Financial News

WillScot Mobile Mini (NASDAQ:WSC) Reports Sales Below Analyst Estimates In Q3 Earnings

Temporary space provider WillScot (NASDAQ:WSC) fell short of the market’s revenue expectations in Q3 CY2024, with sales flat year on year at $601.4 million. The company’s full-year revenue guidance of $2.4 billion at the midpoint also came in 2.1% below analysts’ estimates. Its non-GAAP profit of $0.38 per share was also 17.6% below analysts’ consensus estimates.

Is now the time to buy WillScot Mobile Mini? Find out by accessing our full research report, it’s free.

WillScot Mobile Mini (WSC) Q3 CY2024 Highlights:

- Revenue: $601.4 million vs analyst estimates of $617.8 million (2.6% miss)

- Adjusted EPS: $0.38 vs analyst expectations of $0.46 (17.6% miss)

- EBITDA: $266.9 million vs analyst estimates of $277.4 million (3.8% miss)

- The company dropped its revenue guidance for the full year to $2.4 billion at the midpoint from $2.45 billion, a 2% decrease

- EBITDA guidance for the full year is $1.06 billion at the midpoint, below analyst estimates of $1.10 billion

- Gross Margin (GAAP): 53.5%, down from 56.2% in the same quarter last year

- Operating Margin: -5.9%, down from 29.4% in the same quarter last year

- EBITDA Margin: 44.4%, in line with the same quarter last year

- Free Cash Flow was -$60.12 million, down from $185.4 million in the same quarter last year

- Market Capitalization: $7.38 billion

Brad Soultz, Chief Executive Officer of WillScot, commented, “Our team continued to execute well in Q3, delivering record third quarter Adjusted EBITDA Margins, with Adjusted Free Cash Flow and Return on Invested Capital also near record levels. Headwinds in non-residential construction impacted top-line revenue, particularly among smaller scale and rate sensitive customers. In contrast, we continue to see steady demand across larger projects and strong backlogs among our national accounts and general contractors. And we anticipate that the overall operating environment will only benefit from interest rate and political certainty. These indicators, combined with our recent investments in our commercial and operations platform and accelerating run-rates in our newer product categories, give us confidence in our growth prospects for 2025."

Company Overview

Originally focusing on mobile offices for construction sites, WillScot (NASDAQ:WSC) provides ready-to-use temporary spaces, largely for longer-term lease.

Construction and Maintenance Services

Construction and maintenance services companies not only boast technical know-how in specialized areas but also may hold special licenses and permits. Those who work in more regulated areas can enjoy more predictable revenue streams - for example, fire escapes need to be inspected every five years–. More recently, services to address energy efficiency and labor availability are also creating incremental demand. But like the broader industrials sector, construction and maintenance services companies are at the whim of economic cycles as external factors like interest rates can greatly impact the new construction that drives incremental demand for these companies’ offerings.

