Financial News

Redfin (NASDAQ:RDFN) Reports Sales Below Analyst Estimates In Q3 Earnings, Stock Drops 13.3%

Real estate technology company Redfin (NASDAQ: RDFN) met Wall Street’s revenue expectations in Q3 CY2024, with sales up 3.4% year on year to $278 million. On the other hand, next quarter’s outlook exceeded expectations with revenue guided to $242 million at the midpoint, or 1.5% above analysts’ estimates. Its GAAP loss of $0.28 per share was 38.2% below analysts’ consensus estimates.

Is now the time to buy Redfin? Find out by accessing our full research report, it’s free.

Redfin (RDFN) Q3 CY2024 Highlights:

- Revenue: $278 million vs analyst estimates of $280.7 million (in line)

- EPS: -$0.28 vs analyst expectations of -$0.20 ($0.08 miss)

- EBITDA: $3.95 million vs analyst estimates of $8.73 million ($4.8 million miss)

- Revenue Guidance for Q4 CY2024 is $242 million at the midpoint, above analyst estimates of $238.5 million

- EBITDA guidance for Q4 CY2024 is $4.5 million at the midpoint, below analyst estimates of $8.45 million

- Gross Margin (GAAP): 36.6%, in line with the same quarter last year

- Operating Margin: -9.7%, in line with the same quarter last year

- EBITDA Margin: 1.4%, down from 2.8% in the same quarter last year

- Free Cash Flow was -$35.32 million, down from $99.52 million in the same quarter last year

- Brokerage Transactions: 12,363, down 712 year on year

- Market Capitalization: $1.31 billion

“Redfin’s third-quarter results were within our guidance range, and we’re now forecasting fourth-quarter growth in market share and revenues,” said Redfin CEO Glenn Kelman.

Company Overview

Founded by a former medical school student, electrical engineer, and Amazon data engineer, Redfin (NASDAQ: RDFN) is a real estate company offering brokerage services through an online platform.

Real Estate Services

Technology has been a double-edged sword in real estate services. On the one hand, internet listings are effective at disseminating information far and wide, casting a wide net for buyers and sellers to increase the chances of transactions. On the other hand, digitization in the real estate market could potentially disintermediate key players like agents who use information asymmetries to their advantage.

