Financial News

3M’s (NYSE:MMM) Q4: Beats On Revenue

Industrial conglomerate 3M (NYSE: MMM) beat Wall Street’s revenue expectations in Q4 CY2024, with sales up 5.8% year on year to $6.01 billion. Its non-GAAP profit of $1.68 per share was 9.3% above analysts’ consensus estimates.

Is now the time to buy 3M? Find out by accessing our full research report, it’s free.

3M (MMM) Q4 CY2024 Highlights:

- Revenue: $6.01 billion vs analyst estimates of $5.85 billion (5.8% year-on-year growth, 2.7% beat)

- Adjusted EPS: $1.68 vs analyst estimates of $1.54 (9.3% beat)

- Adjusted EBITDA: $1.42 billion vs analyst estimates of $1.50 billion (23.6% margin, 5% miss)

- Adjusted EPS guidance for the upcoming financial year 2025 is $7.75 at the midpoint, missing analyst estimates by 0.7%

- Operating Margin: 18.1%, down from 21.9% in the same quarter last year

- Free Cash Flow Margin: 25.4%, down from 34.4% in the same quarter last year

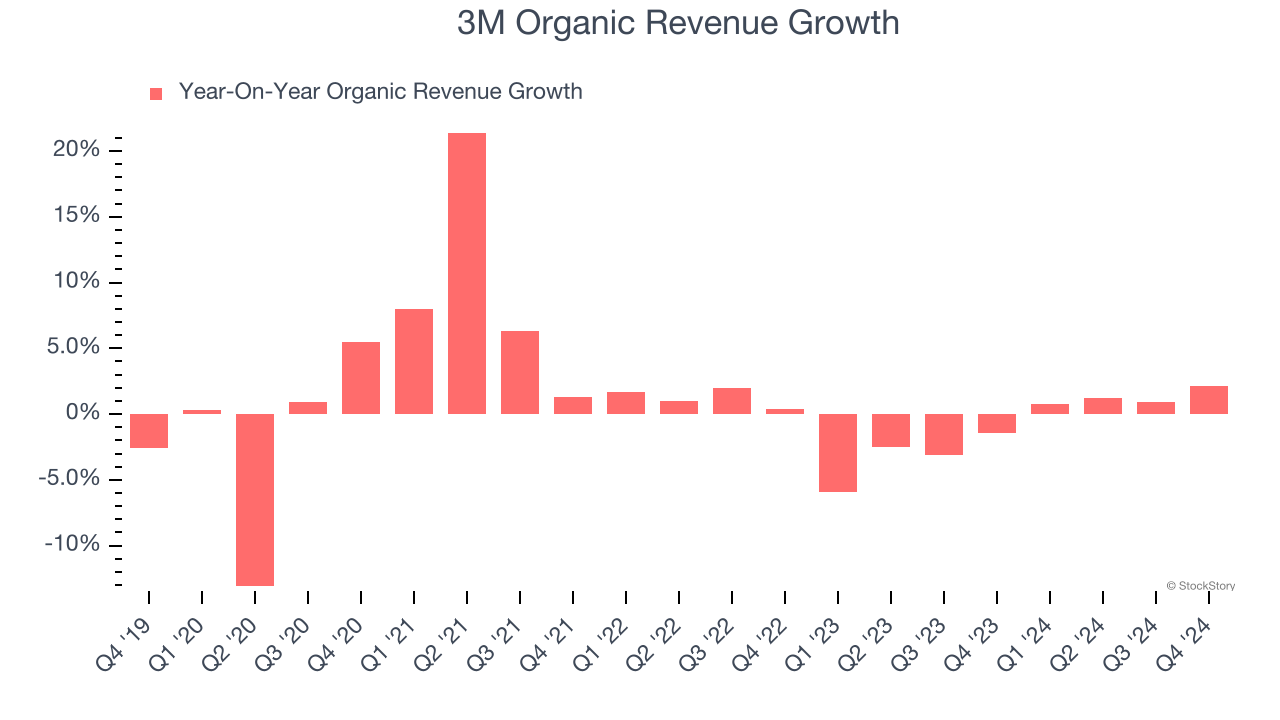

- Organic Revenue rose 2.1% year on year (-1.4% in the same quarter last year)

- Market Capitalization: $76.8 billion

Company Overview

Producers of the first asthma inhaler, 3M Company (NYSE: MMM) is a global conglomerate known for products in industries like healthcare, safety, electronics, and consumer goods.

