Financial News

Movado’s (NYSE:MOV) Q4 Earnings Results: Revenue In Line With Expectations, Stock Jumps 20.7%

Luxury watch company Movado (NYSE: MOV) met Wall Street’s revenue expectations in Q4 CY2024, with sales up 1% year on year to $181.5 million. Its GAAP profit of $0.36 per share was 7.2% below analysts’ consensus estimates.

Is now the time to buy Movado? Find out by accessing our full research report, it’s free.

Movado (MOV) Q4 CY2024 Highlights:

- Revenue: $181.5 million vs analyst estimates of $181.6 million (1% year-on-year growth, in line)

- Operating Income (non-GAAP): $13.5 vs analyst expectations of $10.8 (25% beat)

- Guidance: "Given the current economic uncertainty and the unpredictable impact of recent tariff developments on the Company’s business, the Company has elected not to provide a fiscal 2026 outlook at this time."

- Cost cuts: Already implemented $10 million of annual savings, will reduce marketing spend by $15-20 million this year compared to last

- Operating Margin: 5.1%, down from 7.5% in the same quarter last year

- Free Cash Flow Margin: 20.7%, down from 37.8% in the same quarter last year

- Market Capitalization: $289.7 million

Efraim Grinberg, Chairman and Chief Executive Officer, stated: “Despite a challenging macroeconomic backdrop, we delivered net sales growth in the fourth quarter and also expanded gross profit margin while increasing marketing spend in support of future growth. As we communicated when reporting third quarter results in December, we increased our focus on reducing go-forward operating expenses. As of our fiscal year end, we had already implemented actions that are expected to deliver $10 million in annualized savings while increasing efficiency across our enterprise in order to generate higher productivity and profitability. Additionally, we will bring our marketing spend to be more in line with sales in fiscal 2026, with planned spend being reduced by a range of $15 million to $20 million relative to fiscal 2025.”

Company Overview

With its watches displayed in 20 museums around the world, Movado (NYSE: MOV) is a watchmaking company with a portfolio of watch brands and accessories.

Apparel and Accessories

Thanks to social media and the internet, not only are styles changing more frequently today than in decades past but also consumers are shifting the way they buy their goods, favoring omnichannel and e-commerce experiences. Some apparel and accessories companies have made concerted efforts to adapt while those who are slower to move may fall behind.

