Financial News

Sportsman's Warehouse (NASDAQ:SPWH) Reports Strong Q1 But Stock Drops 10.3%

Outdoor specialty retailer Sportsman's Warehouse (NASDAQ: SPWH) reported Q1 CY2025 results topping the market’s revenue expectations, with sales up 2% year on year to $249.1 million. Its non-GAAP loss of $0.41 per share was 13.5% above analysts’ consensus estimates.

Is now the time to buy Sportsman's Warehouse? Find out by accessing our full research report, it’s free.

Sportsman's Warehouse (SPWH) Q1 CY2025 Highlights:

- Revenue: $249.1 million vs analyst estimates of $238.2 million (2% year-on-year growth, 4.6% beat)

- Adjusted EPS: -$0.41 vs analyst estimates of -$0.47 (13.5% beat)

- Adjusted EBITDA: -$8.96 million vs analyst estimates of -$10.02 million (-3.6% margin, 10.6% beat)

- EBITDA guidance for the full year is $39 million at the midpoint, above analyst estimates of $34.87 million

- Operating Margin: -7.9%, in line with the same quarter last year

- Free Cash Flow was -$64.05 million compared to -$37.96 million in the same quarter last year

- Same-Store Sales rose 2% year on year (-13.5% in the same quarter last year)

- Market Capitalization: $78.49 million

“In the first quarter we delivered our first positive same store sales comp in nearly four years, an indication that our transformation strategy continues to gain traction,” said Paul Stone, President and Chief Executive Officer of Sportsman’s Warehouse.

Company Overview

A go-to destination for individuals passionate about hunting, fishing, camping, hiking, shooting sports, and more, Sportsman's Warehouse (NASDAQ: SPWH) is an American specialty retailer offering a diverse range of active gear, equipment, and apparel.

Sales Growth

Examining a company’s long-term performance can provide clues about its quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years.

With $1.20 billion in revenue over the past 12 months, Sportsman's Warehouse is a small retailer, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and negotiating leverage with suppliers.

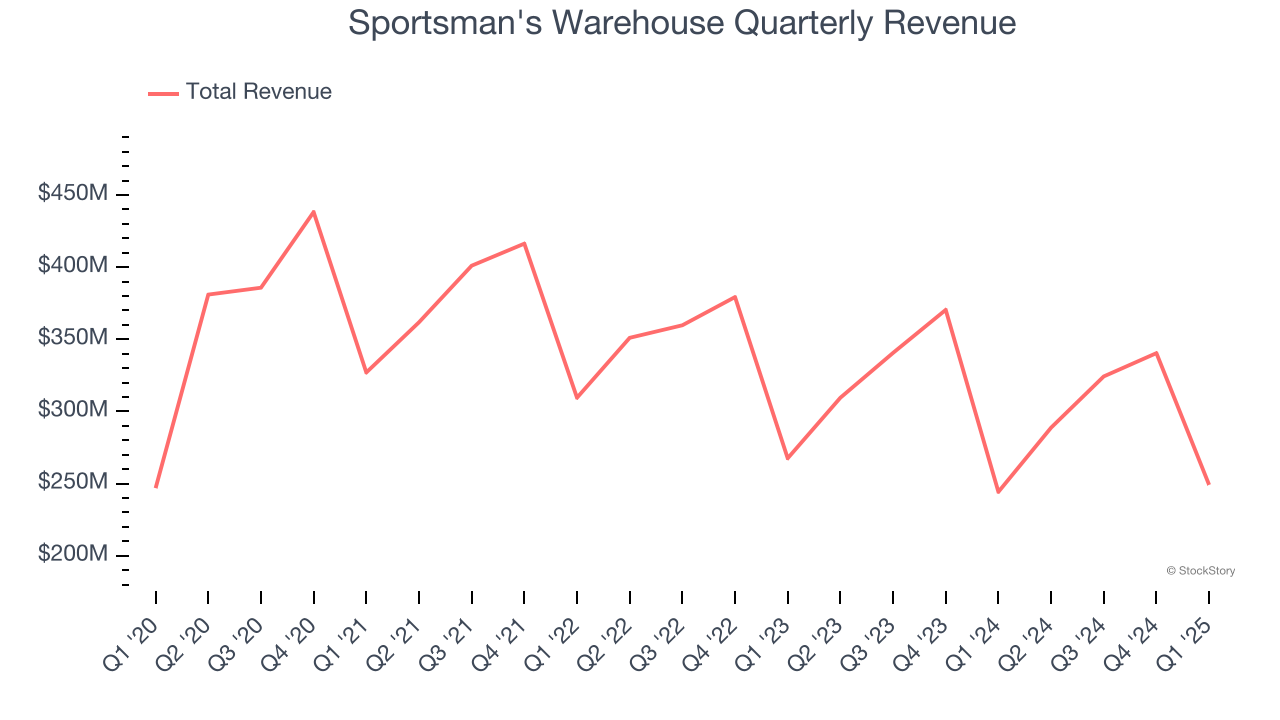

As you can see below, Sportsman's Warehouse’s 6.1% annualized revenue growth over the last six years (we compare to 2019 to normalize for COVID-19 impacts) was tepid. This shows it failed to generate demand in any major way and is a rough starting point for our analysis.

