Financial News

Monarch (NASDAQ:MCRI) Misses Q3 Sales Expectations

Luxury casino and resort operator Monarch (NASDAQ: MCRI) fell short of the market’s revenue expectations in Q3 CY2025 as sales rose 3.6% year on year to $142.8 million. Its GAAP profit of $1.69 per share was 7.4% above analysts’ consensus estimates.

Is now the time to buy Monarch? Find out by accessing our full research report, it’s free for active Edge members.

Monarch (MCRI) Q3 CY2025 Highlights:

- Revenue: $142.8 million vs analyst estimates of $145.5 million (3.6% year-on-year growth, 1.8% miss)

- EPS (GAAP): $1.69 vs analyst estimates of $1.57 (7.4% beat)

- Adjusted EBITDA: $54.85 million vs analyst estimates of $53.87 million (38.4% margin, 1.8% beat)

- Operating Margin: 26.7%, up from 25.6% in the same quarter last year

- Market Capitalization: $1.76 billion

CEO CommentJohn Farahi, Co-Chairman and Chief Executive Officer of Monarch, commented: “In the third quarter of 2025, Monarch delivered all-time record quarterly financial results. Net revenue increased 3.6% year-over-year to $142.8 million, reflecting growth in casino, food and beverage, and hotel revenues.

Company Overview

Established in 1993, Monarch (NASDAQ: MCRI) operates luxury casinos and resorts, offering high-end gaming, dining, and hospitality experiences.

