Financial News

SolarEdge (NASDAQ:SEDG) Misses Q3 Sales Targets, Stock Drops 17.2%

Solar power systems company SolarEdge (NASDAQ: SEDG) fell short of the market’s revenue expectations in Q3 CY2024, with sales falling 64% year on year to $260.9 million. Next quarter’s revenue guidance of $190 million underwhelmed, coming in 38.9% below analysts’ estimates. Its non-GAAP loss of $15.33 per share was also 837% below analysts’ consensus estimates.

Is now the time to buy SolarEdge? Find out by accessing our full research report, it’s free.

SolarEdge (SEDG) Q3 CY2024 Highlights:

- Revenue: $260.9 million vs analyst estimates of $270.9 million (3.7% miss)

- During the third quarter, SolarEdge undertook an asset valuation analysis which resulted in a write down and impairment of various assets. In total, the write down and impairment amount was $1.03 billion - this affected metrics below the revenue line

- Adjusted EPS: -$15.33 vs analyst estimates of -$1.64

- EBITDA: -$1.08 billion vs analyst estimates of -$102 million (957% miss)

- Revenue Guidance for Q4 CY2024 is $190 million at the midpoint, below analyst estimates of $311 million

- Gross Margin (GAAP): -269%, down from 19.7% in the same quarter last year

- Operating Margin: -416%, down from -2.3% in the same quarter last year

- EBITDA Margin: -413%, down from 5.3% in the same quarter last year

- Free Cash Flow was -$111.2 million compared to -$5.36 million in the same quarter last year

