Financial News

Monolithic Power Systems’s (NASDAQ:MPWR) Q3 Sales Top Estimates But Stock Drops

Power management chips maker Monolithic Power Systems (NASDAQ: MPWR) announced better-than-expected revenue in Q3 CY2024, with sales up 30.6% year on year to $620.1 million. The company expects next quarter’s revenue to be around $610 million, close to analysts’ estimates. Its non-GAAP profit of $4.06 per share was also 2.3% above analysts’ consensus estimates.

Is now the time to buy Monolithic Power Systems? Find out by accessing our full research report, it’s free.

Monolithic Power Systems (MPWR) Q3 CY2024 Highlights:

- Revenue: $620.1 million vs analyst estimates of $600.4 million (3.3% beat)

- Adjusted EPS: $4.06 vs analyst estimates of $3.97 (2.3% beat)

- Adjusted Operating Income: $220.8 million vs analyst estimates of $215.6 million (2.4% beat)

- Revenue Guidance for Q4 CY2024 is $610 million at the midpoint, roughly in line with what analysts were expecting

- Gross Margin (GAAP): 55.4%, in line with the same quarter last year

- Inventory Days Outstanding: 140, down from 171 in the previous quarter

- Operating Margin: 26.5%, down from 28.5% in the same quarter last year

- Market Capitalization: $45.5 billion

“Our results continue to demonstrate the success of our proven, long-term growth strategy and our transformation from being only a chip supplier to a full solutions provider,” said Michael Hsing, CEO and founder of MPS.

Company Overview

Founded in 1997 by its longtime CEO Michael Hsing, Monolithic Power Systems (NASDAQ: MPWR) is an analog and mixed signal chipmaker that specializes in power management chips meant to minimize total energy consumption.

Analog Semiconductors

Demand for analog chips is generally linked to the overall level of economic growth, as analog chips serve as the building blocks of most electronic goods and equipment. Unlike digital chip designers, analog chip makers tend to produce the majority of their own chips, as analog chip production does not require expensive leading edge nodes. Less dependent on major secular growth drivers, analog product cycles are much longer, often 5-7 years.

