Financial News

Apple’s (NASDAQ:AAPL) Q1 Sales Beat Estimates

iPhone and iPad maker Apple (NASDAQ: AAPL) reported Q1 CY2025 results topping the market’s revenue expectations, with sales up 5.1% year on year to $95.36 billion. Its GAAP profit of $1.65 per share was 1.6% above analysts’ consensus estimates.

Is now the time to buy Apple? Find out by accessing our full research report, it’s free.

Apple (AAPL) Q1 CY2025 Highlights:

- Revenue: $95.36 billion vs analyst estimates of $94.72 billion (0.7% beat)

- Operating Profit (GAAP): $29.59 billion vs analyst estimates of $29.44 billion (0.5% beat)

- EPS (GAAP): $1.65 vs analyst estimates of $1.62 (1.6% beat)

- Products Revenue: $68.71 billion vs analyst estimates of $67.98 billion (1.1% beat)

- Services Revenue: $26.65 billion vs analyst estimates of $26.71 billion (small miss)

- Gross Margin: 47.1%, in line with the same quarter last year

- Operating Margin: 31%, in line with the same quarter last year

- Free Cash Flow Margin: 21.9%, in line with the same quarter last year

- Market Capitalization: $3.19 trillion

“Today Apple is reporting strong quarterly results, including double-digit growth in Services,” said Tim Cook, Apple’s CEO.

Revenue Growth

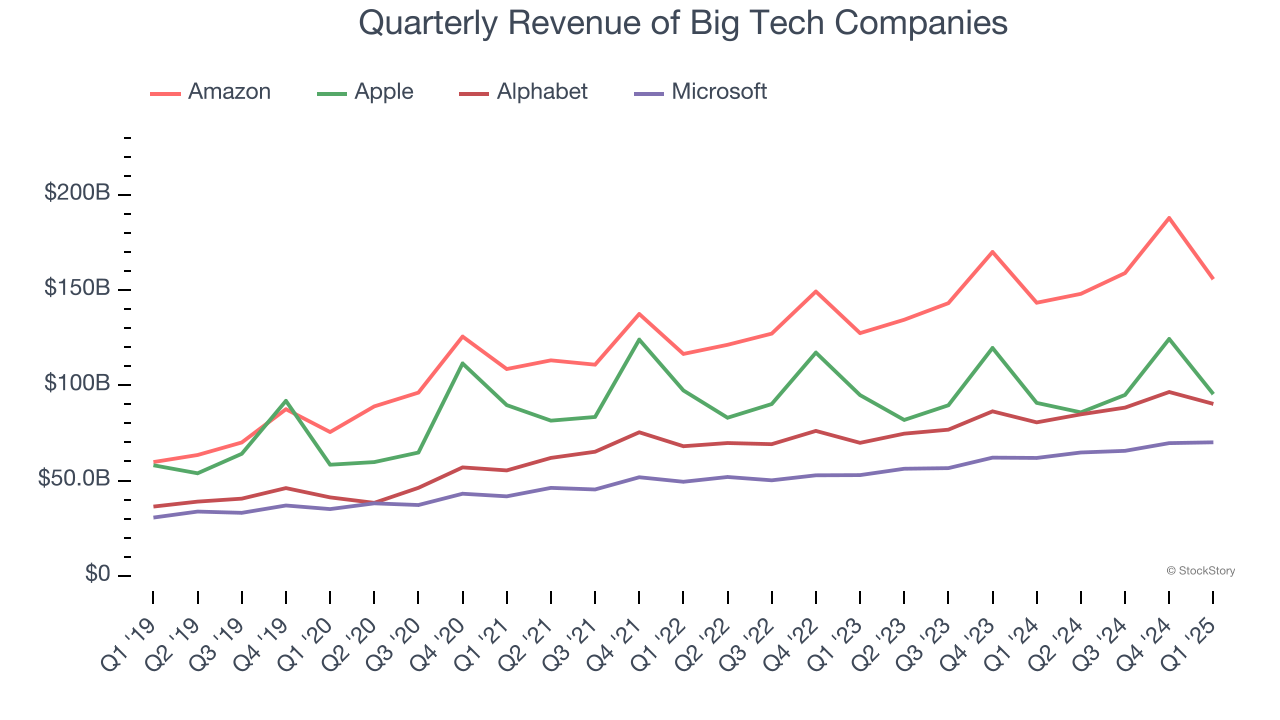

Apple (with its installed base of 2 billion+ devices) shows that growth and massive scale can coexist despite the conventional wisdom about the law of large numbers. The company’s revenue base of $268 billion five years ago has increased to $400.4 billion in the last year, translating into a decent 8.4% annualized growth rate.