Sales Growth

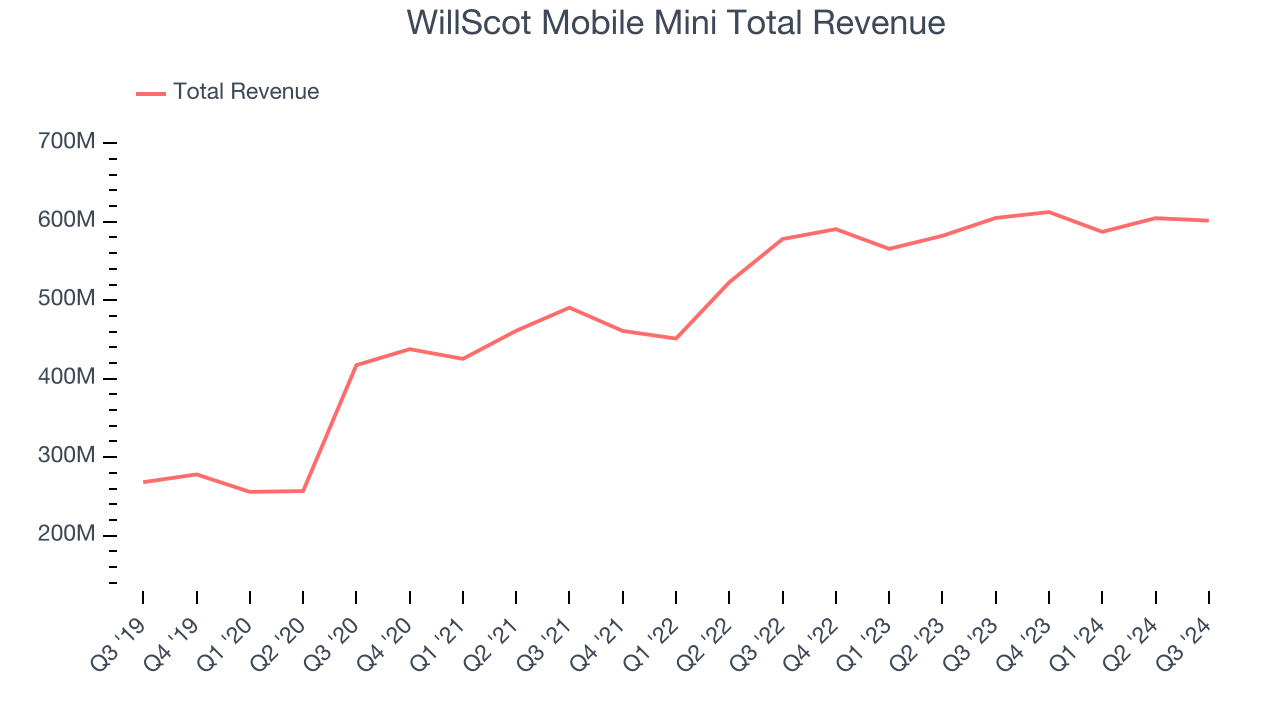

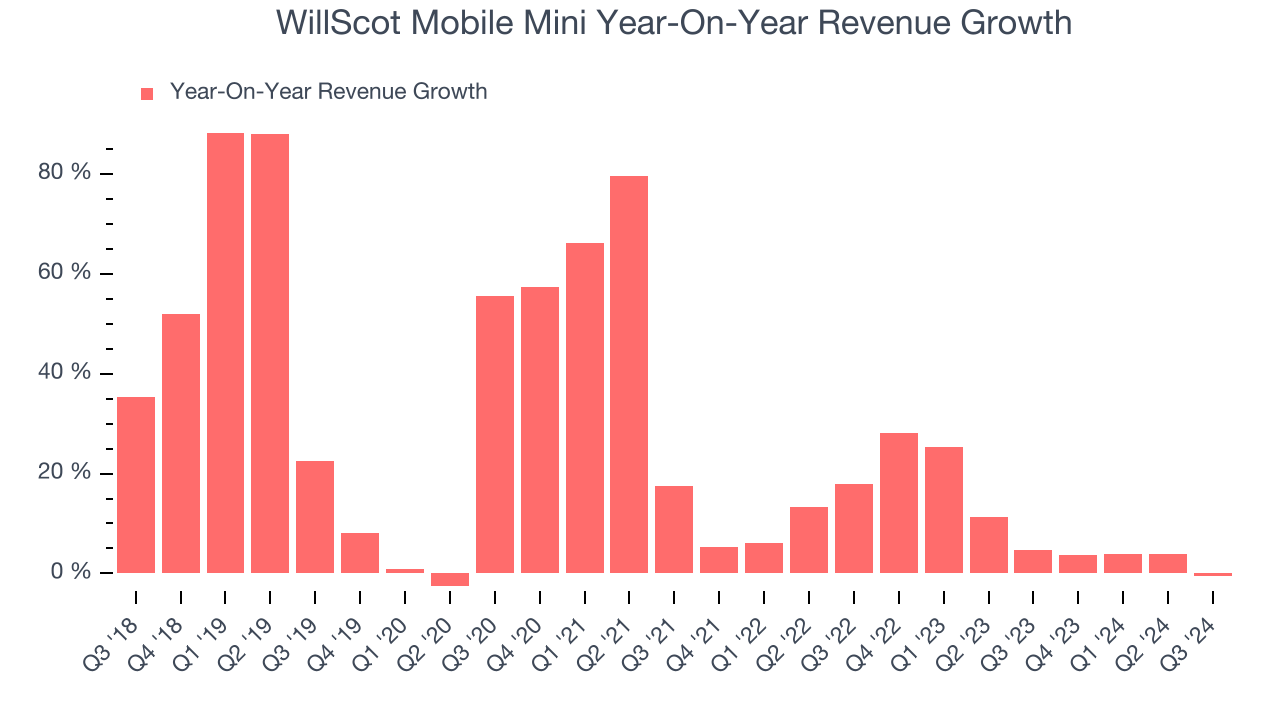

Reviewing a company’s long-term performance can reveal insights into its business quality. Any business can have short-term success, but a top-tier one sustains growth for years. Over the last five years, WillScot Mobile Mini grew its sales at an incredible 18.2% compounded annual growth rate. This is a great starting point for our analysis because it shows WillScot Mobile Mini’s offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. WillScot Mobile Mini’s annualized revenue growth of 9.3% over the last two years is below its five-year trend, but we still think the results were good and suggest demand was strong.