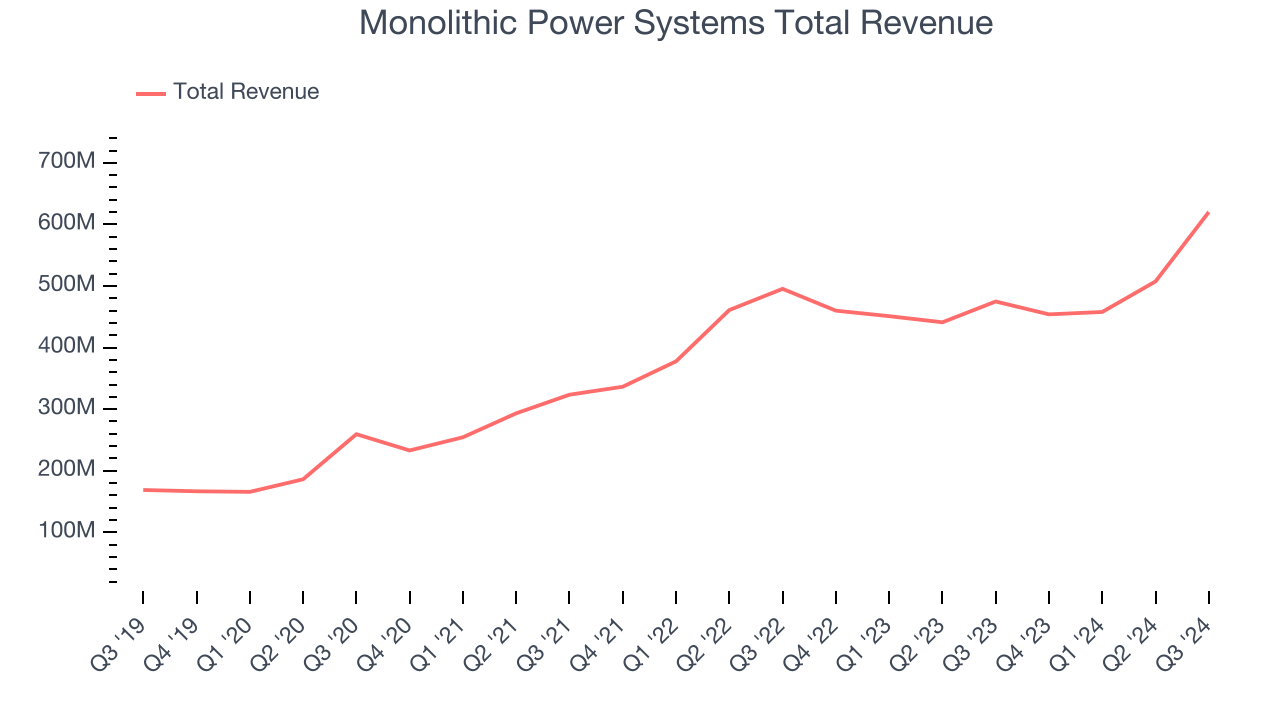

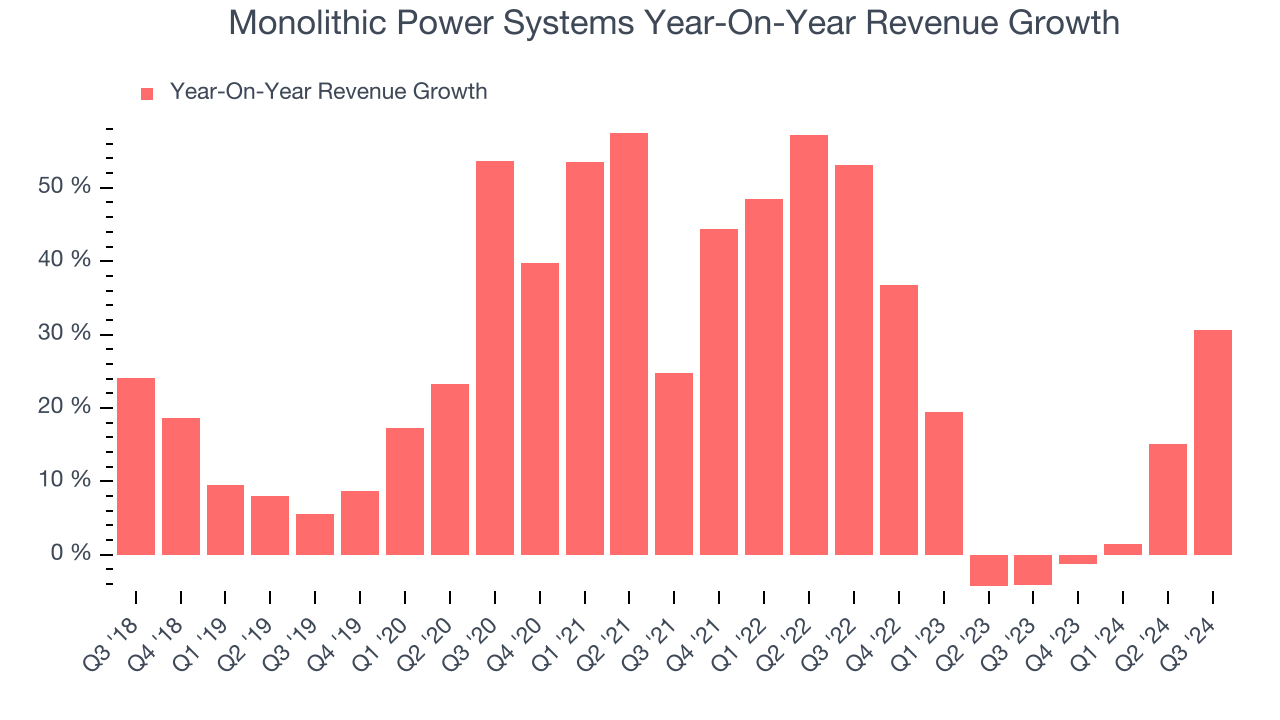

Sales Growth

A company’s long-term performance can indicate its business quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Over the last five years, Monolithic Power Systems grew its sales at an incredible 27.1% compounded annual growth rate. This is a great starting point for our analysis because it shows Monolithic Power Systems’s offerings resonate with customers. Semiconductors are a cyclical industry, and long-term investors should be prepared for periods of high growth followed by periods of revenue contractions (which can sometimes offer opportune times to buy).

We at StockStory place the most emphasis on long-term growth, but within semiconductors, a half-decade historical view may miss new demand cycles or industry trends like AI. Monolithic Power Systems’s annualized revenue growth of 10.5% over the last two years is below its five-year trend, but we still think the results were good and suggest demand was strong.