Revenue Growth

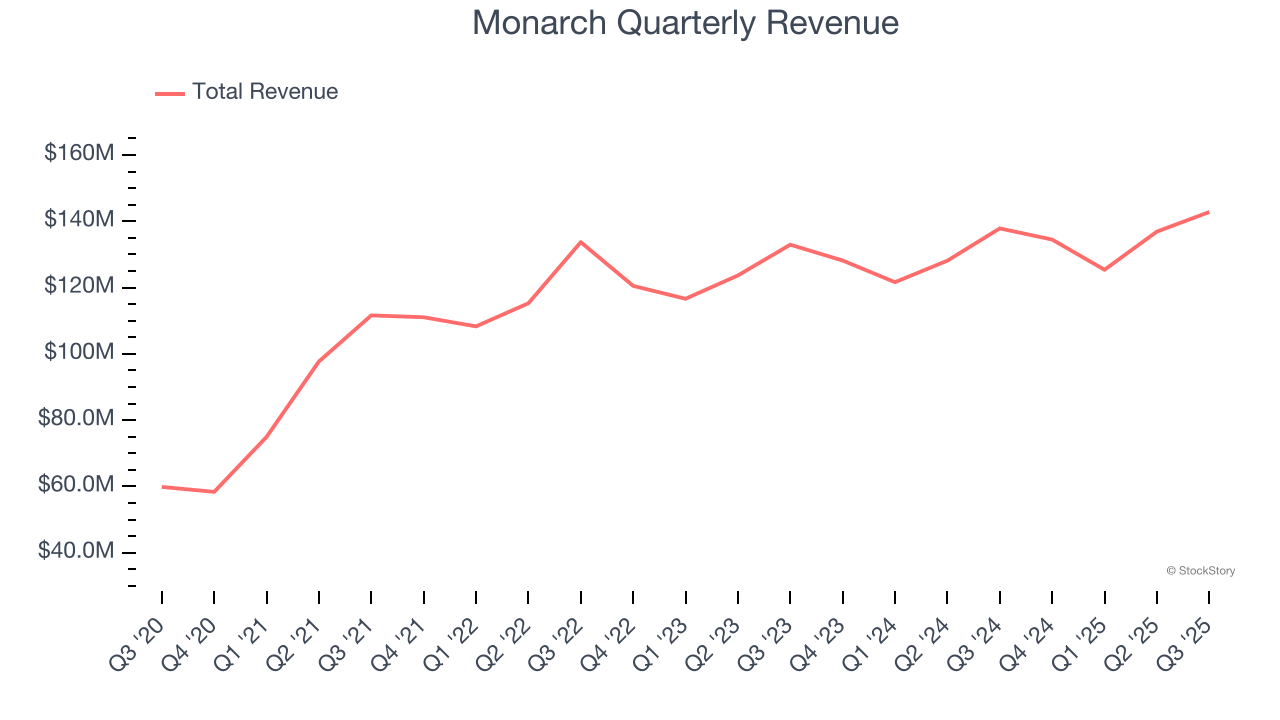

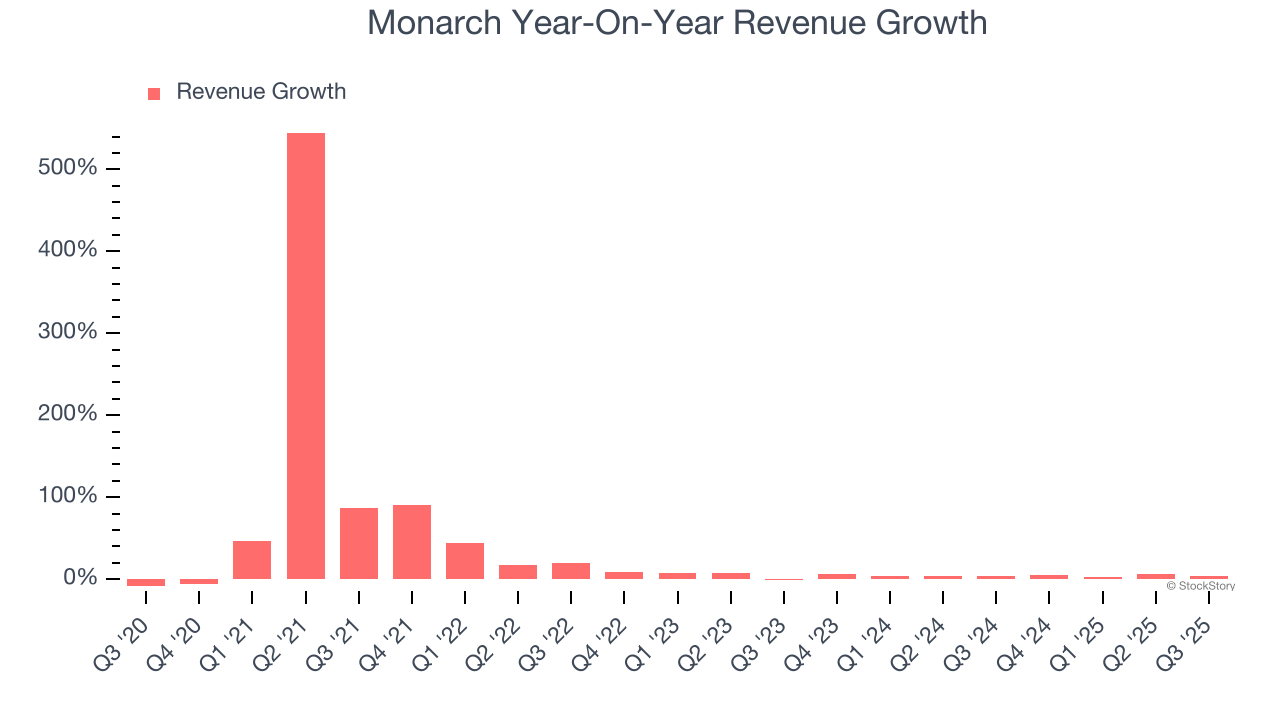

Examining a company’s long-term performance can provide clues about its quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Over the last five years, Monarch grew its sales at an impressive 23.5% compounded annual growth rate. Its growth beat the average consumer discretionary company and shows its offerings resonate with customers, a helpful starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new product or trend. Monarch’s recent performance shows its demand has slowed significantly as its annualized revenue growth of 4.5% over the last two years was well below its five-year trend. Note that COVID hurt Monarch’s business in 2020 and part of 2021, and it bounced back in a big way thereafter.

