Financial News

Meta (NASDAQ:META) Posts Q3 Sales In Line With Estimates

Social network operator Meta Platforms (NASDAQ:META) met Wall Street’s revenue expectations in Q3 CY2024, with sales up 18.9% year on year to $40.59 billion. The company expects next quarter’s revenue to be around $46.5 billion, close to analysts’ estimates. Its GAAP profit of $6.03 per share was 13.9% above analysts’ consensus estimates.

Is now the time to buy Meta? Find out by accessing our full research report, it’s free.

Meta (META) Q3 CY2024 Highlights:

- Revenue: $40.59 billion vs analyst estimates of $40.31 billion (in line)

- EPS: $6.03 vs analyst estimates of $5.29 (13.9% beat)

- EBITDA: $25.63 billion vs analyst estimates of $24.06 billion (6.5% beat)

- Revenue Guidance for Q4 CY2024 is $46.5 billion at the midpoint, roughly in line with what analysts were expecting

- Gross Margin (GAAP): 81.8%, in line with the same quarter last year

- Operating Margin: 42.7%, up from 40.3% in the same quarter last year

- EBITDA Margin: 63.1%, up from 60% in the same quarter last year

- Free Cash Flow Margin: 38.2%, up from 28.7% in the previous quarter

- Daily Active People: 3.29 billion, up 150 million year on year

- Market Capitalization: $1.50 trillion

"We had a good quarter driven by AI progress across our apps and business," said Mark Zuckerberg, Meta founder and CEO.

Company Overview

Famously founded by Mark Zuckerberg in his Harvard dorm, Meta Platforms (NASDAQ:META) operates a collection of the largest social networks in the world - Facebook, Instagram, WhatsApp, and Messenger, along with its metaverse focused Reality Labs.

Social Networking

Businesses must meet their customers where they are, which over the past decade has come to mean on social networks. In 2020, users spent over 2.5 hours a day on social networks, a figure that has increased every year since measurement began. As a result, businesses continue to shift their advertising and marketing dollars online.

