Financial News

Plug Power’s (NASDAQ:PLUG) Q1 Sales Beat Estimates, Quarterly Revenue Guidance Slightly Exceeds Expectations

Fuel cell technology Plug Power (NASDAQ: PLUG) announced better-than-expected revenue in Q1 CY2025, with sales up 11.2% year on year to $133.7 million. Guidance for next quarter’s revenue was better than expected at $160 million at the midpoint, 1.2% above analysts’ estimates. Its GAAP loss of $0.21 per share was 10.9% below analysts’ consensus estimates.

Is now the time to buy Plug Power? Find out by accessing our full research report, it’s free.

Plug Power (PLUG) Q1 CY2025 Highlights:

- Revenue: $133.7 million vs analyst estimates of $132 million (11.2% year-on-year growth, 1.3% beat)

- EPS (GAAP): -$0.21 vs analyst expectations of -$0.19 (10.9% miss)

- Revenue Guidance for Q2 CY2025 is $160 million at the midpoint, above analyst estimates of $158.1 million

- Operating Margin: -134%, up from -216% in the same quarter last year

- Free Cash Flow was -$151.6 million compared to -$260.3 million in the same quarter last year

- Market Capitalization: $823.6 million

“With new capacity online in Louisiana, accelerating adoption of our GenEco electrolyzers, and improved cash flow discipline, Plug is executing with focus and urgency,” said Andy Marsh, CEO of Plug.

Company Overview

Powering forklifts for Walmart’s distribution centers, Plug Power (NASDAQ: PLUG) provides hydrogen fuel cells used to power electric motors.

