Financial News

3 Reasons to Avoid SKY and 1 Stock to Buy Instead

Champion Homes trades at $87.55 per share and has moved almost in lockstep with the market over the last six months. The stock has lost 9.6% while the S&P 500 is down 6.2%. This may have investors wondering how to approach the situation.

Is now the time to buy Champion Homes, or should you be careful about including it in your portfolio? Check out our in-depth research report to see what our analysts have to say, it’s free.

Why Is Champion Homes Not Exciting?

Even though the stock has become cheaper, we're swiping left on Champion Homes for now. Here are three reasons why you should be careful with SKY and a stock we'd rather own.

1. Sales Volumes Stall, Demand Waning

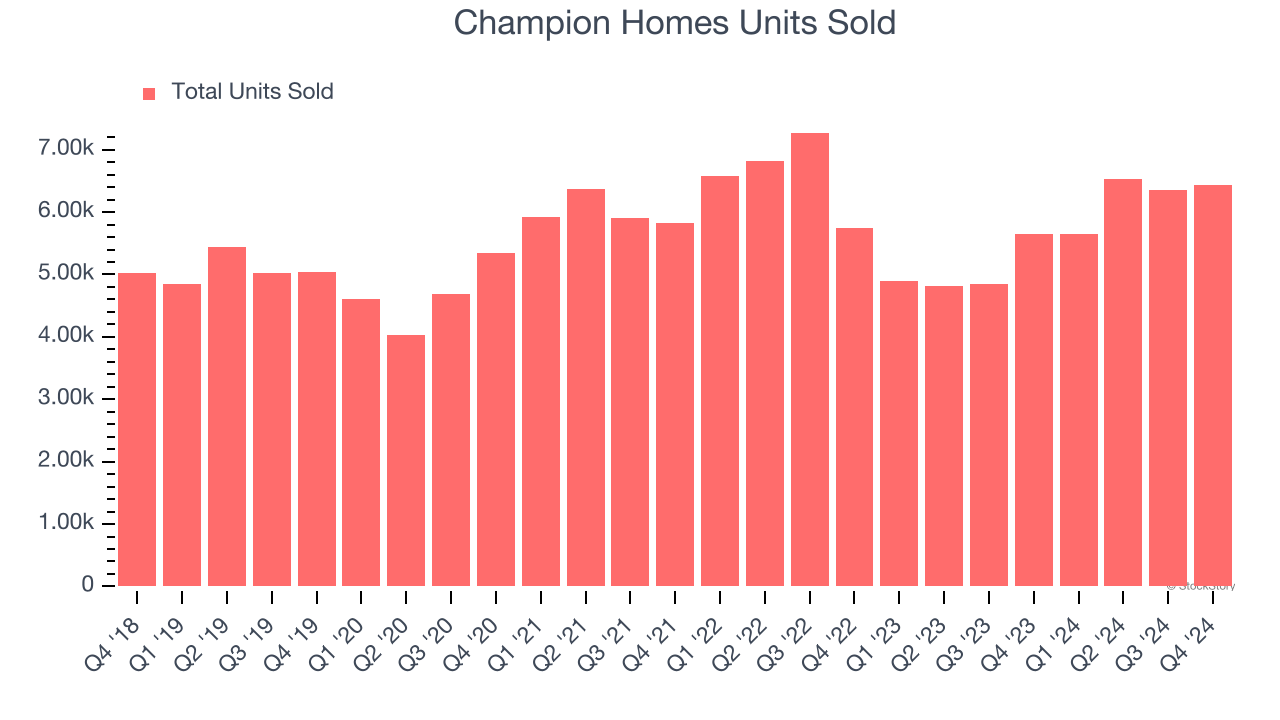

Revenue growth can be broken down into changes in price and volume (the number of units sold). While both are important, volume is the lifeblood of a successful Home Builders company because there’s a ceiling to what customers will pay.

Over the last two years, Champion Homes failed to grow its units sold, which came in at 6,437 in the latest quarter. This performance was underwhelming and implies there may be increasing competition or market saturation. It also suggests Champion Homes might have to lower prices or invest in product improvements to accelerate growth, factors that can hinder near-term profitability.