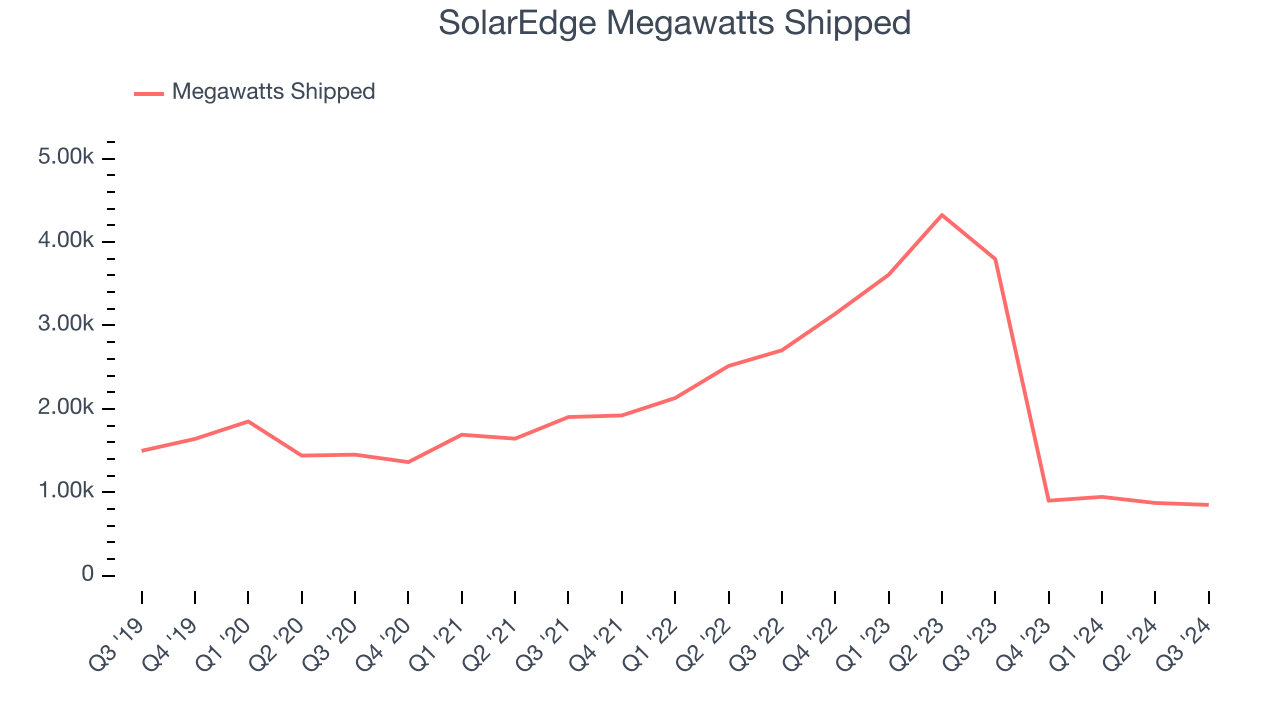

- Megawatts Shipped: 850, down 2,946 year on year

- Market Capitalization: $1.07 billion

Company Overview

Established in 2006, SolarEdge (NASDAQ: SEDG) creates advanced systems to improve the efficiency of solar panels.

Renewable Energy

Renewable energy companies are buoyed by the secular trend of green energy that is upending traditional power generation. Those who innovate and evolve with this dynamic market can win share while those who continue to rely on legacy technologies can see diminishing demand, which includes headwinds from increasing regulation against “dirty” energy. Additionally, these companies are at the whim of economic cycles, as interest rates can impact the willingness to invest in renewable energy projects.