General Industrial Machinery

Automation that increases efficiency and connected equipment that collects analyzable data have been trending, creating new demand for general industrial machinery companies. Those who innovate and create digitized solutions can spur sales and speed up replacement cycles, but all general industrial machinery companies are still at the whim of economic cycles. Consumer spending and interest rates, for example, can greatly impact the industrial production that drives demand for these companies’ offerings.

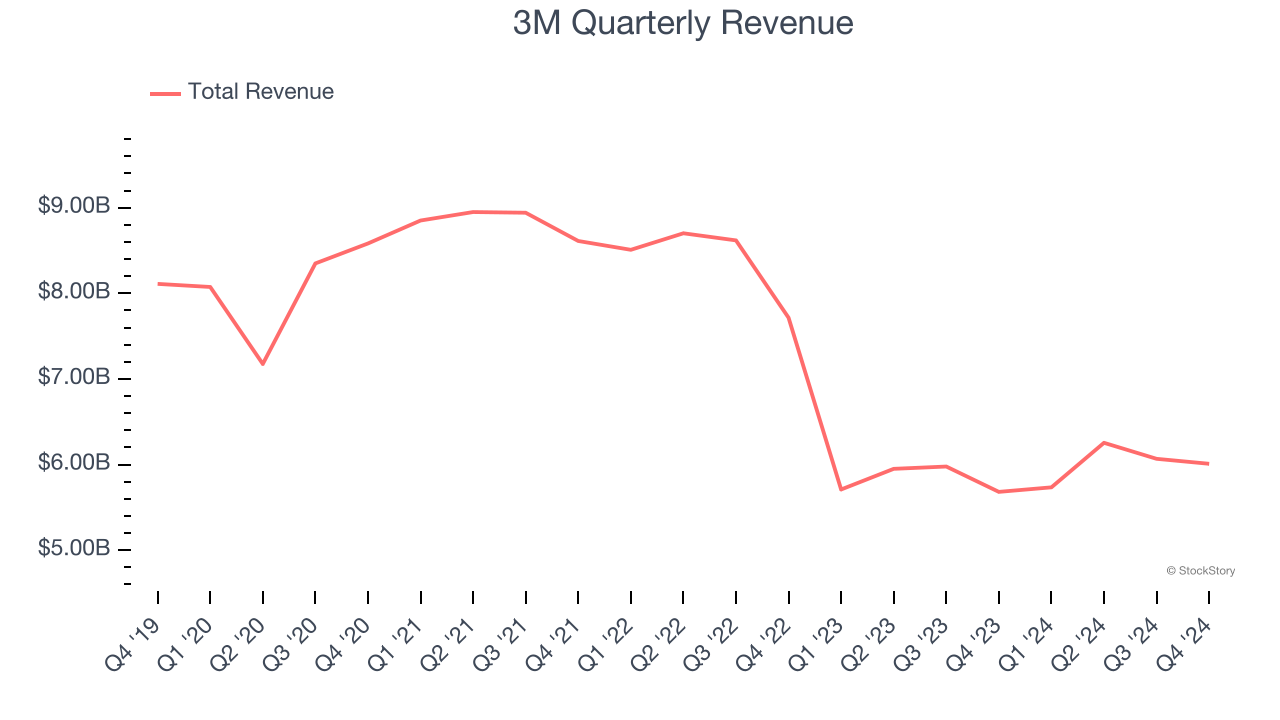

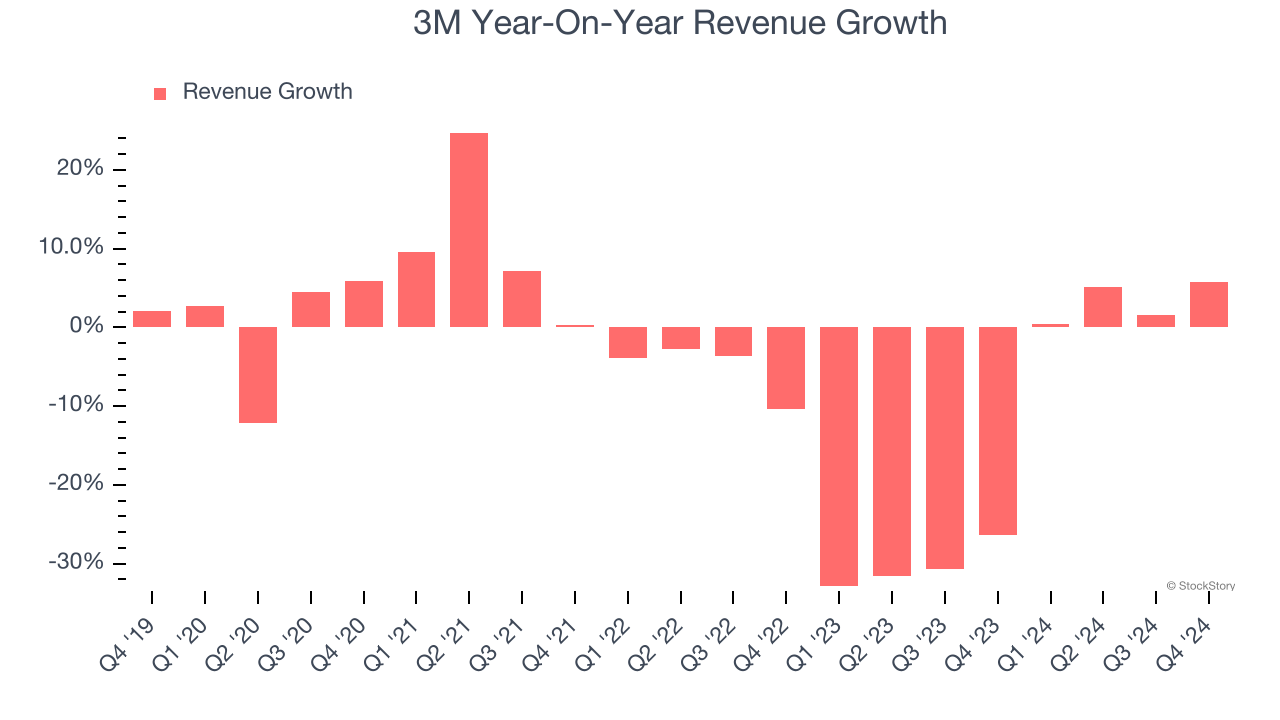

Sales Growth

A company’s long-term performance is an indicator of its overall quality. While any business can experience short-term success, top-performing ones enjoy sustained growth for years. 3M’s demand was weak over the last five years as its sales fell at a 5.6% annual rate. This was below our standards and signals it’s a low quality business.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. 3M’s recent history shows its demand has stayed suppressed as its revenue has declined by 15.3% annually over the last two years. 3M isn’t alone in its struggles as the General Industrial Machinery industry experienced a cyclical downturn, with many similar businesses observing lower sales at this time.

We can better understand the company’s sales dynamics by analyzing its organic revenue, which strips out one-time events like acquisitions and currency fluctuations because they don’t accurately reflect its fundamentals. Over the last two years, 3M’s organic revenue was flat. Because this number is better than its normal revenue growth, we can see that some mixture of divestitures and foreign exchange rates dampened its headline results.

This quarter, 3M reported year-on-year revenue growth of 5.8%, and its $6.01 billion of revenue exceeded Wall Street’s estimates by 2.7%.

Looking ahead, sell-side analysts expect revenue to remain flat over the next 12 months. Although this projection suggests its newer products and services will catalyze better top-line performance, it is still below average for the sector.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses–everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