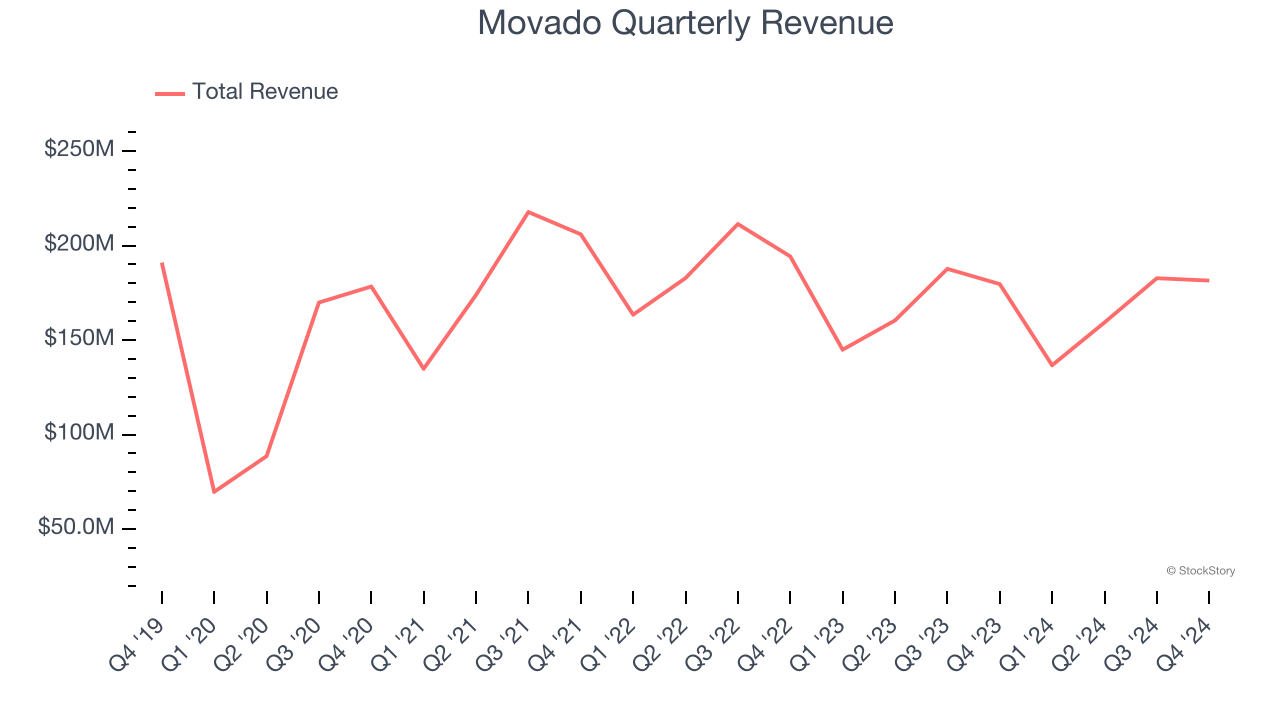

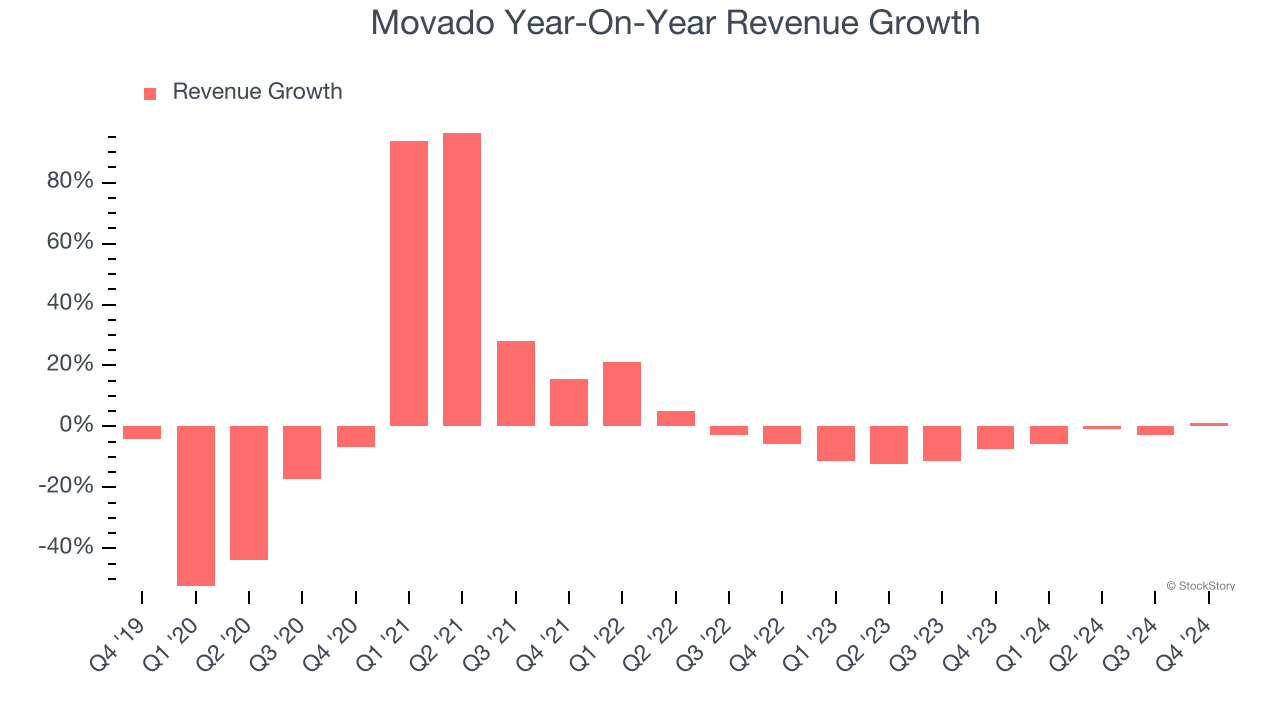

Sales Growth

A company’s long-term sales performance can indicate its overall quality. Any business can have short-term success, but a top-tier one grows for years. Movado struggled to consistently generate demand over the last five years as its sales dropped at a 1.2% annual rate. This wasn’t a great result and suggests it’s a low quality business.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new product or trend. Movado’s recent performance shows its demand remained suppressed as its revenue has declined by 6.3% annually over the last two years.