In light of its big tech peers, however, Apple’s growth trailed Amazon (17%), Alphabet (16.6%), and Microsoft (14.3%) over the same period. This is an important consideration because investors often use the comparisons as a starting point for their valuations. When adjusting for these benchmarks, we think Apple is a bit expensive.

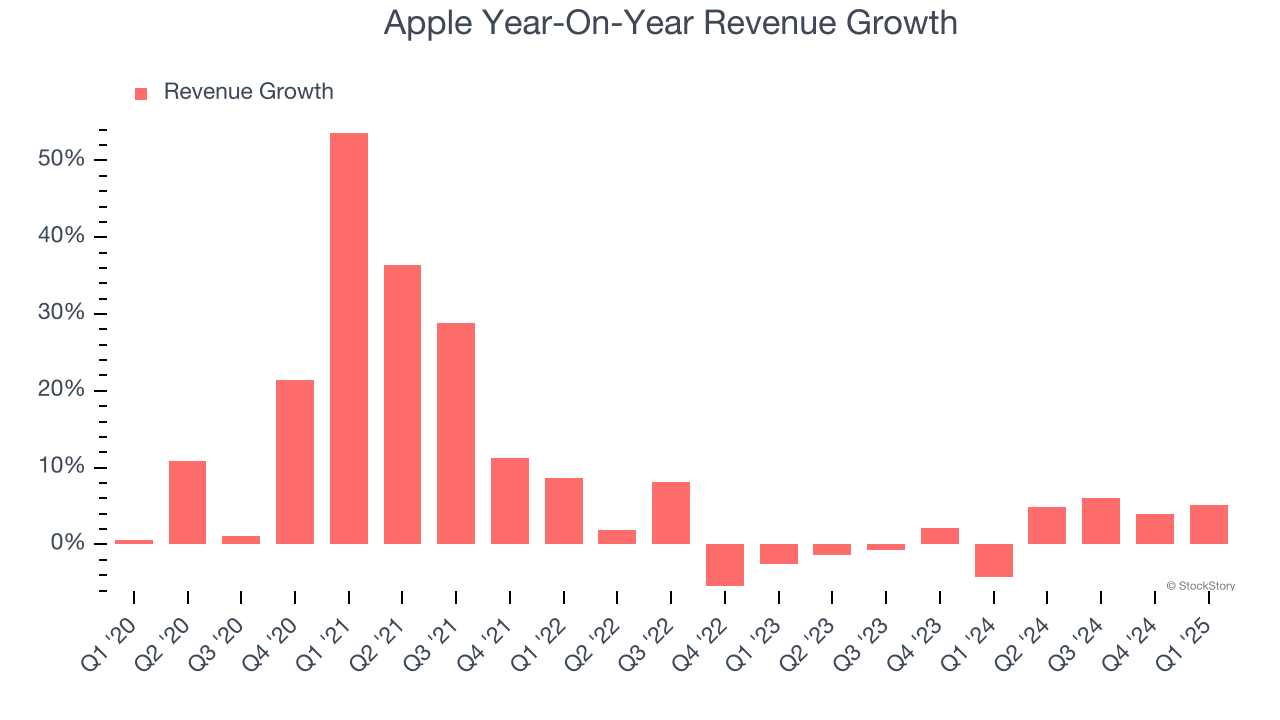

We at StockStory emphasize long-term growth, but for big tech companies, a half-decade historical view may miss emerging trends in AI. Apple’s recent performance shows its demand has slowed as its annualized revenue growth of 2% over the last two years was below its five-year trend.

