Financial News

Unpacking Q3 Earnings: Qorvo (NASDAQ:QRVO) In The Context Of Other Processors and Graphics Chips Stocks

Let’s dig into the relative performance of Qorvo (NASDAQ: QRVO) and its peers as we unravel the now-completed Q3 processors and graphics chips earnings season.

The biggest demand drivers for processors (CPUs) and graphics chips at the moment are secular trends related to 5G and Internet of Things, autonomous driving, and high performance computing in the data center space, specifically around AI and machine learning. Like all semiconductor companies, digital chip makers exhibit a degree of cyclicality, driven by supply and demand imbalances and exposure to PC and Smartphone product cycles.

The 8 processors and graphics chips stocks we track reported a mixed Q3. As a group, revenues beat analysts’ consensus estimates by 1.3% while next quarter’s revenue guidance was 5% below.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 5.9% since the latest earnings results.

Qorvo (NASDAQ: QRVO)

Formed by the merger of TriQuint and RF Micro Devices, Qorvo (NASDAQ: QRVO) is a designer and manufacturer of RF chips used in almost all smartphones globally, along with a variety of chips used in networking equipment and infrastructure.

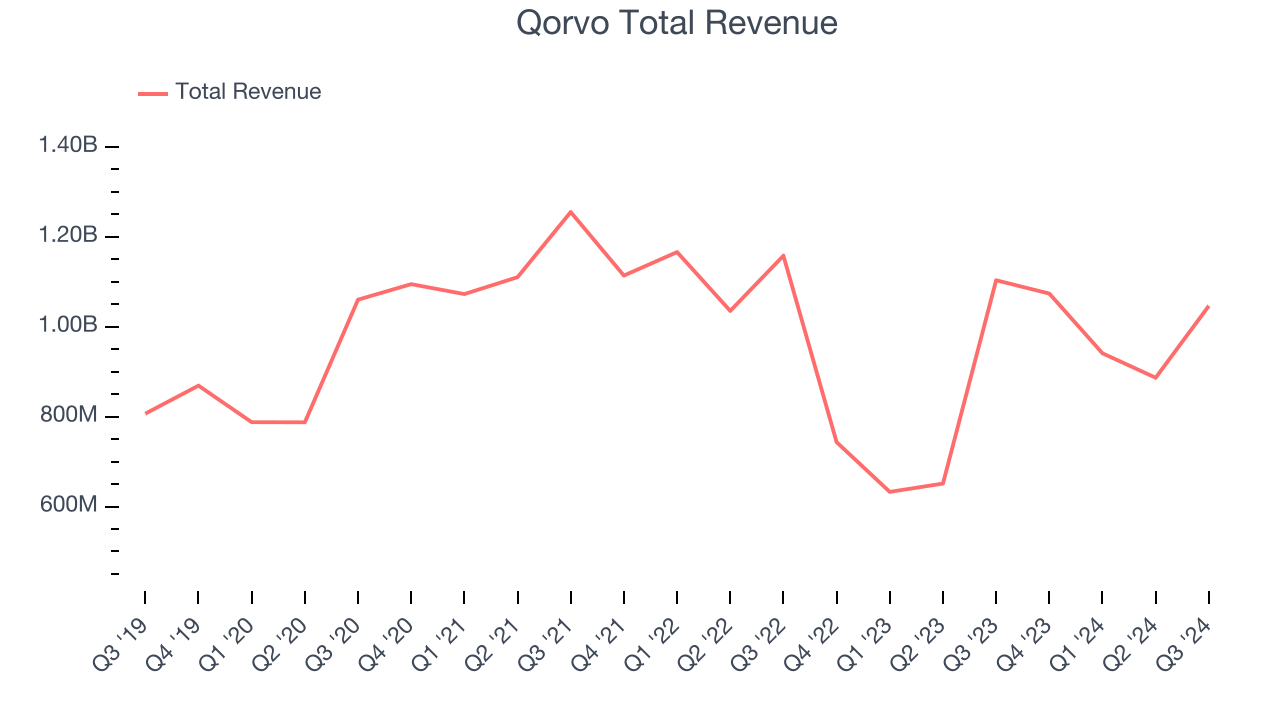

Qorvo reported revenues of $1.05 billion, down 5.2% year on year. This print exceeded analysts’ expectations by 1.8%. Overall, it was a satisfactory quarter for the company with a solid beat of analysts’ adjusted operating income estimates but revenue guidance for next quarter missing analysts’ expectations significantly.

Bob Bruggeworth, president and chief executive officer of Qorvo, said, “In the September quarter, ACG successfully supported our largest customer’s seasonal smartphone ramp. In HPA, we expanded our D&A business while building a broad-based business in power management. In CSG, we maintained our leadership in Wi-Fi applications while investing to grow in diverse businesses including automotive solutions and SoCs for ultra-wideband and Matter. HPA and CSG are on pace to achieve mid-teen year-over-year growth in fiscal 2025.”

Unsurprisingly, the stock is down 31.4% since reporting and currently trades at $69.

Is now the time to buy Qorvo? Access our full analysis of the earnings results here, it’s free.