Sales Growth

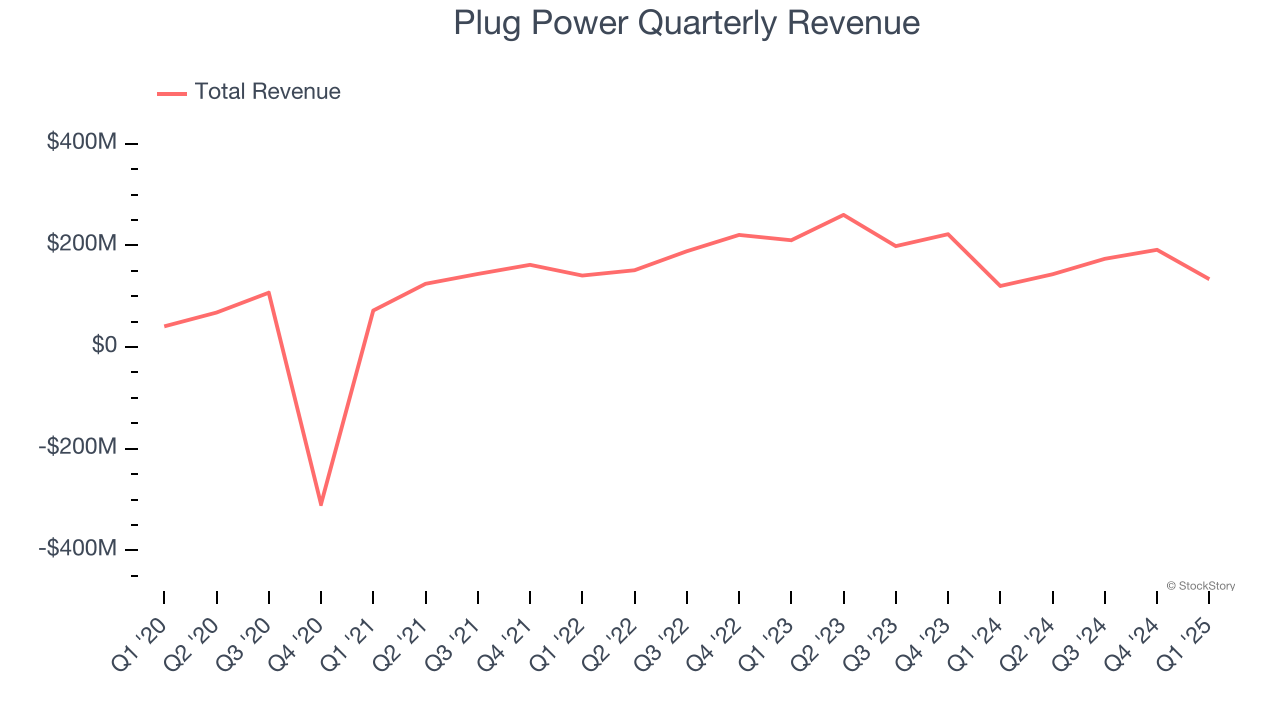

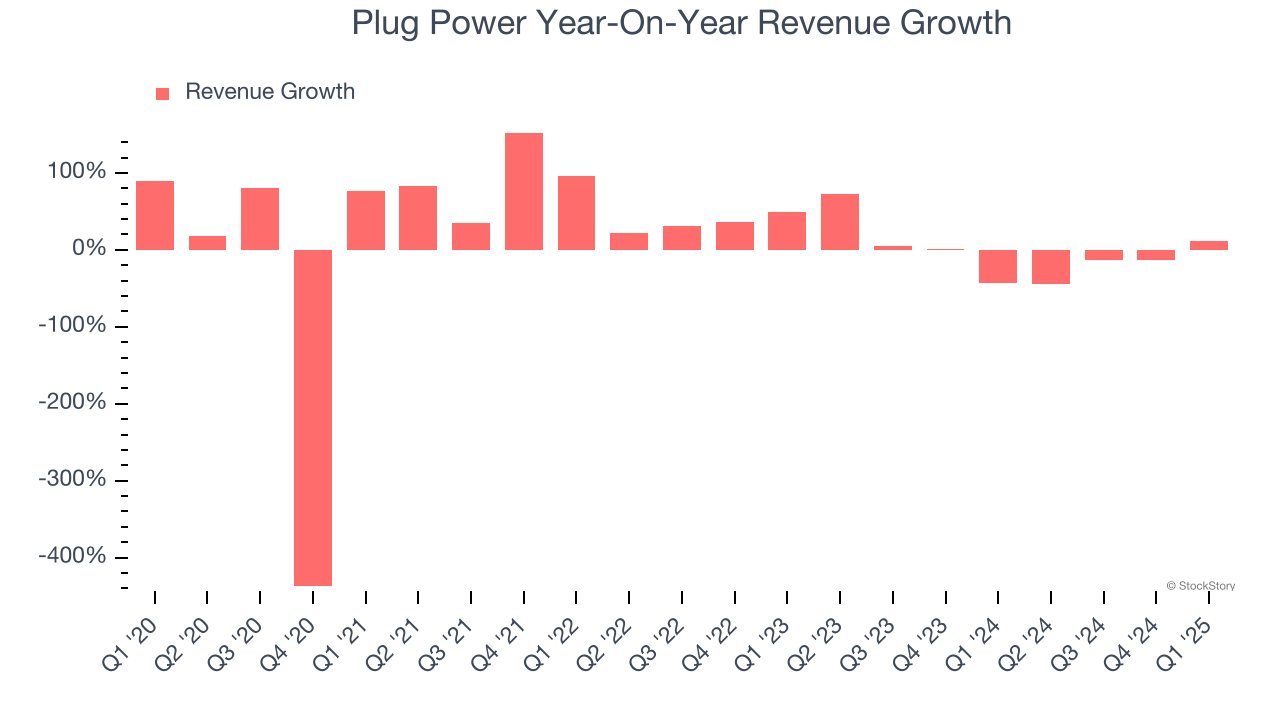

A company’s long-term sales performance can indicate its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Thankfully, Plug Power’s 20.8% annualized revenue growth over the last five years was incredible. Its growth beat the average industrials company and shows its offerings resonate with customers.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Plug Power’s recent performance marks a sharp pivot from its five-year trend as its revenue has shown annualized declines of 8.7% over the last two years. Plug Power isn’t alone in its struggles as the Renewable Energy industry experienced a cyclical downturn, with many similar businesses observing lower sales at this time.

This quarter, Plug Power reported year-on-year revenue growth of 11.2%, and its $133.7 million of revenue exceeded Wall Street’s estimates by 1.3%. Company management is currently guiding for a 11.6% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 22.8% over the next 12 months, an improvement versus the last two years. This projection is eye-popping and implies its newer products and services will fuel better top-line performance.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Operating Margin

Plug Power’s high expenses have contributed to an average operating margin of negative 192% over the last five years. Unprofitable industrials companies require extra attention because they could get caught swimming naked when the tide goes out. It’s hard to trust that the business can endure a full cycle.

Looking at the trend in its profitability, Plug Power’s operating margin decreased significantly over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability. Plug Power’s performance was poor no matter how you look at it - it shows that costs were rising and it couldn’t pass them onto its customers.