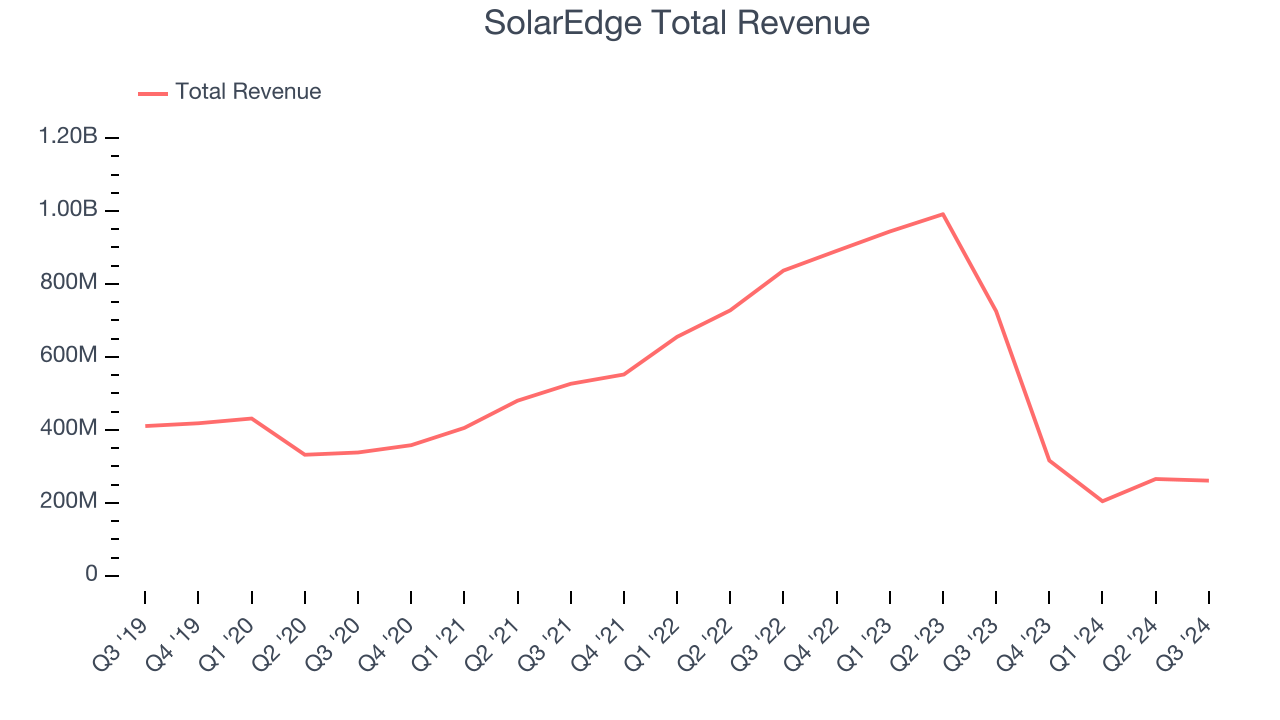

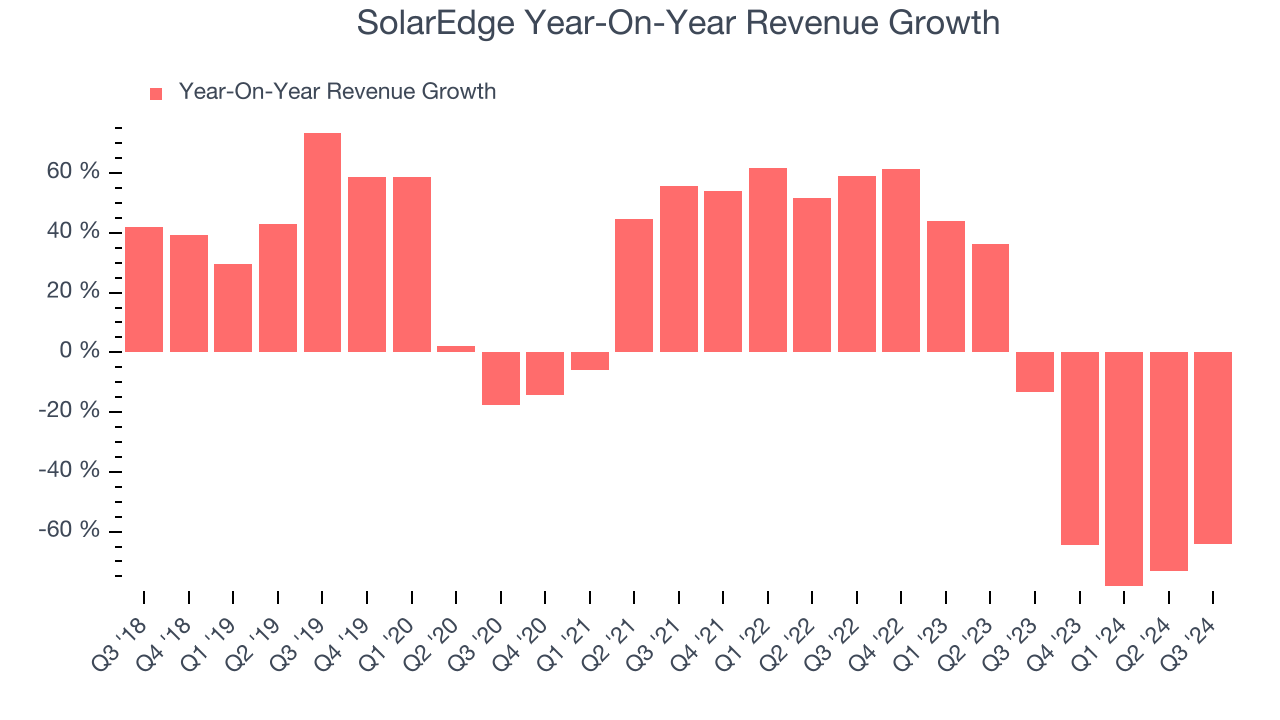

Sales Growth

A company’s long-term performance can give signals about its business quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Over the last five years, SolarEdge’s revenue declined by 3.8% per year. This shows demand was weak, a rough starting point for our analysis.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. SolarEdge’s recent history shows its demand has stayed suppressed as its revenue has declined by 38.5% annually over the last two years.

SolarEdge also discloses its number of megawatts shipped, which reached 850 in the latest quarter. Over the last two years, SolarEdge’s megawatts shipped averaged 7.2% year-on-year declines. Because this number is higher than its revenue growth during the same period, we can see the company’s monetization has fallen.

