Financial News

2 Reasons to Like JNJ and 1 to Stay Skeptical

Since September 2024, Johnson & Johnson has been in a holding pattern, posting a small return of 0.7% while floating around $163.19.

Does this present a buying opportunity for JNJ? Or is its underperformance reflective of its story and business quality? Find out in our full research report, it’s free.

Why Does Johnson & Johnson Spark Debate?

Founded in 1886 and known for its iconic red cross logo, Johnson & Johnson (NYSE: JNJ) is a global healthcare company that develops and sells pharmaceuticals, medical devices, and technologies focused on human health and well-being.

Two Positive Attributes:

1. Economies of Scale Give It Negotiating Leverage with Suppliers

Larger companies benefit from economies of scale, where fixed costs like infrastructure, technology, and administration are spread over a higher volume of goods or services, reducing the cost per unit. Scale can also lead to bargaining power with suppliers, greater brand recognition, and more investment firepower. A virtuous cycle can ensue if a scaled company plays its cards right.

With $88.82 billion in revenue over the past 12 months, Johnson & Johnson is one of the most scaled enterprises in healthcare. This is particularly important because branded pharmaceuticals companies are volume-driven businesses due to their low margins.

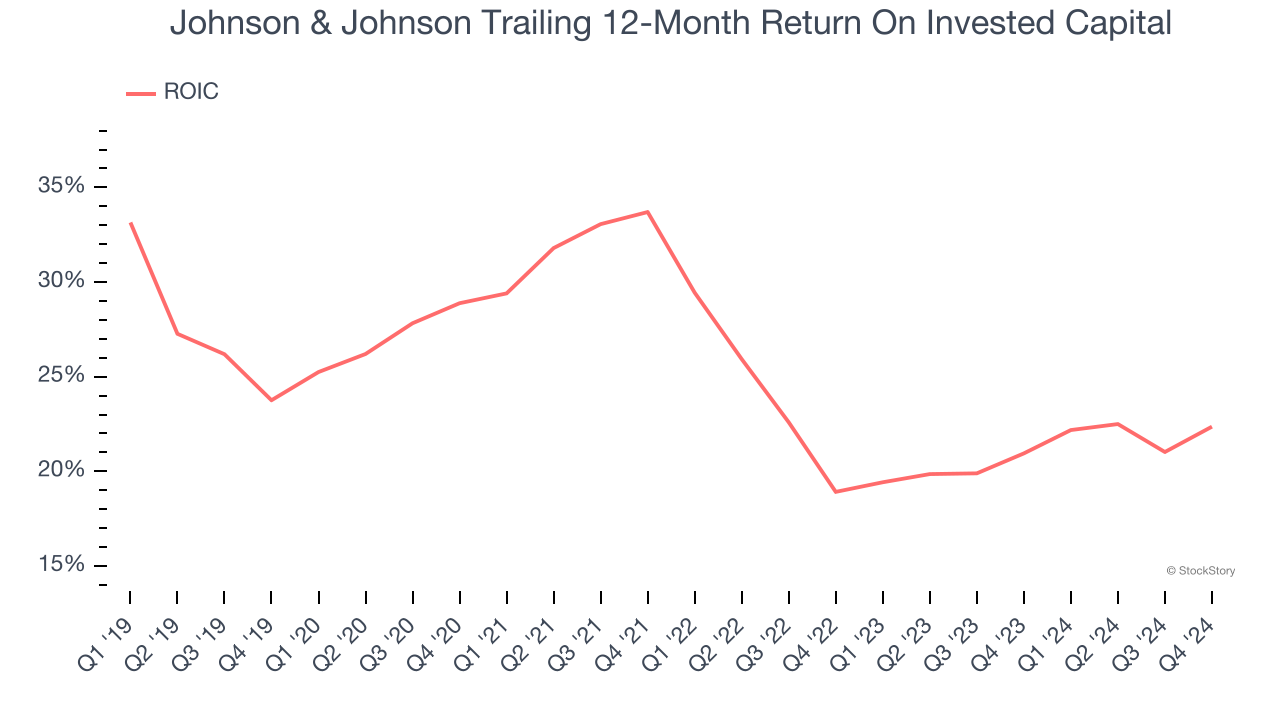

2. Stellar ROIC Showcases Lucrative Growth Opportunities

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Johnson & Johnson’s five-year average ROIC was 25%, placing it among the best healthcare companies. This illustrates its management team’s ability to invest in highly profitable ventures and produce tangible results for shareholders.

One Reason to be Careful:

Declining Constant Currency Revenue, Demand Takes a Hit

Investors interested in Branded Pharmaceuticals companies should track constant currency revenue in addition to reported revenue. This metric excludes currency movements, which are outside of Johnson & Johnson’s control and are not indicative of underlying demand.

Over the last two years, Johnson & Johnson’s constant currency revenue averaged 1.4% year-on-year declines. This performance was underwhelming and implies there may be increasing competition or market saturation. It also suggests Johnson & Johnson might have to lower prices or invest in product improvements to accelerate growth, factors that can hinder near-term profitability.

Final Judgment

Johnson & Johnson’s merits more than compensate for its flaws, but at $163.19 per share (or 15.7× forward price-to-earnings), is now the time to initiate a position? See for yourself in our in-depth research report, it’s free.

Stocks We Like Even More Than Johnson & Johnson

The elections are now behind us. With rates dropping and inflation cooling, many analysts expect a breakout market - and we’re zeroing in on the stocks that could benefit immensely.

Take advantage of the rebound by checking out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Comfort Systems (+751% five-year return). Find your next big winner with StockStory today for free.

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the following

Privacy Policy and Terms Of Service.