We can dig further into the company’s revenue dynamics by analyzing its most important segments, Leasing and Delivery and Installation, which are 75.7% and 19.1% of revenue. Over the last two years, WillScot Mobile Mini’s Leasing revenue (recurring) averaged 11.3% year-on-year growth while its Delivery and Installation revenue (non-recurring) averaged 3.2% growth.

This quarter, WillScot Mobile Mini missed Wall Street’s estimates and reported a rather uninspiring 0.6% year-on-year revenue decline, generating $601.4 million of revenue.

Looking ahead, sell-side analysts expect revenue to grow 5.4% over the next 12 months, a deceleration versus the last two years. This projection is underwhelming and shows the market believes its products and services will see some demand headwinds. At least the company is tracking well in other measures of financial health.

When a company has more cash than it knows what to do with, buying back its own shares can make a lot of sense–as long as the price is right. Luckily, we’ve found one, a low-priced stock that is gushing free cash flow AND buying back shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

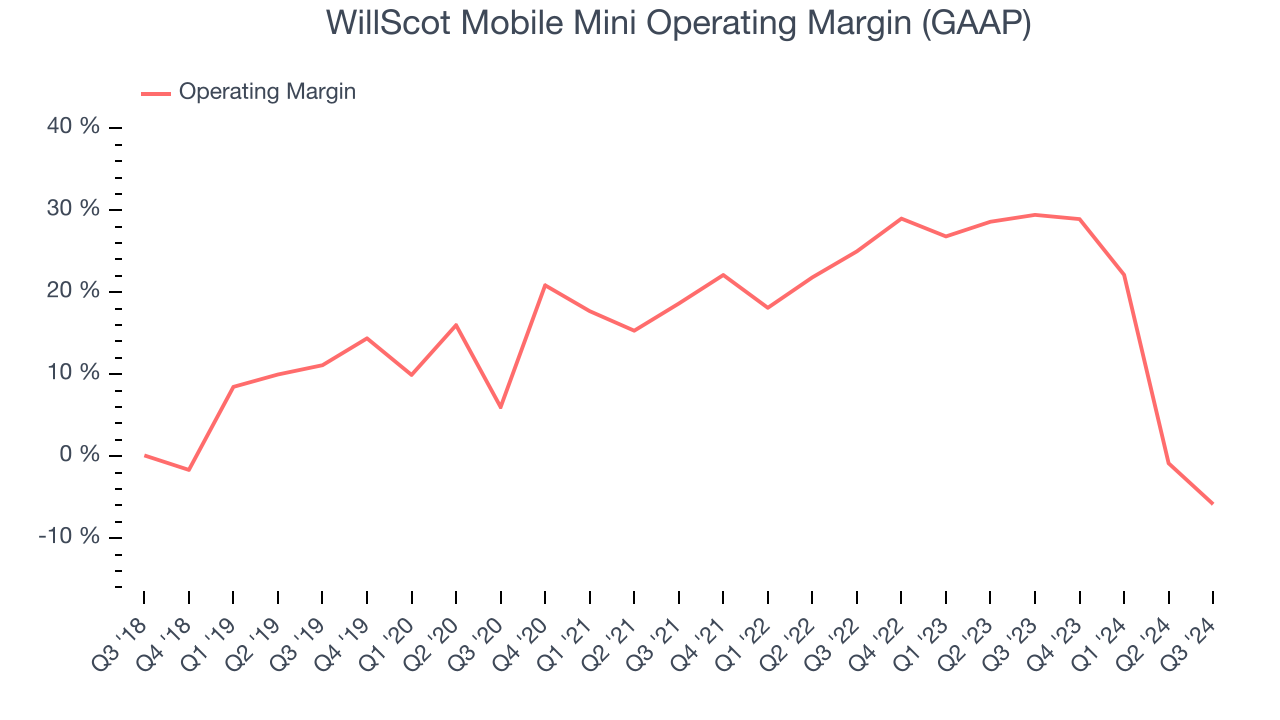

Operating Margin

WillScot Mobile Mini has been a well-oiled machine over the last five years. It demonstrated elite profitability for an industrials business, boasting an average operating margin of 18.8%. This result isn’t surprising as its high gross margin gives it a favorable starting point.

Analyzing the trend in its profitability, WillScot Mobile Mini’s annual operating margin might have seen some fluctuations but has generally stayed the same over the last five years, highlighting the long-term consistency of its business.