Sales Growth

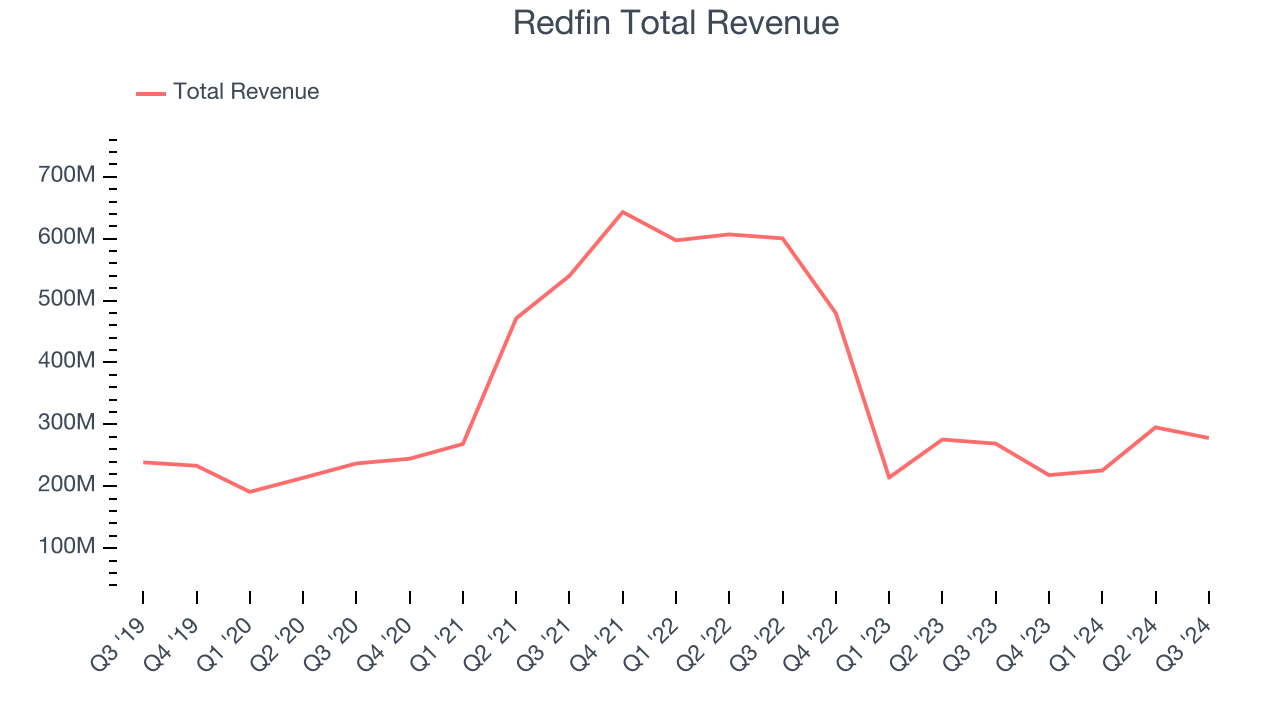

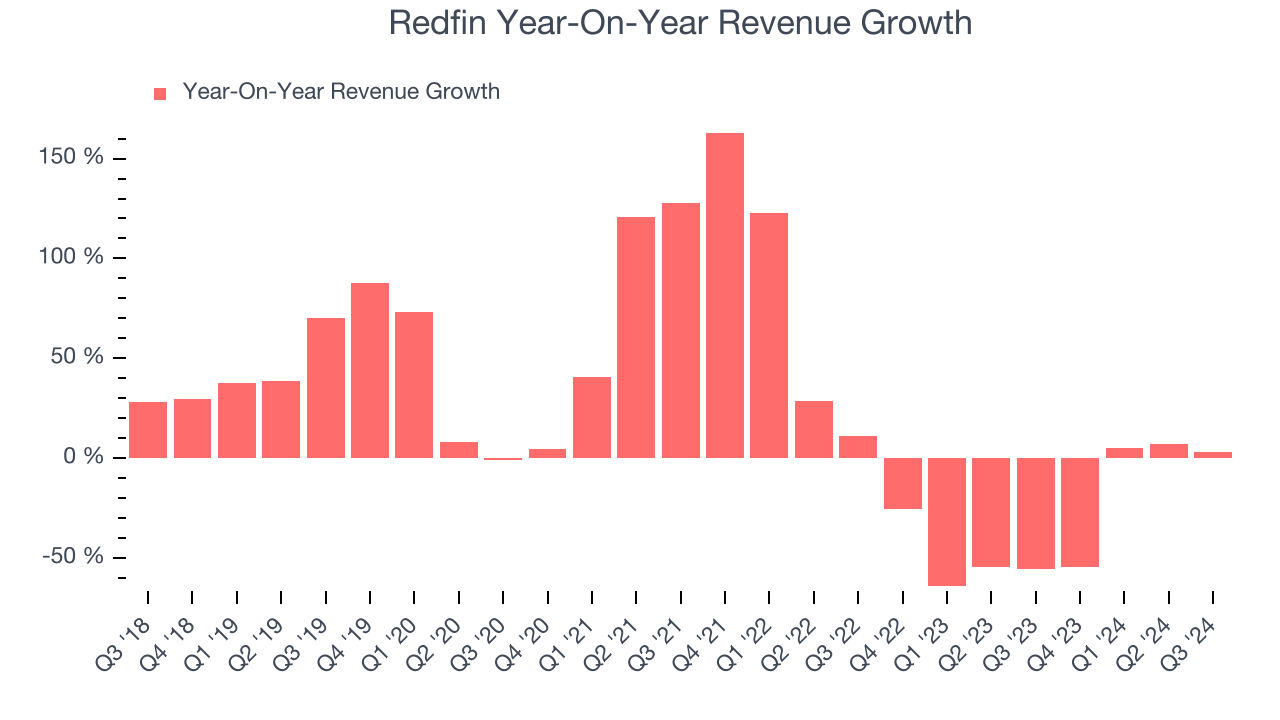

A company’s long-term performance can indicate its business quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Unfortunately, Redfin’s 8.7% annualized revenue growth over the last five years was sluggish. This shows it failed to expand in any major way, a rough starting point for our analysis.