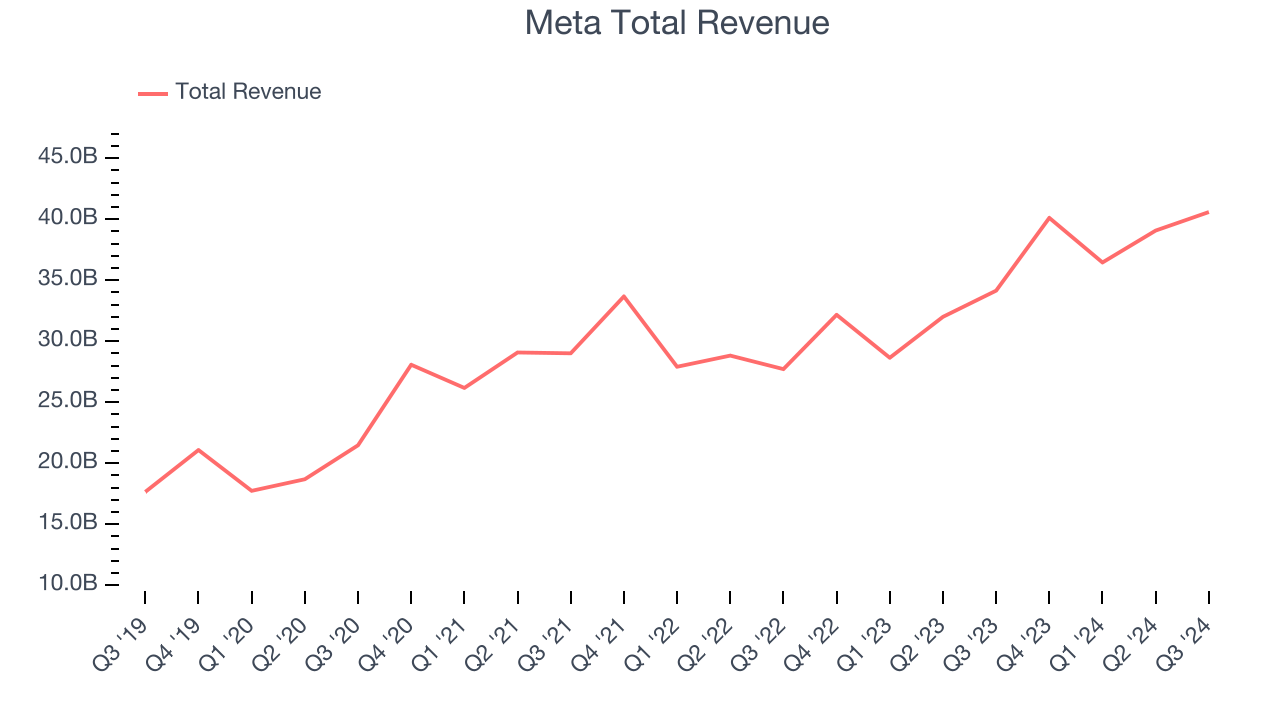

Sales Growth

A company’s long-term performance can give signals about its business quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Thankfully, Meta’s 11.6% annualized revenue growth over the last three years was decent. This is a useful starting point for our analysis.

This quarter, Meta’s year-on-year revenue growth was 18.9%, and its $40.59 billion of revenue was in line with Wall Street’s estimates. Management is currently guiding for a 15.9% year-on-year increase next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 14.4% over the next 12 months, an acceleration versus the last three years. This projection is admirable and shows the market believes its newer products and services will catalyze higher growth rates.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

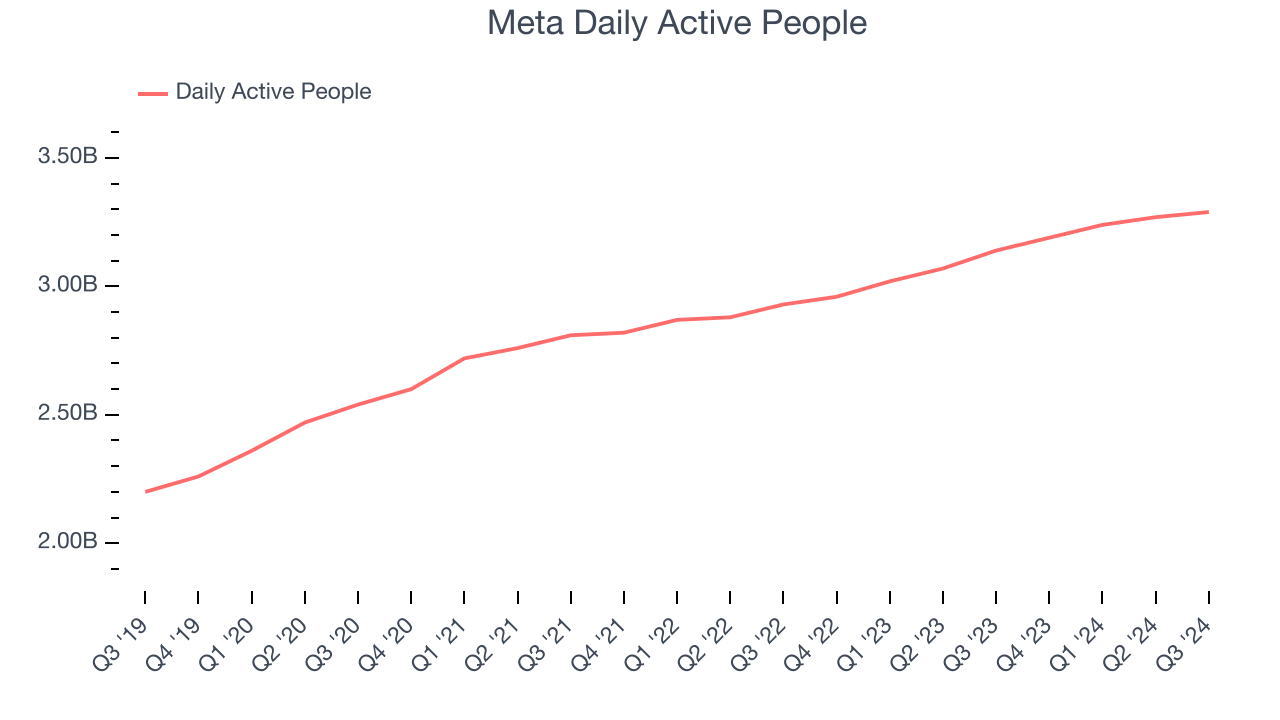

Daily Active People

User Growth

As a social network, Meta generates revenue growth by increasing its user base and charging advertisers more for the ads each user is shown.

Over the last two years, Meta’s daily active people, a key performance metric for the company, increased by 6.3% annually to 3.29 billion in the latest quarter. This growth rate is slightly below average for a consumer internet business and is largely a function of its already massive scale and penetrated market. If Meta wants to reach the next level, it must innovate with new products.

