Financial News

Remitly’s (NASDAQ:RELY) Q3 Sales Beat Estimates, Stock Jumps 18.3%

Online money transfer platform Remitly (NASDAQ:RELY) announced better-than-expected revenue in Q3 CY2024, with sales up 39.3% year on year to $336.5 million. On the other hand, next quarter’s revenue guidance of $340 million was less impressive, coming in 2.1% below analysts’ estimates. Its GAAP profit of $0.01 per share was also 114% above analysts’ consensus estimates.

Is now the time to buy Remitly? Find out by accessing our full research report, it’s free.

Remitly (RELY) Q3 CY2024 Highlights:

- Revenue: $336.5 million vs analyst estimates of $320.6 million (5% beat)

- EPS: $0.01 vs analyst estimates of -$0.07 ($0.08 beat)

- EBITDA: $46.71 million vs analyst estimates of $27.33 million (70.9% beat)

- Revenue Guidance for Q4 CY2024 is $340 million at the midpoint, below analyst estimates of $347.3 million

- EBITDA guidance for the full year is $110 million at the midpoint, above analyst estimates of $97.92 million

- Gross Margin (GAAP): 59.2%, up from 55.7% in the same quarter last year

- Operating Margin: 0.1%, up from -15.3% in the same quarter last year

- EBITDA Margin: 13.9%, up from 4.3% in the same quarter last year

- Active Customers: 7.3 million, up 1.89 million year on year

- Market Capitalization: $2.91 billion

“I am grateful to our customers and global teams for the exceptional third quarter results,” said Matt Oppenheimer, co-founder and Chief Executive Officer, Remitly.

Company Overview

With Amazon founder Jeff Bezos as an early investor, Remitly (NASDAQ:RELY) is an online platform that enables consumers to safely and quickly send money globally.

Online Marketplace

Marketplaces have existed for centuries. Where once it was a main street in a small town or a mall in the suburbs, sellers benefitted from proximity to one another because they could draw customers by offering convenience and selection. Today, a myriad of online marketplaces fulfill that same role, aggregating large customer bases, which attracts commission-paying sellers, generating flywheel scale effects that feed back into further customer acquisition.