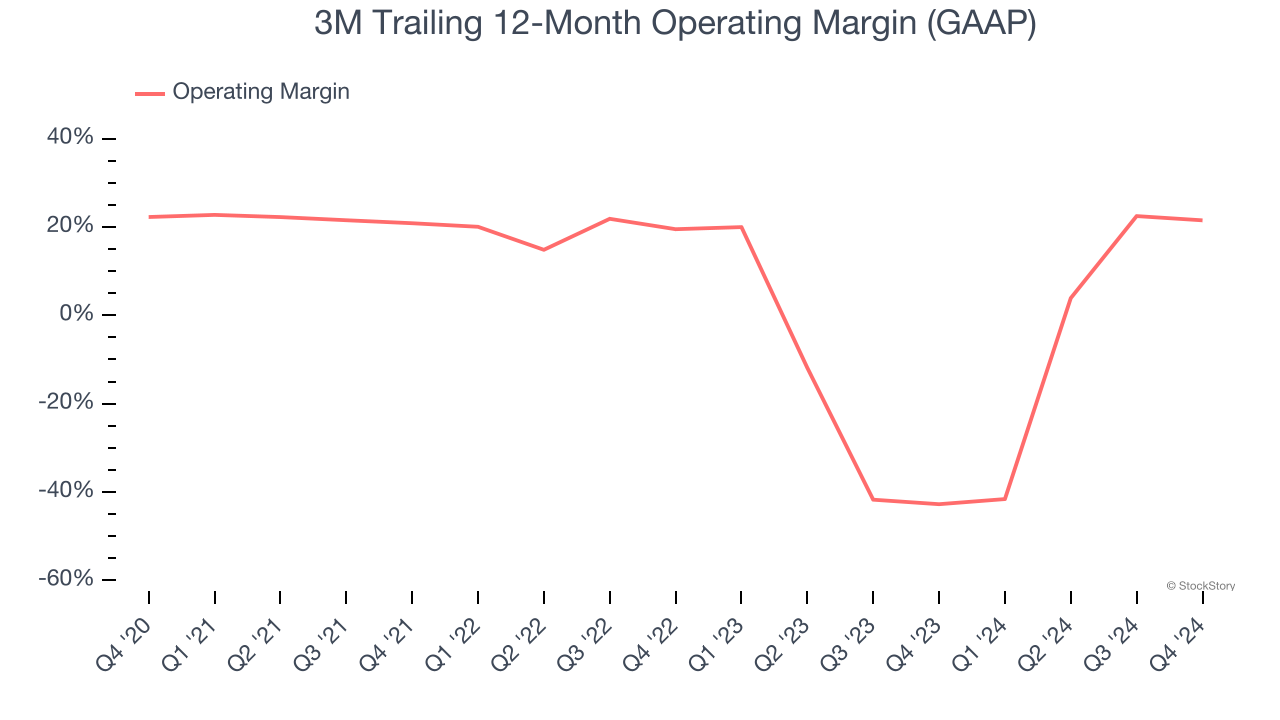

3M has managed its cost base well over the last five years. It demonstrated solid profitability for an industrials business, producing an average operating margin of 11%. This result isn’t surprising as its high gross margin gives it a favorable starting point.

Looking at the trend in its profitability, 3M’s operating margin might have seen some fluctuations but has generally stayed the same over the last five years, highlighting the long-term consistency of its business.

This quarter, 3M generated an operating profit margin of 18.1%, down 3.8 percentage points year on year. Conversely, its revenue and gross margin actually rose, so we can assume it was recently less efficient because its operating expenses like marketing, R&D, and administrative overhead grew faster than its revenue.