This quarter, SolarEdge missed Wall Street’s estimates and reported a rather uninspiring 64% year-on-year revenue decline, generating $260.9 million of revenue. Management is currently guiding for a 39.9% year-on-year decline next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 50.1% over the next 12 months, an improvement versus the last two years. This projection is admirable and illustrates the market believes its newer products and services will fuel higher growth rates.

When a company has more cash than it knows what to do with, buying back its own shares can make a lot of sense–as long as the price is right. Luckily, we’ve found one, a low-priced stock that is gushing free cash flow AND buying back shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

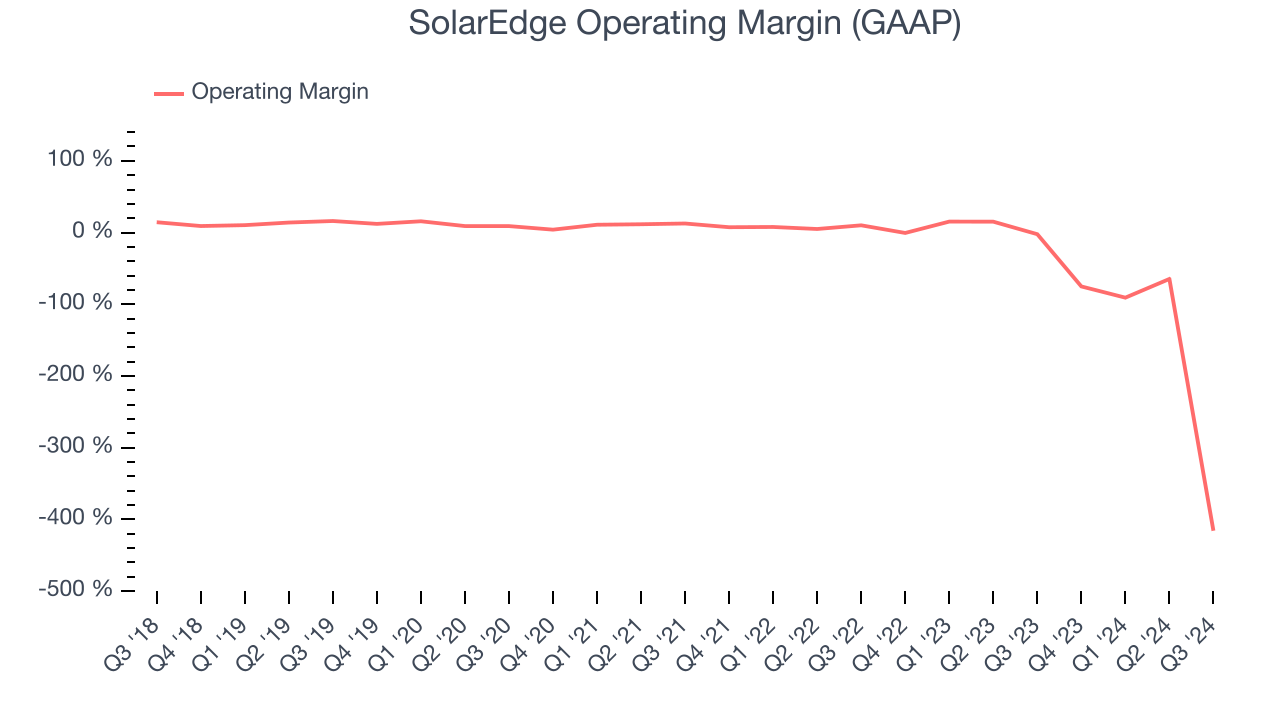

Operating Margin

SolarEdge’s high expenses have contributed to an average operating margin of negative 7.8% over the last five years. Unprofitable industrials companies require extra attention because they could get caught swimming naked when the tide goes out. It’s hard to trust that the business can endure a full cycle.

Analyzing the trend in its profitability, SolarEdge’s annual operating margin decreased significantly over the last five years. The company’s performance was poor no matter how you look at it. It shows operating expenses were rising and it couldn’t pass those costs onto its customers.