In Q3, WillScot Mobile Mini generated an operating profit margin of negative 5.9%, down 35.3 percentage points year on year. Since WillScot Mobile Mini’s operating margin decreased more than its gross margin, we can assume it was recently less efficient because expenses such as marketing, R&D, and administrative overhead increased.

Earnings Per Share

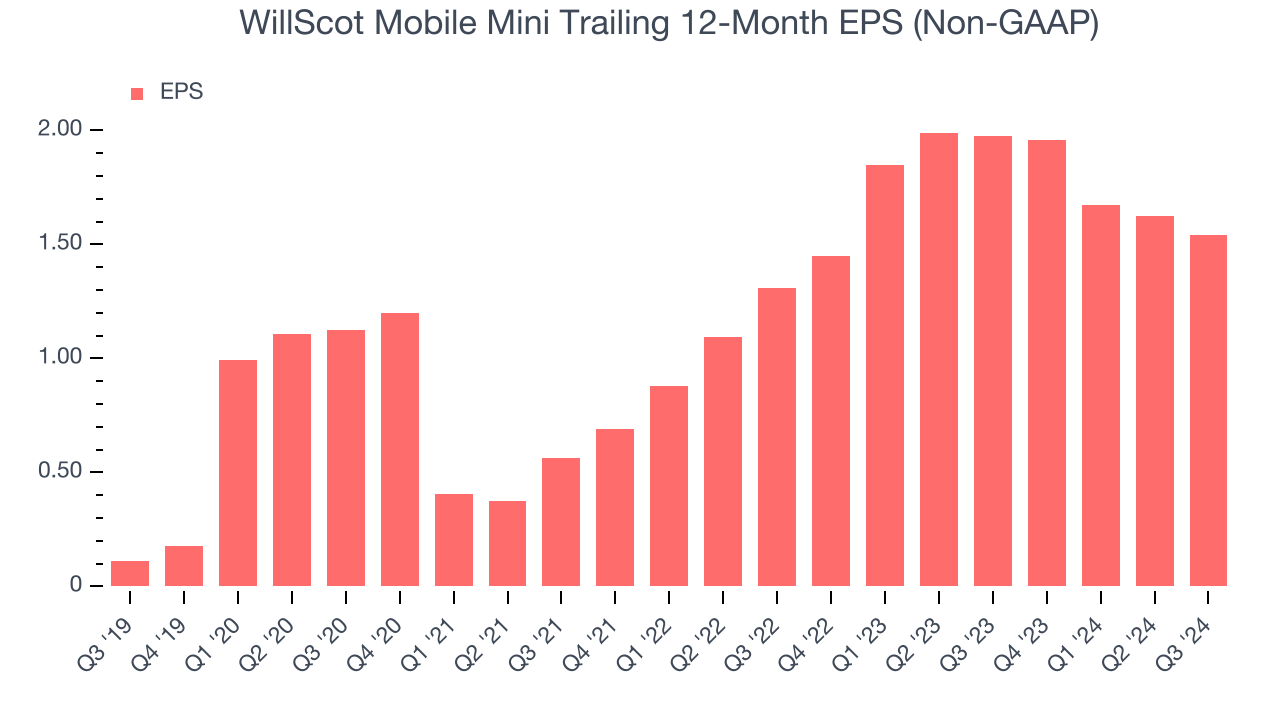

Analyzing revenue trends tells us about a company’s historical growth, but the long-term change in its earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

WillScot Mobile Mini’s EPS grew at an astounding 69% compounded annual growth rate over the last five years, higher than its 18.2% annualized revenue growth. However, this alone doesn’t tell us much about its business quality because its operating margin didn’t expand.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For WillScot Mobile Mini, its two-year annual EPS growth of 8.6% was lower than its five-year trend. This wasn’t great, but at least the company was successful in other measures of financial health.In Q3, WillScot Mobile Mini reported EPS at $0.38, down from $0.46 in the same quarter last year. This print missed analysts’ estimates, but we care more about long-term EPS growth than short-term movements. Over the next 12 months, Wall Street expects WillScot Mobile Mini’s full-year EPS of $1.54 to grow by 33.8%.

Key Takeaways from WillScot Mobile Mini’s Q3 Results

We struggled to find many strong positives in these results. Its EBITDA forecast for the full year missed and its revenue fell short of Wall Street’s estimates. Overall, this was a weaker quarter. The stock remained flat at $38.88 immediately following the results.

Is WillScot Mobile Mini an attractive investment opportunity at the current price?When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.

Stock quotes supplied by Barchart

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the following

Privacy Policy and Terms and Conditions.