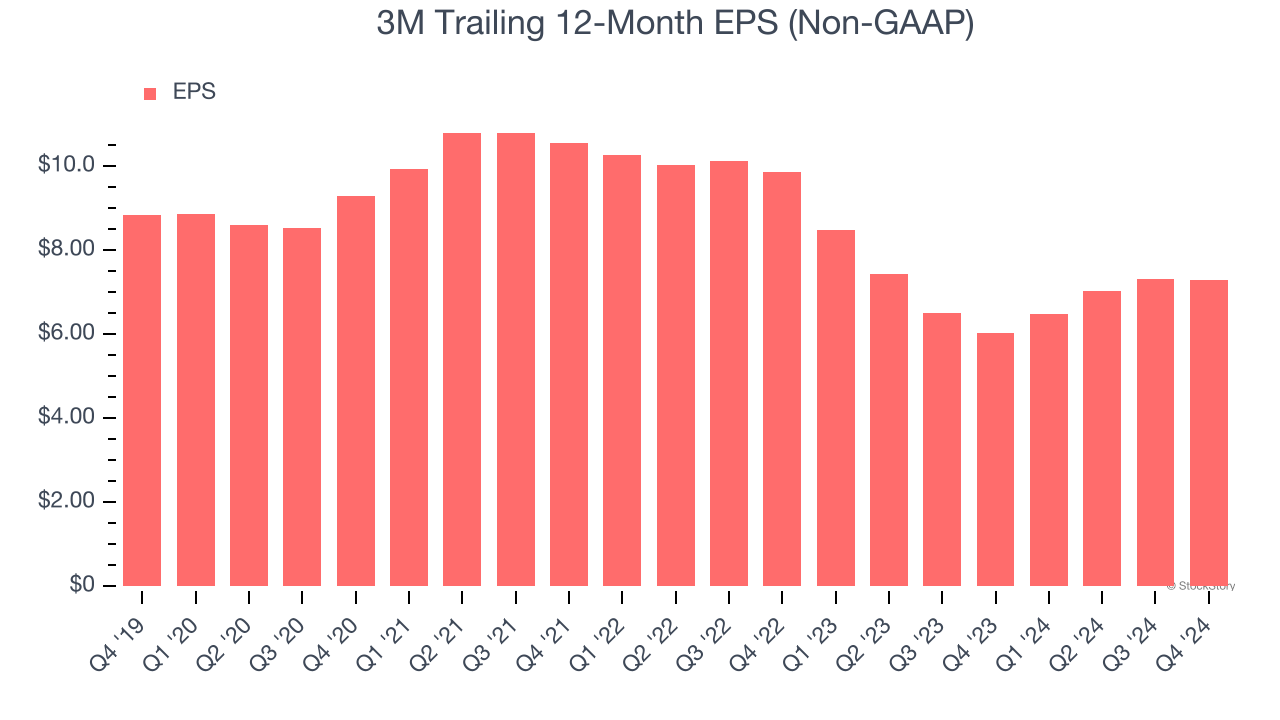

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

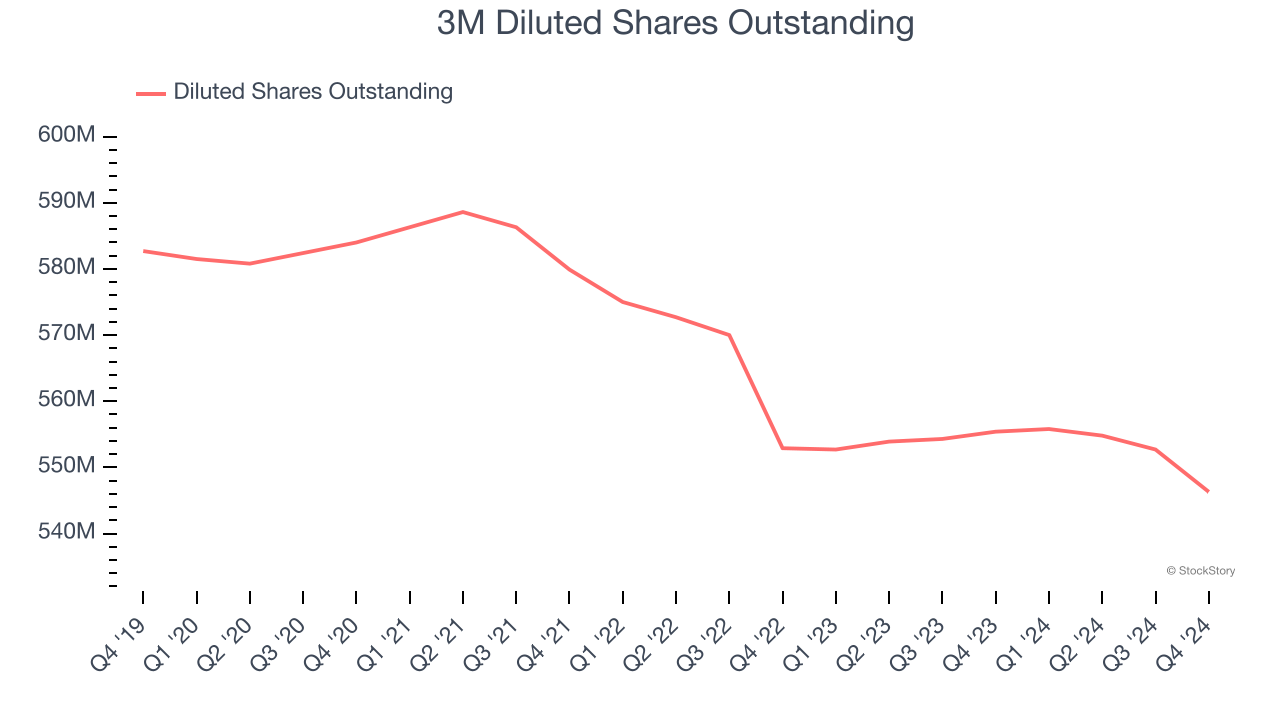

Sadly for 3M, its EPS and revenue declined by 3.8% and 5.6% annually over the last five years. We tend to steer our readers away from companies with falling revenue and EPS, where diminishing earnings could imply changing secular trends and preferences. If the tide turns unexpectedly, 3M’s low margin of safety could leave its stock price susceptible to large downswings.

A five-year view shows that 3M has repurchased its stock, shrinking its share count by 6.2%. This tells us its EPS outperformed its revenue not because of increased operational efficiency but financial engineering, as buybacks boost per share earnings.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For 3M, its two-year annual EPS declines of 14% show it’s continued to underperform. These results were bad no matter how you slice the data.

In Q4, 3M reported EPS at $1.68, down from $1.70 in the same quarter last year. Despite falling year on year, this print beat analysts’ estimates by 9.3%. Over the next 12 months, Wall Street expects 3M’s full-year EPS of $7.29 to grow 4.7%.

Key Takeaways from 3M’s Q4 Results

We enjoyed seeing 3M exceed analysts’ revenue and EPS expectations this quarter. On the other hand, its full-year EPS guidance fell slightly short of Wall Street’s estimates. Zooming out, we think this was a decent quarter featuring some areas of strength but also some blemishes. The stock traded up 2.8% to $145.01 immediately following the results.

Is 3M an attractive investment opportunity at the current price? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.