In Q3, SolarEdge generated a negative 416% operating margin. In this quarter, SolarEdge undertook an asset valuation analysis which resulted in a write down and impairment of various assets. In total, the write down and impairment amount was $1.03 billion - this affected metrics below the revenue line.

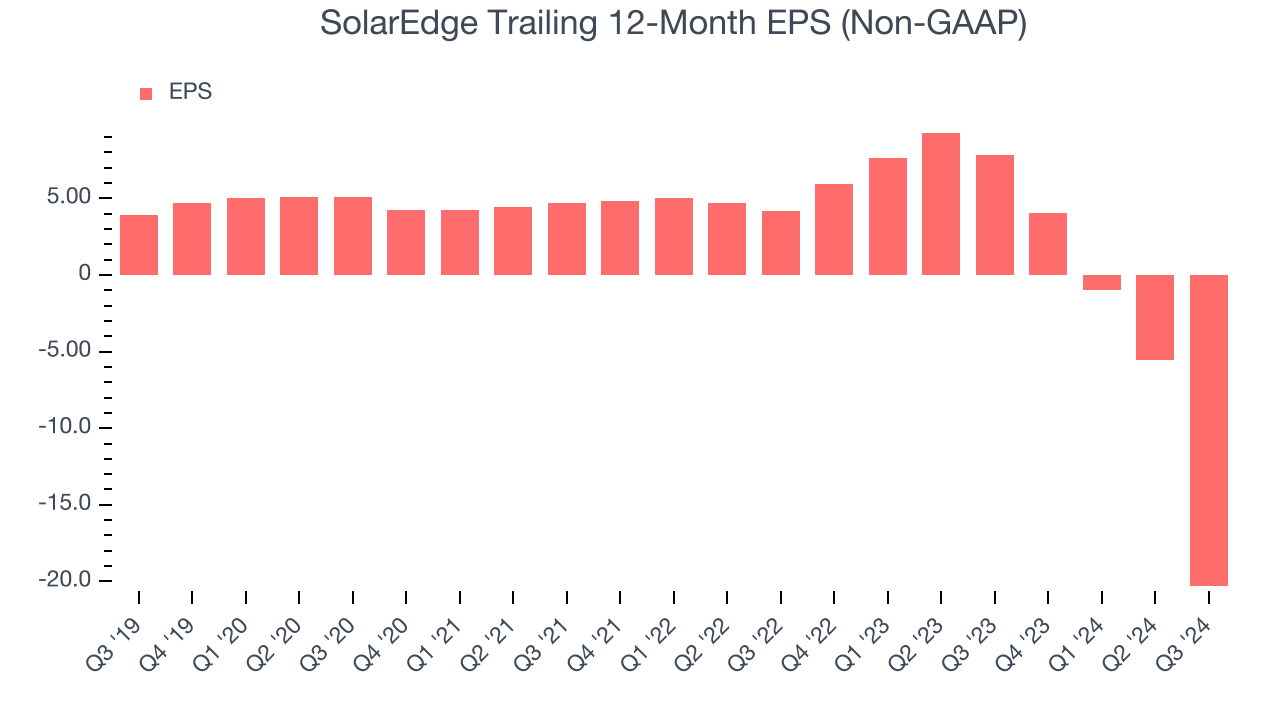

Earnings Per Share

Analyzing revenue trends tells us about a company’s historical growth, but the long-term change in its earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Sadly for SolarEdge, its EPS declined by more than its revenue over the last five years, dropping 48.5% annually. In this quarter, SolarEdge undertook an asset valuation analysis which resulted in a write down and impairment of various assets. In total, the write down and impairment amount was $1.03 billion - this affected metrics below the revenue line.