2. EPS Took a Dip Over the Last Two Years

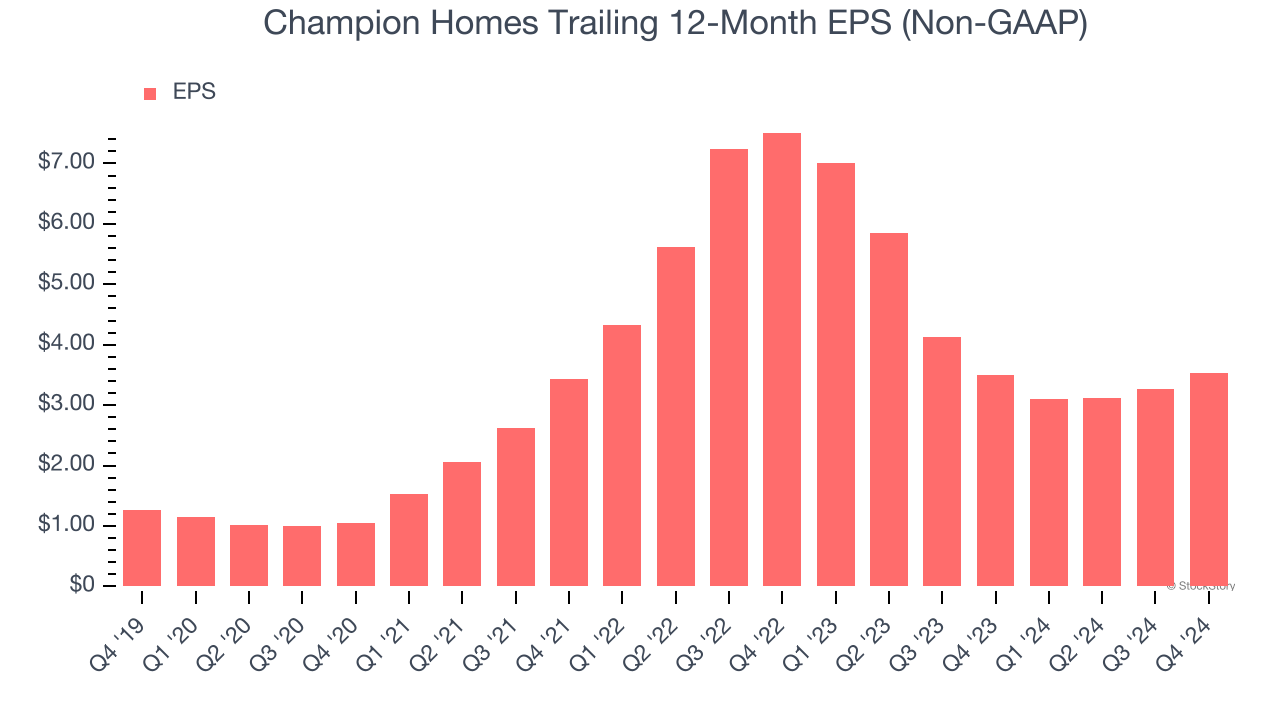

Although long-term earnings trends give us the big picture, we like to analyze EPS over a shorter period to see if we are missing a change in the business.

Sadly for Champion Homes, its EPS declined by more than its revenue over the last two years, dropping 31.5%. This tells us the company struggled to adjust to shrinking demand.

3. New Investments Fail to Bear Fruit as ROIC Declines

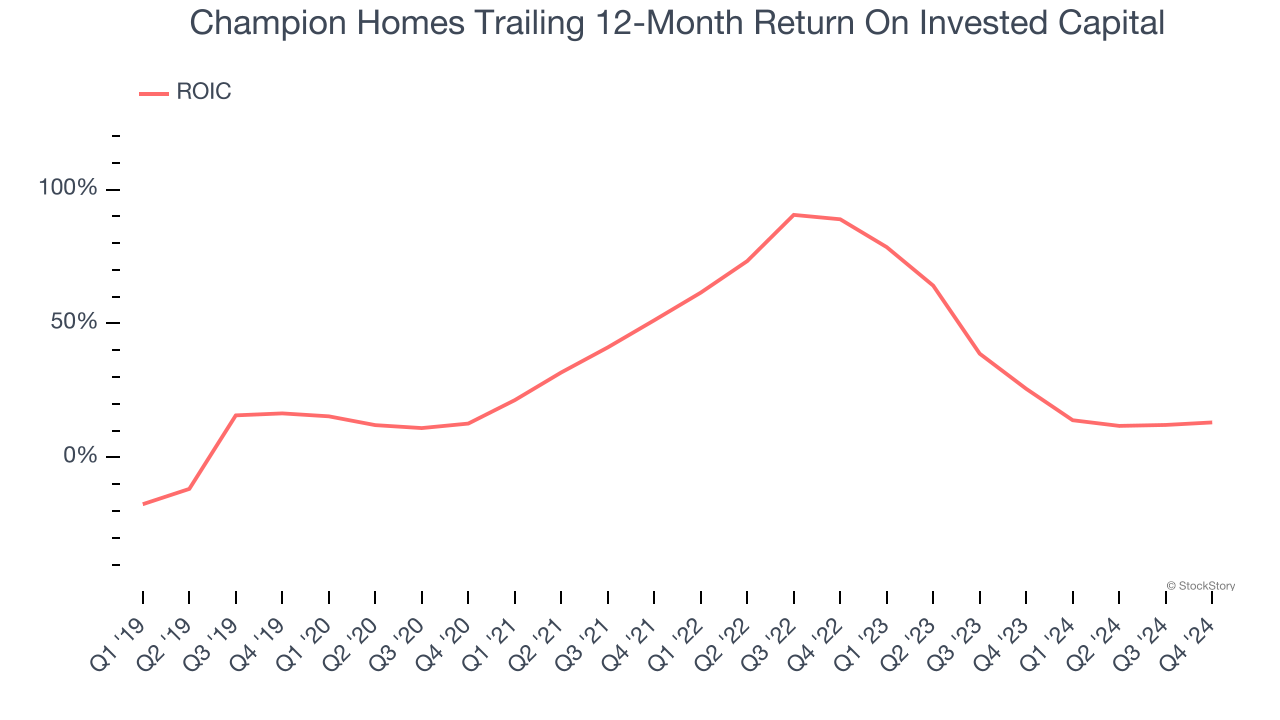

ROIC, or return on invested capital, is a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, Champion Homes’s ROIC has unfortunately decreased significantly. We like what management has done in the past, but its declining returns are perhaps a symptom of fewer profitable growth opportunities.

Final Judgment

Champion Homes isn’t a terrible business, but it isn’t one of our picks. Following the recent decline, the stock trades at 23.4× forward P/E (or $87.55 per share). At this valuation, there’s a lot of good news priced in - we think there are better investment opportunities out there. Let us point you toward the most dominant software business in the world.

Stocks We Like More Than Champion Homes

Donald Trump’s victory in the 2024 U.S. Presidential Election sent major indices to all-time highs, but stocks have retraced as investors debate the health of the economy and the potential impact of tariffs.

While this leaves much uncertainty around 2025, a few companies are poised for long-term gains regardless of the political or macroeconomic climate, like our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Sterling Infrastructure (+1,096% five-year return). Find your next big winner with StockStory today.

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the following

Privacy Policy and Terms Of Service.