This quarter, Monolithic Power Systems reported wonderful year-on-year revenue growth of 30.6%, and its $620.1 million of revenue exceeded Wall Street’s estimates by 3.3%. Management is currently guiding for a 34.4% year-on-year increase next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 24% over the next 12 months, an improvement versus the last two years. This projection is commendable and indicates the market believes its newer products and services will spur faster growth.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

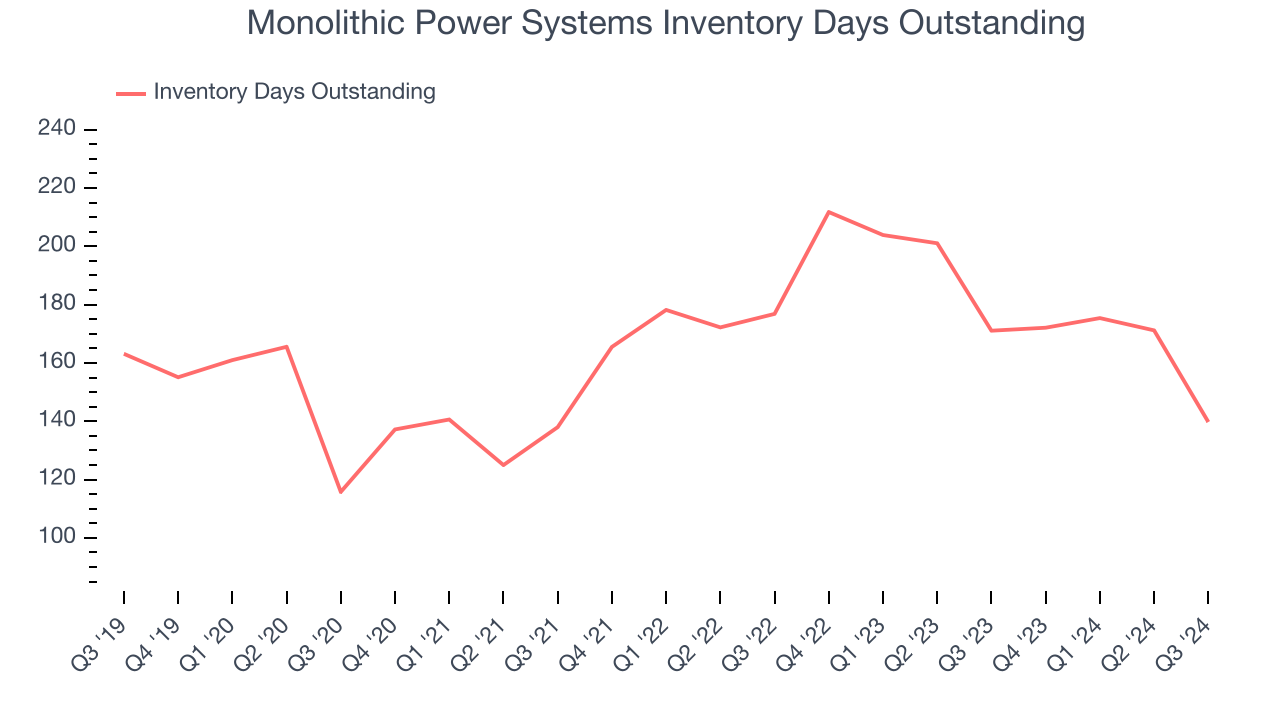

Product Demand & Outstanding Inventory

Days Inventory Outstanding (DIO) is an important metric for chipmakers, as it reflects a business’ capital intensity and the cyclical nature of semiconductor supply and demand. In a tight supply environment, inventories tend to be stable, allowing chipmakers to exert pricing power. Steadily increasing DIO can be a warning sign that demand is weak, and if inventories continue to rise, the company may have to downsize production.

This quarter, Monolithic Power Systems’s DIO came in at 140, which is 24 days below its five-year average. At the moment, these numbers show no indication of an excessive inventory buildup.

Key Takeaways from Monolithic Power Systems’s Q3 Results

We were impressed by Monolithic Power Systems’s strong improvement in inventory levels. We were also excited its revenue and operating profit outperformed Wall Street’s estimates. Looking ahead, revenue and operating profit guidance were in line with expectations. Perhaps the market was expecting more, especially for guidance given the strong quarter. Shares traded down 6.4% to $860 immediately following the results.

Should you buy the stock or not?If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.