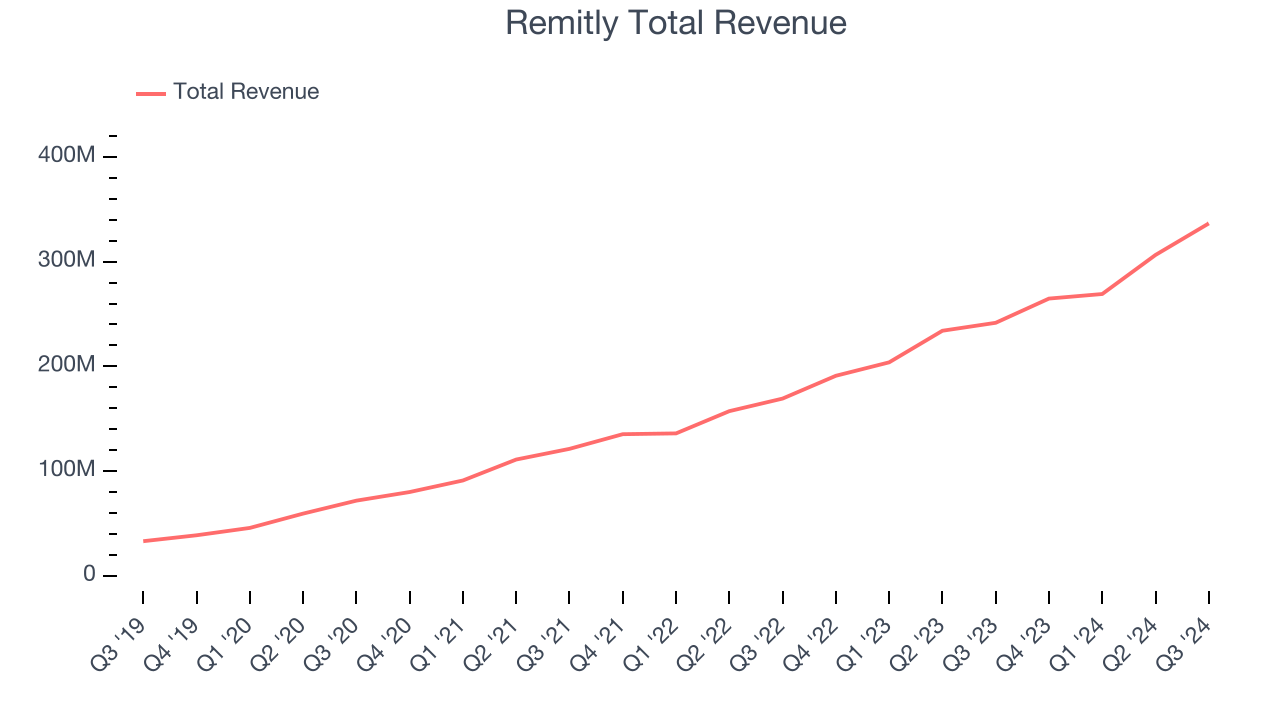

Sales Growth

A company’s long-term performance can indicate its business quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Over the last three years, Remitly grew its sales at an incredible 42.9% compounded annual growth rate. This is a great starting point for our analysis because it shows Remitly’s offerings resonate with customers.

This quarter, Remitly reported wonderful year-on-year revenue growth of 39.3%, and its $336.5 million of revenue exceeded Wall Street’s estimates by 5%. Management is currently guiding for a 28.4% year-on-year increase next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 25.8% over the next 12 months, a deceleration versus the last three years. This projection is still commendable and shows the market sees success for its products and services.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Active Customers

Buyer Growth

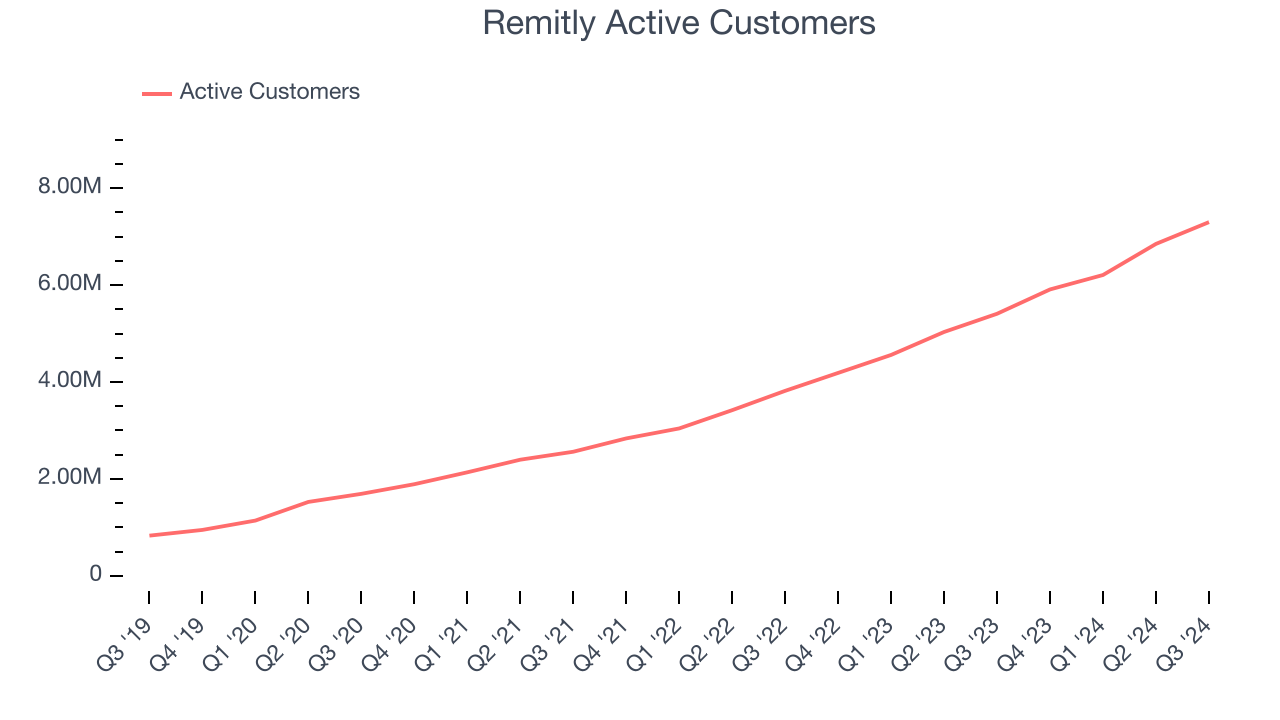

As an online marketplace, Remitly generates revenue growth by increasing both the number of buyers on its platform and the average order size in dollars.