Plug Power’s operating margin was negative 134% this quarter. The company's consistent lack of profits raise a flag.

Earnings Per Share

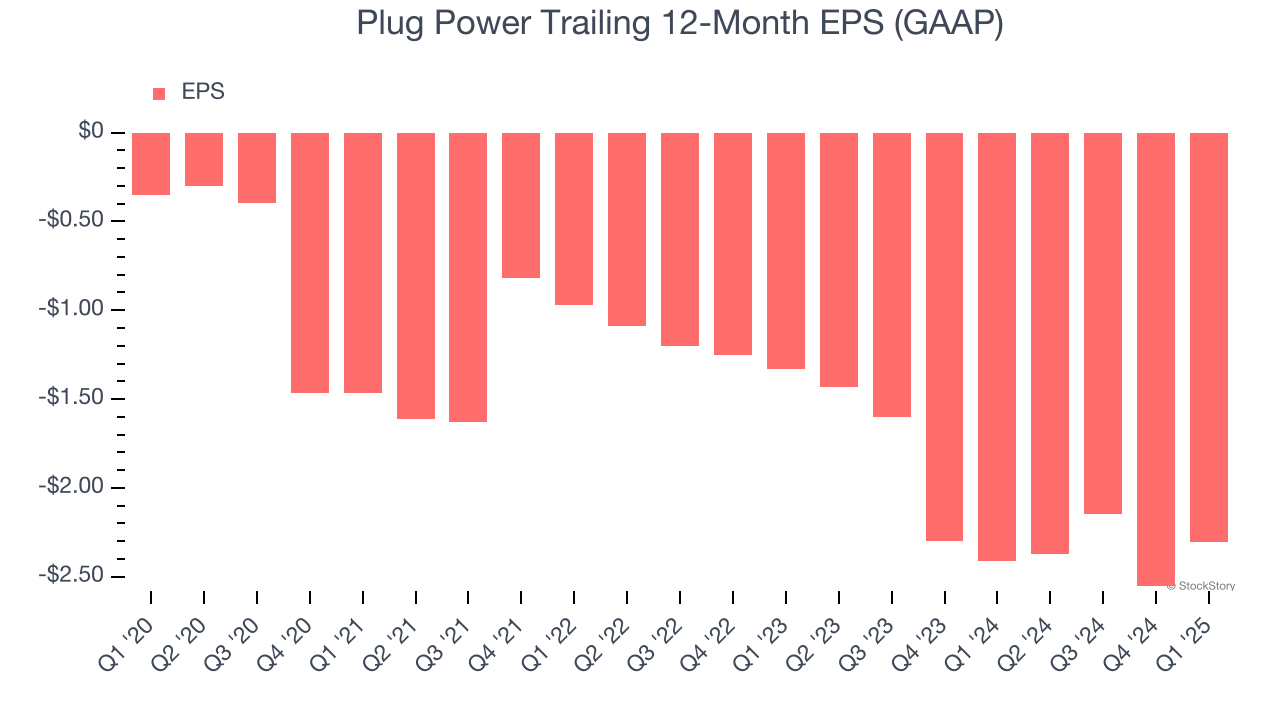

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Plug Power’s earnings losses deepened over the last five years as its EPS dropped 45.8% annually. We tend to steer our readers away from companies with falling EPS, where diminishing earnings could imply changing secular trends and preferences. If the tide turns unexpectedly, Plug Power’s low margin of safety could leave its stock price susceptible to large downswings.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Plug Power, its two-year annual EPS declines of 31.6% show it’s still underperforming. These results were bad no matter how you slice the data.

In Q1, Plug Power reported EPS at negative $0.21, up from negative $0.46 in the same quarter last year. Despite growing year on year, this print missed analysts’ estimates. Over the next 12 months, Wall Street expects Plug Power to improve its earnings losses. Analysts forecast its full-year EPS of negative $2.30 will advance to negative $0.53.

Key Takeaways from Plug Power’s Q1 Results

It was good to see Plug Power narrowly top analysts’ revenue expectations this quarter. We were also glad its revenue guidance for next quarter slightly exceeded Wall Street’s estimates. On the other hand, its EPS missed significantly. Overall, this was a mixed quarter. The stock remained flat at $0.91 immediately after reporting.

Should you buy the stock or not? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.

More News

View More

Recent Quotes

View MoreQuotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.