This quarter, Movado grew its revenue by 1% year on year, and its $181.5 million of revenue was in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 3.6% over the next 12 months. While this projection indicates its newer products and services will spur better top-line performance, it is still below the sector average.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

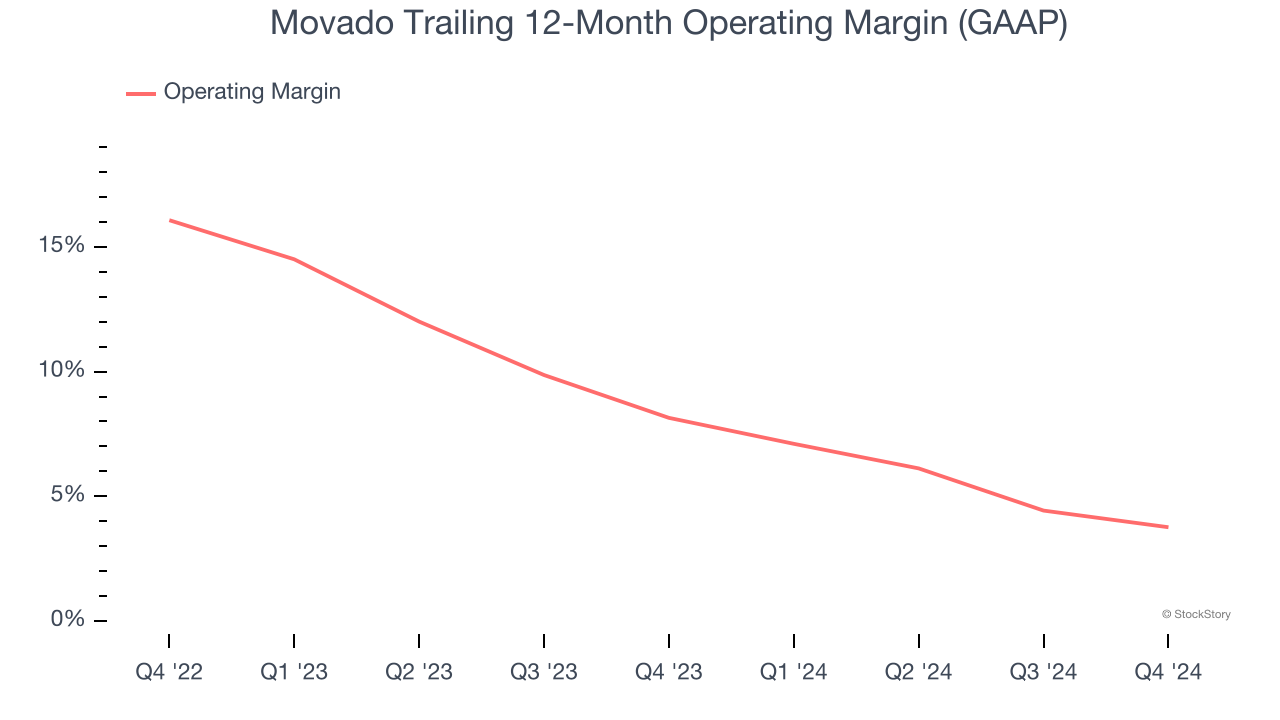

Operating Margin

Movado’s operating margin has shrunk over the last 12 months and averaged 6% over the last two years. The company’s profitability was mediocre for a consumer discretionary business and shows it couldn’t pass its higher operating expenses onto its customers.