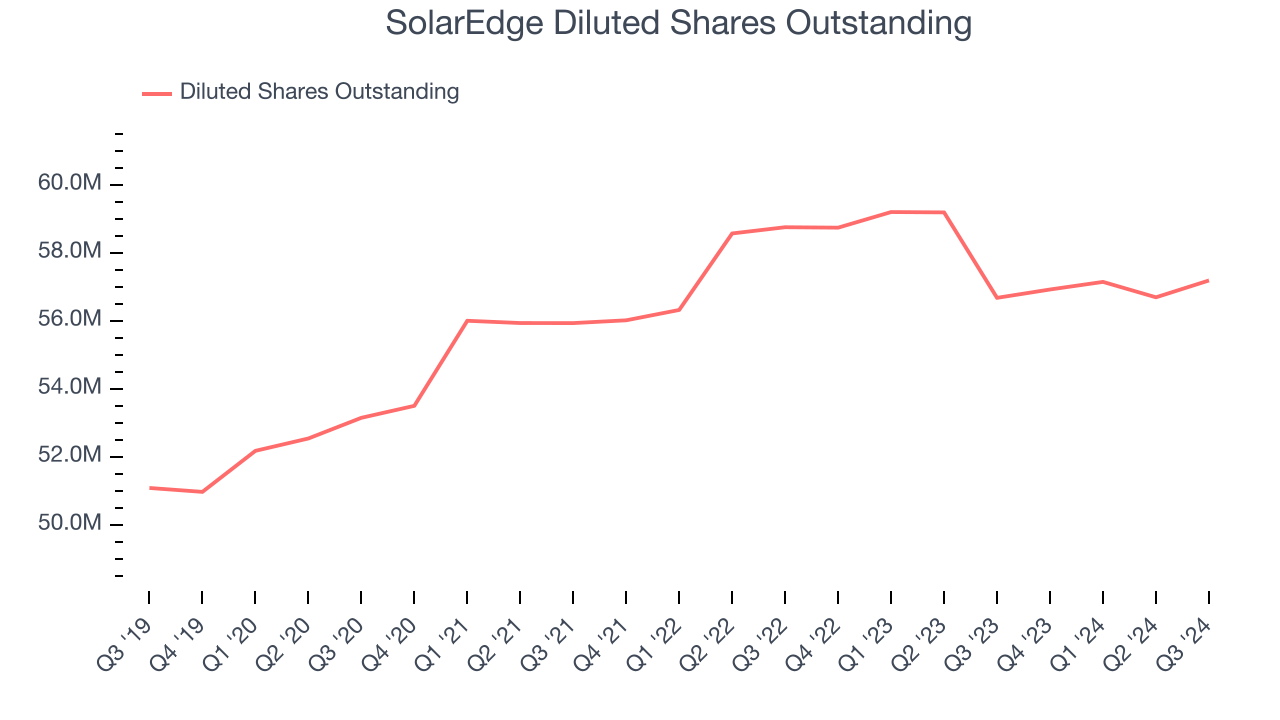

Diving into the nuances of SolarEdge’s earnings can give us a better understanding of its performance. As we mentioned earlier, SolarEdge’s operating margin declined by 172.3 percentage points over the last five years. Its share count also grew by 11.9%, meaning the company not only became less efficient with its operating expenses but also diluted its shareholders.

Like with revenue, we analyze EPS over a more recent period because it can give insight into an emerging theme or development for the business.

For SolarEdge, its two-year annual EPS declines of 162% show it’s continued to underperform. These results were bad no matter how you slice the data.

In Q3, SolarEdge reported EPS at negative $15.33, down from negative $0.55 in the same quarter last year. This print missed analysts’ estimates. Over the next 12 months, Wall Street expects SolarEdge to improve its earnings losses. Analysts forecast its full-year EPS of negative $20.32 will advance to negative $2.69.

Key Takeaways from SolarEdge’s Q3 Results

We struggled to find many strong positives in these results. Its revenue guidance for next quarter missed and its revenue fell short of Wall Street’s estimates. Overall, this quarter could have been better. The stock traded down 17.2% to $12.14 immediately after reporting.

SolarEdge may have had a tough quarter, but does that actually create an opportunity to invest right now? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.

More News

View More

Recent Quotes

View MoreQuotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.