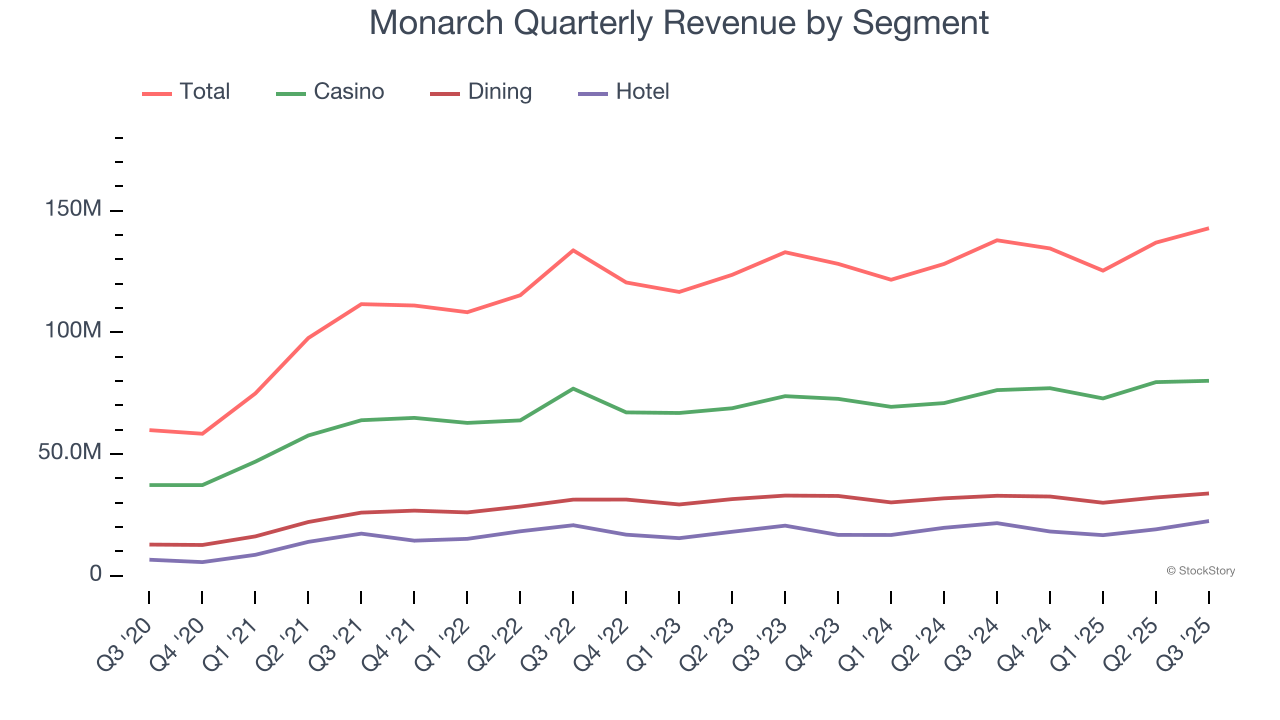

We can dig further into the company’s revenue dynamics by analyzing its three most important segments: Casino, Dining, and Hotel, which are 56.1%, 23.7%, and 15.8% of revenue. Over the last two years, Monarch’s revenues in all three segments increased. Its Casino revenue (Poker, Blackjack) averaged year-on-year growth of 5.8% while its Dining (food and beverage) and Hotel (overnight stays) revenues averaged 1.4% and 3.8%.

This quarter, Monarch’s revenue grew by 3.6% year on year to $142.8 million, falling short of Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 4.5% over the next 12 months, similar to its two-year rate. This projection doesn't excite us and suggests its newer products and services will not catalyze better top-line performance yet. At least the company is tracking well in other measures of financial health.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