This quarter, Movado generated an operating profit margin of 5.1%, down 2.5 percentage points year on year. This contraction shows it was less efficient because its expenses grew faster than its revenue.

Earnings Per Share

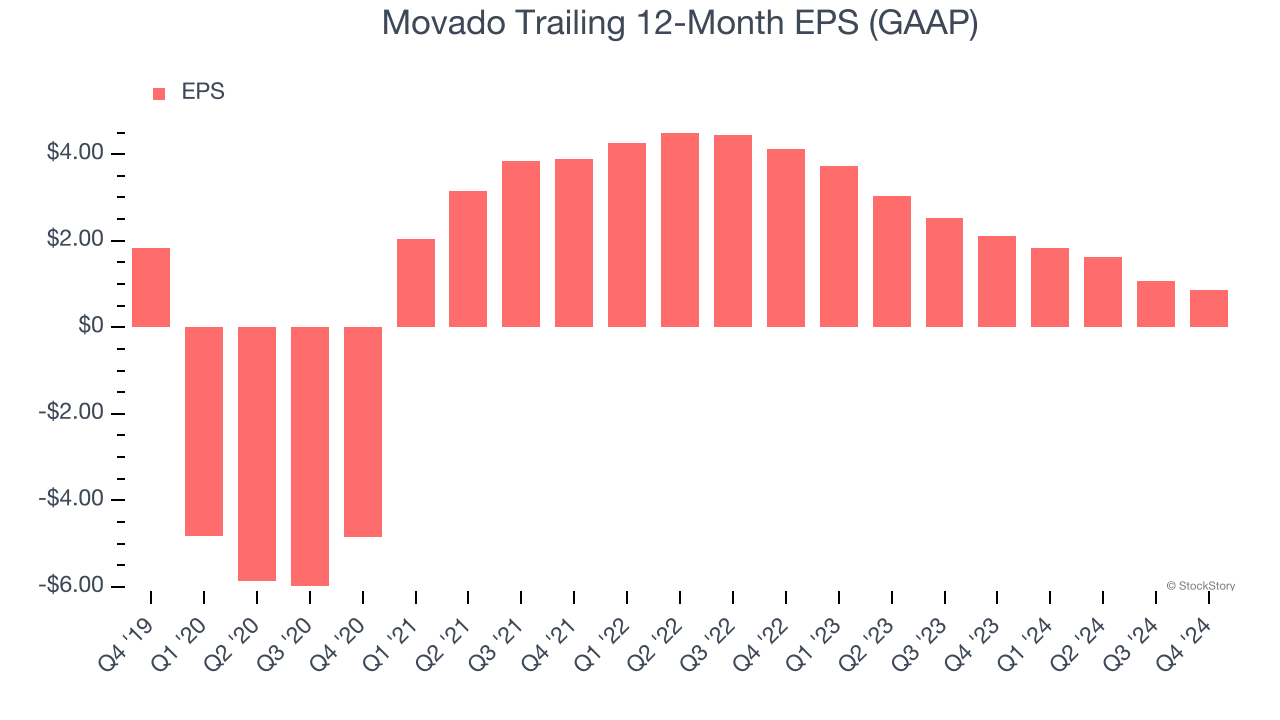

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Sadly for Movado, its EPS declined by 13.8% annually over the last five years, more than its revenue. We can see the difference stemmed from higher interest expenses or taxes as the company actually grew its operating margin and repurchased its shares during this time.

In Q4, Movado reported EPS at $0.36, down from $0.57 in the same quarter last year. This print missed analysts’ estimates. Over the next 12 months, Wall Street expects Movado’s full-year EPS of $0.87 to grow 205%.

Key Takeaways from Movado’s Q4 Results

Revenue was in line but adjusted operating income beat. Looking ahead, the company did not give formal guidance but is focused on cost cuts. Movado has already implemented $10 million of annual savings and will reduce marketing spend by $15-20 million this year compared to last. The stock traded up 20.7% to $15.69 immediately after reporting.

So do we think Movado is an attractive buy at the current price? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.

More News

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the following

Privacy Policy and Terms Of Service.