Financial News

Apparel and Accessories Stocks Q2 Recap: Benchmarking ThredUp (NASDAQ:TDUP)

Quarterly earnings results are a good time to check in on a company’s progress, especially compared to its peers in the same sector. Today we are looking at ThredUp (NASDAQ: TDUP) and the best and worst performers in the apparel and accessories industry.

Thanks to social media and the internet, not only are styles changing more frequently today than in decades past but also consumers are shifting the way they buy their goods, favoring omnichannel and e-commerce experiences. Some apparel and accessories companies have made concerted efforts to adapt while those who are slower to move may fall behind.

The 17 apparel and accessories stocks we track reported a strong Q2. As a group, revenues beat analysts’ consensus estimates by 2.9% while next quarter’s revenue guidance was 13% below.

While some apparel and accessories stocks have fared somewhat better than others, they have collectively declined. On average, share prices are down 2.3% since the latest earnings results.

ThredUp (NASDAQ: TDUP)

Founded to revolutionize thrifting, ThredUp (NASDAQ: TDUP) is a leading online fashion resale marketplace offering a wide selection of gently-used clothing and accessories.

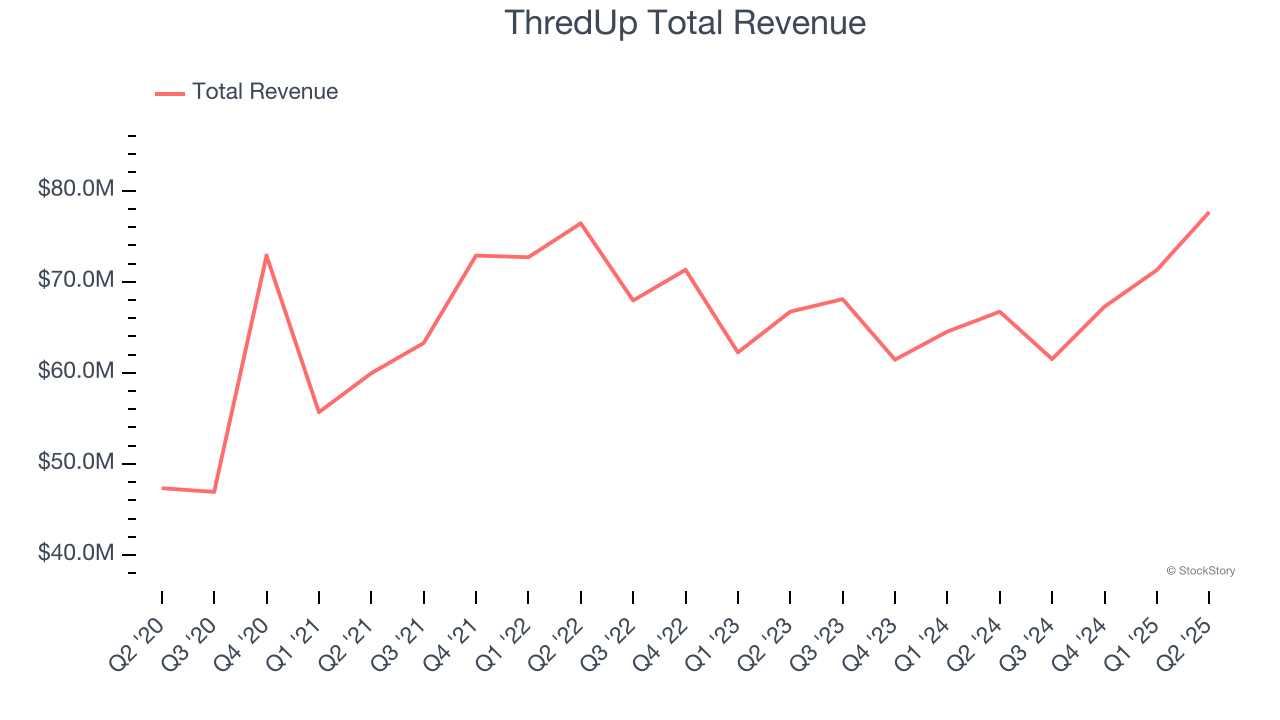

ThredUp reported revenues of $77.66 million, up 16.4% year on year. This print exceeded analysts’ expectations by 4%. Overall, it was a stunning quarter for the company with a solid beat of analysts’ EBITDA estimates.

“Driven by strong customer and order growth, we are extremely pleased with our second quarter performance,” said ThredUp CEO and co-founder James Reinhart.

ThredUp pulled off the fastest revenue growth of the whole group. Investor expectations, however, were likely higher than Wall Street’s published projections, leaving some wishing for even better results (analysts’ consensus estimates are those published by big banks and advisory firms, not the investors who make buy and sell decisions). The stock is down 11.1% since reporting and currently trades at $8.63.

Is now the time to buy ThredUp? Access our full analysis of the earnings results here, it’s free for active Edge members.

