Financial News

Spotting Winners: J&J Snack Foods (NASDAQ:JJSF) And Shelf-Stable Food Stocks In Q3

As the Q3 earnings season wraps, let’s dig into this quarter’s best and worst performers in the shelf-stable food industry, including J&J Snack Foods (NASDAQ: JJSF) and its peers.

As America industrialized and moved away from an agricultural economy, people faced more demands on their time. Packaged foods emerged as a solution offering convenience to the evolving American family, whether it be canned goods or snacks. Today, Americans seek brands that are high in quality, reliable, and reasonably priced. Furthermore, there's a growing emphasis on health-conscious and sustainable food options. Packaged food stocks are considered resilient investments. People always need to eat, so these companies can enjoy consistent demand as long as they stay on top of changing consumer preferences. The industry spans from multinational corporations to smaller specialized firms and is subject to food safety and labeling regulations.

The 20 shelf-stable food stocks we track reported a mixed Q3. As a group, revenues were in line with analysts’ consensus estimates while next quarter’s revenue guidance was 5.7% below.

In light of this news, share prices of the companies have held steady. On average, they are relatively unchanged since the latest earnings results.

Weakest Q3: J&J Snack Foods (NASDAQ: JJSF)

Best known for its SuperPretzel soft pretzels and ICEE frozen drinks, J&J Snack Foods (NASDAQ: JJSF) produces a range of snacks and beverages and distributes them primarily to supermarket and food service customers.

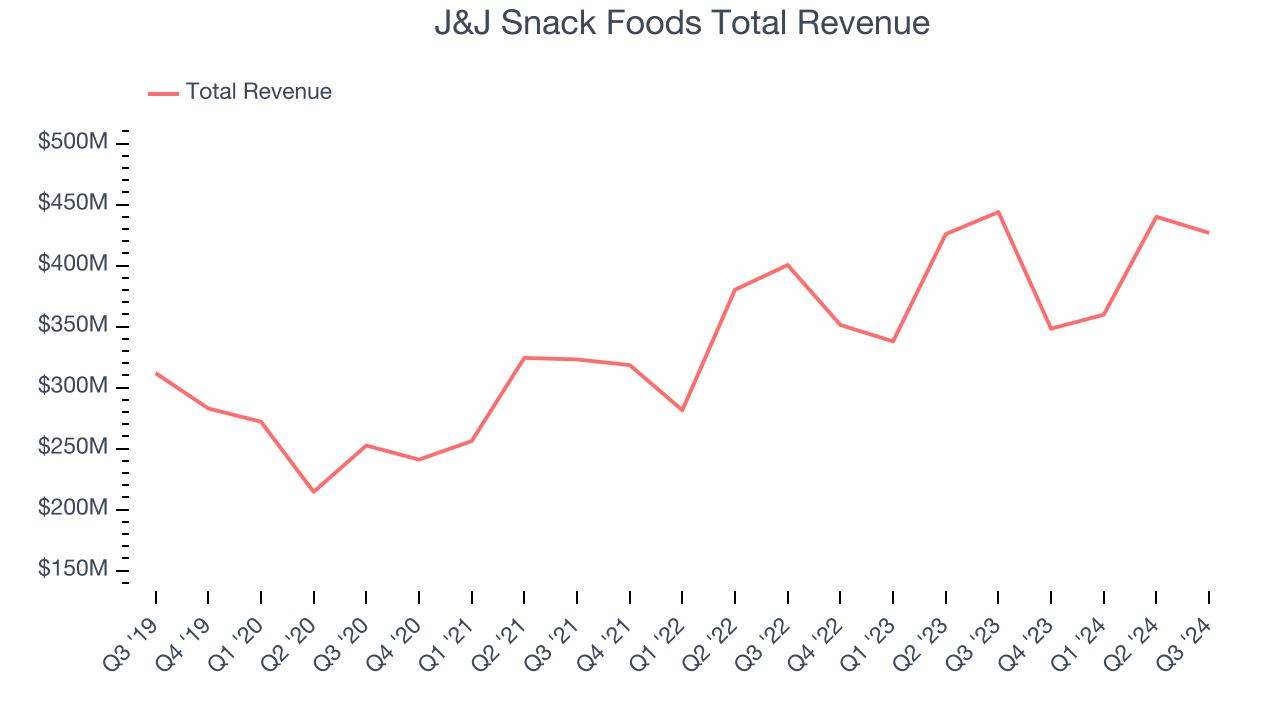

J&J Snack Foods reported revenues of $426.8 million, down 3.9% year on year. This print was in line with analysts’ expectations, but overall, it was a disappointing quarter for the company with a significant miss of analysts’ EBITDA and gross margin estimates.

“J&J Snack Foods delivered another year of strong financial performance in fiscal 2024,” stated Dan Fachner, J&J Snack Foods Chairman, President, and CEO.

Unsurprisingly, the stock is down 3.6% since reporting and currently trades at $167.16.

Read our full report on J&J Snack Foods here, it’s free.

Best Q3: Kellanova (NYSE: K)

With Corn Flakes as its first and most iconic product, Kellanova (NYSE: K) is a packaged foods company that is dominant in the cereal and snack categories.