This quarter, Sportsman's Warehouse reported modest year-on-year revenue growth of 2% but beat Wall Street’s estimates by 4.6%.

Looking ahead, sell-side analysts expect revenue to remain flat over the next 12 months, a deceleration versus the last six years. This projection is underwhelming and implies its products will face some demand challenges.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

Same-Store Sales

Same-store sales show the change in sales for a retailer's e-commerce platform and brick-and-mortar shops that have existed for at least a year. This is a key performance indicator because it measures organic growth.

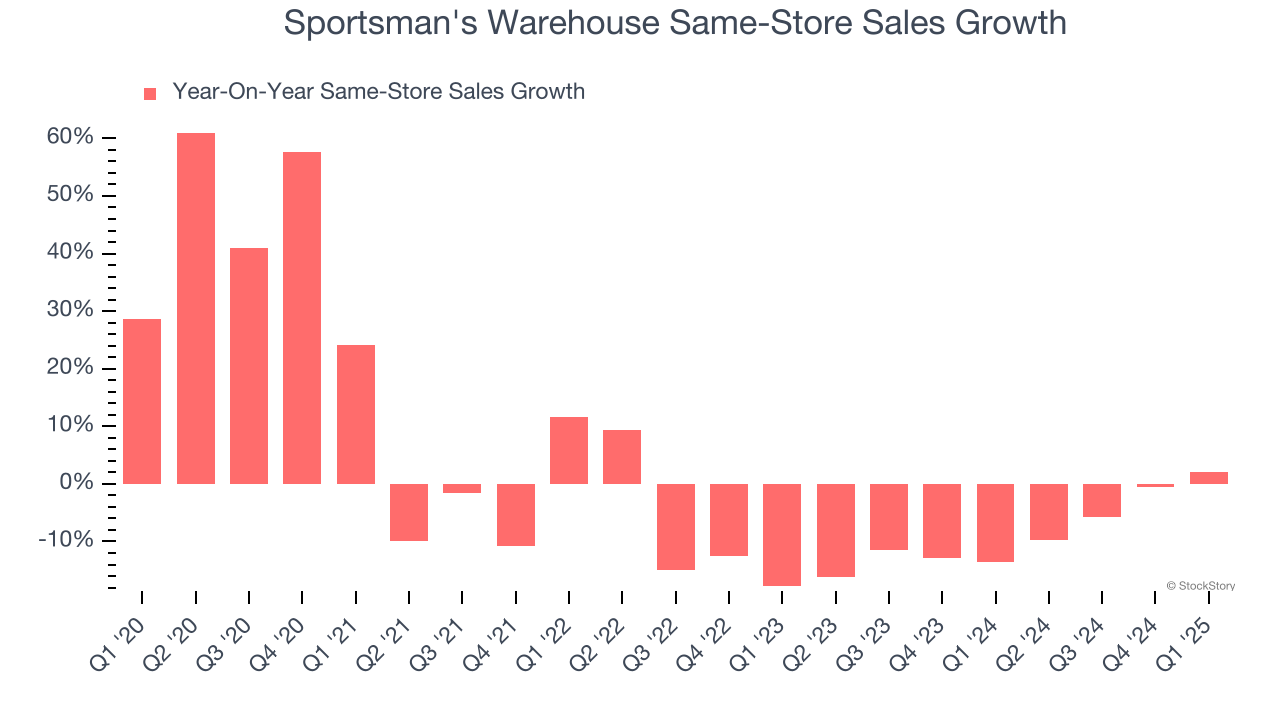

Sportsman's Warehouse’s demand has been shrinking over the last two years as its same-store sales have averaged 8.5% annual declines.

In the latest quarter, Sportsman's Warehouse’s same-store sales rose 2% year on year. This growth was a well-appreciated turnaround from its historical levels, showing the business is regaining momentum.

Key Takeaways from Sportsman's Warehouse’s Q1 Results

We were impressed by how significantly Sportsman's Warehouse blew past analysts’ revenue, EPS, and EBITDA expectations this quarter. On the other hand, its gross margin missed. Zooming out, we think this was a good print with some key areas of upside. The market seemed to be hoping for more, and the stock traded down 10.3% to $2.10 immediately after reporting.

So do we think Sportsman's Warehouse is an attractive buy at the current price? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.

More News

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the following

Privacy Policy and Terms Of Service.