Financial News

1 Industrials Stock with Exciting Potential and 2 That Underwhelm

Even if they go mostly unnoticed, industrial businesses are the backbone of our country. But their prominence also brings high exposure to the ups and downs of economic cycles. Luckily, the tide is turning in their favor as the industry’s 26.8% return over the past six months has topped the S&P 500 by 8.4 percentage points.

Although these companies have produced results lately, a cautious approach is imperative. When the cycle naturally turns, the losers can be left for dead while the winners consolidate and take more of the market. Keeping that in mind, here is one industrials stock poised to generate sustainable market-beating returns and two we’re steering clear of.

Two Industrials Stocks to Sell:

Mercury Systems (MRCY)

Market Cap: $4.87 billion

Founded in 1981, Mercury Systems (NASDAQ: MRCY) specializes in providing processing subsystems and components for primarily defense applications.

Why Do We Pass on MRCY?

- Core business is underperforming as its organic revenue has disappointed over the past two years, suggesting it might need acquisitions to stimulate growth

- Issuance of new shares over the last five years caused its earnings per share to fall by 22.5% annually while its revenue grew

- Diminishing returns on capital from an already low starting point show that neither management’s prior nor current bets are going as planned

At $81.61 per share, Mercury Systems trades at 88.9x forward P/E. To fully understand why you should be careful with MRCY, check out our full research report (it’s free).

Commercial Vehicle Group (CVGI)

Market Cap: $60.76 million

Formed from a partnership between two distinct companies, CVG (NASDAQ: CVGI) offers various components used in vehicles and systems used in warehouses.

Why Should You Sell CVGI?

- Annual sales declines of 1.5% for the past five years show its products and services struggled to connect with the market during this cycle

- Eroding returns on capital from an already low base indicate that management’s recent investments are destroying value

- Depletion of cash reserves could lead to a fundraising event that triggers shareholder dilution

Commercial Vehicle Group’s stock price of $1.76 implies a valuation ratio of 26.6x forward P/E. Read our free research report to see why you should think twice about including CVGI in your portfolio.

One Industrials Stock to Buy:

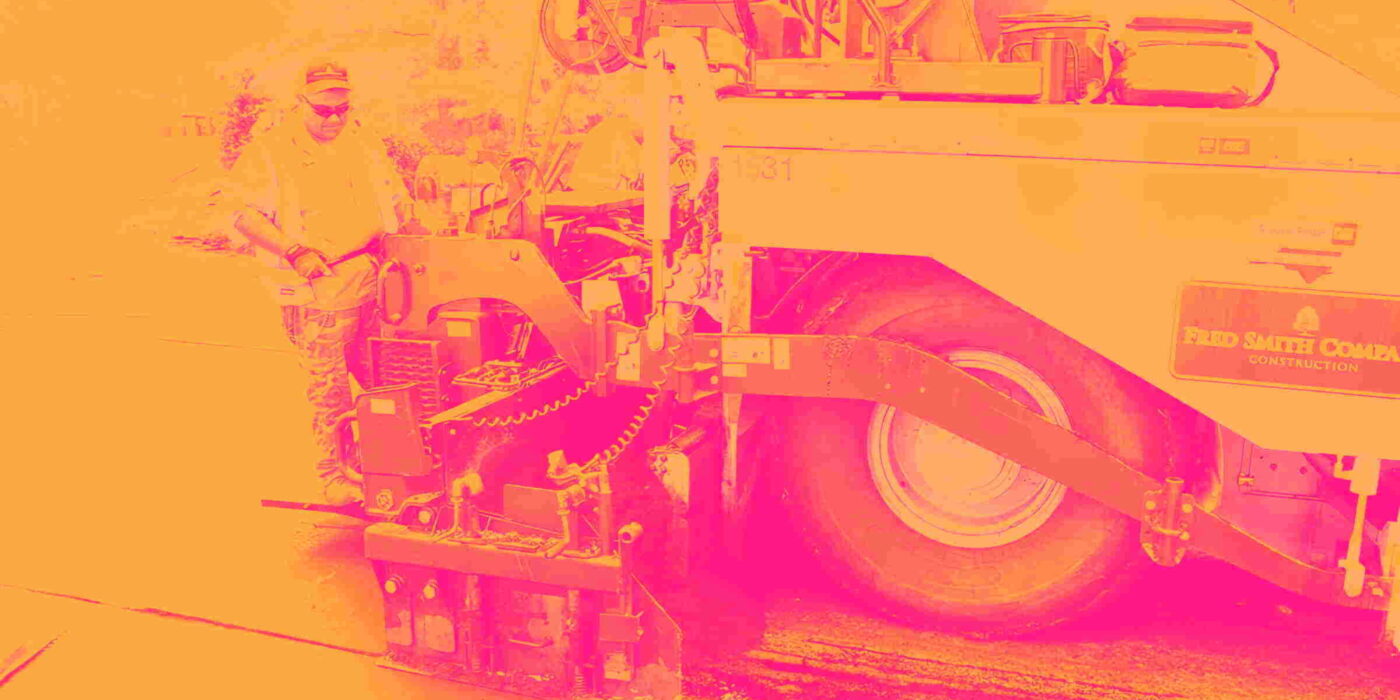

Construction Partners (ROAD)

Market Cap: $7.00 billion

Founded in 2001, Construction Partners (NASDAQ: ROAD) is a civil infrastructure company that builds and maintains roads, highways, and other infrastructure projects.

Why Is ROAD a Good Business?

- Market share will likely rise over the next 12 months as its expected revenue growth of 30% is robust

- Incremental sales over the last two years have been highly profitable as its earnings per share increased by 70.6% annually, topping its revenue gains

- Free cash flow margin increased by 5.1 percentage points over the last five years, giving the company more capital to invest or return to shareholders

Construction Partners is trading at $123.93 per share, or 46.2x forward P/E. Is now a good time to buy? See for yourself in our in-depth research report, it’s free.

High-Quality Stocks for All Market Conditions

When Trump unveiled his aggressive tariff plan in April 2025, markets tanked as investors feared a full-blown trade war. But those who panicked and sold missed the subsequent rebound that’s already erased most losses.

Don’t let fear keep you from great opportunities and take a look at Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today for free. Find your next big winner with StockStory today. Find your next big winner with StockStory today

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.

More News

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the following

Privacy Policy and Terms Of Service.