 33.7% year on year, outperforming analysts’ expectations by 4.1%. The business had a stunning quarter with a solid beat of analysts’ EPS estimates.

Rumble pulled off the biggest analyst estimates beat and fastest revenue growth among its peers. The market seems happy with the results as the stock is up 16.7% since reporting. It currently trades at $9.07.

Is now the time to buy Rumble? Access our full analysis of the earnings results here, it’s free.

Weakest Q1: IAC (NASDAQ: IAC)

Originally known as InterActiveCorp and built through Barry Diller's strategic acquisitions since the 1990s, IAC (NASDAQ: IAC) operates a portfolio of category-leading digital businesses including Dotdash Meredith, Angi, and Care.com, focusing on digital publishing, home services, and caregiving platforms.

IAC reported revenues of $570.5 million, down 8.6% year on year, falling short of analysts’ expectations by 29.5%. It was a disappointing quarter as it posted a significant miss of analysts’ EPS estimates.

IAC delivered the weakest performance against analyst estimates and slowest revenue growth in the group. Interestingly, the stock is up 10.9% since the results and currently trades at $39.23.

Read our full analysis of IAC’s results here.

Vimeo (NASDAQ: VMEO)

Originally launched in 2004 as a platform for filmmakers seeking a high-quality alternative to YouTube, Vimeo (NASDAQ: VMEO) provides cloud-based video creation, editing, hosting, and distribution software that helps businesses and creators make, manage, and share professional-quality videos.

Vimeo reported revenues of $103 million, down 1.8% year on year. This result beat analysts’ expectations by 1.6%. Overall, it was a very strong quarter as it also produced a solid beat of analysts’ EPS estimates.

The stock is down 21.8% since reporting and currently trades at $4.03.

Read our full, actionable report on Vimeo here, it’s free.

Getty Images (NYSE: GETY)

With a vast library of over 562 million visual assets documenting everything from breaking news to iconic historical moments, Getty Images (NYSE: GETY) is a global visual content marketplace that licenses photos, videos, illustrations, and music to businesses, media outlets, and creative professionals.

Getty Images reported revenues of $224.1 million, flat year on year. This number came in 4.7% below analysts' expectations. Overall, it was a softer quarter as it also produced a significant miss of analysts’ EPS estimates.

Getty Images had the weakest full-year guidance update among its peers. The stock is down 13.4% since reporting and currently trades at $1.77.

Read our full, actionable report on Getty Images here, it’s free.

Market Update

As a result of the Fed’s rate hikes in 2022 and 2023, inflation has come down from frothy levels post-pandemic. The general rise in the price of goods and services is trending towards the Fed’s 2% goal as of late, which is good news. The higher rates that fought inflation also didn't slow economic activity enough to catalyze a recession. So far, soft landing. This, combined with recent rate cuts (half a percent in September 2024 and a quarter percent in November 2024) have led to strong stock market performance in 2024. The icing on the cake for 2024 returns was Donald Trump’s victory in the U.S. Presidential Election in early November, sending major indices to all-time highs in the week following the election. Still, debates around the health of the economy and the impact of potential tariffs and corporate tax cuts remain, leaving much uncertainty around 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Strong Momentum Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

More News

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the following

Privacy Policy and Terms Of Service.