Best Q2: Figs (NYSE: FIGS)

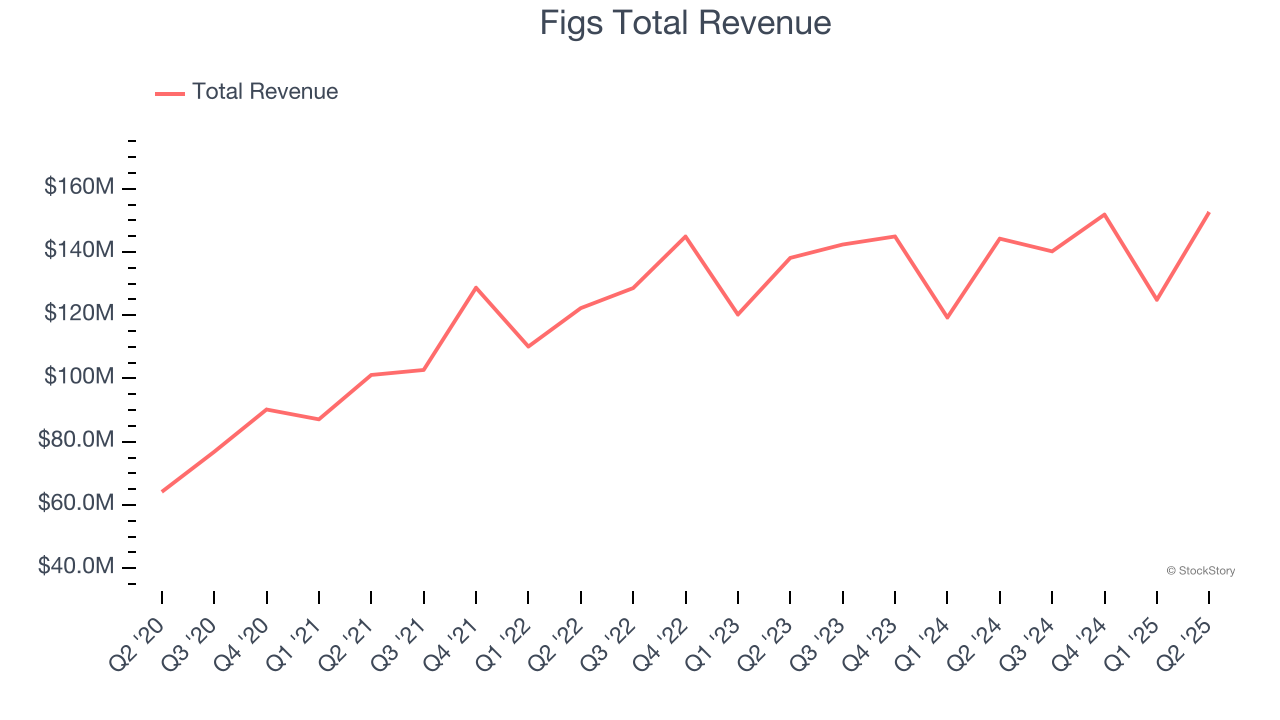

Rising to fame via TikTok and founded in 2013 by Heather Hasson and Trina Spear, Figs (NYSE: FIGS) is a healthcare apparel company known for its stylish approach to medical attire and uniforms.

Figs reported revenues of $152.6 million, up 5.8% year on year, outperforming analysts’ expectations by 5.5%. The business had a stunning quarter with a beat of analysts’ EPS and EBITDA estimates.

The market seems happy with the results as the stock is up 5.2% since reporting. It currently trades at $6.90.

Is now the time to buy Figs? Access our full analysis of the earnings results here, it’s free for active Edge members.

Weakest Q2: Carter's (NYSE: CRI)

Rumored to sell more than 10 products for every child born in the United States, Carter's (NYSE: CRI) is an American designer and marketer of children's apparel.

Carter's reported revenues of $585.3 million, up 3.7% year on year, exceeding analysts’ expectations by 3.4%. Still, it was a softer quarter as it posted a significant miss of analysts’ adjusted operating income estimates.

As expected, the stock is down 16.1% since the results and currently trades at $27.46.

Read our full analysis of Carter’s results here.

VF Corp (NYSE: VFC)

Owner of The North Face, Vans, and Supreme, VF Corp (NYSE: VFC) is a clothing conglomerate specializing in branded lifestyle apparel, footwear, and accessories.

VF Corp reported revenues of $1.76 billion, down 3.9% year on year. This print beat analysts’ expectations by 3.6%. It was a stunning quarter as it also put up an impressive beat of analysts’ EBITDA estimates.

The stock is up 7% since reporting and currently trades at $13.30.

Read our full, actionable report on VF Corp here, it’s free for active Edge members.

Tapestry (NYSE: TPR)

Originally founded as Coach, Tapestry (NYSE: TPR) is an American fashion conglomerate with a portfolio of luxury brands offering high-quality accessories and fashion products.

Tapestry reported revenues of $1.72 billion, up 8.3% year on year. This result surpassed analysts’ expectations by 2.6%. Aside from that, it was a mixed quarter as it also recorded a solid beat of analysts’ constant currency revenue estimates but a significant miss of analysts’ EPS estimates.

Tapestry had the weakest full-year guidance update among its peers. The stock is down 6.7% since reporting and currently trades at $106.

Read our full, actionable report on Tapestry here, it’s free for active Edge members.

Market Update

As a result of the Fed’s rate hikes in 2022 and 2023, inflation has come down from frothy levels post-pandemic. The general rise in the price of goods and services is trending towards the Fed’s 2% goal as of late, which is good news. The higher rates that fought inflation also didn't slow economic activity enough to catalyze a recession. So far, soft landing. This, combined with recent rate cuts (half a percent in September 2024 and a quarter percent in November 2024) have led to strong stock market performance in 2024. The icing on the cake for 2024 returns was Donald Trump’s victory in the U.S. Presidential Election in early November, sending major indices to all-time highs in the week following the election. Still, debates around the health of the economy and the impact of potential tariffs and corporate tax cuts remain, leaving much uncertainty around 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Hidden Gem Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.

More News

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the following

Privacy Policy and Terms Of Service.