Over the last two years, Remitly’s active customers, a key performance metric for the company, increased by 41.9% annually to 7.3 million in the latest quarter. This growth rate is among the fastest of any consumer internet business and indicates its platform's popularity is exploding.

In Q3, Remitly added 1.89 million active customers, leading to 35% year-on-year growth. The quarterly print was lower than its two-year result, suggesting its new initiatives aren’t accelerating buyer growth just yet.

Revenue Per Buyer

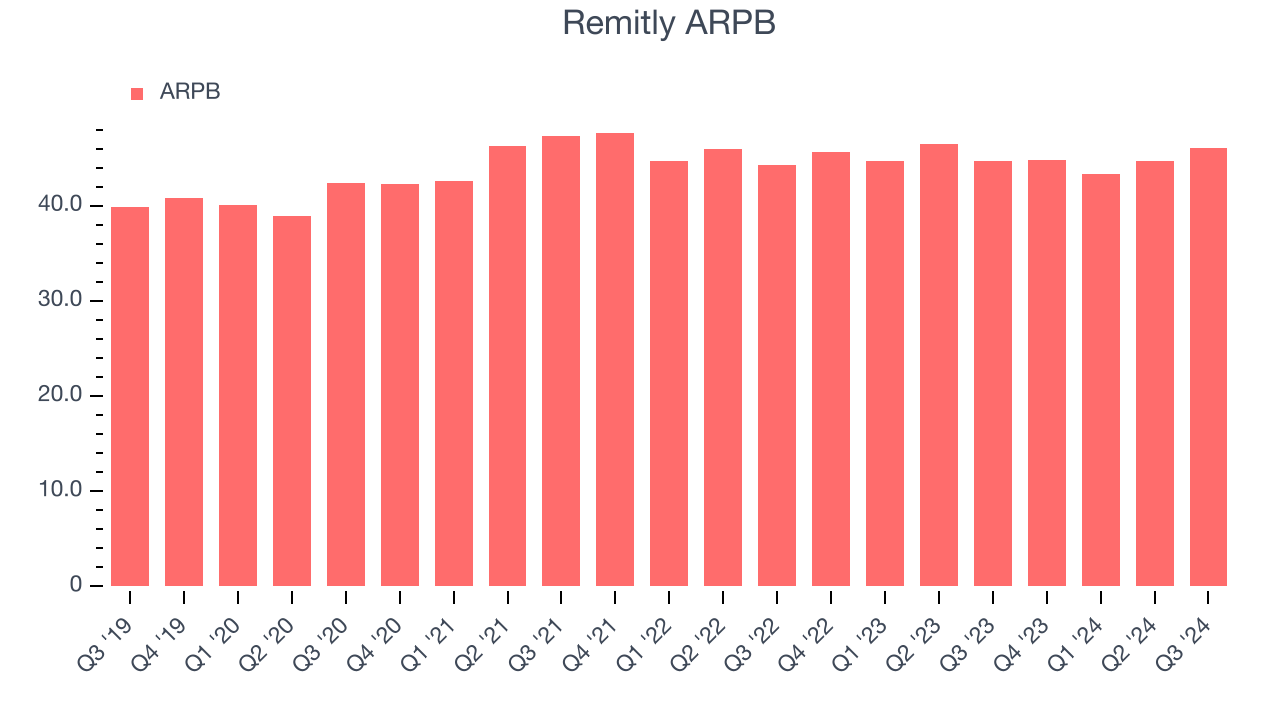

Average revenue per buyer (ARPB) is a critical metric to track for consumer internet businesses like Remitly because it measures how much the company earns in transaction fees from each buyer. ARPB also gives us unique insights into a user’s average order size and Remitly’s take rate, or "cut", on each order.

Remitly’s ARPB has been roughly flat over the last two years. This isn’t great, but the increase in active customers is more relevant for assessing long-term business potential. We’ll monitor the situation closely; if Remitly tries boosting ARPB by taking a more aggressive approach to monetization, it’s unclear whether buyers can continue growing at the current pace.

This quarter, Remitly’s ARPB clocked in at $46.10. It grew 3.2% year on year, slower than its buyer growth.

Key Takeaways from Remitly’s Q3 Results

We were impressed by how significantly Remitly blew past analysts’ EBITDA expectations this quarter. We were also glad its full-year EBITDA guidance exceeded Wall Street’s estimates. The stock traded up 18.3% to $18.05 immediately following the results.

Indeed, Remitly had a rock-solid quarterly earnings result, but is this stock a good investment here? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.

Stock quotes supplied by Barchart

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the following

Privacy Policy and Terms and Conditions.