Long-term growth is the most important, but within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends and consumer preferences. Redfin’s history shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 35.6% annually.

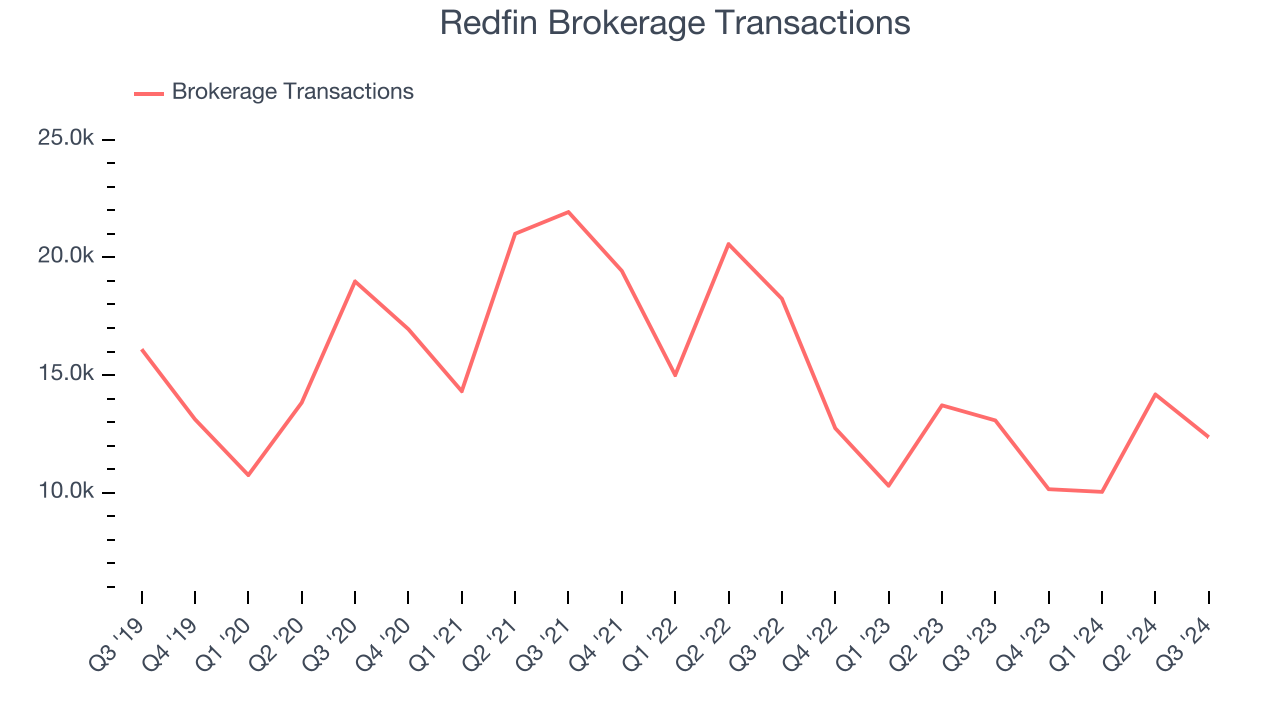

We can dig further into the company’s revenue dynamics by analyzing its number of brokerage transactions and partner transactions, which clocked in at 12,363 and 3,025 in the latest quarter. Over the last two years, Redfin’s brokerage transactions averaged 19% year-on-year declines while its partner transactions averaged 8.5% year-on-year declines.