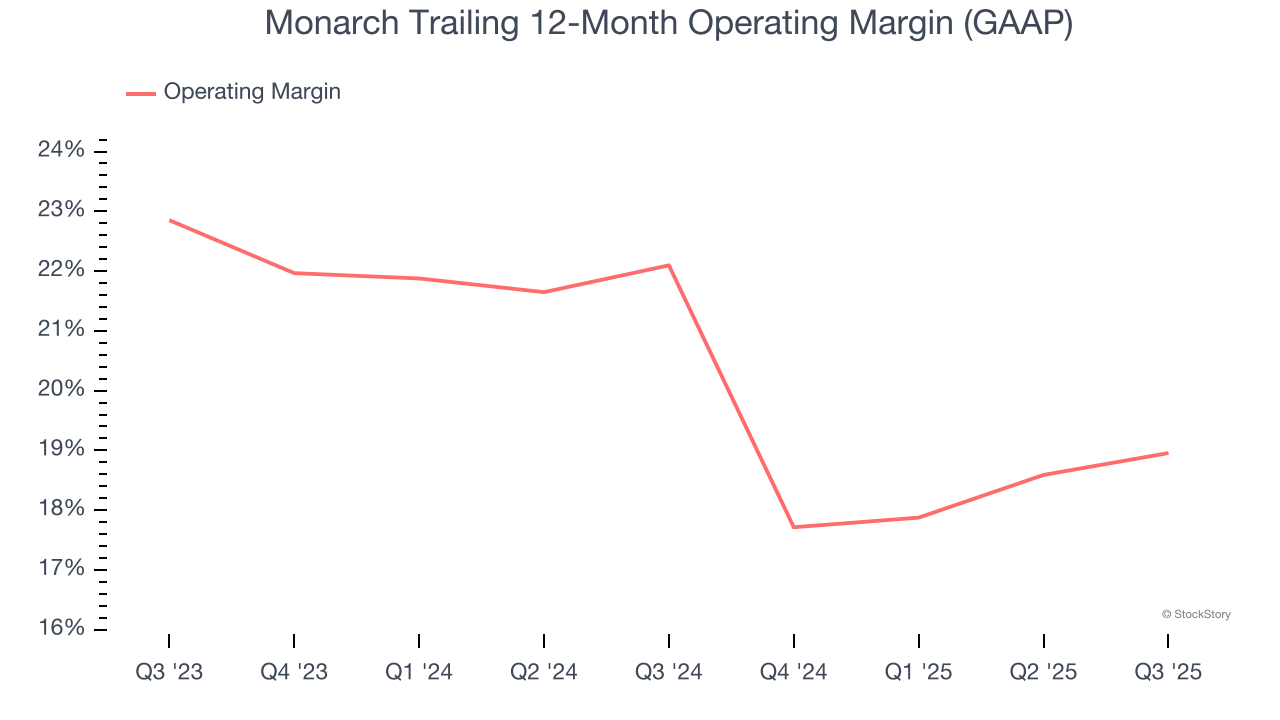

Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Monarch’s operating margin has shrunk over the last 12 months, but it still averaged 20.5% over the last two years, top-notch for a consumer discretionary business. This shows it’s an efficient company that manages its expenses effectively, and its top-notch historical revenue growth also suggests its margin dropped because it ramped up investments to capture market share, a strategy that seems to have paid off so far.

This quarter, Monarch generated an operating margin profit margin of 26.7%, up 1.1 percentage points year on year. This increase was a welcome development and shows it was more efficient.

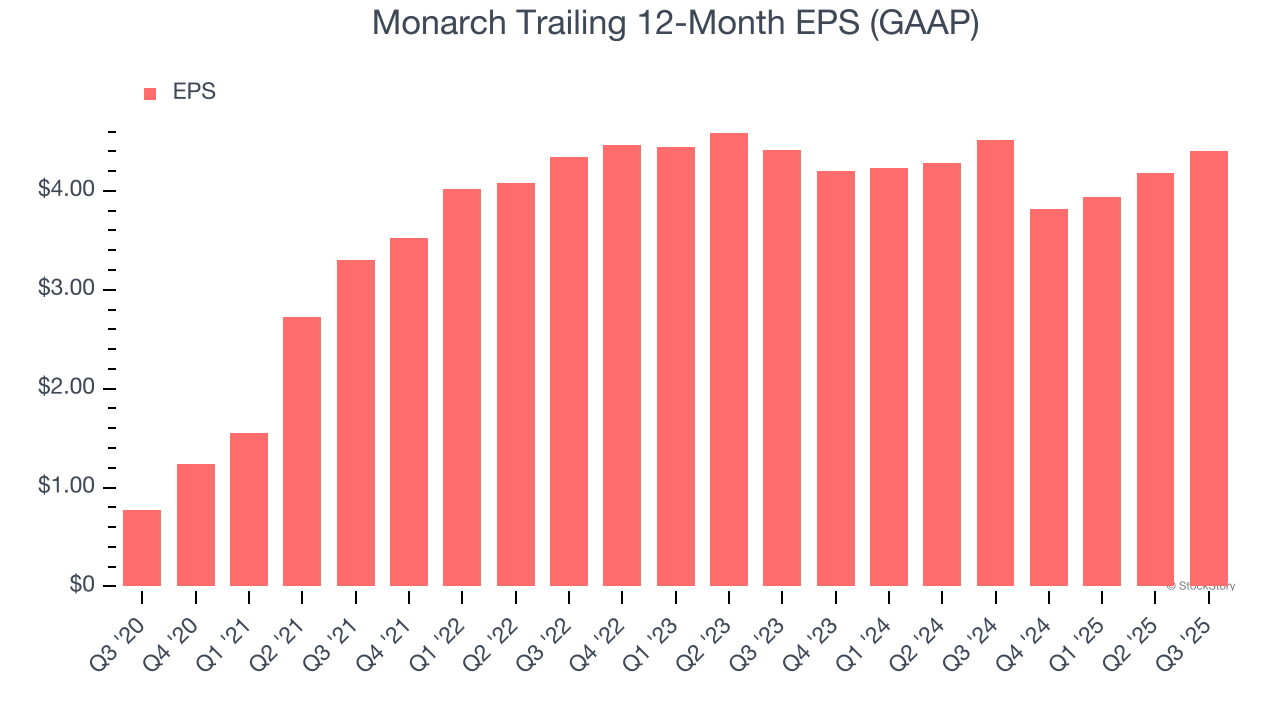

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Monarch’s EPS grew at an astounding 41.7% compounded annual growth rate over the last five years, higher than its 23.5% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

In Q3, Monarch reported EPS of $1.69, up from $1.47 in the same quarter last year. This print beat analysts’ estimates by 7.4%. Over the next 12 months, Wall Street expects Monarch’s full-year EPS of $4.40 to grow 27.3%.

Key Takeaways from Monarch’s Q3 Results

It was good to see Monarch beat analysts’ EPS expectations this quarter. On the other hand, its revenue missed. Overall, this was a mixed quarter. The stock remained flat at $98 immediately following the results.

Is Monarch an attractive investment opportunity at the current price? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.

More News

View More

Recent Quotes

View MoreQuotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.