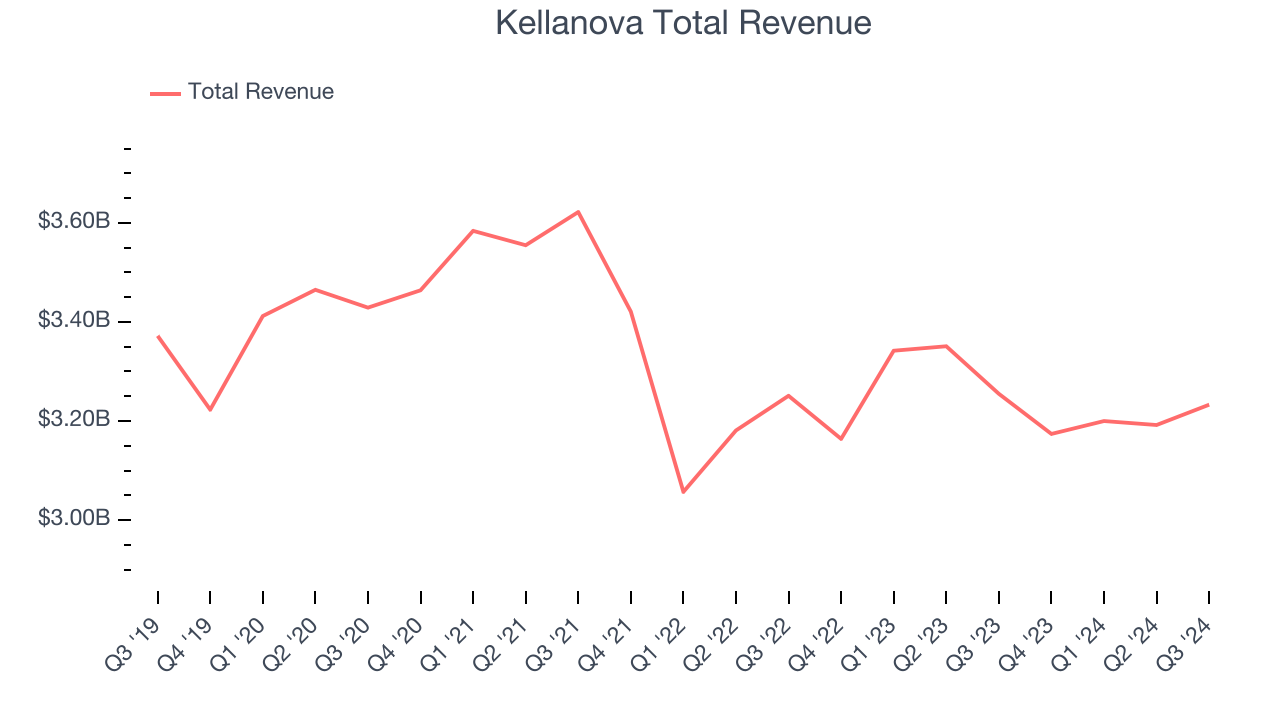

Kellanova reported revenues of $3.23 billion, flat year on year, outperforming analysts’ expectations by 2.5%. The business had a satisfactory quarter with a solid beat of analysts’ organic revenue estimates but a miss of analysts’ EBITDA estimates.

However, the results were likely priced into the stock as it’s traded sideways since reporting. Shares currently sit at $80.73.

Is now the time to buy Kellanova? Access our full analysis of the earnings results here, it’s free.

TreeHouse Foods (NYSE: THS)

Whether it be packaged crackers, broths, or beverages, Treehouse Foods (NYSE: THS) produces a wide range of private-label foods for grocery and food service customers.

TreeHouse Foods reported revenues of $854.4 million, down 1% year on year, falling short of analysts’ expectations by 2.9%. It was a softer quarter as it posted a significant miss of analysts’ organic revenue and gross margin estimates.

TreeHouse Foods delivered the weakest performance against analyst estimates and weakest full-year guidance update in the group. As expected, the stock is down 8.5% since the results and currently trades at $34.04.

Read our full analysis of TreeHouse Foods’s results here.

Lancaster Colony (NASDAQ: LANC)

Known for its frozen garlic bread and Parkerhouse rolls, Lancaster Colony (NASDAQ: LANC) sells bread, dressing, and dips to the retail and food service channels.

Lancaster Colony reported revenues of $466.6 million, up 1.1% year on year. This number was in line with analysts’ expectations. More broadly, it was a slower quarter as it recorded a miss of analysts’ EBITDA and EPS estimates.

The stock is up 5.3% since reporting and currently trades at $194.42.

Read our full, actionable report on Lancaster Colony here, it’s free.

Kraft Heinz (NASDAQ: KHC)

The result of a 2015 mega-merger between Kraft and Heinz, Kraft Heinz (NASDAQ: KHC) is a packaged foods giant whose products span coffee to cheese to packaged meat.

Kraft Heinz reported revenues of $6.38 billion, down 2.8% year on year. This number missed analysts’ expectations by 0.6%. More broadly, it was a mixed quarter as it also produced full-year EPS guidance slightly topping analysts’ expectations.

The stock is down 9.9% since reporting and currently trades at $31.37.

Read our full, actionable report on Kraft Heinz here, it’s free.

Market Update

Thanks to the Fed's series of rate hikes in 2022 and 2023, inflation has cooled significantly from its post-pandemic highs, drawing closer to the 2% goal. This disinflation has occurred without severely impacting economic growth, suggesting the success of a soft landing. The stock market has thrived in 2024, spurred by recent rate cuts (0.5% in September and 0.25% in November), and a notable surge followed Donald Trump’s presidential election win in November, propelling indices to historic highs. Nonetheless, the outlook for 2025 remains clouded by potential trade policy changes and corporate tax discussions, which could impact business confidence and growth. The path forward holds both optimism and caution as new policies take shape.

Want to invest in winners with rock-solid fundamentals? Check out our Strong Momentum Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

More News

View More

Recent Quotes

View MoreQuotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.