This quarter, Apple reported year-on-year revenue growth of 5.1%, and its $95.36 billion of revenue exceeded Wall Street’s estimates by 0.7%. Looking ahead, sell-side analysts expect revenue to grow 4.7% over the next 12 months. This projection illustrates the market thinks that AI, in the form of Apple Intelligence, could catalyze better top-line performance. However, its anticipated growth is still a far cry from its heyday in the 2010s.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

Products: Steve Jobs’s Legacy

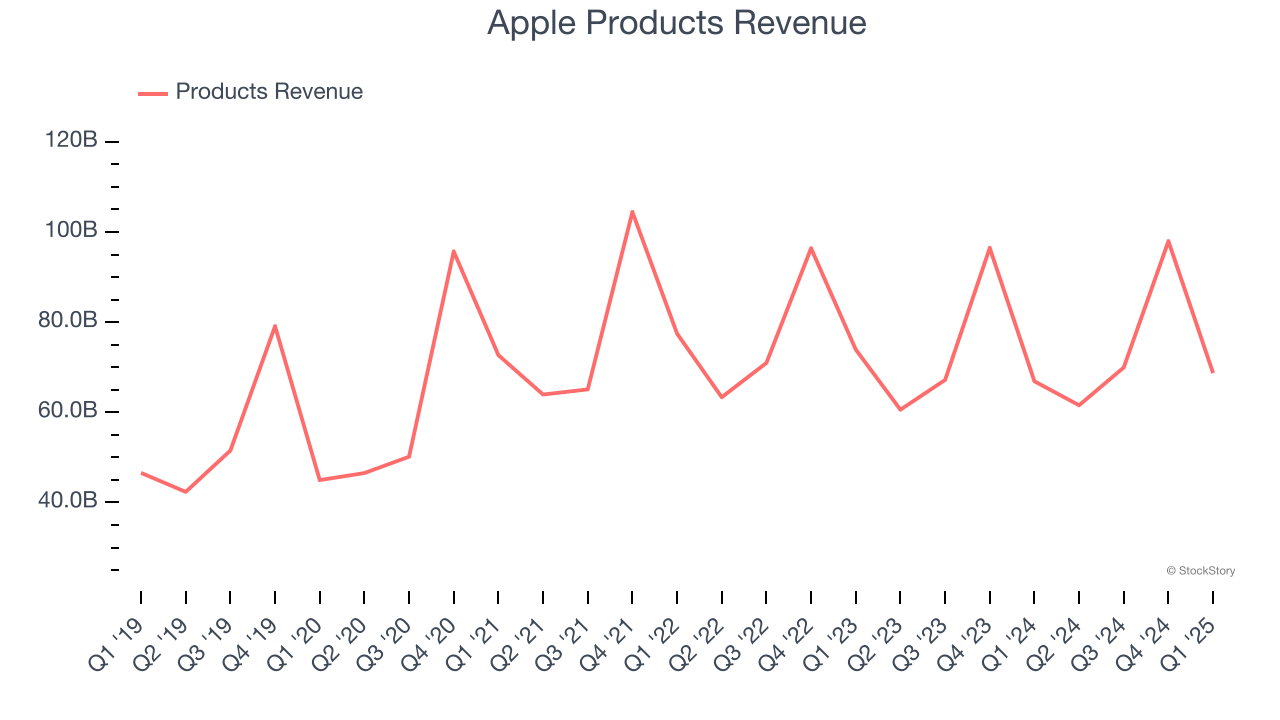

Apple’s Products segment includes everything from its flagship iPhone, iPad, and MacBook computers to AirPods and Apple Watch. We are closely monitoring whether the GenAI-powered Apple Intelligence, which was released in September 2024 but has limited interoperability with older devices, can spur an upgrade cycle for the company.

Products sales are by far the biggest chunk of Apple’s revenue at 74.5%, and they grew by 6.5% annually over the last five years, slower than total revenue. Recently, demand went south as its sales dropped at an annual clip of 1.1% over the last two years. Apple could really use that upgrade cycle right about now.

This quarter, Products sales were up 2.7% year on year, topping Wall Street’s estimates by 1.1%. Holding aside expectations, the recently improved rate of change shows that more customers are upgrading their devices than before. We’ll be watching to see if Apple Intelligence and iOS 18 can accelerate this trend. Wall Street seems to believe it will.

Key Takeaways from Apple’s Q1 Results

It was good to see Apple narrowly top analysts’ revenue expectations this quarter, driven by the beat in Products segment. On the other hand, the Services segment slightly underperformed. Overall, this print was decent, but the areas below expectations seem to be driving the move. The stock traded down 2% to $208.47 immediately following the results.

Is Apple an attractive investment opportunity right now? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the following

Privacy Policy and Terms Of Service.