In Q3, Meta added 150 million daily active people, leading to 4.8% year-on-year growth. The quarterly print was lower than its two-year result, suggesting its new initiatives aren’t accelerating user growth just yet.

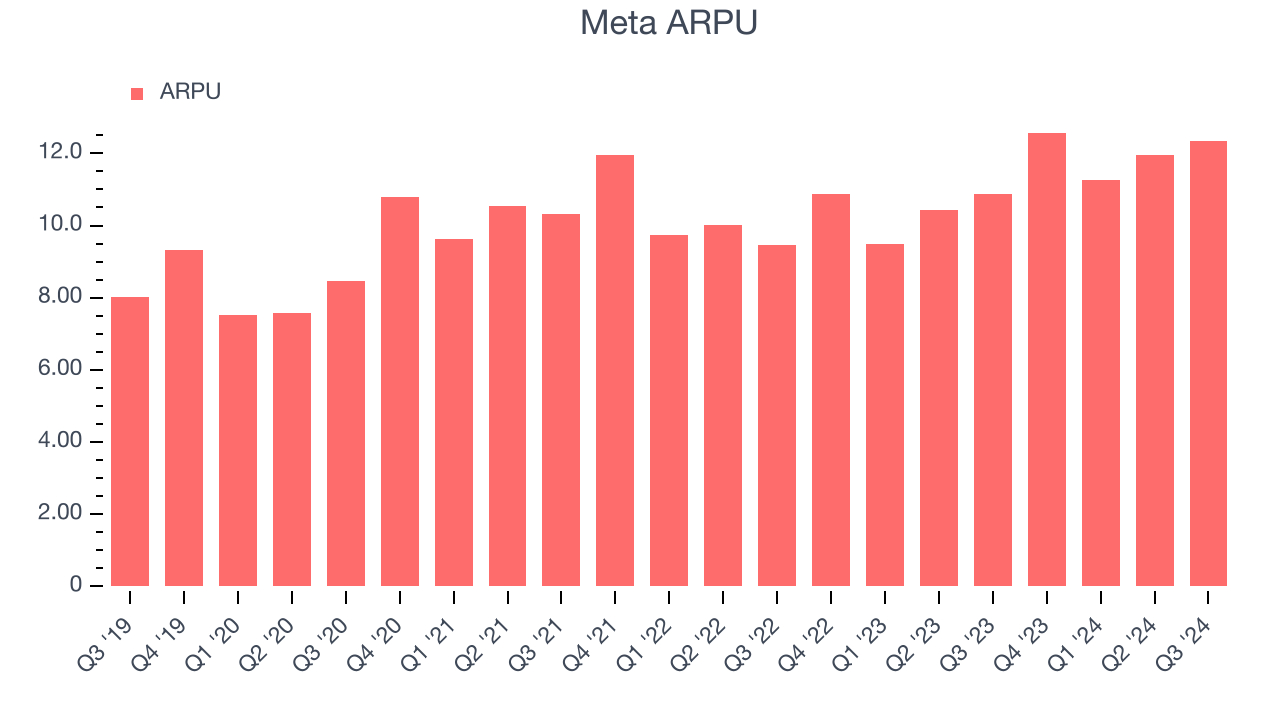

Revenue Per User

Average revenue per user (ARPU) is a critical metric to track for consumer internet businesses like Meta because it measures how much the company earns from the ads shown to its users. ARPU can also be a proxy for how valuable advertisers find Meta’s audience and its ad-targeting capabilities.

Meta’s ARPU growth has been impressive over the last two years, averaging 8.8%. Its ability to increase monetization while growing its daily active people demonstrates its platform’s value, as its users continue to spend more each year.

This quarter, Meta’s ARPU clocked in at $12.34. It grew 13.4% year on year, faster than its daily active people.

Key Takeaways from Meta’s Q3 Results

We were impressed by how significantly Meta blew past analysts’ EBITDA and EPS expectations this quarter. On the other hand, its daily active people missed and it called for "significant capital expenditures growth in 2025". Overall, this quarter had some key positives, but the market seemed to focus on the aggressive infrastructure investments that will come next year. The stock traded down 3.2% to $573 immediately after reporting.

Is Meta an attractive investment opportunity right now?We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.

Stock quotes supplied by Barchart

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the following

Privacy Policy and Terms and Conditions.