This quarter, Redfin grew its revenue by 3.4% year on year, and its $278 million of revenue was in line with Wall Street’s estimates. Management is currently guiding for a 11% year-on-year increase next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 7.8% over the next 12 months, an improvement versus the last two years. While this projection illustrates the market thinks its newer products and services will fuel better performance, it is still below the sector average.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

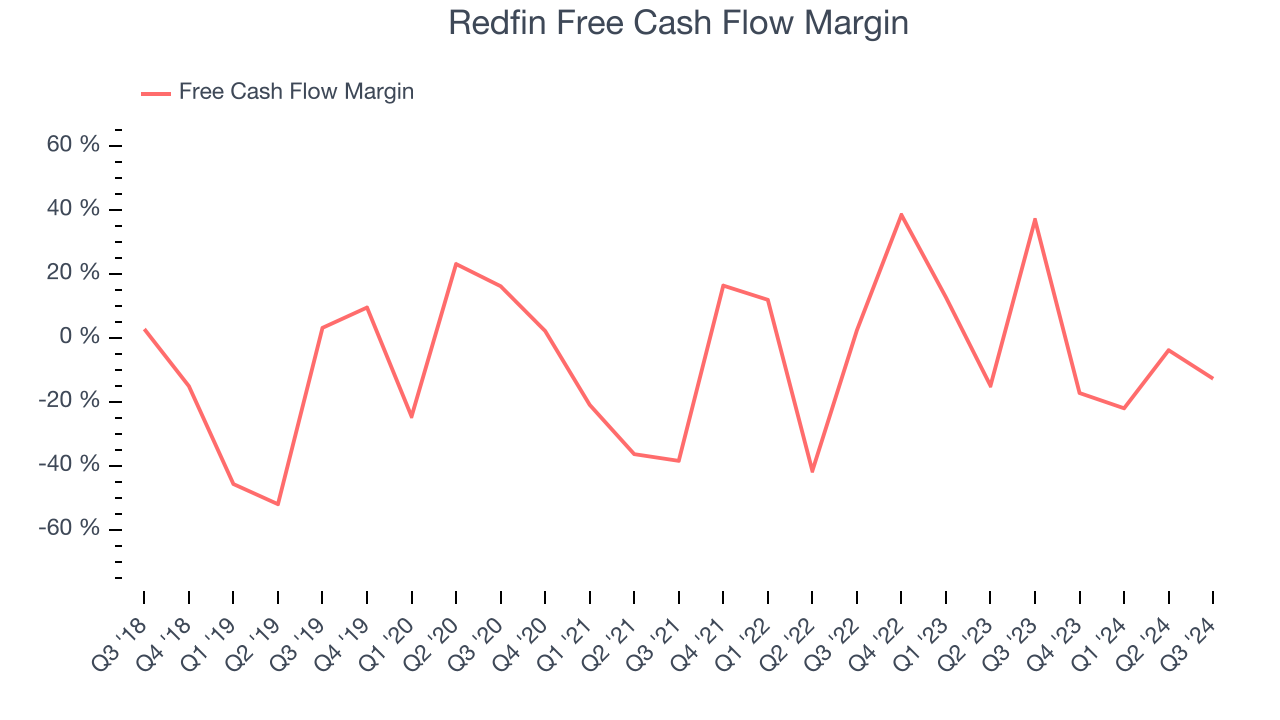

Redfin has shown weak cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 6.1%, subpar for a consumer discretionary business.

Redfin burned through $35.32 million of cash in Q3, equivalent to a negative 12.7% margin. The company’s cash flow turned negative after being positive in the same quarter last year, prompting us to pay closer attention. Short-term fluctuations typically aren’t a big deal because investment needs can be seasonal, but we’ll be watching to see if the trend extrapolates into future quarters.

Over the next year, analysts predict Redfin will continue burning cash, albeit to a lesser extent. Their consensus estimates imply its free cash flow margin of negative 13.1% for the last 12 months will increase to negative 1.6%.

Key Takeaways from Redfin’s Q3 Results

It was good to see Redfin’s strong revenue guidance for next quarter, which topped analysts’ expectations. On the other hand, its number of brokerage transactions missed and its EBITDA fell short of Wall Street’s estimates. Looking ahead, EBITDA guidance was also below expectations, throwing some cold water on the solid revenue guide. Overall, this was a weaker quarter. The stock traded down 13.3% to $9.94 immediately following the results.

Redfin didn’t show it’s best hand this quarter, but does that create an opportunity to buy the stock right now? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.

More News

View More

Recent Quotes

View MoreQuotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.