Best Q3: Nvidia (NASDAQ: NVDA)

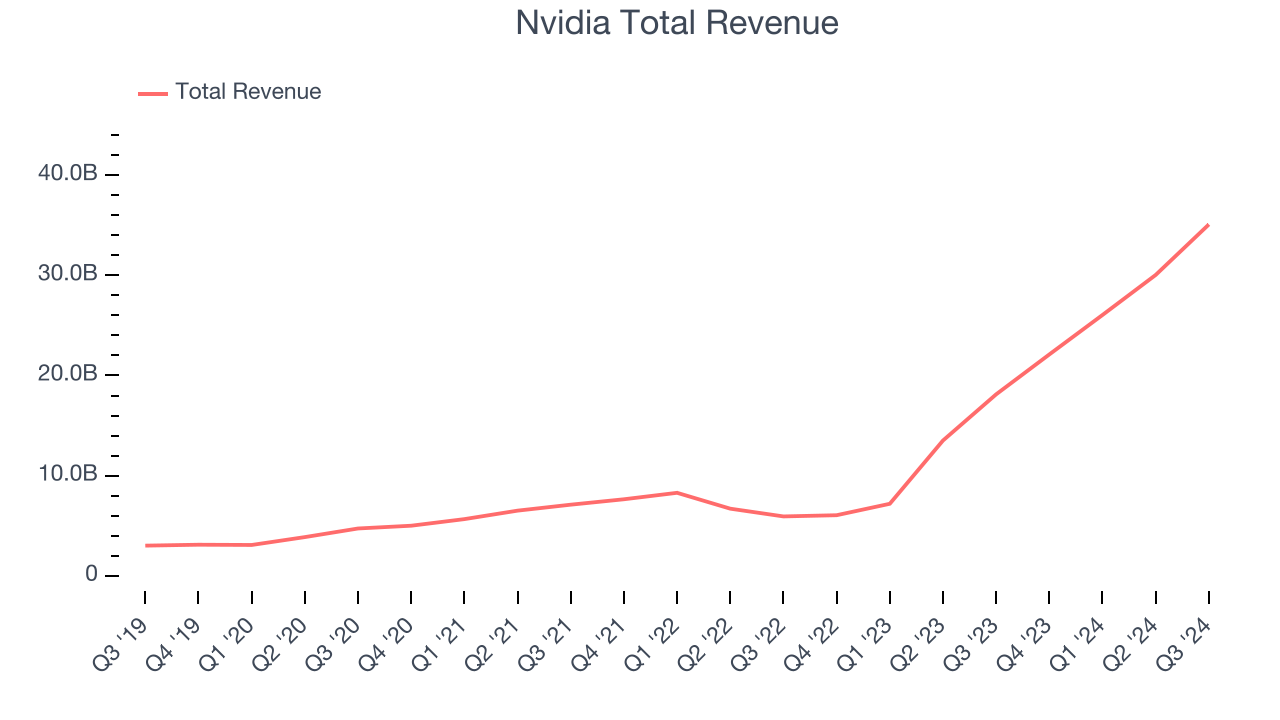

Founded in 1993 by Jensen Huang and two former Sun Microsystems engineers, Nvidia (NASDAQ: NVDA) is a leading fabless designer of chips used in gaming, PCs, data centers, automotive, and a variety of end markets.

Nvidia reported revenues of $35.08 billion, up 93.6% year on year, outperforming analysts’ expectations by 5.9%. The business had an exceptional quarter with an impressive beat of analysts’ EPS estimates and a solid beat of analysts’ adjusted operating income estimates.

Nvidia delivered the biggest analyst estimates beat and fastest revenue growth among its peers. Although it had a fine quarter compared its peers, the market seems unhappy with the results as the stock is down 6.4% since reporting. It currently trades at $136.62.

Is now the time to buy Nvidia? Access our full analysis of the earnings results here, it’s free.

Weakest Q3: SMART (NASDAQ: SGH)

Based in the US, SMART Global Holdings (NASDAQ: SGH) is a diversified semiconductor company offering memory, digital, and LED products.

SMART reported revenues of $311.1 million, down 1.7% year on year, falling short of analysts’ expectations by 4.3%. It was a disappointing quarter as it posted a significant miss of analysts’ adjusted operating income and EPS estimates.

SMART delivered the weakest performance against analyst estimates in the group. The stock is flat since the results and currently trades at $21.

Read our full analysis of SMART’s results here.

Allegro MicroSystems (NASDAQ: ALGM)

The result of a spinoff from Sanken in Japan, Allegro MicroSystems (NASDAQ: ALGM) is a designer of power management chips and distance sensors used in electric vehicles and data centers.

Allegro MicroSystems reported revenues of $187.4 million, down 32% year on year. This result met analysts’ expectations. Zooming out, it was a slower quarter as it logged revenue guidance for next quarter missing analysts’ expectations.

The stock is down 2.2% since reporting and currently trades at $21.73.

Read our full, actionable report on Allegro MicroSystems here, it’s free.

AMD (NASDAQ: AMD)

Founded in 1969 by a group of former Fairchild semiconductor executives led by Jerry Sanders, Advanced Micro Devices or AMD (NASDAQ: AMD) is one of the leading designers of computer processors and graphics chips used in PCs and data centers.

AMD reported revenues of $6.82 billion, up 17.6% year on year. This print beat analysts’ expectations by 1.6%. More broadly, it was a mixed quarter as it also logged a significant improvement in its inventory levels but revenue guidance for next quarter slightly missing analysts’ expectations.

The stock is down 17.2% since reporting and currently trades at $137.65.

Read our full, actionable report on AMD here, it’s free.

Market Update

Thanks to the Fed's series of rate hikes in 2022 and 2023, inflation has cooled significantly from its post-pandemic highs, drawing closer to the 2% goal. This disinflation has occurred without severely impacting economic growth, suggesting the success of a soft landing. The stock market has thrived in 2024, spurred by recent rate cuts (0.5% in September and 0.25% in November), and a notable surge followed Donald Trump’s presidential election win in November, propelling indices to historic highs. Nonetheless, the outlook for 2025 remains clouded by potential trade policy changes and corporate tax discussions, which could impact business confidence and growth. The path forward holds both optimism and caution as new policies take shape.

Want to invest in winners with rock-solid fundamentals? Check out our Top 6 Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

More News

View More

Recent Quotes

View MoreQuotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.